Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

-

Tesla's Supercharger Team was recently laid off. We discuss what this means for the company on today's TMC Podcast streaming live at 1PM PDT. You can watch on X or on YouTube where you can participate in the live chat.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Been a bull since 2013, and I got to say this market is ridiculous

Yes I am starting to agree. I guess the SP now is still overvalued less than the SP was undervalued last year, and therefore within its natural variance

I will be taking some profits today because I have just bought a house! I will be paying cash by selling 15% of my Tesla shares. I will sell another 5% if we go above $2,500 over the next few months to help pay next years large capital gains tax bill.

The rest I will hold long term.

I am starting to ask myself why I bother going to work every morning...

Especially if you believe in autonomy, $2,000 is a hell of a good price.

The current stock price madness is simple supply and demand. Most shareholders want to continue to hold TSLA. New investors want to buy TSLA. Market makers are being forced to buy TSLA to delta hedge. And S&P 500 inclusion is about to increase demand from benchmarked funds, and massively reduce supply due to indexed funds buying. Therefore, the stock price is going up rapidly.

Runarbt

Active Member

That might be correct.Not 100% sure, but I think it started around 1650$

Startet week at 1650, ended at 1790.. however SP was only bumped down from 2090 til 2050.

soo.. might see a change from 2100 to 2250.. if volume and fomo keeps up.

Edit: That is, maximum pain at 2250.. if this week = last, SP will then be 240 higher, 2490 close at Friday? :-D

Last edited:

HG Wells

Martian Embassy

Bit more than 15 point drop as the 7am market partial open happens.

Should be an interesting day.

Edit: looks like it was a EMD (Early Morning Dip).

EDIT EDIT: Full recovery by 7:16 LOOKING GOOD !

Should be an interesting day.

Edit: looks like it was a EMD (Early Morning Dip).

EDIT EDIT: Full recovery by 7:16 LOOKING GOOD !

Last edited:

The rainbow is neat, but I really dislike that weird sound track that comes on as I'm always listening to something else.Been driving the best car in the World, my Model 3, for over two years now and can definitely say that experience trumps any amount of zeros sitting in my investment account. Buy the Tesla. Understand it. Allows you to buy TSLA with conviction, without worry. That is worth a lot.

Really enjoying AP, purchased June 30th, 2020. I was driving around thinking, this is amazing and realized that I was only using enhanced cruise control, not realizing you needed to double down press the right steering wheel stalk. AP truly is amazing, much better than I expected, and it is like driving a brand new car, all by an OTA update.

For those laughing at me on the AP, how many Tesla owners know what happens when you quadruple down press the right steering wheel stalk? Had no idea until my 13 year old son told me. Hilarious. The hint is in a photo of my M3 taken today after dropping my daughter off at her University residence this evening.

View attachment 579940

Here's to another great week in my Tesla, regardless of the TSLA share price.

SebastianR

Active Member

Edit: looks like it was a EMD (Early Morning Dip).

I noticed that: These days Frankfurt typically opens on after-hours closing prices, then goes up and once pre-market starts, there is an EMD

WEDBUSH LIFTS TESLA'S BULL CASE PT TO $3,500 FROM $2,500 ON CHINA DEMAND, BATTERY POTENTIAL; NEUTRAL RATING, $1,900 BASE PT KEPT $TSLA

https://twitter.com/DeItaOne/status/1297853022060654592

https://twitter.com/DeItaOne/status/1297853022060654592

Tslynk67

Well-Known Member

I don't think the Jun'22s are good value atm. Unless he's playing the short term, I can't blame him for selling.

I think the stock is better value than the Jun'22s atm. Only reason I haven't sold mine yet is because I expect near term upside.

I have 3x Jun 22 c3500 and 4x c1250 - the 1250's started life as Jan 21 $875 costing $14k each just before C19 dip, then I rolled in June to the $1250's. They're approaching 10x the initial value, which is way more than the stock.

Might even hold all these until expiration and exercise for the shares. I've October and November calls for the shorter term that I'll probably offload before expiry. Hard to judge when to sell with the stock going nuts and so many catalysts coming up!

Driver Dave

Member

Which is it?

“Trading volume indicates the number of shares or contracts traded in the market. It tells if a particular price trend is supported by market players. If the price of a share is increasing with higher than normal volume, it indicates investors support the rally and that the stock would continue to move upwards.”

or

“Splitting to 420 would be funny.”

“Trading volume indicates the number of shares or contracts traded in the market. It tells if a particular price trend is supported by market players. If the price of a share is increasing with higher than normal volume, it indicates investors support the rally and that the stock would continue to move upwards.”

or

“Splitting to 420 would be funny.”

https://twitter.com/kelvinyang7/status/1297855549745373185?s=21

Tesla China claims 30% weight reduction while improving safety metric by 20% and 100% raw material utilization on rear underbody using single piece casting.

“整”的,挺好。

Tesla China claims 30% weight reduction while improving safety metric by 20% and 100% raw material utilization on rear underbody using single piece casting.

“整”的,挺好。

Tslynk67

Well-Known Member

I have been saying this for years. It is just soooooooooo(!) nice, that for once, "ridiculous" plays in our favor ;-)

And don't worry, once all Robin Hood hopefuls are on board, once all the shorts have covered and all the index funds have bought their shares, we will find out what Mr. Market really thinks about TSLA...

I know we joke about RHooders, but WSB has 1.4m subscribers - if they all decided to buy some $TSLA post-split that's some volume.

engle

Member

Good to see this is still on CNN.com's front page for FOMO buyers late to the party?

It's been there since 12:42 PM ET, Fri August 21, 2020:

"... Of course, Tesla fans can correctly point out that analysts have been consistently wrong and that Wall Street will eventually have to raise its earnings forecasts and price targets on the stock. Tesla may also get a further boost if it is finally added to the blue-chip S&P 500 index -- a move that could soon happen now that the company has posted a consistent run of profitable quarters."

There is also this now-classic CNN Elon Musk interview on TSLA IPO Day:

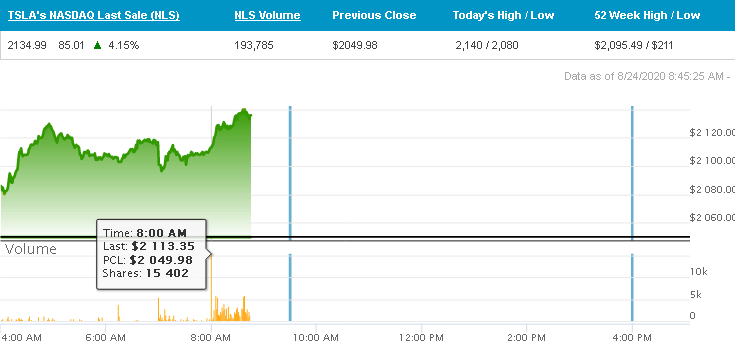

Pre-market is now Bid 2,118.00 and Ask 2,119.00 Volume 260,497

[Fidelity doesn't show me the last trade price for pre-market for some reason on their "Active Trader Pro" PC app platform]

It's been there since 12:42 PM ET, Fri August 21, 2020:

"... Of course, Tesla fans can correctly point out that analysts have been consistently wrong and that Wall Street will eventually have to raise its earnings forecasts and price targets on the stock. Tesla may also get a further boost if it is finally added to the blue-chip S&P 500 index -- a move that could soon happen now that the company has posted a consistent run of profitable quarters."

There is also this now-classic CNN Elon Musk interview on TSLA IPO Day:

Pre-market is now Bid 2,118.00 and Ask 2,119.00 Volume 260,497

[Fidelity doesn't show me the last trade price for pre-market for some reason on their "Active Trader Pro" PC app platform]

Last edited:

https://twitter.com/kelvinyang7/status/1297855549745373185?s=21

Tesla China claims 30% weight reduction while improving safety metric by 20% and 100% raw material utilization on rear underbody using single piece casting.

“整”的,挺好。

I translated the image, sorry for quick and dirty work, but maybe someone finds it useful

Strange premarket indeed. I have some TSLA call warrants, with different strikes and expiry dates, all listed in Frankfurt. So far today nobody has made any trades on any of those.

Suppose this could be a broker glitch too..

With all the helpful information I have gotten here, I feel compelled to add what little I know about selling these warrants:

In December and January I bought a bunch of OTM TSLA call warrants since at that time I could not trade standard options.

I sold them when they were deep ITM. At that stage they were rather illiquid, with no ask price at all.

Not wanting to squander away my profits, I found other warrants, with same strike & expiration and looked at their bid+ask. Also, when they are deep ITM, their price should track the underlying TSLA SP (keeping in mind the share-fraction in the contract).

Others here have warned against these warrants, for additional reasons: much higher transaction costs, buyer bears risk if issuer defaults, issuer has right to force an exercise prior to expiry. Also, one should be extra, extra careful when planning to sell them shortly before expiry. In one case, my bank had listed the last trading date as that of the expiration date, but in reality no Market Maker would trade it on that day - so I ended up with a (forced) exercise, i.e. exchange to cash, but with higher transaction cost than for a sale (if I recall correctly). Lastly, in spite of several attempts, my bank would or could not transfer these warrants to my new broker (IBKR) - I wanted to do this to increase my trading margin, but in the end had to do it by selling and transferring the cash. BTW, the post-tax profits from a couple of these warrants was enough to cover the exercise of a standard call option. That was a nice experience. Along these lines it is a nice feature of these warrants that one knows (from one's own trading choice), who the issuer is. If memory serves my 100 TSLA was thus financed by some trading house in Abu Dhabi.

Cheers to all longs.

HG Wells

Martian Embassy

Amazing

No one seems to have noticed we are up 80.

Must be monday.

No one seems to have noticed we are up 80.

Must be monday.

Nominated for longest post ever....but also informative!I translated the image, sorry for quick and dirty work, but maybe someone finds it useful

View attachment 580044 View attachment 580049 View attachment 580050 View attachment 580051 View attachment 580052 View attachment 580053 View attachment 580054 View attachment 580055 View attachment 580056 View attachment 580057

Ahem...87.Amazing

No one seems to have noticed we are up 80.

Must be monday.

Ahem...87.

Shh... You'll jinx it.

Artful Dodger

"Neko no me"

08:00 a.m. Whistle: Mon, 24 Aug 2020

Comment: "Steady climb again in early Pre-market; 07:00 a.m. dip defeated"

Cheers!

- TSLA share price: $2,112.84 62.86 +1.31%

- TSLA 08:00 A.M. Volume: 249,570 "Heavy"

- NASDAQ-100 Futures: +117.50 +1.02% 08:30:16 ET

- Pre-Market High: $2,140.00 (08:38:52 AM)

- Pre-Market Low: $2,080.01 (04:00:00 AM)

Comment: "Steady climb again in early Pre-market; 07:00 a.m. dip defeated"

Cheers!

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K