Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

FredTMC

Model S VIN #4925

I don't understand why GAAP profitability is a big deal in the first place. I see potential downside where people pickup that TMC thinks Tesla is going to be GAAP profitable, they aren't and the stock tanks. On the other hand, the smart money knows not to look at GAAP numbers because of leasing, and so they will only care about the non-GAAP numbers in case we have a beat. So aside from the ability to say "yay we got a GAAP profitable quarter", I don't see any value discussing GAAP numbers. It makes much more sense to spend time estimating non-GAAP numbers..

Agreed. Gaap profitability isn't a big mover. What's important is that TM show "reckless growth" (per Jerome) AKA relentless growth. TSLA needs to keep beating their guidance and keep raising their guidance qtr by qtr. With the new production line coming online later this year, hopefully under promise and over deliver will continue to happen.

JRP3

Hyperactive Member

Naive speculation:

Gigafactory capital help incoming?

After Fisker Debacle, Obama Revives Stalled Green Car Loan Program - Forbes

Gigafactory capital help incoming?

After Fisker Debacle, Obama Revives Stalled Green Car Loan Program - Forbes

“Motor vehicle parts manufacturers play a significant role in the development and deployment of new technologies to meet the demand for fuel-efficient vehicles and we believe the ATVM Loan Program can play an important financing role as the industry establishes the next generation of manufacturing facilities in the United States,” said U.S. Energy Secretary Ernest Moniz.

The auto industry is once again booming, but that has led to capacity constraints among some parts suppliers, who need capital to expand. The revisions to the green car loan program will make it easier for suppliers of everything from advanced engines and powertrains to lightweight materials and high-tech electronic systems to apply. Even fuel-efficient tire manufacturers are eligible.

Robertj

Member

Ibd TV Daily Stock Analysis. Tesla Motors

Stock News & Stock Market Analysis Videos on IBD TV - IBD - Investors.com

Stock News & Stock Market Analysis Videos on IBD TV - IBD - Investors.com

GravityPull

Member

Naive speculation:

Gigafactory capital help incoming?

After Fisker Debacle, Obama Revives Stalled Green Car Loan Program - Forbes

Now Elon just needs to wave the likely possibility of $3Billion funding from the Dept of Energy in Panasonic's face to stop Panasonic from dragging their feet on the GigaFactory.

Maybe Obama Should insist that DOE partner with Tesla on GigaFactory! Can you imagine the outrage on Fox News!

justthateasy

Member

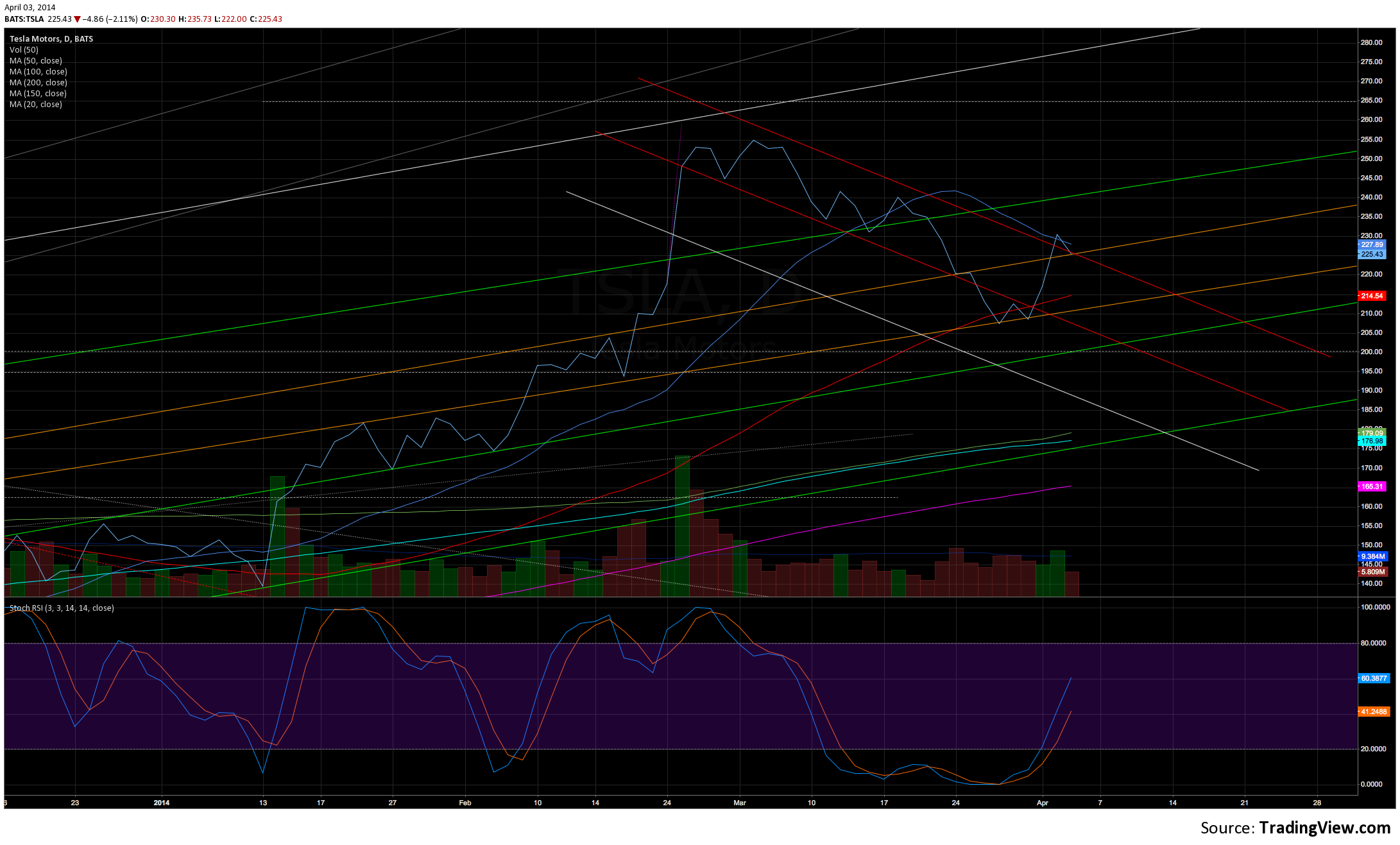

Here is my TSLA chart.

I expected the price range we had today and to finish in the red except for the dip all the way down to 222. I thought the lowest we'd see today was 225.

I really want to say that TSLA is finally out of that downtrend but I think it's too early to definitively say so because it finished exactly where the resistance line of the downtrend and the support line of the uptrend meet. I'm about 70% sure we're finally out of the woods but tomorrow will really test the direction that TSLA goes for the next couple of weeks. What ever happens, I'm sticking to my guns for now and reiterating that I think TSLA will hit a new ATH before the month is up.

- - - Updated - - -

O'Reilly has become the latest Tesla cheerleader so that fake outrage could go either way at Faux.

I expected the price range we had today and to finish in the red except for the dip all the way down to 222. I thought the lowest we'd see today was 225.

I really want to say that TSLA is finally out of that downtrend but I think it's too early to definitively say so because it finished exactly where the resistance line of the downtrend and the support line of the uptrend meet. I'm about 70% sure we're finally out of the woods but tomorrow will really test the direction that TSLA goes for the next couple of weeks. What ever happens, I'm sticking to my guns for now and reiterating that I think TSLA will hit a new ATH before the month is up.

- - - Updated - - -

Now Elon just needs to wave the likely possibility of $3Billion funding from the Dept of Energy in Panasonic's face to stop Panasonic from dragging their feet on the GigaFactory.

Maybe Obama Should insist that DOE partner with Tesla on GigaFactory! Can you imagine the outrage on Fox News!

O'Reilly has become the latest Tesla cheerleader so that fake outrage could go either way at Faux.

Maybe the faux strategy is a psyops move- fox starts waving Tesla banners so a lot of liberals start being suspect and questioning it. Can't be THAT green, efficient etc if faux endorses it- there /must/ be something wrong with it!

Jack6591

Active Member

Panasonic Reorganization

http://panasonic.co.jp/corp/news/official.data/data.dir/2014/03/en140327-5/en140327-5.pdf

I know this is dated, but I've been out of the loop.

http://panasonic.co.jp/corp/news/official.data/data.dir/2014/03/en140327-5/en140327-5.pdf

I know this is dated, but I've been out of the loop.

The Blue Owl

Endangerous Herbivore

Looks like Tesla's full over-allotment option was exercised by the investment banks from the latest round of capital raising.

which put the GF raise at $2.3B if I remember correctly?

sleepyhead

Active Member

which put the GF raise at $2.3B if I remember correctly?

Yes.

But then you subtract fees and I believe that Tesla spent close to $80m on anti-dulition warrant transactions. So Tesla might get to keep close to $2-$2.1b.

justthateasy

Member

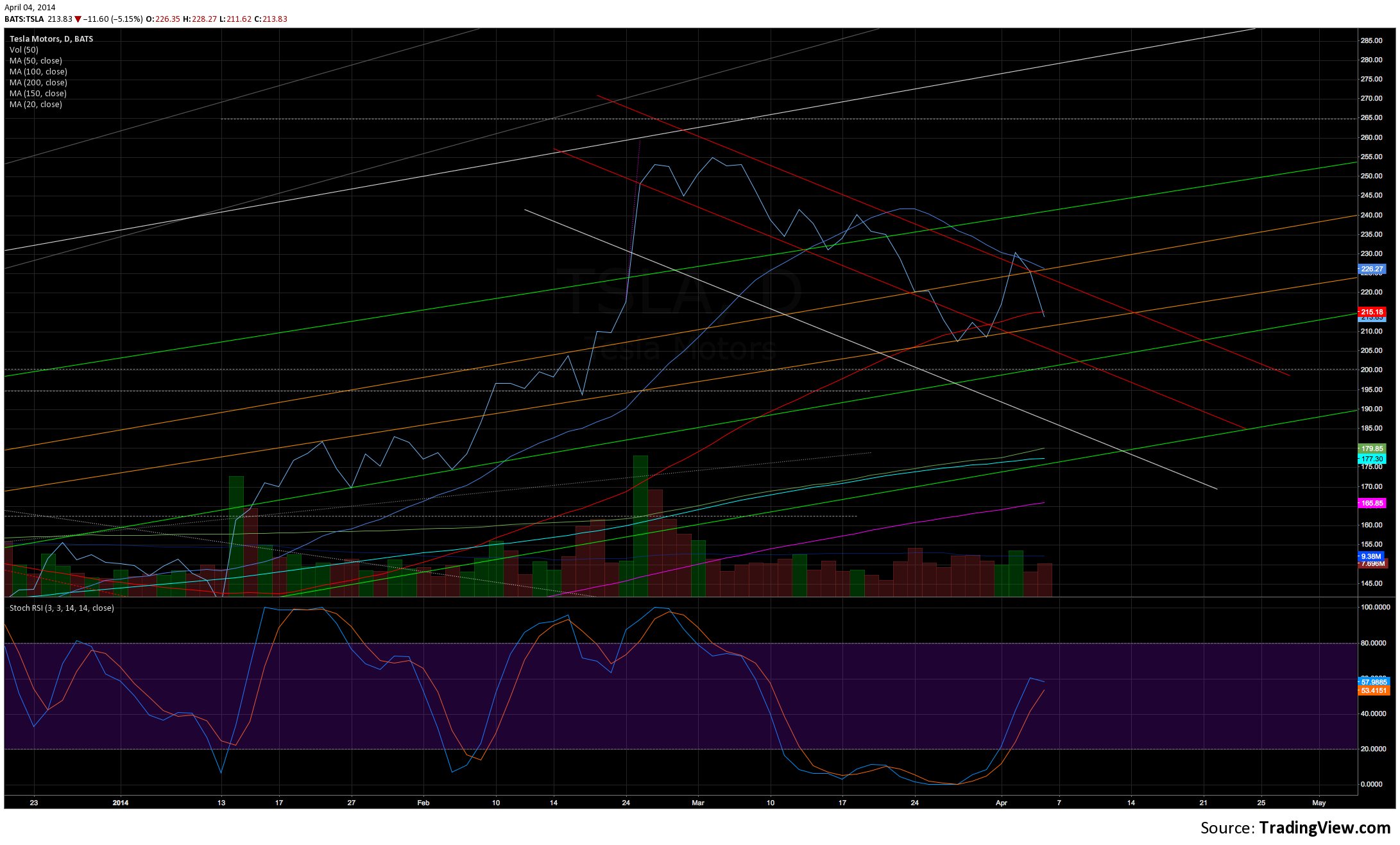

It looks like we have a case of "the market giveth, the market taketh" today.

According to my chart, today's drop covered the entire range of the orange trend lines. We're back in that downtrend but if that orange support line holds for the next couple of weeks, TSLA might actually overcome all of this selling pressure. I definitely spoke too soon when it looked like we might have been out of the woods and that relief rally we had this week was nothing more than a clearing. Here's to hoping next week will be better for us.

According to my chart, today's drop covered the entire range of the orange trend lines. We're back in that downtrend but if that orange support line holds for the next couple of weeks, TSLA might actually overcome all of this selling pressure. I definitely spoke too soon when it looked like we might have been out of the woods and that relief rally we had this week was nothing more than a clearing. Here's to hoping next week will be better for us.

justdoit

Member

Wow... really undecided about what to do here. Is anyone considering going short by buying puts or selling calls? If this is close to the top of the momentum stocks rallies, then there might be lots of money to be made on the way down (or at least protecting yourself).

Mario Kadastik

Active Member

Is hell freezing over? Top Gear UK giving high praise to Model S ... Maserati Ghibli takes on Tesla Model S - BBC Top Gear

palmer_md

Member

Is hell freezing over? Top Gear UK giving high praise to Model S ... Maserati Ghibli takes on Tesla Model S - BBC Top Gear

This is TopGear magazine, not the TV show. The article was written by they guy that Jeremy Clarkson replaced as host of TopGear TV.

dha

Member

Wow... really undecided about what to do here. Is anyone considering going short by buying puts or selling calls? If this is close to the top of the momentum stocks rallies, then there might be lots of money to be made on the way down (or at least protecting yourself).

I would not dare to ever go net short TSLA. However, my core long position has been hedged with June PUTS for about a month now. I intend to remain hedged through Q1 earnings. My hope is to mitigate any losses between now and June, sell the puts for a profit and immediately use the proceeds to acquire more stock.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 104

- Replies

- 23

- Views

- 866

- Replies

- 21

- Views

- 6K

- Replies

- 0

- Views

- 226