It's a busted decline story. Yeah, I wish they'd say that.Gary nailed this one. We will see CNBC dance around TSLA all day.

View attachment 670851

I try my hardest to avoid TSLAQ myself but it's like trying to avoid cockroaches.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Yes because it is not just broadcast TV.Agreed his take on it is spot on. Question (honest question, not trying to be factitous): Do people watch CNBC? By "people" I mean people who actually buy and sell stocks. Is CNBC broadcast television, with commercial breaks and the whole thing - is that still "a thing" in the United States?

Lots of You Tube Clips and Twitter clips as well.

Edit to say it also proves the absurdity of the show. They are supposed to provide information so one can make an informed

Decision. Yet as it relates to Tesla they do almost the exact opposite.

Last edited:

Krugerrand

Meow

You could have stymied her by answering the question: I’m playing dead. You should try it.@StealthP3D

sometimes curiosity as to if they have changed their outlooks or mindsets.

chatted with someone, pushed a few rhetorical buttons in a slightly condescending, somewhat supercilious manner

“what have you done to preserve your wealth?” she asked me

pointed out she, while wealthy from very active trading, I did no work other than buy and hold,

pointed out that she lacks even a scintilla of a vision of the future that I have been pointing out since 2012 and fail at basic comprehension,

(pushed buttons that drive them into a tizzy whilst refining my viewpoints

pointed out that 7 figure fluctuations of portfolio valuation do not concern me anymore as we are at the beginning of the exponential curve, as they no longer do.

TSLAQ remains mired in a tangled web, but it’s nice seeing they cannot mature or even glimpse the future that 100’s of 1,000’s of us do, growing in numbers every day

(and i’m probably not “normal”), (90 degrees incident)

If people want stock type news, unfortunately cnbc is still one of the top ones since they constantly interview with Ceos of multiple companies. Fox Business news is way too political and just pushes agendas for the republican party. Bloomberg is also decent.Agreed his take on it is spot on. Question (honest question, not trying to be factitous): Do people watch CNBC? By "people" I mean people who actually buy and sell stocks. Is CNBC broadcast television, with commercial breaks and the whole thing - is that still "a thing" in the United States?

Perhaps not millennial and younger, but the older folks still trust in what cnbc has to say. Not many people of those generation will go on youtube and listen to some dudes bull or bear thesis.

Great comment as always. I have some experience with pure subscription services so this is particularly interesting to me. What is interesting is the case where a pure purchase transforms into a hybrid model.The FSD purchases probably will not change much with subscriptions, especially in the more expensive models. That model will expand the FSD market rather than conquer purchases. Subscription models that have regular upgrade advantages included (e.g. Apple iPhone) do accelerate purchase cycles. With FSD the model will draw mostly people who could not afford buying it or just want to try before buying.

As for Osborning, that applies to superior technology driving out inferior technology and has nothing to do with the relative impact of having multiple adoption pricing options for the same product.

Without question, were there to be variable costs, there could be a revenue dip from the subscription model. There isn't, since the marginal cost of FSD is trivial, not zero, but trivial. Revenues will continue to rise as FSD deliverables allow accounting recognition of reserves. Because of the accounting issues there will be precisely zero negative income effect for FSD. Were there to be significant defection from purchase to subscription (there will NOT be) the only effect will be on cash flow, and that will not be very material.

(I have stated these opinions as facts because I believe them to be. Others, like @The Accountant , can speak with authority on the P&L consequences of these developments. There are numerous potential analogies for the purchase vs subscription models. Many of these (e.g Jeppeson for aircraft, 'rent to own' in numerous arenas, 'Power by the Hour') are imprecise analogies simply because there has not been this kind of product before. Thus, except for accounting issues, this is really new.)

It will be fascinating to watch the choices customers make.

I'll hold judgement on how this week plays out until I see whether the powers that be are able to walk the SP back down to 600.Think we have a lot of retail shorts caught with their pants down. Big players have been accumulating in 500s past couple of weeks.

Everyone loves a good retail short burn.

Given Thursday’s event and the SP strength in mid 500s we may have some legs here. 650 to 700 by Thursday PM?

Absolutely do not listen to me. I am kinda like the board jester around here.

If people want stock type news, unfortunately cnbc is still one of the top ones since they constantly interview with Ceos of multiple companies. Fox Business news is way too political and just pushes agendas for the republican party. Bloomberg is also decent.

Perhaps not millennial and younger, but the older folks still trust in what cnbc has to say. Not many people of those generation will go on youtube and listen to some dudes bull or bear thesis.

CNBS is for the MM, by the MM.

Lot's of info. It's still my favourite for financial news all day.

But it's up to you to notice a trend on how skewed they can be.

Tesla is lucky to have a legion of fans that can counter the FUD narratives. Also feels great to be in TMC, to get a measure of the actual things happening around Tesla.

"Thank the FUD machine for buying opportunities as you go"

So .. you tell me to basically go & buy some 700er lottery-tickets? ...Given Thursday’s event and the SP strength in mid 500s we may have some legs here. 650 to 700 by Thursday PM?

Absolutely do not listen to me. I am kinda like the board jester around here.

From the option-market i would think they want to cap it at 650 max...

Yeah many do. It's rare among people say 30 and under, but there are millions of middle-ish class guys who watch it every day. Plus it's often on in places like gyms etc. I actually tried a little while back just to know what they were pumping/trashing but I couldn't take the commercials.Agreed his take on it is spot on. Question (honest question, not trying to be factitous): Do people watch CNBC? By "people" I mean people who actually buy and sell stocks. Is CNBC broadcast television, with commercial breaks and the whole thing - is that still "a thing" in the United States?

Featsbeyond50

Active Member

(Off topic but I can't resist) In America we have cable packages with thousands of shows. I heard some of those shows have more people working to produce the content than there are actual viewers of the show.Do people watch CNBC?

If you're not paying for it, you're the product.(Off topic but I can't resist) In America we have cable packages with thousands of shows. I heard some of those shows have more people working to produce the content than there are actual viewers of the show.

No problem if there is more staff to produce a show than to watch it, as long as advertisers think their advertising dollars are well spent.

Artful Dodger

"Neko no me"

Edit to say it also proves the absurdity of the show. They are supposed to provide information so one can make an informed

Lol, of COURSE you're informed: informed of what advertisers want you to do.

CNBC has the same value as S3 Partners on TSLA short interest: the public information IS the lie; what is not revealed contains the truth.

Narrows down the range of possibilities significantly.

Cheers!

Agreed his take on it is spot on. Question (honest question, not trying to be factitous): Do people watch CNBC? By "people" I mean people who actually buy and sell stocks. Is CNBC broadcast television, with commercial breaks and the whole thing - is that still "a thing" in the United States?

On average 200,000 American viewers watch CNBC, rising to about 250,000 to 300,000 during popular programs like Fast Money Half Time Report, The Exchange and Closing Bell, but dropping to 140,000 during a program like Squawk Box. In a huge country of 330 million people that is - excusez le mot - laughable. In a puny country like The Netherlands programs get cancelled when they draw less than 400,000 or 500,000 viewers. Might be a good idea for this channel too.

gabeincal

Active Member

Well folks, let's burn those shorts once again - they don't learn.

Artful Dodger

"Neko no me"

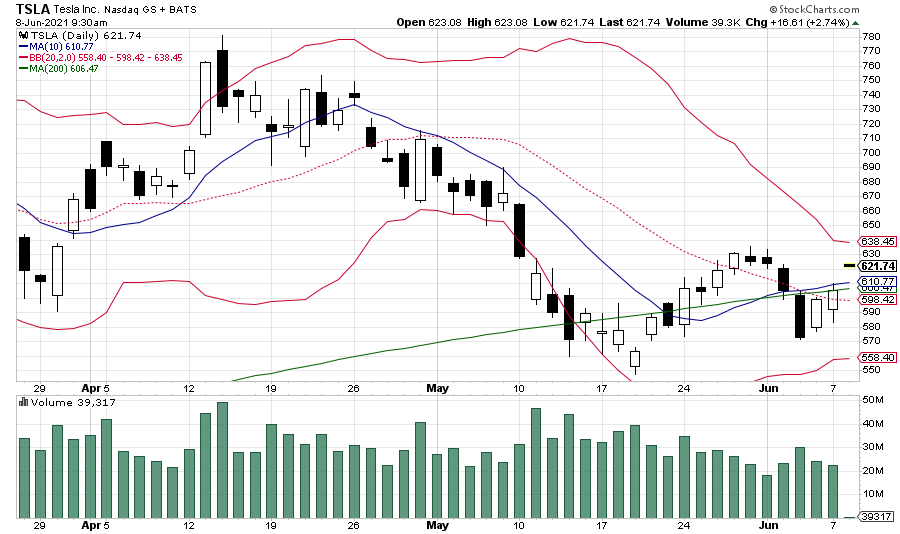

TSLA Pre-Market Volume was 1,131,312 shares today (high vol). Opening above the Mid-BB has stabilized both the Upper- and Lower-BB as of now:

Cheers!

Cheers!

henchman24

Active Member

Thanks, that's a good data point. It looks like Wyoming has had a number of added Supercharger locations in recent years.

Your friend must be disconnected from reality to believe the Ford is better than a Tesla in all ways:

Range

Performance

Price

Autopilot and other software features

Hmmmm....I always thought those type of people only existed on the Internet, it's quite a shocker to realize they exist in the flesh and blood! Does he have any other unusual traits?

The only add I can recall recently is Casper closing that gap, but yeah the chargers have been around for a while. It just opens up a lot of the state for any realistic roadtrip.

I think people get so tied up in the Tesla hate that they just can see clearly how far Tesla is really ahead. His Mach E is a great car and I don't blame him at all for buying it. I wouldn't have over a Y, but for anything under 50k... it is about the best non-Tesla EV out there.

The 33k number is pretty damn good and puts to bed the China sales FUD.

Was busy working and Training a lot lately.Gary nailed this one. We will see CNBC dance around TSLA all day.

View attachment 670851

I try my hardest to avoid TSLAQ myself but it's like trying to avoid cockroaches.

the only thing I could hear from media, people around and sponsored articles were that China Tesla sales were plunging and that it was not going well.

Now I just play dead and wait for people to get a reality check. Sold my AMC after the gamma squeeze to buy more TSLA.

Artful Dodger

"Neko no me"

Well folks, let's burn those shorts once again - they don't learn.

Well you know that MMs always work hard to 'fill-the-gap' (applies mostly to gaps up, like this morning).

Once that's out of the way, let's see how much buying interest materializes. It's close to the Plaid delivery event, but I suspect still too far for 'sell-the news'.

I notice the Upper-BB is at a conveniently tempting 637.47 right now...

Cheers!

Last edited:

J

jbcarioca

Guest

Except for your last sentence I agree. "older folks" come in many flavors, just as do all age groups. It's generally a great risk to make age-based generalizations even hedged by "not many". Recently I received data from YouTube paid subscriber channel usage demographics. You might change your views when considering that paid subscribers skew strongly old. No surprise, they often have more money than do younger ones. As fro cnbc specifically you may consider that 'older folks' might tend to be more cynical about commentator distortions than many younger ones.If people want stock type news, unfortunately cnbc is still one of the top ones since they constantly interview with Ceos of multiple companies. Fox Business news is way too political and just pushes agendas for the republican party. Bloomberg is also decent.

Perhaps not millennial and younger, but the older folks still trust in what cnbc has to say. Not many people of those generation will go on youtube and listen to some dudes bull or bear thesis.

The real problem is that generalizations about one characteristic are invariably misleading. The facts are always more complex than a single factor. So it is with this.

Candidly, the correlation most significant in any such assessment is the combination of income and education NOT age. Obviously both income and education level have age-related components, but pure age is never quite predictably dominant. Except, I must add, age is the most predictive single attribute for mortality. Not much else, though.

If you were correct my 1973 graduate school class YouTube group would have many fewer members. Personally I probably spend more time with Reddit and Discord than I do with YouTube but that's just me. YouTube does give me much better access to recent footage of sources I want to see, plus of course flyovers of Tesla facilities and SpaceX launches.

OMG, I must be younger than I think. Really Singuy, you need to observe what oldsters do in Singapore. It seems more than 40% of them use YouTube.

and almost 90% use the internet. Obviously Singapore has better education and income levels than most places in the world, so that's no surprise.

As for securities market news the vast majority of well educated and high income people, regardless of age, do not use general news sources for securities information. For that we elderly types are much like other groups similar in economic and educational level, so we tend to seek such information as close to the source as possible, and thus monitor sources of FUD as well as direct market data. Trust in any public media tends to be low in any well educated group, anywhere.

So Tom Mueller retired from SpaceX a few months ago. He was lead rocket engine designer. Raptor was not yet in mass production, and tweaks are still being made, yet principle work had been completed, and he decided to move on.Why not go out in style- after successful production of Semi - supposed to happen by end of year?

Why couldn't Jerome have done the same with the Semi?

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K