Someone with more statistics knowledge than I might find greater correlation than I see. I see options buyers and sellers correcting their exposures based on price shifts (and possibly the reverse causation that Papafox sees), but on the Fridays in this chart: in 2 weeks SP>MP, and in 2 weeks the opposite, all within $10.From JimS’s charts (courtesy of @Papafox) they seem to correlate very well (see example below). Or is that showing instead that MP draws up to SP mid-week instead of the other way around?

Papafox very often jeers how manipulative the pirates are by getting SP to MP, some weeks to the penny.

View attachment 1019900

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I can double the number of ICs if I have to to pay for a roll up or down, along with bring the winning side in, so I'm not worried about a move that could put my ICs ITM.It seems very safe, but that is what I told myself with TSLA when the Hertz story came out and wiped out call spreads and then shortly after the Twitter thing happened and wiped out puts. With straight calls and puts you are just forced to roll, buy or sell. With spreads you are forced to pay the spread. If NVDA took a 30% hit after earnings, it would be a big hit on those spreads. The risk is under 1%, but I would guess would be a painful black swan.

tivoboy

Active Member

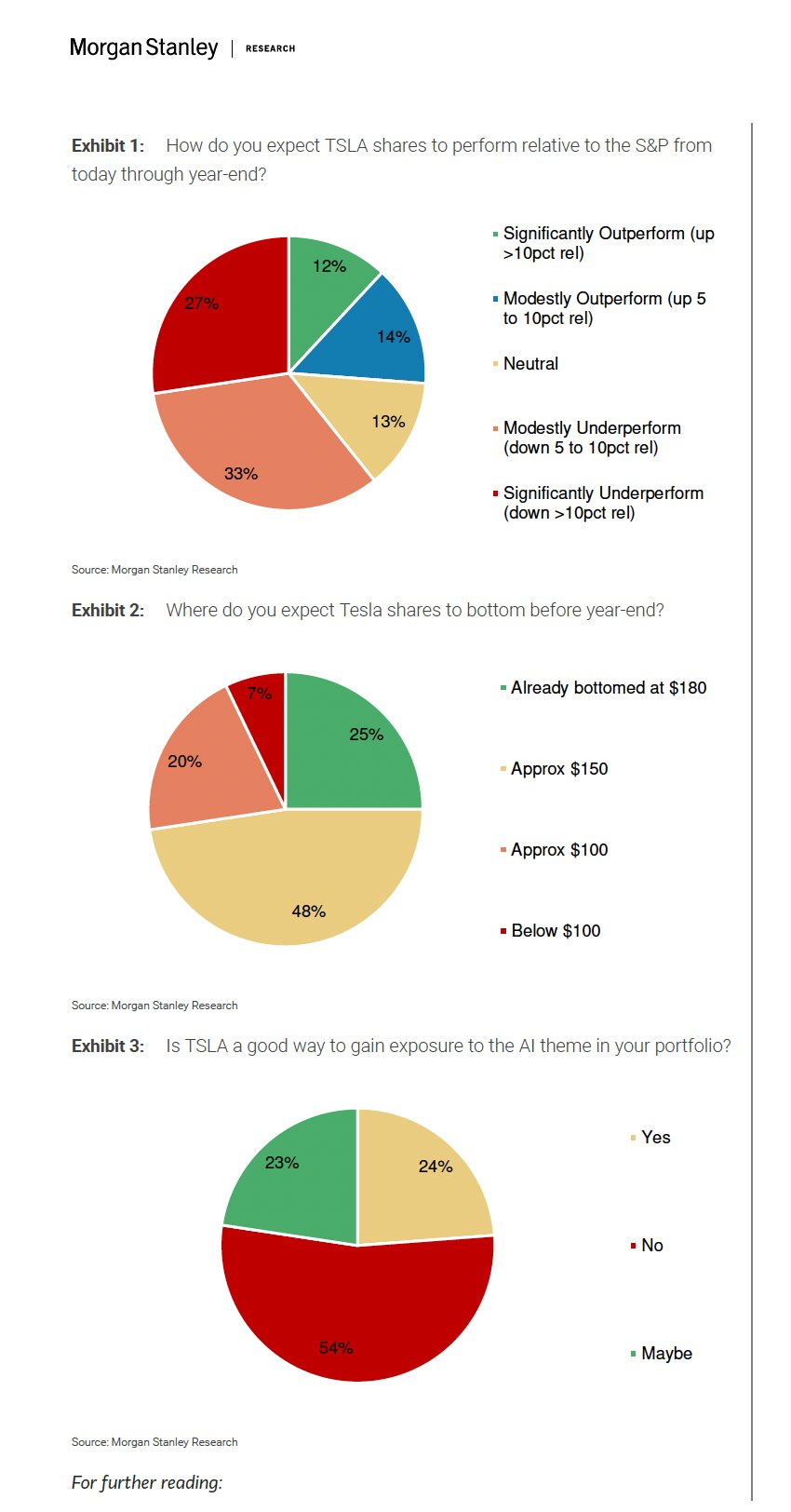

Uh, what is the E that they are using?At $199.95 TSLA's P/E Ratio has fallen to 46.4

TSLA' s PE Ratio Range Over the Past 10 Years

- Min: 31.23

- Med: 126.09

- Max: 1,396.86

- Current: 46.4

View attachment 1019783

Uh, what is the E that they are using?

I'm guessing the standard definition based on the company's disclosures? Enlighten us if you have another view.

"The Price to Earnings Ratio (PE Ratio) is calculated by taking the stock price/EPS Diluted (TTM). This metric is considered a valuation metric that confirms whether the earnings of a company justifies the stock price. There isn't necesarily an optimum PE ratio, since different industries will have different ranges of PE Ratios. Because of this, PE Ratio is great to evaluate from a relative standpoint with other similar companies.

Tesla PE Ratio Analysis | YCharts

In depth view into Tesla PE Ratio including historical data from 2010, charts and stats.

tivoboy

Active Member

Yes, I meant what E are they coming up with.. for forward price to EARNINGS, many analysts have projected E at ~ 2.50-3$ for the 2024 year… that changes the ratio for sure, if the P is the same. Current Q1 projects are between .55-70 CENTS, granted a low sales quarter, but not necessarily a high COST quarter. Costs will most likely rise throughout the year, mostly from wages my guess. So, if we put conservatively E at $3, we’re still at 70+ P/EI'm guessing the standard definition based on the company's disclosures? Enlighten us if you have another view.

"The Price to Earnings Ratio (PE Ratio) is calculated by taking the stock price/EPS Diluted (TTM). This metric is considered a valuation metric that confirms whether the earnings of a company justifies the stock price. There isn't necesarily an optimum PE ratio, since different industries will have different ranges of PE Ratios. Because of this, PE Ratio is great to evaluate from a relative standpoint with other similar companies.

View attachment 1019907

Tesla PE Ratio Analysis | YCharts

In depth view into Tesla PE Ratio including historical data from 2010, charts and stats.ycharts.com

Someone with more statistics knowledge than I might find greater correlation than I see. I see options buyers and sellers correcting their exposures based on price shifts (and possibly the reverse causation that Papafox sees), but on the Fridays in this chart: in 2 weeks SP>MP, and in 2 weeks the opposite, all within $10.

I’d like to think any correlation we are seeing is like you seem to suggest, that it’s due to sellers correcting their exposures based on active pricing, which in turn shifts MP.

Tail/dog, which wags which? Maybe someone here did the research and can share their findings.

thenewguy1979

"The" Dog

Yoona started on the research couple weeks back. I recalled she got the raw data for the past 3-4 years on SP vs MP.I’d like to think any correlation we are seeing is like you seem to suggest, that it’s due to sellers correcting their exposures based on active pricing, which in turn shifts MP.

Tail/dog, which wags which? Maybe someone here did the research and can share their findings.

@Yoona please advise?

Interesting, but weren’t the higher P/E’s over last months (65+) also based on EPS estimates at the time? On that same scale today TSLA’s P/E is lower than it’s been in a long time. Seemingly a better buy.Yes, I meant what E are they coming up with.. for forward price to EARNINGS, many analysts have projected E at ~ 2.50-3$ for the 2024 year… that changes the ratio for sure, if the P is the same. Current Q1 projects are between .55-70 CENTS, granted a low sales quarter, but not necessarily a high COST quarter. Costs will most likely rise throughout the year, mostly from wages my guess. So, if we put conservatively E at $3, we’re still at 70+ P/E

But I hear what you’re saying, that in a way it doesn’t make TSLA a better buy now because its lower P/E is based on lower earnings per share (less valuable due to lower EPS?). Though this is a bit strange because wasn’t TSLA derided for having a higher multiple in the past? We can’t have it both ways.

I’m sure I’m missing something.

tivoboy

Active Member

Well earnings pretty much cratered… coming in in Q4 about half of what had been projected at the beginning of the year 2023. As revenues came in lighter, that put downward pressure on earnings. Early last year 2023, when we were at 108, PE was ~ 25… that was a screaming buy signal among other signals. I’m not saying it should be that low, but getting to truly 35-45 would be another such signal. This stock will move independent of that for sure, MOMO, FOMO don’t care about such things. But some part of the supportive narrative should be reasonable PE. For 2024, growth at least in automotive seems to be FLAT to possibly DOWN. At least revenues, if not overall sales. We’ll see. And I can’t see energy storage making up all that lack of YOY growth.Interesting, but weren’t the higher P/E’s over last months (65+) also based on EPS estimates at the time? On that same scale today TSLA’s P/E is lower than it’s been in a long time. Seemingly a better buy.

But I hear what you’re saying, that in a way it doesn’t make TSLA a better buy now because its lower P/E is based on lower earnings per share (less valuable due to lower EPS?). Though this is a bit strange because wasn’t TSLA derided for having a higher multiple in the past? We can’t have it both ways.

I’m sure I’m missing something.

ChiefRollo

Member

From this chart, it comes across consistently as a lagging indicator.JimS’s charts (courtesy of @Papafox) seem to implicate that MP does drive SP (see example below) except on rare outlier weeks driven by other reasons causing the divergence. Or is that showing instead that MP draws up to SP mid-week instead of the other way around?

(Papafox very often jeers how manipulative the pirates are by getting SP to MP, some weeks to the penny.)

View attachment 1019900

DarkKnight83

Member

They are using the wrong E. PE is ˜66 now.Uh, what is the E that they are using?

DarkKnight83

Member

They are using the wrong E to calculate PE. TSLA got one time tax refund last Q. So GAAP EPS is 2.21. But Non-GAAP is .71. That’s where this 44 PE comes from. It’s a wrong calculation.Interesting, but weren’t the higher P/E’s over last months (65+) also based on EPS estimates at the time? On that same scale today TSLA’s P/E is lower than it’s been in a long time. Seemingly a better buy.

But I hear what you’re saying, that in a way it doesn’t make TSLA a better buy now because its lower P/E is based on lower earnings per share (less valuable due to lower EPS?). Though this is a bit strange because wasn’t TSLA derided for having a higher multiple in the past? We can’t have it both ways.

I’m sure I’m missing something.

i dunno what to do with mp raw data , seems like a hit-miss thing and who is pulling whoYoona started on the research couple weeks back. I recalled she got the raw data for the past 3-4 years on SP vs MP.

@Yoona please advise?

ChiefRollo

Member

I think Tesla in a way set PE ratio aside when it decided to no longer play nice (to invite participants in the collective effort “to accelerate the world's transition to sustainable energy through electric vehicles”) and began flexing its cost muscle…toward accelerated ICE conversion-share gain. As we know, that focus on “growing while one can” makes sense but ignores public pressure on profit generation. We know many can make EV’s…as there have been over 300 EV makers just in China; very few though will prove to do so sustainably profitably. Legacy players and their mouthpieces have and no doubt will continue their PE narrative…not unlike that once upon a time at AMZN’s expense. AMZN had its unique vision that it worked hard toward…while shutting down the noise; I believe Tesla is trying to do the same.Well earnings pretty much cratered… coming in in Q4 about half of what had been projected at the beginning of the year 2023. As revenues came in lighter, that put downward pressure on earnings. Early last year 2023, when we were at 108, PE was ~ 25… that was a screaming buy signal among other signals. I’m not saying it should be that low, but getting to truly 35-45 would be another such signal. This stock will move independent of that for sure, MOMO, FOMO don’t care about such things. But some part of the supportive narrative should be reasonable PE. For 2024, growth at least in automotive seems to be FLAT to possibly DOWN. At least revenues, if not overall sales. We’ll see. And I can’t see energy storage making up all that lack of YOY growth.

This is great for TSLA then, maybe it lures in lots of buyers who think it’s on discountThey are using the wrong E to calculate PE. TSLA got one time tax refund last Q. So GAAP EPS is 2.21. But Non-GAAP is .71. That’s where this 44 PE comes from. It’s a wrong calculation.

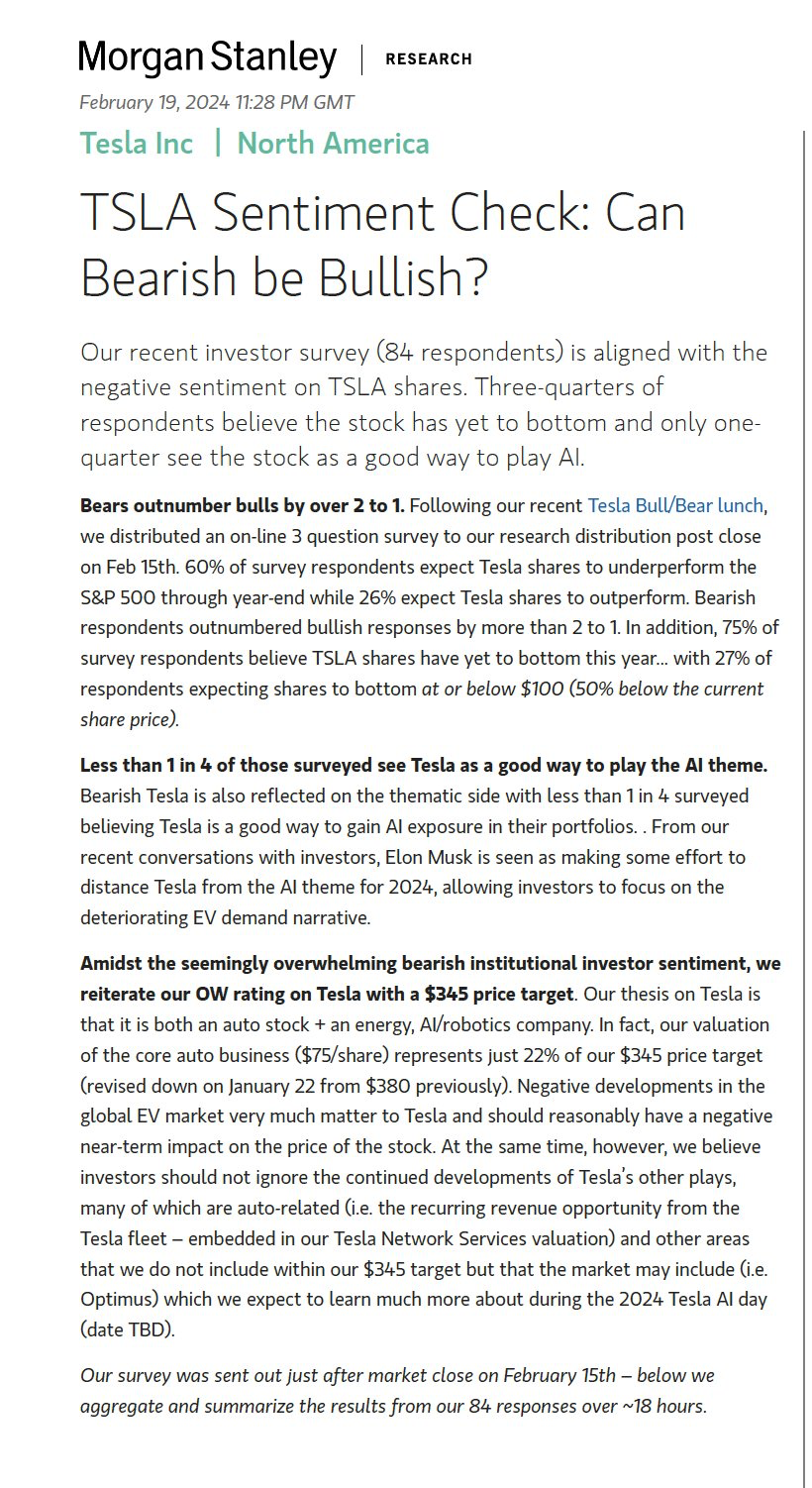

New note from AJ @ MS:

Rating: OW

SP: $345

(Credit: Sawyer)

Rating: OW

SP: $345

(Credit: Sawyer)

tivoboy

Active Member

Figure out the statistical tracking percentage between the two, and target tighter IC around it.i dunno what to do with mp raw data , seems like a hit-miss thing and who is pulling who

Dunno if it matters, but TSLA is falling in 24-hour trading. (Does RH trading mean anything to regular trading?)

Last edited:

sry i don't do tight IC, my cheat sheet says 6Δ is good enough (i dare not go 16 unless it’s wed or thur)Figure out the statistical tracking percentage between the two, and target tighter IC around it.

vanna suggests TSLA will probably be range-bound this week, so i STO IC for theta harvesting this long weekend

35% in 4 hrs, should close it tom for round 2

Last edited:

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K