Elon playing 4D chess again, eh?High jobless numbers mean good interest rate outlook?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Knightshade

Well-Known Member

Is the news of the no longer having the wheel nag on 12.4 pumping the stock?

*checks SP*

No.

when sp drops, credit becomes larger and chances of breaking even gets biggerit worked!

i had SMCI B/W stuck at 901.66 pre-earnings

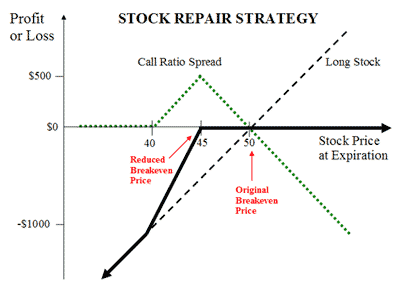

instead of weekly -c905 CC and wait forever for sp to rise, i did a 1:2 Call Ratio Spread aka Stock Repair Strategy aka CC + Bull Call Spread

+c835 x1 and -c870 x2 reduced my breakeven from 901.66 into 865

rinse/repeat and i'm out with no capital loss since there is large initial credit every week

View attachment 1045346

Stock Repair Strategy

You did your homework, picked a great stock, totally undervalued and ready for a nice price rise. However, after you bought the stock, the damn thing goes and drops 20%. So what do you do now?optionstradingiq.com

so i rolled 5/17 +c835 x1 -c870 x2 into 5/24 +c800 x1 -c850 x2 (978.25 credit), lowering cost basis from 901.66 to 865 to 850

per contract, there is even an 812 profit at expiry... sweetttttttttttttttttttttttttttttttt

edit: at current sp 805, it means i will make realized gain=1478 per contract using this strategy instead of doing nothing and waiting for sp to rise into 901.66; 1478 is almost the same as CC income so this is a bigger win

Last edited:

when sp drops, credit becomes larger and chances of breaking even gets bigger

so i rolled 5/17 +c835 x1 -c870 x2 into 5/24 +c800 x1 -c850 x2 (978.25 credit), lowering cost basis from 901.66 to 865 to 850

per contract, there is even an 812 profit at expiry... sweetttttttttttttttttttttttttttttttt

View attachment 1045580

Am I understanding this correctly? It looks like this repair strategy is to help exit an underwater position with a profit? Since the profits are capped once the stock price recovers.

If I wanted to keep the shares (at the original cost basis of $900, but now shifted to ~$846), do I just roll-merge the 2x -c850 into a single -c860 (or higher strike)? Or would I continue the repair strategy and roll into a higher strike (the midpoint should've shifted higher)?

the purpose is to lower the breakeven of underwater stocks; profit is nice-to-have bonus (if you can time it) because this would normally be 0 credit during setupAm I understanding this correctly? It looks like this repair strategy is to help exit an underwater position with a profit? Since the profits are capped once the stock price recovers.

If I wanted to keep the shares (at the original cost basis of $900, but now shifted to ~$846), do I just roll-merge the 2x -c850 into a single -c860 (or higher strike)? Or would I continue the repair strategy and roll into a higher strike (the midpoint should've shifted higher)?

rolling depends on you if you still want the shares; if you think stock will drop again or go up after the fix

don't forget there is an early assignment risk if you go too far dte

Stock Repair Strategy Guide [Setup, Entry, Adjustment, Exit]

Stock repair is an options strategy used to help recover losses from a long stock position. Learn more with Option Alpha's free strategy guide.

Now that you got it down to 850, your next roll, the -c has to be at least 850 right? Because you do not want to sell below the cost basis. With this strategy, it's best to start it asap while the SP did not move too far away from the cost basis. I was looking at some of my $215 TSLA CB shares and I would need to go out to jul 24 for +c175 -c190.when sp drops, credit becomes larger and chances of breaking even gets bigger

so i rolled 5/17 +c835 x1 -c870 x2 into 5/24 +c800 x1 -c850 x2 (978.25 credit), lowering cost basis from 901.66 to 865 to 850

per contract, there is even an 812 profit at expiry... sweetttttttttttttttttttttttttttttttt

edit: at current sp 805, it means i will make realized gain=1478 per contract using this strategy instead of doing nothing and waiting for sp to rise into 901.66; 1478 is almost the same as CC income so this is a bigger win

View attachment 1045585

edit: Ahh..looks like you would be using the 850 as the new cost basis and use that as a starting point to roll into a new repair strategy with the -c being 850-(+c SP/2)

Last edited:

if sp expires at 850, my new cost basis is 850Now that you got it down to 850, your next roll, the -c has to be at least 850 right? Because you do not want to sell below the cost basis. With this strategy, it's best to start it asap while the SP did not move too far away from the cost basis. I was looking at some of my $215 TSLA CB shares and I would need to go out to jul 190.

depending on your outlook for the stock, at that point you can

- collapse everything and exit altogether (no loss), or

- close the options (with realized gain) and keep the stock (with unrealized loss) and rinse/repeat the strategy, or

- close the options (with realized gain) and keep the stock (with unrealized loss) and ATM CC (start the wheel again)

Last edited:

5-Day 178.40

20-Day 167.94

50-Day 172.53

100-Day 193.56

200-Day 217.79

20-Day 167.94

50-Day 172.53

100-Day 193.56

200-Day 217.79

CrunchyJello

Member

when sp drops, credit becomes larger and chances of breaking even gets bigger

so i rolled 5/17 +c835 x1 -c870 x2 into 5/24 +c800 x1 -c850 x2 (978.25 credit), lowering cost basis from 901.66 to 865 to 850

per contract, there is even an 812 profit at expiry... sweetttttttttttttttttttttttttttttttt

edit: at current sp 805, it means i will make realized gain=1478 per contract using this strategy instead of doing nothing and waiting for sp to rise into 901.66; 1478 is almost the same as CC income so this is a bigger win

View attachment 1045585

Would selling another OTM put (i.e. 1x700p) not help the repair process?

Or are we just taking on unwarranted extra risk?

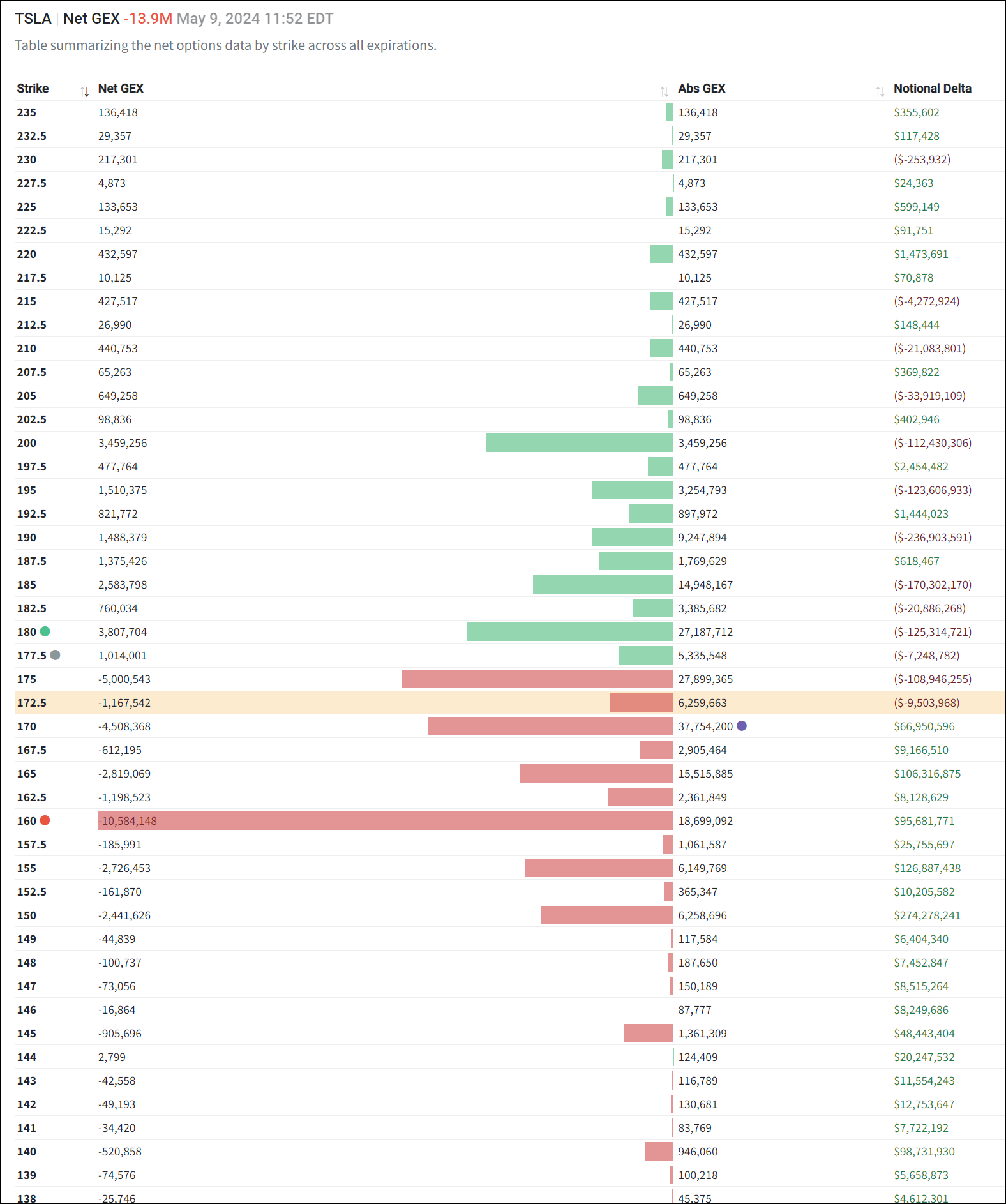

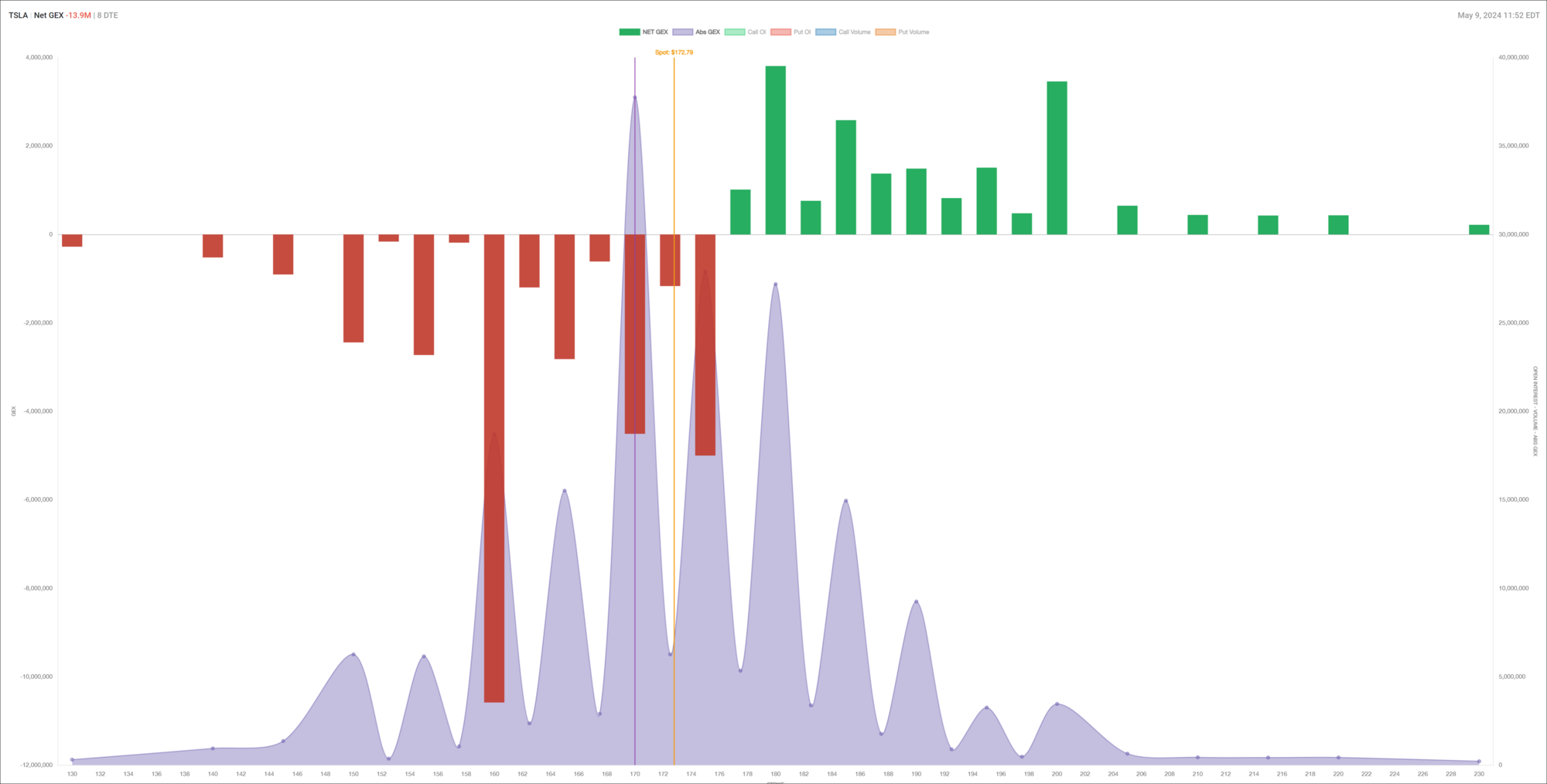

As of now next week is not looking as much improvement, seems range-bound $160-$175 absent a surprise catalyst (@Yoona is this what you're seeing as well?).

This sux since I took a decent hit BTC a bunch of 5/17 -C165's up in the mid-180's on April 29 and didn't cover loss with a simultaneous STO new ones (roll) since the movements were so erratic I didn't want to do something stupid and get run over. This time "wait and see" before selling new CC's worked against me, though I did catch earlier this week a handful -C210 7/19 @$7.60 but BTC too early for $5.75 (now $3.60).

On the bright side 90% of my shares are no longer tied up in CC's, but I've lost several weeks of gains from the recent gyrations, I feel so stupid

Was considering STO today 5x -P170 10/18/24 (162 days out) @$18.50, but afraid of taking on more risk in case we drop further to $160-$140 and even lower on some crazy developments (Tesla "pivot" "vote" "drama" and/or macro related). Already have 15x -P300 6/18/26 @$115.76 (now red @$133.75) that can survive down to $130's, that's more risk than I'd like (I also noticed OI dropped on these from 2,500+ to 554 ).

).

I feel stuck and just sitting on my hands until we see $184-187 (if...) where I can try to sell the -C210 7/19 again.

How are you generating income from TSLA on weeks like these, or are you also sitting it out?

5/17

@Yoona correct me if I'm wrong, the red Net Delta Exposure bars in the rightmost box, taken together with the red bars in the other panels, gives confluence for downward pressure. When Net Delta Exposure is all green (or at least very little red), and the other's also more green than red, can support more bullish moves. Meaning Delta is the last to check, but if it matches Gamma and Vanna, then there's higher probability that bias will likely happen (per one of the guys in the Quant discord).

This sux since I took a decent hit BTC a bunch of 5/17 -C165's up in the mid-180's on April 29 and didn't cover loss with a simultaneous STO new ones (roll) since the movements were so erratic I didn't want to do something stupid and get run over. This time "wait and see" before selling new CC's worked against me, though I did catch earlier this week a handful -C210 7/19 @$7.60 but BTC too early for $5.75 (now $3.60).

On the bright side 90% of my shares are no longer tied up in CC's, but I've lost several weeks of gains from the recent gyrations, I feel so stupid

Was considering STO today 5x -P170 10/18/24 (162 days out) @$18.50, but afraid of taking on more risk in case we drop further to $160-$140 and even lower on some crazy developments (Tesla "pivot" "vote" "drama" and/or macro related). Already have 15x -P300 6/18/26 @$115.76 (now red @$133.75) that can survive down to $130's, that's more risk than I'd like (I also noticed OI dropped on these from 2,500+ to 554

I feel stuck and just sitting on my hands until we see $184-187 (if...) where I can try to sell the -C210 7/19 again.

How are you generating income from TSLA on weeks like these, or are you also sitting it out?

5/17

@Yoona correct me if I'm wrong, the red Net Delta Exposure bars in the rightmost box, taken together with the red bars in the other panels, gives confluence for downward pressure. When Net Delta Exposure is all green (or at least very little red), and the other's also more green than red, can support more bullish moves. Meaning Delta is the last to check, but if it matches Gamma and Vanna, then there's higher probability that bias will likely happen (per one of the guys in the Quant discord).

Last edited:

Right now I'm just adjusting up and down, trying to find a week where the SP closes close to my straddle strike, then I can widen it out to a strangle...As of now next week is not looking as much improvement, seems range-bound $170-$175 again absent a surprise catalyst (@Yoona is this what you're seeing as well?).

This sux since I took a decent hit BTC a bunch of 5/17 -C165's up in the mid-180's on April 29 and didn't cover loss with a simultaneous STO new ones (roll) since the movements were so erratic I didn't want to do something stupid and get run over. This time "wait and see" before selling new CC's worked against me, though I did catch earlier this week a handful -C210 7/19 @$7.60 but BTC too early for $5.75 (now $3.60).

On the bright side 90% of my shares are no longer tied up in CC's, but I've lost several weeks of gains from the recent gyrations, I feel so stupid

Was considering STO today 5x -P170 10/18/24 (162 days out) @$18.50, but afraid of taking on more risk in case we drop further to $160-$140 and even lower on some crazy developments (Tesla and/or macro related). Already have 15x -P300 6/18/26 @$115.76 (now red @$133.75) that can survive down to $130's, that's more risk than I'd like (I also noticed OI dropped on these from 2,500+ to 554).

I feel stuck and just sitting on my hands until we see $184-187 (if...) where I can try to sell the -C210 7/19 again.

How are you generating income from TSLA on weeks like these or are you also sitting it out?

5/17

View attachment 1045597

@Yoona correct me if I'm wrong, the red Net Delta Exposure bars in the rightmost box, taken together with the red bars in the other panels, gives confluence for downward pressure. When Net Delta Exposure is all green (or at least very little red), and the other's also more green than red, can support more bullish moves. Meaning Delta is the last to check, but if it matches Gamma and Vanna, then there's higher probability that bias will likely happen (per one of the guys in the Quant discord).

View attachment 1045598

View attachment 1045599

Obviously very wary of the downside right now, so even though I could double-up my puts and roll them out a week and down from 100x -p180 to 200x -p170, I'm very reticent to do so, although that remains one possibility if I need it

I have my NVDA 5x -c800 to play out on 5/24, likely outcome there is sell off my 500 shares, recuperating a decent wedge of cash into my account, which will certainly help with put management -> not that I have any risk of margin call or anything like that, but it opens up more possibilities, if we did get a huge dump from here I could sell off the 200x +p150's and flip to CSP

If NVDA is mid-800's on 5/24 then perhaps rolling the -c800 & -p900 would be the more profitable thing to do,need to see closer to the time

And if NVDA closes close, or above $900 in their earnings week, then I can start to sell puts against the Jan 2025 +p900's I'm holding, a few $$$ coming in there takes the pressure off the TSLA trades

thenewguy1979

"The" Dog

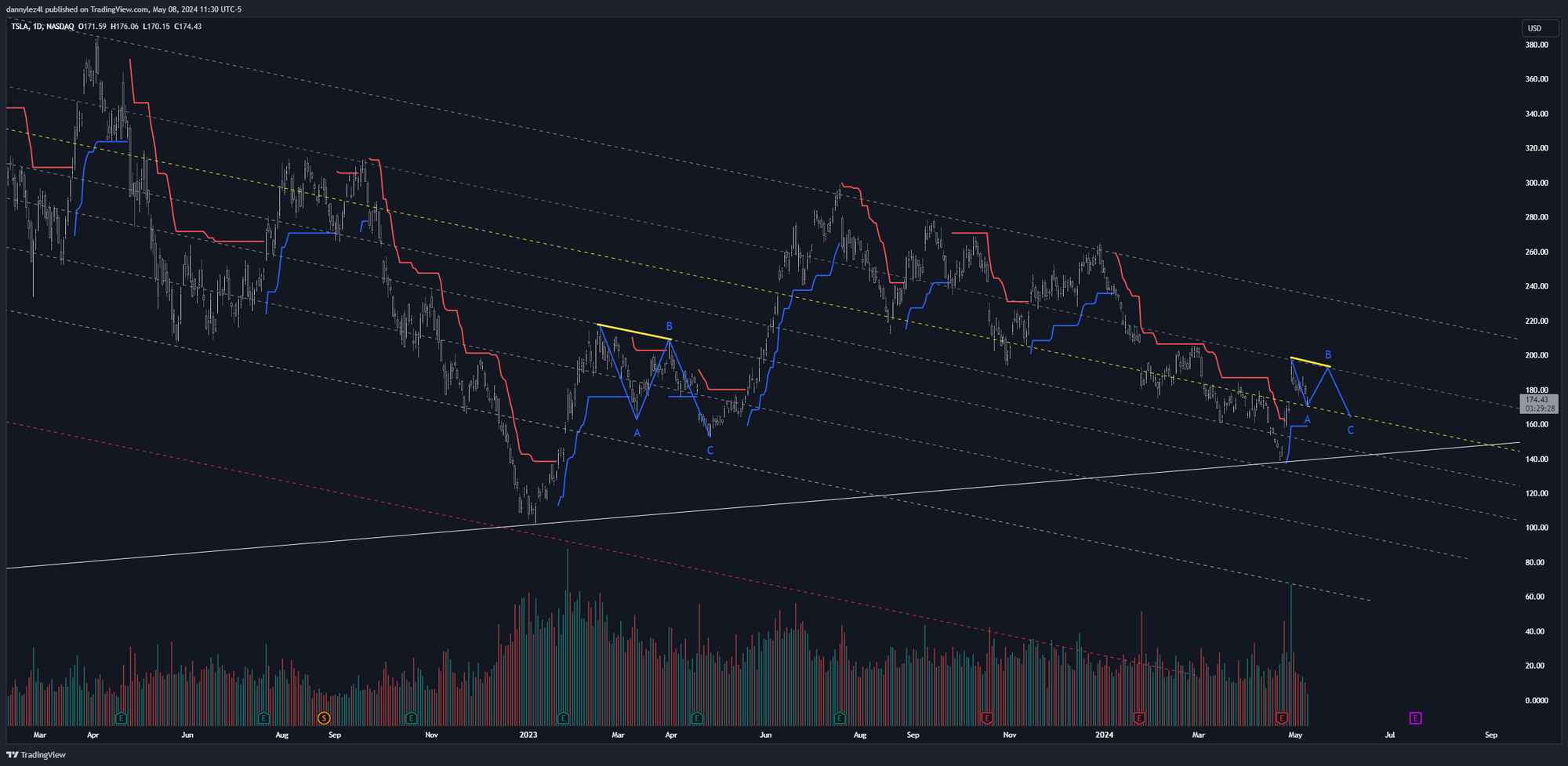

Didn't dl003 chart yesterday show a bounce up to maybe 180 before we drop further to 160 level?

When everyone and their mom bet on Puts there's always that lingering fear of a rug pull.

When everyone and their mom bet on Puts there's always that lingering fear of a rug pull.

Right now I'm just adjusting up and down, trying to find a week where the SP closes close to my straddle strike, then I can widen it out to a strangle...

Obviously very wary of the downside right now, so even though I could double-up my puts and roll them out a week and down from 100x -p180 to 200x -p170, I'm very reticent to do so, although that remains one possibility if I need it

Yes, with all the turmoil @ Tesla downside is still a great risk, though some chartists are saying the risk is to the upside now given how far down we are overall +the recent recovery (though they don't follow the fundamentals of Tesla that exert pressure and do have an impact).

Would STO 5x -P170 10/18/24 (162 days out) @$18.50 (with a SL if we lose ~$170-$168) make sense around here as a way to gain from a rise to recover losses? I know we're not supposed to open new trades to make up for previous losses/mistakes and to assess each trade on its own merits. Still...lol.

Last edited:

EW update: Purple path ($193-$155) or gray path ($160-$236)

Clear as mud

Clear as mud

Price will stay weak for a few more days to a week, before some "good news" comes out and take us back to 185-190. Then, the 2nd leg down begins.Didn't dl003 chart yesterday show a bounce up to maybe 180 before we drop further to 160 level?

When everyone and their mom bet on Puts there's always that lingering fear of a rug pull.

View attachment 1045608

I've already 45x Dec 2025 -p190 & -c190 -> obviously one side of those will expire, the -c are covered by Dec 2025 +c200's, which I intend to roll out to end 2026 or better still, 2027 when the chain opens up, but I don't wish to add to this position, although it is a great final escape plan when one is is a bit of a fix, each -p/-c straddle pays around $90, and again one side will expire worthless, so as long as the puts do lose out too much extrinsic, it's a good interim position, but already got bloated enoughYes, with all the turmoil @ Tesla downside is still a great risk, though some chartists are saying the risk is to the upside now given how far down we are overall +the recent recovery (though they don't follow the fundamentals of Tesla that exert pressure and do have an impact).

Would STO 5x -P170 10/18/24 (162 days out) @$18.50 (with a SL if we lose ~$170-$168) make sense around here as a way to gain from a rise to recover losses? I know we're not supposed to open new trades to make up for previous mistakes and to assess each trade on its own merits. Still...lol.

I hope to hit my cash goal before the end of the year, after that I'll look to start rolling out those straddles to lower/higher strikes, hopefully widen it enough that the whole lot expire

I’m back with @MaxPain seeing risk to the downside. Volume has dried up again and other than that post-ER surge it doesn’t seem like much has changed in the short-term.

I’m expecting Q2 to be down, per Troy, and I think the market will start to reflect that as we get closer to P&D next month. I’m feeling pretty comfortable with my ITM calls for this week and bought a few puts for tomorrow and next week.

I’m expecting Q2 to be down, per Troy, and I think the market will start to reflect that as we get closer to P&D next month. I’m feeling pretty comfortable with my ITM calls for this week and bought a few puts for tomorrow and next week.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K