With daily volatility of TSLA, one has to have the coverage to be a long term Tesla investors. It would help if you have the long term view and not be affected by the daily noise while keeping up to date with the company's development and execution.

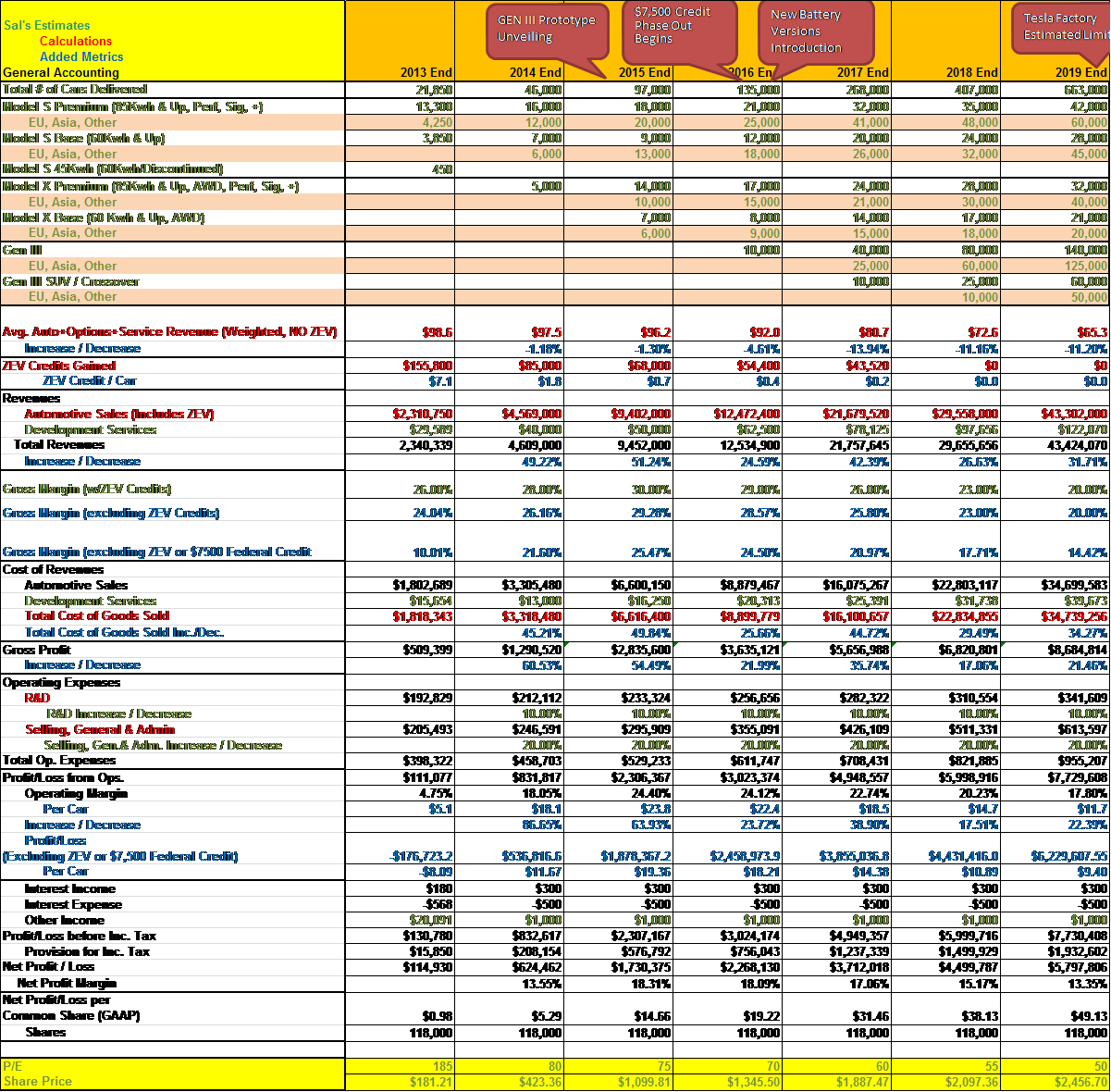

Sal's article gives an comprehensive forecast of where TSLA is going:

Tesla Motors' Full Analysis 2.0

It is an very optimistic and strong bull case. However I don't find any major flaws or anything irrationally exuberant. Anyone interested in taking a crack at the numbers and find some fault? If everyone buys in to these numbers then all he/she needs to do is hold it for 5 years and retire.

----update----

One thing I missed. I have to say it is an impressive model considering the it was done in oct 2012, when TSLA was at $30 range. So far for 2013 the trajectory is right on.

I remembered when I started investing on march, I knew TSLA will hit $70 and perhaps over $100 by year end. When I read articles that have more bullish forecast like $160 price target, I was smiling but in the back of my mind I call them crazy.

Sal's article gives an comprehensive forecast of where TSLA is going:

Tesla Motors' Full Analysis 2.0

It is an very optimistic and strong bull case. However I don't find any major flaws or anything irrationally exuberant. Anyone interested in taking a crack at the numbers and find some fault? If everyone buys in to these numbers then all he/she needs to do is hold it for 5 years and retire.

----update----

One thing I missed. I have to say it is an impressive model considering the it was done in oct 2012, when TSLA was at $30 range. So far for 2013 the trajectory is right on.

I remembered when I started investing on march, I knew TSLA will hit $70 and perhaps over $100 by year end. When I read articles that have more bullish forecast like $160 price target, I was smiling but in the back of my mind I call them crazy.

Attachments

Last edited: