Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Raffy.Roma

Rome (Italy)

Just watched a video where a P85D smokes a Ferrari! Sorry that I cannot post it because I am with my phone. IMO this CAN move the stock.

The most important thing affecting the markets and TSLA this week is the Fed meeting. If the Fed leaves the "considerable time" language in the statement, I believe the markets will be risk on and all the momentum stocks will be back in vogue.

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

Just watched a video where a P85D smokes a Ferrari! Sorry that I cannot post it because I am with my phone. IMO this CAN move the stock.

Seen it, it's gone viral in the last 24hours. Hope the driver doesn't get in trouble (are those road legal speeds?). I think the odds are high it would affect the stock, but maybe if it goes viral enough?

(Also, which of you TMC fellowers think the video is from fiksegts?)

Last edited by a moderator:

Raffy.Roma

Rome (Italy)

if it goes viral enough?

(Also, which of you TMC fellowers think the video is from fiksegts?)

even more than enough IMO

Last edited by a moderator:

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

Someone (ChickenLittle?) suggested reading a book titled "The Volatility Edge in Options Trading" and in one of the chapters the author talks about price spikes as a function of standard deviations.

In charting software, I couldn't find any metric similar to this (volatility is close?), so I did it myself in Excel.

A price spike is calculated this way:

1. Calculate the standard deviation of the 20 price changes immediately preceding the spike (days 1 through 21). The value obtained is the one-day volatility at the end of the first 20 price change window.

2. Multiply this number by the value of the close on day 21 to determine the magnitude of a 1 standard deviation price change at the end of the window.

3. Divide the day 22 price change by this value to recast the change in standard deviations.

Left Axis: Close price of TSLA

Right Axis: Price spike

Observations: Nothing concrete, it was an interesting exercise to go through. Maybe, I could say this: In the last year, large price spikes of more than 3 std deviations have signaled a rally in that direction and keeps going till the opposite 3 std deviation price spike is found.

View attachment 65929

First spike is reaction, second confirmation (second wave of traders coming in), third is reaction (again) to reversal of trend.

The newest issue is the problems at the port in Oakland. It appears that the problem has been slowly escalating. Shipments in the continental US and Canada may not be affected but China/European shipments?

I do not pretend to understand how one gets a number of cars to Europe. Truck shipment across the US, then cargo ship to Europe would seem logical.

https://gwlogistics.wordpress.com/

http://www.latimes.com/business/la-fi-ports-slowdown-20141107-story.html

I do not pretend to understand how one gets a number of cars to Europe. Truck shipment across the US, then cargo ship to Europe would seem logical.

https://gwlogistics.wordpress.com/

http://www.latimes.com/business/la-fi-ports-slowdown-20141107-story.html

Last edited:

Article published this afternoon suggests that Tesla Motors is in a different league from other automakers: 2 Charts That Show There's Tesla, And Then There's Everybody Else - Tesla Motors, Inc. (NASDAQ:TSLA) | Benzinga

Interesting that the image credit on those charts is to Steve Jurvetsen.

v12 to 12v

Active Member

The newest issue is the problems at the port in Oakland. It appears that the problem has been slowly escalating. Shipments in the continental US and Canada may not be affected but China/European shipments?

I do not pretend to understand how one gets a number of cars to Europe. Truck shipment across the US, then cargo ship to Europe would seem logical.

https://gwlogistics.wordpress.com/

http://www.latimes.com/business/la-fi-ports-slowdown-20141107-story.html

Getting parts to Fremont appears to have been hit and miss due to shipping delays.

chickensevil

Active Member

Article published this afternoon suggests that Tesla Motors is in a different league from other automakers: 2 Charts That Show There's Tesla, And Then There's Everybody Else - Tesla Motors, Inc. (NASDAQ:TSLA) | Benzinga

As nice as those charts look, it is cherry picking data at its finest. Of course Tesla is growing both revenue and GM faster than everyone else, because they have a tiny fraction (or started with as is the case of GM) of what their peers have. If I had 1 mil in revenue and grew that to 2 mil the second year, would it be better or worse than another company who has 1 bil and grew it to 1.25 Bil? Just pulling numbers out of the air here of course, but clearly although I have doubled my revenue and my "competitor only grew by 25% on a per dollar basis they are clearly ahead of me in every other regard. So revenue growth as a percent is never going to be a fair... Or useful... Comparison until you really get the two companies in the same league.

Same with the second chart. Tesla might be spending a huge chunk of their revenues on growth and R&D, but the other autos don't need to spend money on growth that much because they are already fully distributes into all relevant markets and they are all spending on a per dollar basis money money than Tesla. Now one can aurgue on the return per dollar spent to determine how useful that R&D spending is for the likes of BMW, VW, and MB, but you cannot dispute that they are spending more dollars than Tesla.

While again, I appreciate the positive view vice the constant negative views we are getting slammed with all the time, this " article" is just as bad as some of those bear pieces on Seeking Alpha that cherry picks data to drive a point.

Muskol

Member

Interesting that the image credit on those charts is to Steve Jurvetsen.

I believe the credit is just for the photo of the Model S first delivery.

roblab

Active Member

As nice as those charts look, it is cherry picking data at its finest.

Well, sure. But if those "everybody else" people would spend some of their profits on growth of their EV business, or their R&D monies on EV R&D, just think where they's be. But they don't. They want to keep the stockholders happy, and they want to run their business model just like they have for decades. Which leaves out EVs.

That's why Tesla is disruptive. The Chartmakers are just trying to make a point graphically. Cherry picking to make it, but it's still a valid point.

As nice as those charts look, it is cherry picking data at its finest. Of course Tesla is growing both revenue and GM faster than everyone else, because they have a tiny fraction (or started with as is the case of GM) of what their peers have. If I had 1 mil in revenue and grew that to 2 mil the second year, would it be better or worse than another company who has 1 bil and grew it to 1.25 Bil? Just pulling numbers out of the air here of course, but clearly although I have doubled my revenue and my "competitor only grew by 25% on a per dollar basis they are clearly ahead of me in every other regard. So revenue growth as a percent is never going to be a fair... Or useful... Comparison until you really get the two companies in the same league.

Same with the second chart. Tesla might be spending a huge chunk of their revenues on growth and R&D, but the other autos don't need to spend money on growth that much because they are already fully distributes into all relevant markets and they are all spending on a per dollar basis money money than Tesla. Now one can aurgue on the return per dollar spent to determine how useful that R&D spending is for the likes of BMW, VW, and MB, but you cannot dispute that they are spending more dollars than Tesla.

While again, I appreciate the positive view vice the constant negative views we are getting slammed with all the time, this " article" is just as bad as some of those bear pieces on Seeking Alpha that cherry picks data to drive a point.

I think I have seen these charts months ago. The period of time that data refers to is not discernable on the charts. Perhaps the pattern shown on the charts is likely to persist for some time to come.

I tend to disagree that data is cherry picked, comparable data is shown for Tesla vs others. Tesla is clearly an outlier in that pack. It is appropriate to put additional explanations that you mention in your post. These explanations are valid and well placed, but the explanations do not invalidate the data.

If one wanted to make a statement that Tesla is experiencing high growth relative to other car makers and that such growth is supported with R&D expenditure with much higher ratio of R&D/capital in comparison to other car makers, then such statement is perfectly validated by the graphs.

Tesla growth is undeniable as is the expenditure in research (innovation) that supports that growth. Great to see.

Last edited:

FANGO

Active Member

Article published this afternoon suggests that Tesla Motors is in a different league from other automakers: 2 Charts That Show There's Tesla, And Then There's Everybody Else - Tesla Motors, Inc. (NASDAQ:TSLA) | Benzinga

Those charts are from a similarly titled article which came out months go and had many other charts and discussions thereof.

Edit: found it Risk Laboratory: Ophir Gottlieb: * Tesla (TSLA) - Ten Charts that Will Challenge Your Conviction & Everything Else You Know

chickensevil

Active Member

I think I have seen these charts months ago. The period of time that data refers to is not discernable on the charts. Perhaps the pattern shown on the charts is likely to persist for some time to come.

I tend to disagree that data is cherry picked, comparable data is shown for Tesla vs others. Tesla is clearly an outlier in that pack. It is appropriate to put additional explanations that you mention in your post. These explanations are valid and well placed, but the explanations do not invalidate the data.

If one wanted to make a statement that Tesla is experiencing high growth relative to other car makers and that such growth is supported with R&D expenditure with much higher ratio of R&D/capital in comparison to other car makers, then such statement is perfectly validated by the graphs.

Tesla growth is undeniable as is the expenditure in research (innovation) that supports that growth. Great to see.

I don't disagree with the message trying to be conveyed. That Tesla is rapidly growing both in terms of Revenues and GM and they are sticking as much money as they can back into the company to continue to grow. And it is also pretty clear that either the automakers are still not serious about the threat to their industry or are just now starting to catch on and are likely to fall short of the solution to their problem (referencing Audi, VW, BMW, etc who have all said they would have a 200+ mile car in X number of years).

But, that all being said, how are these charts any different from pulling registration data to try to claim that Tesla has a demand problem? Or citing the wait times going down (even though the example is itself a flawed metric) by citing that you could still order a P85D last week and get it delivered by the end of the year? Yes, we all know that both of those are flawed for various reasons, which is why none of us have taken that side, but I just want to caution falling for the same trap on the bull side by making ridiculous comparisons like revenue growth. It makes your arguments weaker. Just my two cents...

aznt1217

Active Member

As Elon puts it... it's like eating glass (I left out the staring into the Abyss part) because we all know the story hasn't changed. Any theories as to what is happening now. This downward slide has continued on for WAY too long.

Seems to be a rotation out of the sector, no?

--

No, this is a market-wide selloff based on oil shocks, and broader macroeconomic uncertainty about ability of central banks around the world (US Fed, Euro ECB, Japanese BOJ) to stabilize their respective currencies and economies with monetary policy.

My USO puts (shorting price of oil) are up 315% and I am holding them, because I don't think the Saudis are done having their way with us.

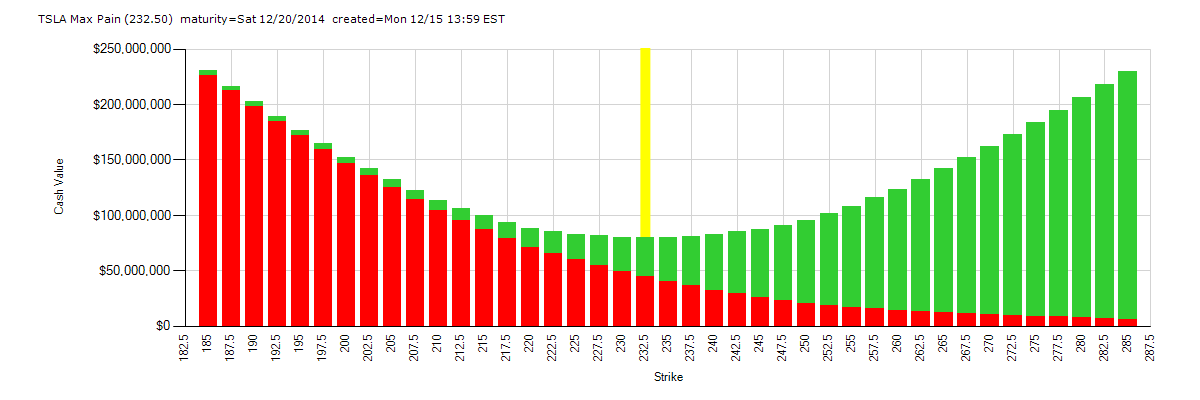

I remember we had a discussion about how high the max pain was for $TSLA on Friday this week, and some were saying it would go down on Monday. After the close on Friday, the max pain was at $235, today as of 1:59 EST it was $232.50, it didn't go down by much. It seems like options players are still betting on a big move.

Link: Max Pain Website

Edit: Similar max pain situations with MBLY, FSLR, SPWR, GPRO, and NFLX. Meanwhile, other momentum stocks have max pain lower or negligibly higher than their current prices.

Link: Max Pain Website

Edit: Similar max pain situations with MBLY, FSLR, SPWR, GPRO, and NFLX. Meanwhile, other momentum stocks have max pain lower or negligibly higher than their current prices.

Last edited:

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 130

- Replies

- 23

- Views

- 943

- Replies

- 21

- Views

- 6K

- Replies

- 0

- Views

- 233