Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Newbie Options Trading

- Thread starter Jonathan Hewitt

- Start date

-

- Tags

- investing options TSLA tsla stock

Thanks mershaw2001, appreciate your response.

Looks like we are looking at two distinctly different strategies. I am curious why you don't recommend selling immediate week?

The one thing, probably the only thing, I know about options is that time decay accelerates pretty dramatically as expiry date approaches. So I was actually thinking of selling the Friday expiry options on Monday, with a reasonable distance of strike price to spot price.

In a medium/long term view, I also think there is a good chance that Tesla will continually go up and up and up for periods at stretch. In a way that's the reason for holding such a large long position in the stock in the first place My view is that as Tesla keeps maturing: Model X, international expansion, supercharger rollout, more sales/service centers within existing countries; the stock price might gradually become less volatile. So the sharp declines of 40%+ will become increasingly rare is my view. So I am bit leery of strategies that could eventually lead to getting the shares called away. I actually don't want to sell even a single share for next five years at a minimum. I would rather not play any option strategies that defeats this plan, even if it means missing out on some short term profits.

My view is that as Tesla keeps maturing: Model X, international expansion, supercharger rollout, more sales/service centers within existing countries; the stock price might gradually become less volatile. So the sharp declines of 40%+ will become increasingly rare is my view. So I am bit leery of strategies that could eventually lead to getting the shares called away. I actually don't want to sell even a single share for next five years at a minimum. I would rather not play any option strategies that defeats this plan, even if it means missing out on some short term profits.

My idea is to sell the weekly calls during dull periods, when there are:

- No expected announcements, no auto shows etc: TMC is a great source to keep an eye on that

- No earnings reports

- No expected upticks due to analyst reports: for example right now, a bunch of analysts already raised price targets to 310 to 325 range. Any more analysts raising their price targets to the same range shouldn't have much impact on the share price.

Once the bet is placed, either make a profit or a loss, face the consequences, then and there. Pay in cash when a loss is made and never let go of the shares.

It's very hard to tell what catalyst might come up over a longer term time frame. The bet can easily sour as the time period expands is my view.

So these are my reasons for thinking of selling short term calls.

Let me ask a different kind of question (to anyone willing to answer):

Tesla closed at 256.78 on Friday.

Aug 29 call with 265 strike has a last price of 1.25 with bid/ask at 1.18/1.28.

Lets say the market opens exactly at the same prices on Monday.

I will sell the call at 1.18.

Now lets say, on wednesday, the stock soars to 266 or worse 268 and that puts the option in the money.

In this case what are the odds that my shares get called away, even before I execute a purchase of the call to neutralize the position?

Of course I would be taking a loss in cash when purchasing the call. I am ok with it. As long as my shares don't disappear I am fine.

In other words, is there a guarantee that any option exercises happen only at or after expiry? Giving me enough chance to protect my shares.

Looks like we are looking at two distinctly different strategies. I am curious why you don't recommend selling immediate week?

The one thing, probably the only thing, I know about options is that time decay accelerates pretty dramatically as expiry date approaches. So I was actually thinking of selling the Friday expiry options on Monday, with a reasonable distance of strike price to spot price.

In a medium/long term view, I also think there is a good chance that Tesla will continually go up and up and up for periods at stretch. In a way that's the reason for holding such a large long position in the stock in the first place

My idea is to sell the weekly calls during dull periods, when there are:

- No expected announcements, no auto shows etc: TMC is a great source to keep an eye on that

- No earnings reports

- No expected upticks due to analyst reports: for example right now, a bunch of analysts already raised price targets to 310 to 325 range. Any more analysts raising their price targets to the same range shouldn't have much impact on the share price.

Once the bet is placed, either make a profit or a loss, face the consequences, then and there. Pay in cash when a loss is made and never let go of the shares.

It's very hard to tell what catalyst might come up over a longer term time frame. The bet can easily sour as the time period expands is my view.

So these are my reasons for thinking of selling short term calls.

Let me ask a different kind of question (to anyone willing to answer):

Tesla closed at 256.78 on Friday.

Aug 29 call with 265 strike has a last price of 1.25 with bid/ask at 1.18/1.28.

Lets say the market opens exactly at the same prices on Monday.

I will sell the call at 1.18.

Now lets say, on wednesday, the stock soars to 266 or worse 268 and that puts the option in the money.

In this case what are the odds that my shares get called away, even before I execute a purchase of the call to neutralize the position?

Of course I would be taking a loss in cash when purchasing the call. I am ok with it. As long as my shares don't disappear I am fine.

In other words, is there a guarantee that any option exercises happen only at or after expiry? Giving me enough chance to protect my shares.

pz1975

Active Member

I would say the chances of options being exercised are almost zero. It has only happened to me once and it was because they were the upper part of a delayed construct bull call spread and they had gone way ITM.

mershaw2001

I'm short the short sellers

Hi SBenson, I will try to give you my reasoning why I avoid the immediate weekly options. You are right, we are looking at two slightly different strategies, but this is because I originally was going to do the strategy you are suggesting and ended up rejecting it as not successful (under my own hand and for my own portfolio size, maybe your hand will be better).

I find that forward week options are too small in value to overcome the significant transaction costs from the brokerage. I will end up paying about 7 dollars to enter the trade, and 7 dollars to exit the trade along with the large bid/ask spread, and so if I sell for ~ 100 dollars then I lose close to 25% of the money simply in transaction costs. I could do these option trades in bulk, but i do most of my option trades in lots of 2 or 3 contracts per transaction, which represents about 20% of my shares in each transaction (1000 shares, selling 2 or 3 options per transaction) to minimize the result of me being on the wrong side of the trade when Tesla spikes up.

Some fraction of the time you will end up in the money and having to buy back for a loss, so i shy away from option contracts where I can't get 150 or more dollars per contract. You are right that the option Aug 29 call 265 strike looks like a good deal, I agree that at 1.18 it is probably a good option to sell. However, that was the price on friday where the weekend was an unknown. When that option opens up on monday, it makes sense to me that the value will be 1.08 or so because of the two days of time decay. So if you can sell options for 5 days away and get 1.20 I agree with you it's a good deal. Perhaps the best is selling at 3:40pm on friday for 1.20. I find that 9, 10, 11 and 12 days are even better deals.

With that said, I would advise that you don't sell such short term calls on ALL your shares. The opportunity loss is too great for this one strike- if tesla hits 268, I think there is a high potential for it to hit 275. You would have then received 1.18 and had to buy back at 1000 dollars (275-265). Furthermore, in your example there is a complicating problem with the move occurring on a wednesday: the stock move is often well before the expiration date and you pay dearly for the remaining time. For instance, the stock will run to 265 (your chosen strike price) on wednesday of the week. Therefore, the option you sold is 0.00 in the money, but it's value is over 5.00 or more because of the spike in implied volatility at near the money options when tesla is running up and the remaining time value of the option. This presents a problem to closing the option to stop yourself from losing big money. Closing an option when you notice the stock begin to make a run becomes TREMENDOUSLY costly. I find it better to actually sell more options into the spike and wait for IV to come down.

Ok those are my views.

To answer your questions: 1) Your shares can be called away by someone at any point, even if the shares are not in the money. I have had this happen when the shares were 0.05 LESS than the option strike. Dunno why that guy wanted the shares, but I can think of a number of complex reasons involving covering short positions in after hours. This is extremely rare.

2) If the stock is a dividend producing stock (so like apple) then it is advantageous to call away the stock if the dividend value is greater than the time decay value left in the option.

3) 99% of the time your shares will not be called away prior to expiration, because the person would be taking a significant loss on the option. Even if they would not take a significant loss, they then incur a risk which they did not have to be exposed to. For instance, if there is 24 hours left to the option and they call away the shares, then tesla goes bankrupt in those 24 hours they would lose big.

4) Shares tend to be called away in premarket. I have had this occur for drug companies where there is a huge announcement, the stock spikes big and the people with the option want to get out before the price falls back to a more reasonable amount. This has happened to me about 5 times. This actually works to both parties advantage: i buy the stock back in the market and sell a new option for a net debit that is lower than i received. The guy who called away the shares makes a profit before the price goes down. For your purpose, you would lose based on tax reasons but you would come out ahead because that person calling away the shares essentially gave you the "time value" of the option for free.

Ok and finally I think this is the most interesting thing that I have been tossing over in my head to help you:

6) If your shares do get called away, you may be able to retroactively save them.

Say you get exercised in the morning, and you wake up to see your account have no tesla shares (but have a ton of cash in it now). You MAY be able to do the following to preserve your long term capital gain status of the shares and to preserve your shares:

- buy all the shares back on the market

- call your broker and then ask him to adjust the lots of shares selected so that the purchase you just made is paired with the shares that were called away.

I believe there is a chance that this would create a day trade that, because both trades settle on the same day, would be acceptable despite the fact that the sell was an hour before the buy. Your end position would be having all of your shares intact with long term capital gain status, and you would have registered in your account a day trade that has a cost basis of the shares that you bought in the afternoon and sales basis of the strike price of the options.

I DON'T KNOW IF THIS WORKS!!! Call your broker before you make this large purchase if your shares are called away.

Well, all of the above is my advice after many months of selling calls and puts on TSLA. Hope you can take something away from it and if you choose to sell the forward weeklys and you do better than I did, tell me how you did it!!

I find that forward week options are too small in value to overcome the significant transaction costs from the brokerage. I will end up paying about 7 dollars to enter the trade, and 7 dollars to exit the trade along with the large bid/ask spread, and so if I sell for ~ 100 dollars then I lose close to 25% of the money simply in transaction costs. I could do these option trades in bulk, but i do most of my option trades in lots of 2 or 3 contracts per transaction, which represents about 20% of my shares in each transaction (1000 shares, selling 2 or 3 options per transaction) to minimize the result of me being on the wrong side of the trade when Tesla spikes up.

Some fraction of the time you will end up in the money and having to buy back for a loss, so i shy away from option contracts where I can't get 150 or more dollars per contract. You are right that the option Aug 29 call 265 strike looks like a good deal, I agree that at 1.18 it is probably a good option to sell. However, that was the price on friday where the weekend was an unknown. When that option opens up on monday, it makes sense to me that the value will be 1.08 or so because of the two days of time decay. So if you can sell options for 5 days away and get 1.20 I agree with you it's a good deal. Perhaps the best is selling at 3:40pm on friday for 1.20. I find that 9, 10, 11 and 12 days are even better deals.

With that said, I would advise that you don't sell such short term calls on ALL your shares. The opportunity loss is too great for this one strike- if tesla hits 268, I think there is a high potential for it to hit 275. You would have then received 1.18 and had to buy back at 1000 dollars (275-265). Furthermore, in your example there is a complicating problem with the move occurring on a wednesday: the stock move is often well before the expiration date and you pay dearly for the remaining time. For instance, the stock will run to 265 (your chosen strike price) on wednesday of the week. Therefore, the option you sold is 0.00 in the money, but it's value is over 5.00 or more because of the spike in implied volatility at near the money options when tesla is running up and the remaining time value of the option. This presents a problem to closing the option to stop yourself from losing big money. Closing an option when you notice the stock begin to make a run becomes TREMENDOUSLY costly. I find it better to actually sell more options into the spike and wait for IV to come down.

Ok those are my views.

To answer your questions: 1) Your shares can be called away by someone at any point, even if the shares are not in the money. I have had this happen when the shares were 0.05 LESS than the option strike. Dunno why that guy wanted the shares, but I can think of a number of complex reasons involving covering short positions in after hours. This is extremely rare.

2) If the stock is a dividend producing stock (so like apple) then it is advantageous to call away the stock if the dividend value is greater than the time decay value left in the option.

3) 99% of the time your shares will not be called away prior to expiration, because the person would be taking a significant loss on the option. Even if they would not take a significant loss, they then incur a risk which they did not have to be exposed to. For instance, if there is 24 hours left to the option and they call away the shares, then tesla goes bankrupt in those 24 hours they would lose big.

4) Shares tend to be called away in premarket. I have had this occur for drug companies where there is a huge announcement, the stock spikes big and the people with the option want to get out before the price falls back to a more reasonable amount. This has happened to me about 5 times. This actually works to both parties advantage: i buy the stock back in the market and sell a new option for a net debit that is lower than i received. The guy who called away the shares makes a profit before the price goes down. For your purpose, you would lose based on tax reasons but you would come out ahead because that person calling away the shares essentially gave you the "time value" of the option for free.

Ok and finally I think this is the most interesting thing that I have been tossing over in my head to help you:

6) If your shares do get called away, you may be able to retroactively save them.

Say you get exercised in the morning, and you wake up to see your account have no tesla shares (but have a ton of cash in it now). You MAY be able to do the following to preserve your long term capital gain status of the shares and to preserve your shares:

- buy all the shares back on the market

- call your broker and then ask him to adjust the lots of shares selected so that the purchase you just made is paired with the shares that were called away.

I believe there is a chance that this would create a day trade that, because both trades settle on the same day, would be acceptable despite the fact that the sell was an hour before the buy. Your end position would be having all of your shares intact with long term capital gain status, and you would have registered in your account a day trade that has a cost basis of the shares that you bought in the afternoon and sales basis of the strike price of the options.

I DON'T KNOW IF THIS WORKS!!! Call your broker before you make this large purchase if your shares are called away.

Well, all of the above is my advice after many months of selling calls and puts on TSLA. Hope you can take something away from it and if you choose to sell the forward weeklys and you do better than I did, tell me how you did it!!

Thanks mershaw2001, appreciate your response.

Looks like we are looking at two distinctly different strategies. I am curious why you don't recommend selling immediate week?

The one thing, probably the only thing, I know about options is that time decay accelerates pretty dramatically as expiry date approaches. So I was actually thinking of selling the Friday expiry options on Monday, with a reasonable distance of strike price to spot price.

In a medium/long term view, I also think there is a good chance that Tesla will continually go up and up and up for periods at stretch. In a way that's the reason for holding such a large long position in the stock in the first placeMy view is that as Tesla keeps maturing: Model X, international expansion, supercharger rollout, more sales/service centers within existing countries; the stock price might gradually become less volatile. So the sharp declines of 40%+ will become increasingly rare is my view. So I am bit leery of strategies that could eventually lead to getting the shares called away. I actually don't want to sell even a single share for next five years at a minimum. I would rather not play any option strategies that defeats this plan, even if it means missing out on some short term profits.

My idea is to sell the weekly calls during dull periods, when there are:

- No expected announcements, no auto shows etc: TMC is a great source to keep an eye on that

- No earnings reports

- No expected upticks due to analyst reports: for example right now, a bunch of analysts already raised price targets to 310 to 325 range. Any more analysts raising their price targets to the same range shouldn't have much impact on the share price.

Once the bet is placed, either make a profit or a loss, face the consequences, then and there. Pay in cash when a loss is made and never let go of the shares.

It's very hard to tell what catalyst might come up over a longer term time frame. The bet can easily sour as the time period expands is my view.

So these are my reasons for thinking of selling short term calls.

Let me ask a different kind of question (to anyone willing to answer):

Tesla closed at 256.78 on Friday.

Aug 29 call with 265 strike has a last price of 1.25 with bid/ask at 1.18/1.28.

Lets say the market opens exactly at the same prices on Monday.

I will sell the call at 1.18.

Now lets say, on wednesday, the stock soars to 266 or worse 268 and that puts the option in the money.

In this case what are the odds that my shares get called away, even before I execute a purchase of the call to neutralize the position?

Of course I would be taking a loss in cash when purchasing the call. I am ok with it. As long as my shares don't disappear I am fine.

In other words, is there a guarantee that any option exercises happen only at or after expiry? Giving me enough chance to protect my shares.

Last edited:

Thanks again mershaw2001 for taking the time to explain things out.

You are clearly going off of experience while it's a theoretical exercise for me at this point. You make a good point about the transaction cost with bid/ask spread. I didn't pay attention to that earlier.

My example does a poor job of expressing my intention actually. My idea was to cap the loss at 100% of the premium collected. So revising it a bit

Tesla closed at 256.78 on Friday.

Aug 29 call with 265 strike has a last price of 1.25 with bid/ask at 1.18/1.28.

Lets say the market opens at 1.08/1.18 on Monday.

I will sell the call at 1.08.

But as soon as the mid price reaches say $2, I will buy it back and stop the loss.

I am not entirely sure how much of underlying movement can cause me to exit. It looks like a mere $4 or $5 move in stock price can potentially kick me out. So if I am frequently coming out with a loss, maybe overall I won't make money. If I were to do this on a weekly basis, because of wash rules I won't be able to get tax deduction on losses but will pay taxes on profits. Net-net I wonder if I will even break even... Do you have any thoughts on this?

I am tempted to buy last 18-months of option history for Tesla at historicaloptiondata.com and see how things would have panned out if I did this every monday like a robot. The hope is, by using judgement I might do better than a blind robot strategy (maybe not, who knows). But I might still not get the full picture because they only sell end-of-day data. If there is a spike intraday which settles back by end of day, I would have gotten out at a loss, but this data won't show it.

You are clearly going off of experience while it's a theoretical exercise for me at this point. You make a good point about the transaction cost with bid/ask spread. I didn't pay attention to that earlier.

My example does a poor job of expressing my intention actually. My idea was to cap the loss at 100% of the premium collected. So revising it a bit

Tesla closed at 256.78 on Friday.

Aug 29 call with 265 strike has a last price of 1.25 with bid/ask at 1.18/1.28.

Lets say the market opens at 1.08/1.18 on Monday.

I will sell the call at 1.08.

But as soon as the mid price reaches say $2, I will buy it back and stop the loss.

I am not entirely sure how much of underlying movement can cause me to exit. It looks like a mere $4 or $5 move in stock price can potentially kick me out. So if I am frequently coming out with a loss, maybe overall I won't make money. If I were to do this on a weekly basis, because of wash rules I won't be able to get tax deduction on losses but will pay taxes on profits. Net-net I wonder if I will even break even... Do you have any thoughts on this?

I am tempted to buy last 18-months of option history for Tesla at historicaloptiondata.com and see how things would have panned out if I did this every monday like a robot. The hope is, by using judgement I might do better than a blind robot strategy (maybe not, who knows). But I might still not get the full picture because they only sell end-of-day data. If there is a spike intraday which settles back by end of day, I would have gotten out at a loss, but this data won't show it.

mershaw2001

I'm short the short sellers

Seems like it is worth trying. I agree that the stock doesn't have to move much to kick you out of your position due to your stock loss- a move to 261 or so on monday would push those options to a value that would stop you out.

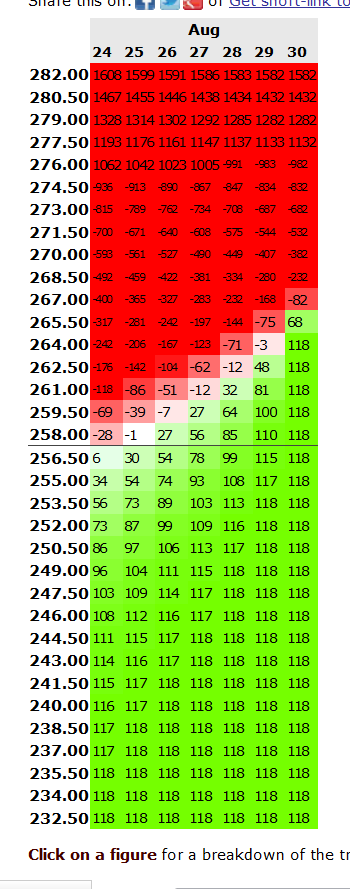

In fact, I remember a site that would help you with your calculations: Options profit calculator

This allows you to calculate where the stock would move to on any particular day in order to stop you out. As you can see from the options profit calculator, a move to 261 on monday causes you to lose 118 dollars on the trade. Since your original sell point was 118, that puts the option value to 236, over your 200 stop loss.

Frankly i think it's not worth looking at retrospective data, i'd say start small and just sell 2 or 3 contracts this week and see how that goes.

In fact, I remember a site that would help you with your calculations: Options profit calculator

This allows you to calculate where the stock would move to on any particular day in order to stop you out. As you can see from the options profit calculator, a move to 261 on monday causes you to lose 118 dollars on the trade. Since your original sell point was 118, that puts the option value to 236, over your 200 stop loss.

Frankly i think it's not worth looking at retrospective data, i'd say start small and just sell 2 or 3 contracts this week and see how that goes.

Thanks again mershaw2001 for taking the time to explain things out.

You are clearly going off of experience while it's a theoretical exercise for me at this point. You make a good point about the transaction cost with bid/ask spread. I didn't pay attention to that earlier.

My example does a poor job of expressing my intention actually. My idea was to cap the loss at 100% of the premium collected. So revising it a bit

Tesla closed at 256.78 on Friday.

Aug 29 call with 265 strike has a last price of 1.25 with bid/ask at 1.18/1.28.

Lets say the market opens at 1.08/1.18 on Monday.

I will sell the call at 1.08.

But as soon as the mid price reaches say $2, I will buy it back and stop the loss.

I am not entirely sure how much of underlying movement can cause me to exit. It looks like a mere $4 or $5 move in stock price can potentially kick me out. So if I am frequently coming out with a loss, maybe overall I won't make money. If I were to do this on a weekly basis, because of wash rules I won't be able to get tax deduction on losses but will pay taxes on profits. Net-net I wonder if I will even break even... Do you have any thoughts on this?

I am tempted to buy last 18-months of option history for Tesla at historicaloptiondata.com and see how things would have panned out if I did this every monday like a robot. The hope is, by using judgement I might do better than a blind robot strategy (maybe not, who knows). But I might still not get the full picture because they only sell end-of-day data. If there is a spike intraday which settles back by end of day, I would have gotten out at a loss, but this data won't show it.

I'm afraid I'm going to be a bit of a Debbie Downer here. The problem with your approach is that any particular option is thinly traded, and and a relatively small change in price of the underlying stock can cause wild swings in both the value and price (and remember, they're not the same thing!) of the options. For example, using your numbers, if TSLA goes to $266.78 (that is, exactly $10 more than it closed on Friday, but only 3.5% rise) the intrinsic value of the option is $1.78, already way above what you got for selling it, and there's still time value to be factored in. So, you go to buy it back at $2, and guess what: no-one wants to sell at that price! Now you're glued to the screen, continually adjusting your offers, and every time it blips up you fret, and all your careful planning goes out the window.

Looking at historical data, or playing pencil and paper exercises, doesn't really work here. For one thing, you're not glued to the screen in realtime, you're just thinking about how you might have played it, probably optimistically. For another, part of the definition of "thinly traded" is that your own trades, even small ones, change the market!

BTW, yes, I am speaking from actual experience. I've written calls, raised my stress level not wanting to lose $33 cost basis stock, and found it impossible not to fret, bought them back at a loss, only to see that if I'd had the courage it would have been fine (unless someone exercised the calls). But sometimes I've stared at a 3x loss, and been unable to buy to cover. I don't play this game any more.

Thanks guys, I feel like I learnt everything I need to learn from you, without having to go through some traumatic experiences.

ggr, you make some good points. Quite honestly I can't afford to be glued to the screen. I have a demanding job and there is no guarantee that the occasional dull periods in my job will coincide with "exciting" periods of my options positions. So this strategy is really not for me. Deep down I am a long term investor. I don't know what got into me to think selling weekly calls is an easy way to make money

The only options strategy that might work for me is buying a bunch of LEAPs when the stock takes a beating. Sure I might not have been able to pull this during the f*re sale. But the short term crash from 260 to 180 early this year was meaningless in my view and would have been a great time to buy some leaps. Oh well, hindsight is 20/20

ggr, you make some good points. Quite honestly I can't afford to be glued to the screen. I have a demanding job and there is no guarantee that the occasional dull periods in my job will coincide with "exciting" periods of my options positions. So this strategy is really not for me. Deep down I am a long term investor. I don't know what got into me to think selling weekly calls is an easy way to make money

The only options strategy that might work for me is buying a bunch of LEAPs when the stock takes a beating. Sure I might not have been able to pull this during the f*re sale. But the short term crash from 260 to 180 early this year was meaningless in my view and would have been a great time to buy some leaps. Oh well, hindsight is 20/20

Last edited:

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

Thanks again mershaw2001 for taking the time to explain things out.

You are clearly going off of experience while it's a theoretical exercise for me at this point. You make a good point about the transaction cost with bid/ask spread. I didn't pay attention to that earlier.

My example does a poor job of expressing my intention actually. My idea was to cap the loss at 100% of the premium collected. So revising it a bit

Tesla closed at 256.78 on Friday.

Aug 29 call with 265 strike has a last price of 1.25 with bid/ask at 1.18/1.28.

Lets say the market opens at 1.08/1.18 on Monday.

I will sell the call at 1.08.

But as soon as the mid price reaches say $2, I will buy it back and stop the loss.

OK here is your error in thought: you want a chance to win with no risk? No, in your example you buy back at a higher price than you got when selling so clearly yourloss was not capped at 100% of the premium collected.

Hello Everyone,

Instead of options, I started buying other products, namely Mini Long Certificates, or "Turbos".

Those I buy are issued by Barclays, and are traded in Paris: here is an example: ISIN FR0012110708

Anyone else using these? I find them "safer" than straight options...

Instead of options, I started buying other products, namely Mini Long Certificates, or "Turbos".

Those I buy are issued by Barclays, and are traded in Paris: here is an example: ISIN FR0012110708

Anyone else using these? I find them "safer" than straight options...

chickensevil

Active Member

Is there a decent formula to figure out what the "fair value" of an option is when you are looking at a specific strike price in order to identify when that price is too low (buy) or too high (sell)? Because the more I watch options the more I am realizing that there are periods where a particular strike will fluctuate around this hover point.

For example the calculator tells me that the 20 Sept @ 280 call for the 27th of Aug has a 0 return value at $4.05 at 270$ So the "fair-value" if the stock was actually at 270 would be 4.05$ so if it is less than 4.05 that would be a steal for that particular option (assuming you still think the price will go to 280 over the time given... of course).

So what is the easy way to identify what the fair-value of the option should be so you know when you go outside those ranges?

For example the calculator tells me that the 20 Sept @ 280 call for the 27th of Aug has a 0 return value at $4.05 at 270$ So the "fair-value" if the stock was actually at 270 would be 4.05$ so if it is less than 4.05 that would be a steal for that particular option (assuming you still think the price will go to 280 over the time given... of course).

So what is the easy way to identify what the fair-value of the option should be so you know when you go outside those ranges?

mershaw2001

I'm short the short sellers

Is there a decent formula to figure out what the "fair value" of an option is when you are looking at a specific strike price in order to identify when that price is too low (buy) or too high (sell)? Because the more I watch options the more I am realizing that there are periods where a particular strike will fluctuate around this hover point.

For example the calculator tells me that the 20 Sept @ 280 call for the 27th of Aug has a 0 return value at $4.05 at 270$ So the "fair-value" if the stock was actually at 270 would be 4.05$ so if it is less than 4.05 that would be a steal for that particular option (assuming you still think the price will go to 280 over the time given... of course).

So what is the easy way to identify what the fair-value of the option should be so you know when you go outside those ranges?

i think that you want to use historical volatility to predict implied volatility, right? Historical volatlity is the volatility of the stock in the past 30 or 60 days, and implied is the volatlity in the future. The historical can be calculated by the fluctuations in the stock and is a known quantity. The implied volatility of an option is calculated by knowing all other greeks of the option and using the black sholes formula to back-calculate the Vega (implied volatility).

Historical volatility isn't always a predictor of IV, as there's no reason that the stock should fluctuate at the same level as before. You can use the black sholes formula and replace implied volatility with historical volatllity to do what you are looking to do: make a prediction of the option price using the current volatility. Historical volatility (HV) is given from Fidelity, i know i can find the 30 and 60 day HV on their active trader platform; i'd imagine you can find it from any website or trading platform. Black sholes is complicated and you probably want to use a black sholes calculator then to price the option. I googled it and found that there are some black sholes calculators online.

I'd be happy to discuss more, tell me what you think of this approach. Or, for others out there who are more knowledgeable about this than myself, feel free to correct me.

I guess the thing about options is that in order to be an expert, you have to intuit volatility. I think that today's tesla volatility is over the historical norm for a few minutes, but its appropriate for the given future news releases (model x etc) and so I would consider the implied volatility to be accurate, despite the fact that its over the historical volatility.

chickensevil

Active Member

Well like what I noticed today as I was watching the 20 Sep @ 280 calls it shot way up this morning into a crazy high price of over 5$ and then it dropped to 3$ then shot back up again to 5$ and then dropped all within the first 15 minutes, and the rose back and has leveled out now it seems in the 3.60 range despite having a stock price of ~270.00. Everything I am seeing is indicating that it should be valued higher than that, but it isn't (it should be around 3.98 at a stock price of 270). So that is why I was hoping there was any easy way to identify these fluctuations at a glance rather than having to run some crazy calculation on each and every option I am interested in, and then cross checking against the current value and hypothetical valuation changes...

mershaw2001

I'm short the short sellers

Another thing to note is whether you could have actually gotten that price. It's one thing if the last transaction as at 5 dollars if you wanted to sell, but it may have been a lone transaction and the only way you could have gotten that fleeting sell order in would be if you had a limit order open. Personally I think having a limit order open on tesla options is a recipe for disaster unless you are glued to the screen. I'm just saying that by the time you go to sell at 5.00 for the option, the bid may only be 4.00.

chickensevil

Active Member

Well that is why for now I am trying to stick with the monthly options in order to give enough volume to support me having more time to trade at the price I want when I want it. I am also staying relatively close to the current strike prices which is also helping this. For example the current volume on the 280s is 2508. That gives a lot more leeway. One week earlier only has 212 for that strike and the week after only has 82.

So when I was messing around with this, I was originally going to plan on a purchase of the 26 Sept options, but then it dawned on me how low the volumes were for that week. I am sure as the week approaches the volume will go up, but it seems to me, unless you want to wait for the week of expiration to do something with them, you should probably stick to the monthlies as that seems to make it much easier. Waiting until the week of expiration if you aren't ATM or ITM at that point you are likely to be screwed on one of those off weeks and the value seems to drop off rather quickly and they get harder to sell (volume drops).

Just my observations, again, I am an uber noob on this whole option thing... I threw 2k into an options account and plan to just play around with it until either it grows into something decent or I burn through it all and it becomes nothing. So far I am 50/50 on having a good judgement call and getting a return on my investment... which means, I have basically avoided losing money... (note I am only talking about closed trades here not my open activity)

So when I was messing around with this, I was originally going to plan on a purchase of the 26 Sept options, but then it dawned on me how low the volumes were for that week. I am sure as the week approaches the volume will go up, but it seems to me, unless you want to wait for the week of expiration to do something with them, you should probably stick to the monthlies as that seems to make it much easier. Waiting until the week of expiration if you aren't ATM or ITM at that point you are likely to be screwed on one of those off weeks and the value seems to drop off rather quickly and they get harder to sell (volume drops).

Just my observations, again, I am an uber noob on this whole option thing... I threw 2k into an options account and plan to just play around with it until either it grows into something decent or I burn through it all and it becomes nothing. So far I am 50/50 on having a good judgement call and getting a return on my investment... which means, I have basically avoided losing money... (note I am only talking about closed trades here not my open activity)

This is a pretty decent calculator, inasmuch as it populates all of the fields for you for a particular security. Recognize, though, that the market's estimate of IV (Implied Volatility) is different than a mechanically calculated historical volatility.

chickensevil

Active Member

This is a pretty decent calculator, inasmuch as it populates all of the fields for you for a particular security. Recognize, though, that the market's estimate of IV (Implied Volatility) is different than a mechanically calculated historical volatility.

Ok so I think that is the piece I was missing was that what was causing crazy prices today was the IV was all over the place within the first 30 minutes of opening... Is that normal to have it be so wild in the early trading? Or was this caused by the jump in share price and everyone now wanting a piece of the pie.

- - - Updated - - -

It also doesn't help anything that the IV over the course of the day looks like this:

So I think that sorta answers my own question which means that the best time to sell today was at the open, (or possibly during the 272 spike), and the best time to buy was pretty much at the end of the day.

I am learning here, I think. It is a lot to take in and I am really glad I got my feet wet slowly with this one to really figure all of this stuff out. So new question (Since I answered my own question), is there a charting tool out there that will do all this in real time? so you can not only watch the stock price but also get some idea of IV over time so you can see how it is trending.

- - - Updated - - -

Also, looking at this historical IV seems to show really well the ramp up pre-earnings, and then the subsequent dramatic drop off in IV. So I definitely am making the right call not to touch options that overlap that time period.

I actually seems like the *best* play is to make a good judgement of the stock price just before ER and buy an option to match that in order to bank on the IV by itself (plus whatever stock movement you gain)

pz1975

Active Member

This was discussed in detail a few months ago, but note that the IV spike around ERs is mostly for options expiring that week and less of a spike out to 4 weeks expiration. Any options with expirations beyond 6 weeks have minimal IV changes around ERs.

mershaw2001

I'm short the short sellers

IV is almost always highest at the beginning of the day, and then it drains over the course of the day as the price stabilizes.

chickensevil

Active Member

IV is almost always highest at the beginning of the day, and then it drains over the course of the day as the price stabilizes.

So generally speaking sell in the morning buy once it stabilizes, price determining of course.

- - - Updated - - -

This was discussed in detail a few months ago, but note that the IV spike around ERs is mostly for options expiring that week and less of a spike out to 4 weeks expiration. Any options with expirations beyond 6 weeks have minimal IV changes around ERs.

OK good to know... So like LEAPS aren't going to be affected. Thanks that helps.

Similar threads

- Replies

- 0

- Views

- 139

- Replies

- 3

- Views

- 720

- Locked

- Replies

- 0

- Views

- 4K

- Replies

- 30

- Views

- 991