Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Any idea if Tesla can see a running tally of the voteing to date, or is it confidential until the closure?

I'm pretty sure they have access in advance. (They have announced general pre-results at the shareholder meeting before voting was closed in the past.)Any idea if Tesla can see a running tally of the voteing to date, or is it confidential until the closure?

MP for NVDA is showing $785 for next week. Is this an error? why is it so low?

Next week is a monthly expiration. I've noticed that max-pain is less reflective of options demand for the longer term options, like monthly, quarterly, and annuals.

The next weekly max-pain (5/24) shows it back at 850.

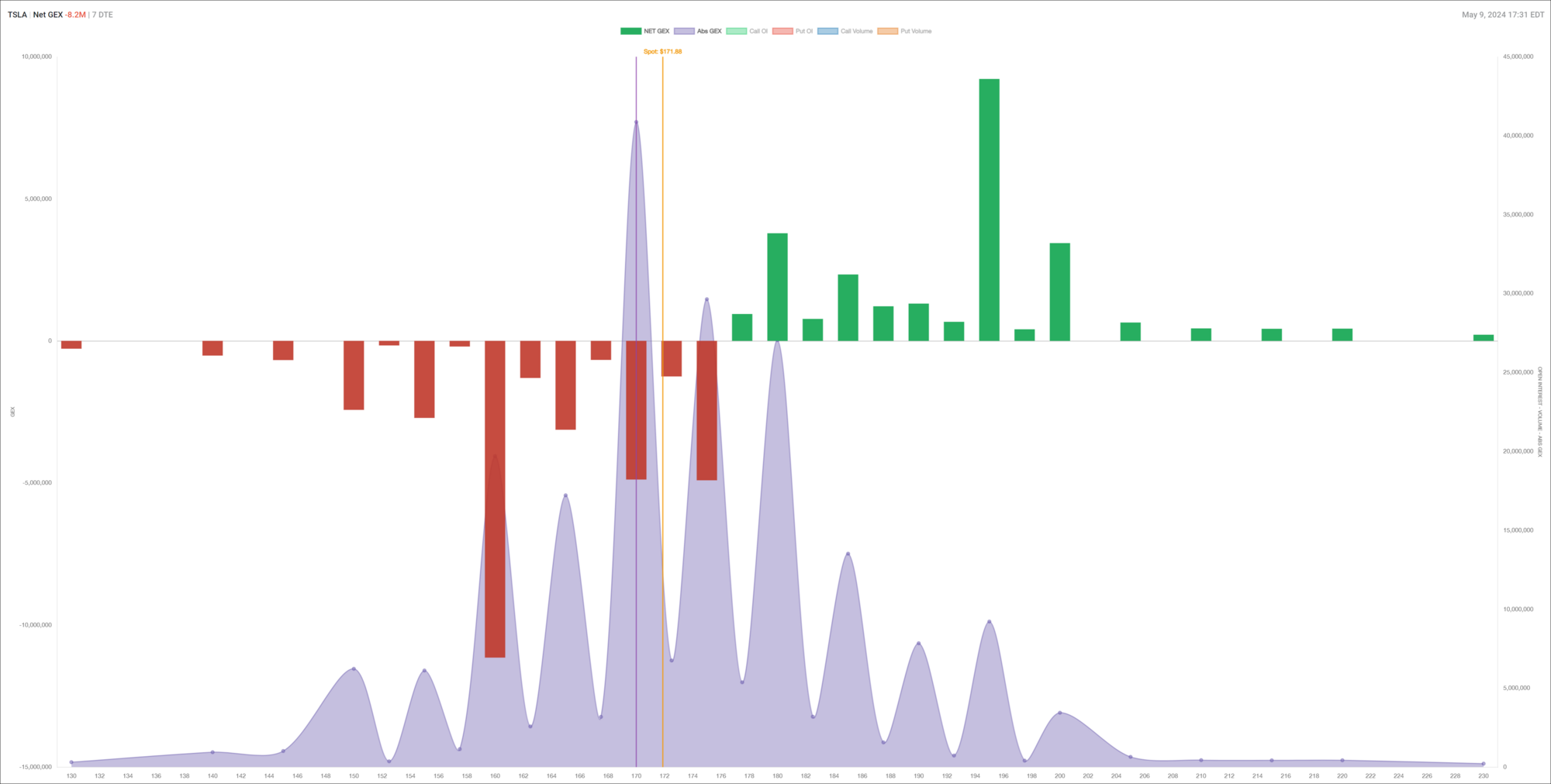

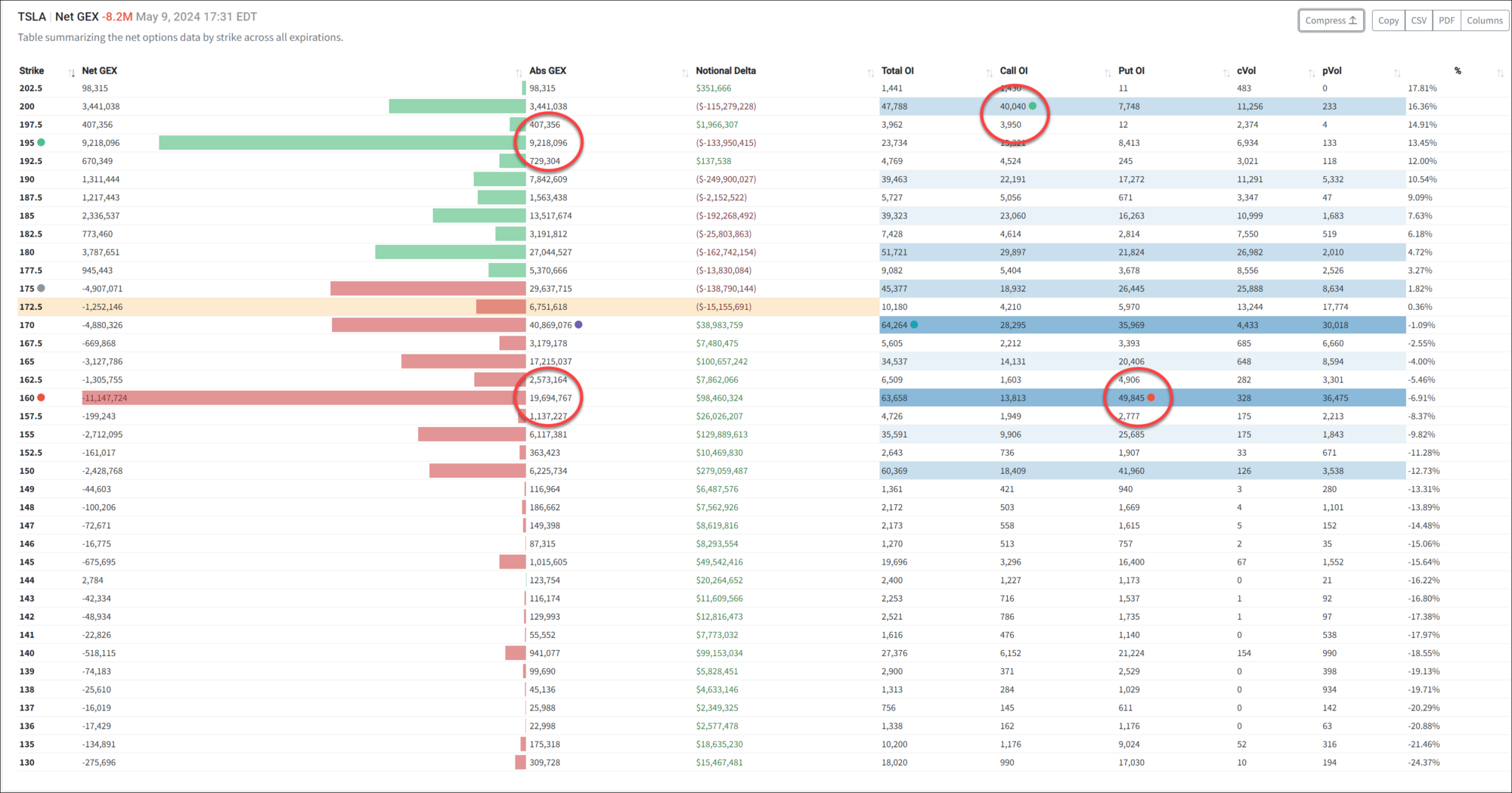

Seems +GEX (calls) dried up for next week and -GEX (puts) grew, so good time to let it run

Purple shows the aggregate GEX weight:

Purple shows the aggregate GEX weight:

I thought some accounting firm in charge ,Any idea if Tesla can see a running tally of the voteing to date, or is it confidential until the closure?

Tesla doesn’t know

Yes, the paper "Are Shareholder Votes Rigged?" concludes that management at U.S. corporations can indeed see votes as they come in. This access allows management to shape voting outcomes in their favor by monitoring and potentially influencing the voting process. The study reveals a systematic advantage that management holds over shareholders, particularly in close vote situations, which can affect the success of shareholder proposals significantly.

Attachments

thenewguy1979

"The" Dog

I guess this aligned with TSLA bouncing back to 185-190 then doing a 2nd drop to 160 as dl003 stated.Welp, the next level WAS 5200, and now we’re through that.. I still think it’s going to be rug pull, but not before a blow off top.

IF CPI next week WEDNESDAY at 05:30 PST, is anywhere near AT or BELOW expectations it’s going to be a very nice call selling day and or ATH in various places.

I DO find it interesting that it isn’t TECH making this the last run, but Financials and Industrials, so IF Tech comes in a tad higher in the next week+, we could for sure get to a new top.

NVDA did also hold the key 882 support for now.....per Wicked it's still bullish for going long into 97x.

Perhaps the puzzles are starting to fit into places now.

I just have this strange feeling about the next month until the shareholder vote results are announced.

Elon has been very actively asking shareholders to vote. I mean he clearly deserves the money but is it possible he is waiting for voting to be closed to announce that he in fact is all in on Robotaxi. To hell with cheaper models or whatever. Everything he is doing including laying off the supercharging team is indicative of him going back to what he really wanted to do in 2020/2022(see excerpt below). Also this news about BP is interesting. Elon is not interested in the small margin hardware stuff anymore.

I see similarities to how Zuck said he was going to spend heavy AR/VR and investors did not like it. Could Q2 2024 be that quarter for Tesla? I believe in robotaxis but if that is how Elon is wiring his brain I think we could be in for a long road which begs the question I have on my mind:

Are LEAPS(Even Dec 2026) leaving us with enough time or is it better to take a safer approach and do shares only?

Here is the excerpt:

"

At the end of the summer of 2022, after Musk made his pronouncements about being "all in" on a Robotaxi with no steering wheel, von Holzhausen and others at Tesla set about persuading him to cover his bet. They knew how to do it in a non-challenging way.

Elon has been very actively asking shareholders to vote. I mean he clearly deserves the money but is it possible he is waiting for voting to be closed to announce that he in fact is all in on Robotaxi. To hell with cheaper models or whatever. Everything he is doing including laying off the supercharging team is indicative of him going back to what he really wanted to do in 2020/2022(see excerpt below). Also this news about BP is interesting. Elon is not interested in the small margin hardware stuff anymore.

I see similarities to how Zuck said he was going to spend heavy AR/VR and investors did not like it. Could Q2 2024 be that quarter for Tesla? I believe in robotaxis but if that is how Elon is wiring his brain I think we could be in for a long road which begs the question I have on my mind:

Are LEAPS(Even Dec 2026) leaving us with enough time or is it better to take a safer approach and do shares only?

Here is the excerpt:

"

At the end of the summer of 2022, after Musk made his pronouncements about being "all in" on a Robotaxi with no steering wheel, von Holzhausen and others at Tesla set about persuading him to cover his bet. They knew how to do it in a non-challenging way.

- "We brought him new information that maybe he wasn't fully digesting in the summer," says Lars Moravy, one of Tesla's top executives. Even if self-driving vehicles were approved by regulators in the U.S., he argued, it would be years before they were approved internationally. So it made sense to build a version of the car with a steering wheel and pedals.

- For years they had talked about what should be Tesla's next-generation offering: a small, inexpensive, mass-market car selling for around $25,000. Musk himself had teased the possibility in 2020, but then he put a hold on those plans, and over the next two years he repeatedly vetoed the idea, saying that the Robotaxi would make the other car unnecessary. Nevertheless, von Holzhausen had quietly kept it alive as a shadow project in his design studio."

OptionsGrinder

Member

This is very insightful. Thank you for sharing.I've adopted a new selling style. 20% of my income goal everyday . I call the top everyday and sell into it. So, while I may not get the best strike possible, the goal is my sell always turns green after I execute it. In fact, my strike has gone down everyday since I started. But, I'm having to adjust my philosophy a bit here. As sellers, we're exposed to the risk of overnight news. The problem with finding the "best" strike and unload 100% or even 50% of firepower right then and there is we get married to the trade, leaving little room for daily development. Therefore, I'm using levels as mid-term guidelines only and relying more on intraday momentum to sell. When the momentum gets close to a pivot on a higher timeframe, then I'll do something like a 20 DTE ATM CC. So, please don't ask me for a rigid strike ahead of time; I'm not a good source for that, at least until, as I've mentioned last week, the daily momentum starts fizzling out. If you caught 200 last week, that's great. But right now, I'm doing short term sells only. The strategy seems easy now as we're in a short term downtrend. However, when we reach "cheap" on the 2H, either through time, price or a bit of both, I will be sitting on my hand and let the spike happen, before calling the daily tops again.

I expect the next bounce to be bigger than $10 and there will be some news to make it feel legit. So, I'm eating the lower strike everyday as we're chopping down in exchange for the ability to stay out of that $10+ bounce. Maybe in a few months I'll become more in tune but right now I'm taking it slow. Using my new approach, the spike from 140 to 200 would have been so clearly telegraphed.

tivoboy

Active Member

$NVDA I think we might actually break that support, my AI target was very short term and $967, but I don’t we’ll get there in this run.. could still happen, but I think it’s going to be sub $880, before $960+.I guess this aligned with TSLA bouncing back to 185-190 then doing a 2nd drop to 160 as dl003 stated.

NVDA did also hold the key 882 support for now.....per Wicked it's still bullish for going long into 97x.

Perhaps the puzzles are starting to fit into places now.

So do you now think the 920 we saw this Monday as the top for this run?$NVDA I think we might actually break that support, my AI target was very short term and $967, but I don’t we’ll get there in this run.. could still happen, but I think it’s going to be sub $880, before $960+.

You and your AI are much better at this than me, but my gut says $880 will hold. The premiums for 5/24 -P900 are way too high at ~$50 though to not feel like I am getting a deal if assigned.$NVDA I think we might actually break that support, my AI target was very short term and $967, but I don’t we’ll get there in this run.. could still happen, but I think it’s going to be sub $880, before $960+.

When everyone is claiming that they are building their own AI chips and that they saw all this coming 3+ years ago... despite reality pointing different directions, I just see NVDA in way too strong of a position right now.

So basically you've shifted from a weekly target to a daily target? I've also thought to try this. My weekly goal is 1%, let's say $20k, but break that down to $4k daily and it looks a lot easier, especially given that individual daily movements seem to be easier to predict than weekly or monthly - someone due, as you say, to removing the out-of-hours news and gapsI've adopted a new selling style. 20% of my income goal everyday . I call the top everyday and sell into it. So, while I may not get the best strike possible, the goal is my sell always turns green after I execute it. In fact, my strike has gone down everyday since I started. But, I'm having to adjust my philosophy a bit here. As sellers, we're exposed to the risk of overnight news. The problem with finding the "best" strike and unload 100% or even 50% of firepower right then and there is we get married to the trade, leaving little room for daily development. Therefore, I'm using levels as mid-term guidelines only and relying more on intraday momentum to sell. When the momentum gets close to a pivot on a higher timeframe, then I'll do something like a 20 DTE ATM CC. So, please don't ask me for a rigid strike ahead of time; I'm not a good source for that, at least until, as I've mentioned last week, the daily momentum starts fizzling out. If you caught 200 last week, that's great. But right now, I'm doing short term sells only. The strategy seems easy now as we're in a short term downtrend. However, when we reach "cheap" on the 2H, either through time, price or a bit of both, I will be sitting on my hand and let the spike happen, before calling the daily tops again.

I expect the next bounce to be bigger than $10 and there will be some news to make it feel legit. So, I'm eating the lower strike everyday as we're chopping down in exchange for the ability to stay out of that $10+ bounce. Maybe in a few months I'll become more in tune but right now I'm taking it slow. Using my new approach, the spike from 140 to 200 would have been so clearly telegraphed.

Might be with to try a split strategy for a while, 50% weeklies, the rest on dailies, see which wins-out

What would be interesting, is whether the BIG moves in TSLA, whether they begin out of hours or are signalled in AH/PM, just avoiding the gap up/down on each occasion would save an awful lot of pain

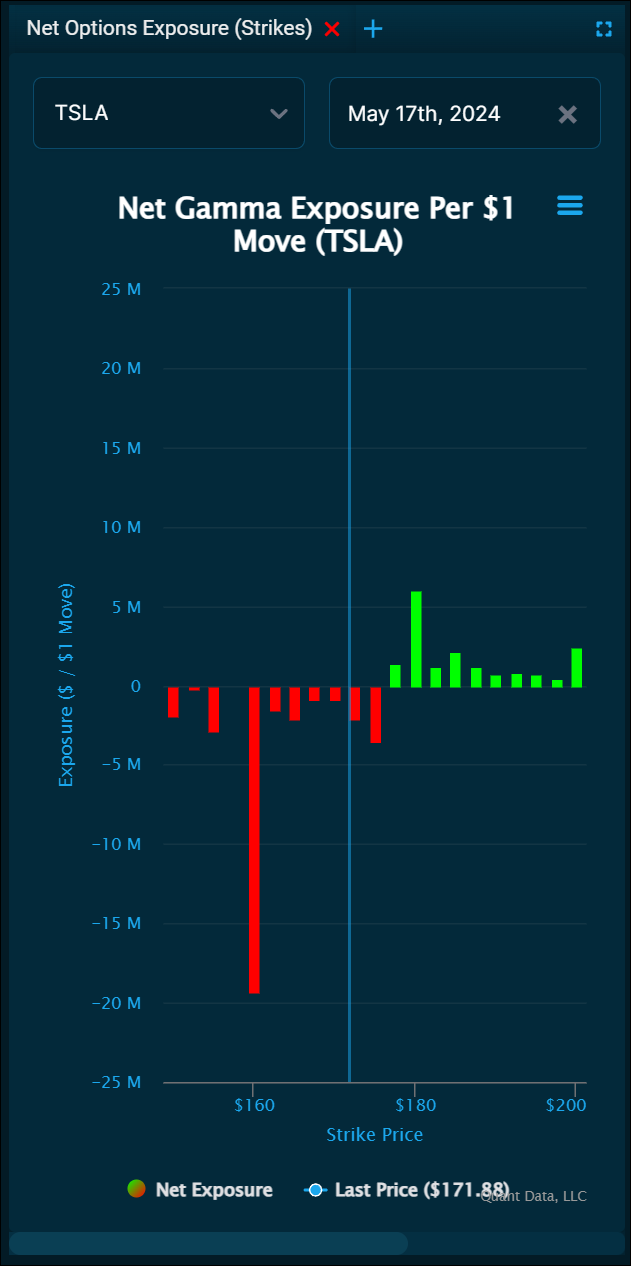

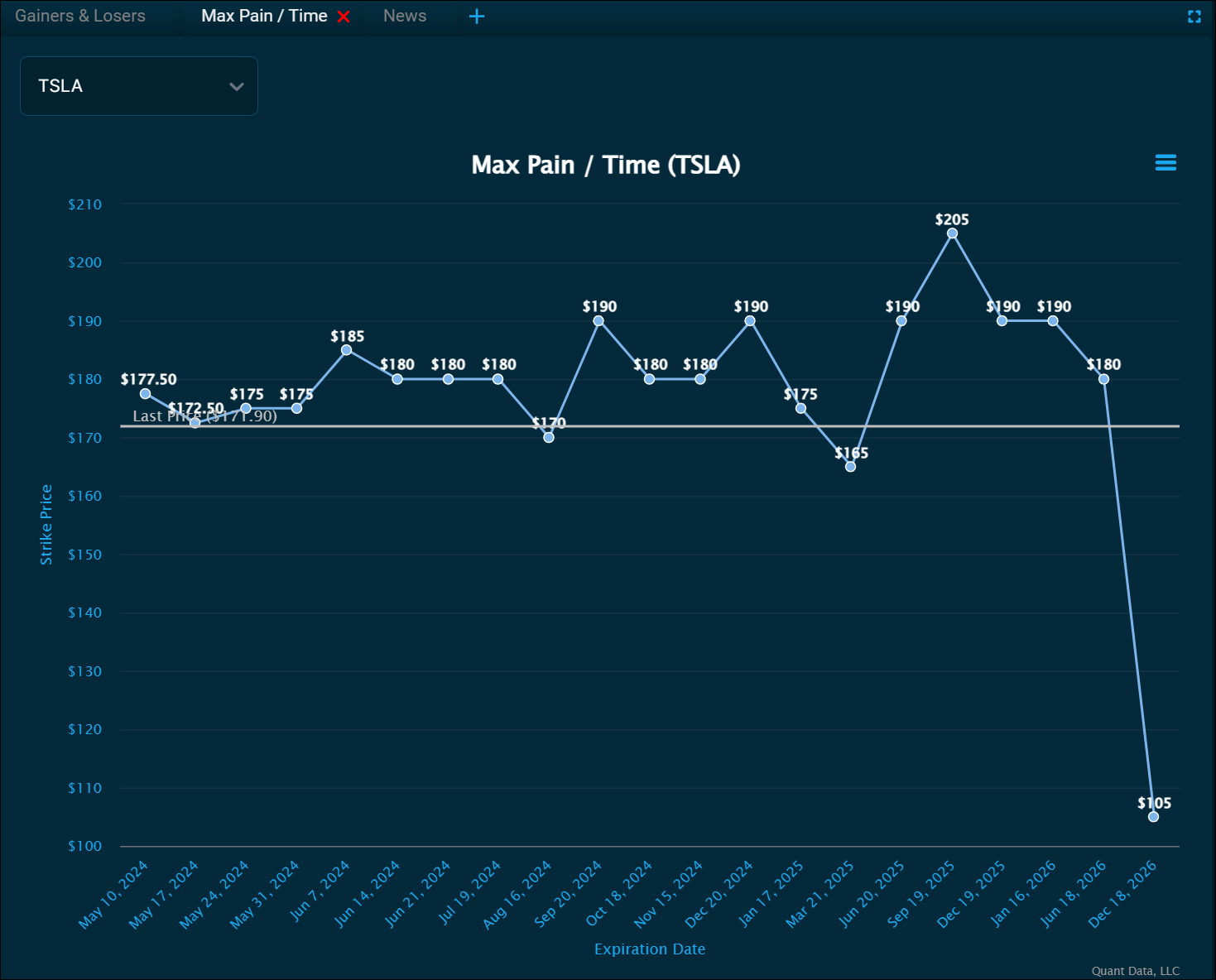

Looking to manage my 100x jan2025 leaps with a Strike of 110. From that graph max pain is in the low 100s at that expiry. What is the general rule to roll LEAPs? Select the 155 Dec2026 for the same number of contracts for the same price?Seems +GEX (calls) dried up for next week and -GEX (puts) grew, so good time to let it run

View attachment 1045688

Purple shows the aggregate GEX weight:

View attachment 1045689

View attachment 1045691

View attachment 1045693

Looking to manage my 100x jan2025 leaps with a Strike of 110. From that graph max pain is in the low 100s at that expiry. What is the general rule to roll LEAPs? Select the 155 Dec2026 for the same number of contracts for the same price?

@woodisgood said:

I'm in a similar situation but resolving it through no/low cost rolling on strong up or down trends during a day. First I had a sugarload of Sept 22 DITM leaps but I moved them all to Jan23 DITM leaps (most at same strikes) for very little. Now it's time to first move them to Mar23 and then to Jun23 while we wait to see a market recovery. I'll eventually will move them to Jan2030s if I have to wait for an excellent return. I can outlast the market's irrationality.

Timing leap rolling works best in an IRA or other tax-protected environment. If you are trading in a regular brokerage account, you might still benefit from doing so if the call price is approaching the price you paid for the call. There's little tax to pay if you sell your Jan23 leap for a little more than you paid. If it's worth less than you paid, you get into a wash-rule situation where you can't deduct the loss. Thus, selling the Jan23 for slightly more than you bought it is the sweet spot if you're not trading in an IRA/401K. In a brokerage account, consider long-term vs. short-term gains.

Let's say the stock price is going up (I know, a rather rare event these days). You first buy the later expiration leap (such as mar23 or jun23) and then you wait for TSLA to rise enough to sell your jan23 leap close in value to the newly purchased, later expiring leap. Voila, a no cost/low cost leap roll. Let's say your Jan22 leap has $180 value but a Mar23 leap of same strike is selling for $185. You need somewhat more than $5 stock price rise to bring about a zero-cost pseudo-roll. If the stock price is descending quickly, you first sell the Jan23 leap then wait to buy the later-expiring leap when it reaches approx. price parity with what you received for selling your Jan23.

Sometimes a strong run upwards or downwards runs out of steam and starts to reverse before you've reached your no-cost goal. In this case, it's essential that you have spare cash in the account to make up the difference. Also, it's important that your brokerage account has a margin component that allows you to use the funds from a just-sold transaction to immediately buy another transaction. Another alternative is to sell a $26.67 Jan23 call and buy a Jun23 $50 leap, provided you're not paying too much for change in time value. The new leap is worth less than the old, but you generate cash in the transaction, and if the cash increase is roughly the same as the decrease in leap value because of higher strike price, you have done a neutral trade. I did this exact trade on Thursday Oct13 and and it doesn't require much of a TSLA price change to be profitable.

You need to get comfortable with the process if you're going to move lots of calls and I strongly suggest trading only 1 call at a time until you have it wired. I try to keep the value of the purchasing and selling calls within about $5 of each other so that I don't need a huge rally or plunge to do the trade without overnight exposure. Overnight exposure in this environment can be dangerous. Nonetheless, I was trading 5 Jan23 166.67s for 5 Mar23 166.67s and was playing the downtrend by selling first and buying later. I took a chance by not completing the trade before market close, figuring there would be a least a few more dollars of drop before TSLA hits rock bottom (I was right) and completed the trade as TSLA bottomed out Thursday morning.

Use the volatility to your advantage.

I have Dec 2025 +c200's that I will sell off if we get any rally above 250, but failing that will roll out to keep alive, cost is $15 to roll out a year - was less before, so IV must have gone up on the 2026 strikes...Looking to manage my 100x jan2025 leaps with a Strike of 110. From that graph max pain is in the low 100s at that expiry. What is the general rule to roll LEAPs? Select the 155 Dec2026 for the same number of contracts for the same price?

Question I ask myself, is would I pay $15 now to open Dec 2026 +c200's, which is an overwhelming yes

I see them as proxy-shares, will keep them alive and sell against them like shares

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K