I have no near terms covered calls for income open, having closed all of them the past couple weeks as we bled down, some stupidly timed (i.e., BTC -C170 5/17 while up in the 180's fearing a continued pump and could have closed it out today for 80% less cost). Gave away all March and April scalp gains on similar duds

. Cost of playing these games. At least it didn't eat into "real" money and use margin. I need to learn to let positions ride closer to expiration before emotionally BTC too soon (though that doesn't always work either...).

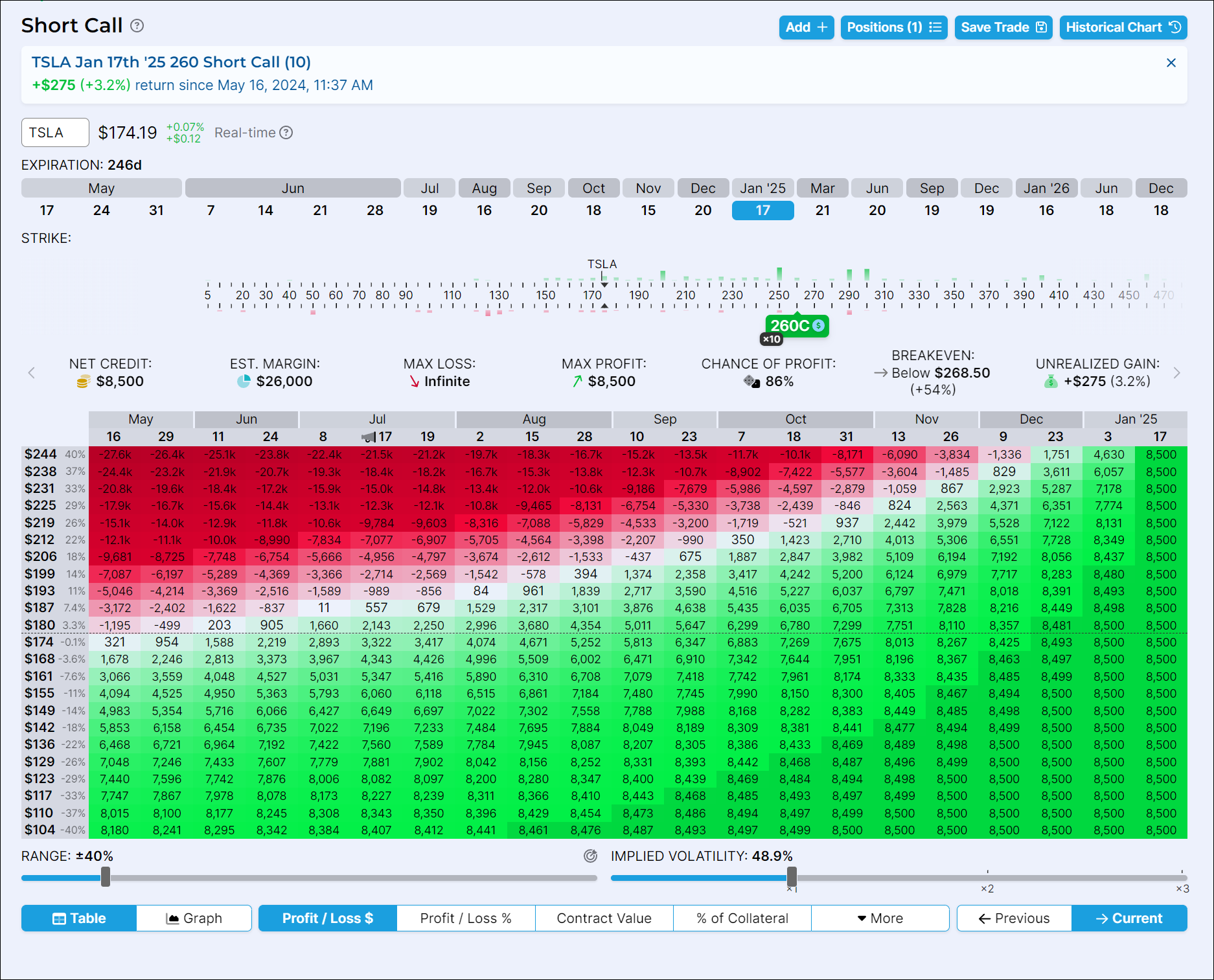

I'm leery to STO new CC's down here in the low 170's since the TA boys are saying be careful and are dangling the $23x carrot as soon as June

(though last time similar predictions of moving up and off $220 saw us tank below $200 instead, so there's that).

Positions like -C215 7/10 is currently paying less than half it was last week ($3.00 vs $8.50).

Practically speaking, I am currently mostly flat with just:

a) Shares

b) 10x -C240 12/2024 @$4.50 (STO before ER in the low $140's). Will just let them ride for now.

c) 12x -C230 1/2025 @$8.25 (STO before ER in the low $140's). Will just let them ride for now.

c) 5x +C150 12/2025 LEAP @$109 (now $61 -44%)

d) 15x -P300 6/2026 LEAP @$115 (now $133 -15%)

My main worry is the

15x -P300 6/6026 I'm carrying if TSLA crashes

<$130 (extrinsic $0.00). Would you moves this somewhere else now, or wait it out and roll/wheel if it gets assigned (will eat margin when assigned).