I 've been dabbling in option trades, mostly CC's and a few bullish calls - lost some $ back in Fall 2019 but made it back and more early 2020 thanks to parts of failing CC's I'd rolled over ... I also haven't gone far enough into the Free Options Trading Course from Option Alpha | Option Alpha recommended by @adiggs in the excellent Selling Options - Be the House thread. One of my strongest new year resolutions ;D

Anyways, back a few months earlier I posted a question on that Be the House Thread, and got some excellent advice re my 03/18/2022 1600 C (March call) not being a great idea, advising rather June calls - advice which I promptly followed, selling some Jan 21 calls and buying a 06/17/2022 C call replacement. This turned out OK, tho of course the Jan calls did return very high profits (had I kept them *AND* sold them at the right time of course easy to say in hindsight), and the March call went into the red, resurfacing in the green on Mega Monday of course.

At this point I'm learning with one of my IRA (& ROTH IRA now accounts), leaving the main stocks mostly in my taxable accounts alone.

So in order to be more disciplined, keeping track, and motivating myself - also helping others learn, hopefully less from my mistakes than better trades, I'm publishing here my current status, and trades, not guaranteeing consistency. Uh I have other day jobs too

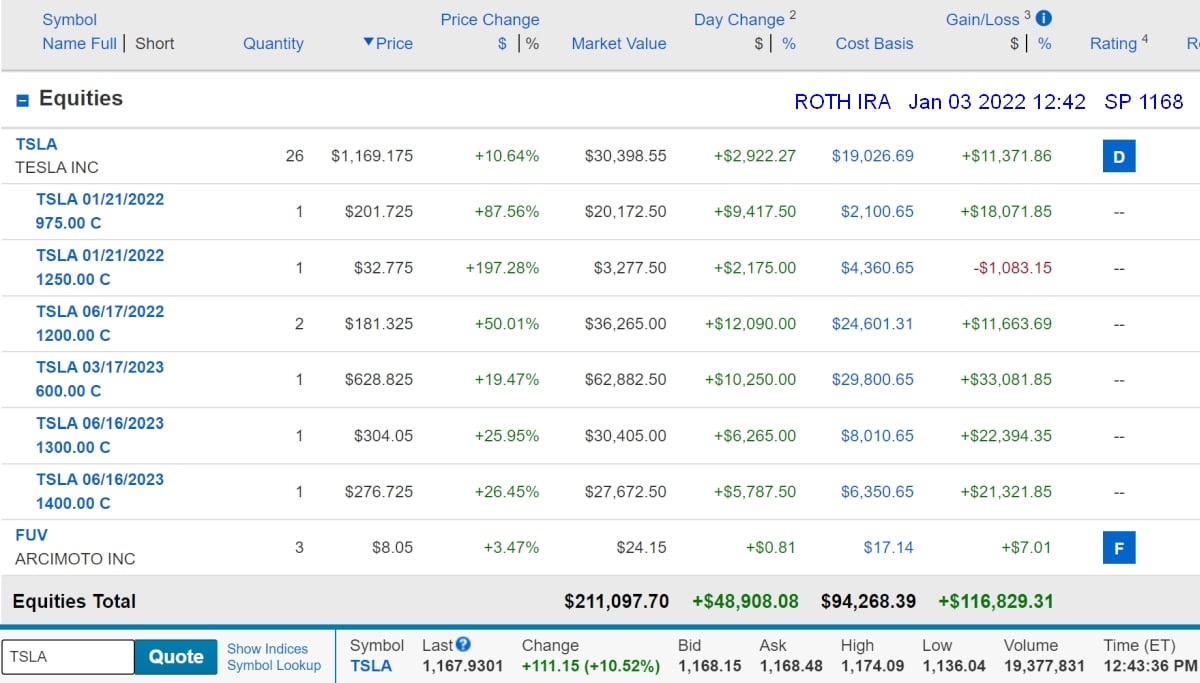

So this is as of Monday Jan 3 2022 first trading day of the year, starting with a bang as we all saw, SP +13% on stunning 4Q deliveries report.

Here's my ROTH

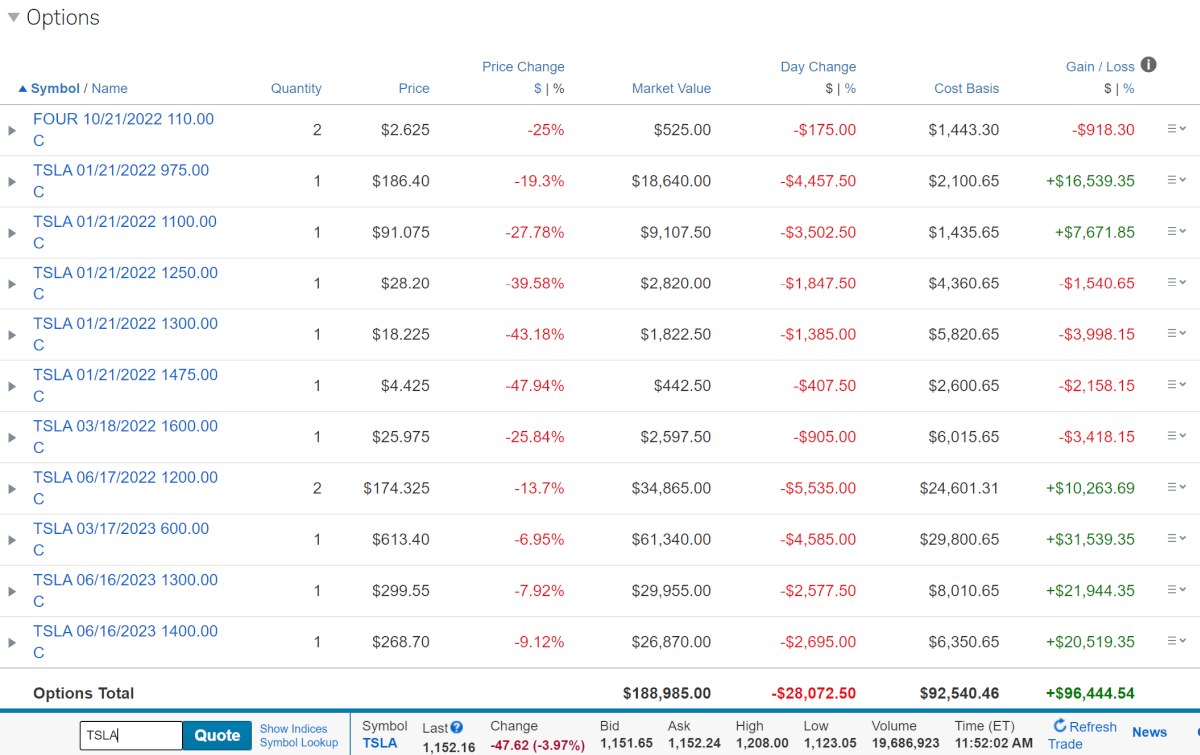

And my IRA which has mostly short calls and a couple symbolic TSLA for reference - I moved most of my safe trades to the ROTH in December as I figured I may as well pay the taxes on the lower valued assets.

I don't expect comments on this thread, altho I'd definitely welcome them. I will ask smallish-er questions in the Be The House (BTH) thread, pointing to this thread for reference.

My goals are to try and aggressively trade for faster growth than with straight TSLA's - I'm confident in Tesla's ability to continue to execute and innovate to I don't mind 50% draw downs as happened recently. 50% would be the limit tho, as lower and it would make comebacks more difficult, I think

Right now I see that with time decay growing fast, I need to do something ASAP re my Jan Calls - Meantime there was a morning bump today Tue Jan 4, followed by a sharp push down, so there I missed it - TBH I was expecting more upswing thru the week, till at least Fri when Elon is expected to announce Giga Texas production starting. Should know better, tho, b/c the SP rarely moves on announcements other than solid numbers that translate into earnings - remembering the Battery Day and AI day major unveils that drew a blah from the markets (moved by the FUD as usual) .

Immediate goal is to stabilize my situation with minimum risks on the downside as I feel I have been foolishly too late on selling these high volatility short calls vs more reasoned trades. After that I could resume short horizon learning trades depending on how I expect the SP to behave short/ medium term.

Today Tue Jan 4 11:52 all these options are in the red, definitely not as pretty as yesterday's greens - let's see what a good strategy is

Thinking out loud, I better start a Wingman Trade tracker to keep track of all trades, as well as a paper trading account (w/ my IBKR account for example, or maybe ThinkorSwim)

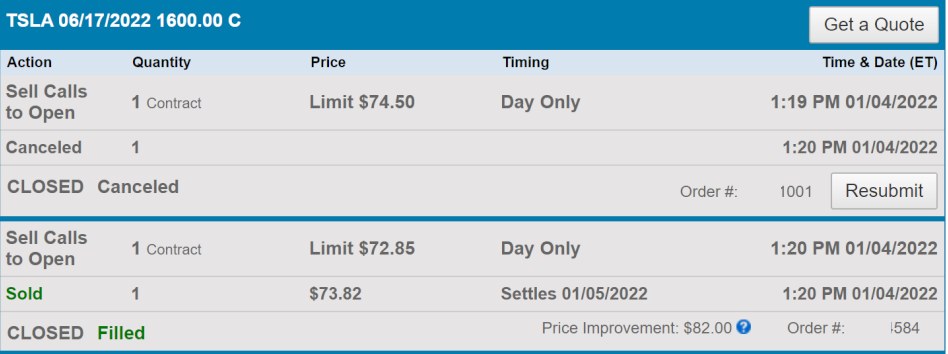

Update: 13:20 - not dealing w/ more tricky Jan 975 call - since I already have that Mar leg, may as well see if I can make a few bucks, on it - $1600 no too likely and I could buy it back too.

Update 2 14:15 Alright - this was a learning trade, to check how liquid it is - will pocket the $580 gain, good for a lunch

Anyways, back a few months earlier I posted a question on that Be the House Thread, and got some excellent advice re my 03/18/2022 1600 C (March call) not being a great idea, advising rather June calls - advice which I promptly followed, selling some Jan 21 calls and buying a 06/17/2022 C call replacement. This turned out OK, tho of course the Jan calls did return very high profits (had I kept them *AND* sold them at the right time of course easy to say in hindsight), and the March call went into the red, resurfacing in the green on Mega Monday of course.

At this point I'm learning with one of my IRA (& ROTH IRA now accounts), leaving the main stocks mostly in my taxable accounts alone.

So in order to be more disciplined, keeping track, and motivating myself - also helping others learn, hopefully less from my mistakes than better trades, I'm publishing here my current status, and trades, not guaranteeing consistency. Uh I have other day jobs too

So this is as of Monday Jan 3 2022 first trading day of the year, starting with a bang as we all saw, SP +13% on stunning 4Q deliveries report.

Here's my ROTH

And my IRA which has mostly short calls and a couple symbolic TSLA for reference - I moved most of my safe trades to the ROTH in December as I figured I may as well pay the taxes on the lower valued assets.

I don't expect comments on this thread, altho I'd definitely welcome them. I will ask smallish-er questions in the Be The House (BTH) thread, pointing to this thread for reference.

My goals are to try and aggressively trade for faster growth than with straight TSLA's - I'm confident in Tesla's ability to continue to execute and innovate to I don't mind 50% draw downs as happened recently. 50% would be the limit tho, as lower and it would make comebacks more difficult, I think

Right now I see that with time decay growing fast, I need to do something ASAP re my Jan Calls - Meantime there was a morning bump today Tue Jan 4, followed by a sharp push down, so there I missed it - TBH I was expecting more upswing thru the week, till at least Fri when Elon is expected to announce Giga Texas production starting. Should know better, tho, b/c the SP rarely moves on announcements other than solid numbers that translate into earnings - remembering the Battery Day and AI day major unveils that drew a blah from the markets (moved by the FUD as usual) .

Immediate goal is to stabilize my situation with minimum risks on the downside as I feel I have been foolishly too late on selling these high volatility short calls vs more reasoned trades. After that I could resume short horizon learning trades depending on how I expect the SP to behave short/ medium term.

Today Tue Jan 4 11:52 all these options are in the red, definitely not as pretty as yesterday's greens - let's see what a good strategy is

Thinking out loud, I better start a Wingman Trade tracker to keep track of all trades, as well as a paper trading account (w/ my IBKR account for example, or maybe ThinkorSwim)

Update: 13:20 - not dealing w/ more tricky Jan 975 call - since I already have that Mar leg, may as well see if I can make a few bucks, on it - $1600 no too likely and I could buy it back too.

Update 2 14:15 Alright - this was a learning trade, to check how liquid it is - will pocket the $580 gain, good for a lunch

Last edited: