Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

-

Tesla's Supercharger Team was recently laid off. We discuss what this means for the company on today's TMC Podcast streaming live at 1PM PDT. You can watch on X or on YouTube where you can participate in the live chat.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

SebastienBonny

Member

Compare 2023Q1 to 2023Q4 and do the same for all previous years and they'll see the lightI see signs of WS slowly seeing what really is happening, maybe thanks to James Stephenson for picturing brightly where rolling 12 months is pointing to, which indicator I mentioned yesterday too. best ever 1st quarter. Lars Strandridder yesterday‘s video pointing out a few fundamental points overseen bij WS too. so my $ are placed on a huge recovery today today to close above Friday’s maybe even and maybe the former green line is still intact then. Thanks for the update @dl003 !

Last Q was the best ever and the first time it was significantly better than Q4 of the previous year.

SebastienBonny

Member

China wholesale for March: 88,869.

We went up like 10K each month...

12/22: 55,796

01/23: 66,051

02/23: 74,402

We went up like 10K each month...

12/22: 55,796

01/23: 66,051

02/23: 74,402

SpeedyEddy

Active Member

nice we closed the gap-up that would have been left for the doubters, but 194.50 would suffice...@#$@#

intelligator

Active Member

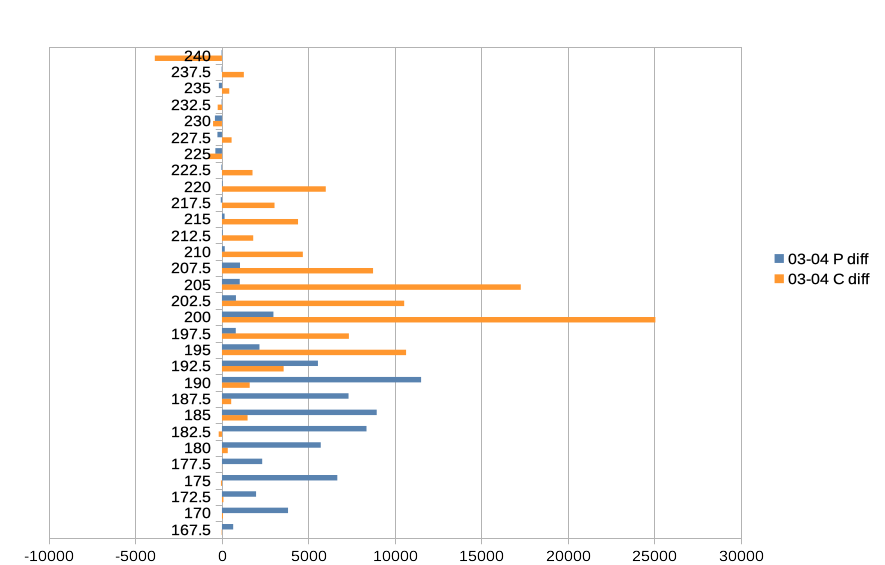

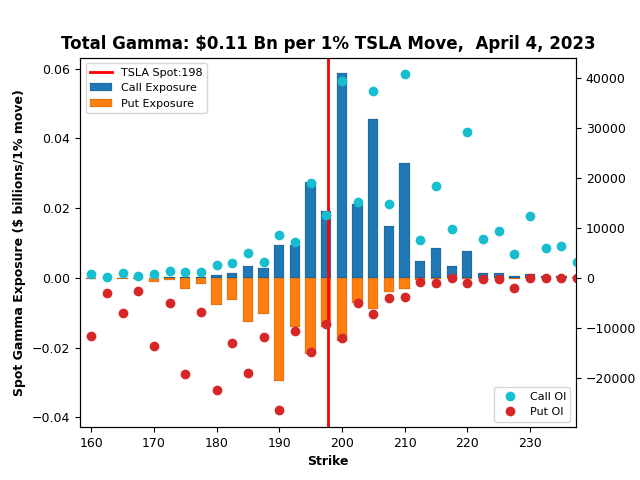

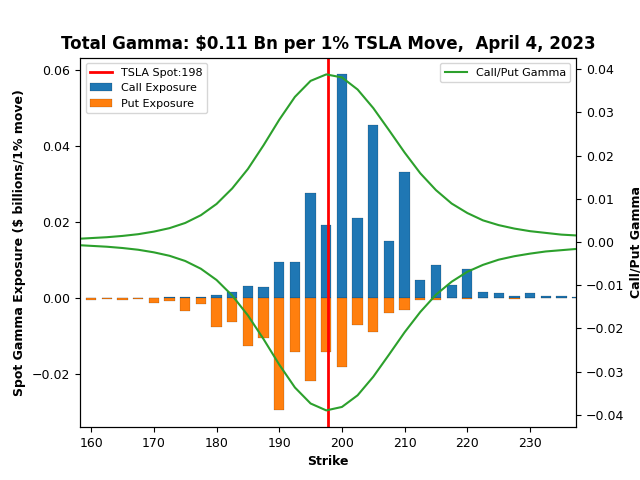

Huge spike in OI (published market open) yesterday to today. That's 25K increase at c200, 17K+ at c205. Each are at or above 40K. Also OI notable are P190, P180, P175. See second graph for volume markers and third for gamma. We are gamma positive yesterday slightly, today full on.

Not looking good folks. This is a very familiar TSLA setup. Anatomy of a dead cat right here. It's played out the same way every time.

View attachment 924836

Wow! Can you share some ranges and what options are you in for this week/next few?

I took my profit on the -175P opened yesterday and rolled them down to -167.5P.Wow! Can you share some ranges and what options are you in for this week/next few?

-230C opened yesterday. The only reason I'm not opening lower strike calls is because I'm still having a lot of long dated naked short calls. Plus the money down here is pathetic.

SpeedyEddy

Active Member

0DTE update

[SPY 410.11 within D trading range but above MAXpain (409) and above W MAXpain (405)]

[$TSLA 192.50 trading below option trading levels and MAXpain]

My expectation is that in service of 0DTE, @tsla today will end a few dollars lower than yesterday's close. Tomorrow and thursday the dependance on TSLA for 0DTE manipulation might not be as strong as today.

[SPY 410.11 within D trading range but above MAXpain (409) and above W MAXpain (405)]

[$TSLA 192.50 trading below option trading levels and MAXpain]

My expectation is that in service of 0DTE, @tsla today will end a few dollars lower than yesterday's close. Tomorrow and thursday the dependance on TSLA for 0DTE manipulation might not be as strong as today.

Thanks! What expiration for the -230C?I took my profit on the -175P opened yesterday and rolled them down to -167.5P.

-230C opened yesterday.

They're all 4/14.Thanks! What expiration for the -230C?

SpeedyEddy

Active Member

Agree on DCB, Macro not looking good either as pressure on FED to not go weak coming weeks. China and Russia opened proxy attacks on the dollar via OPEC+ as they both are in bigger problems, I might add

Closed my -P 192,50 for friday and "rolled" into -C 207.50 for next week.

Still think my SPY -C 394 and QQQ -C 316 for may 5th will be safe.

I only don't get the -P roll on a DCB-call, why not roll down -C instead and only close -P @dl003 ?

Closed my -P 192,50 for friday and "rolled" into -C 207.50 for next week.

Still think my SPY -C 394 and QQQ -C 316 for may 5th will be safe.

I only don't get the -P roll on a DCB-call, why not roll down -C instead and only close -P @dl003 ?

I'm still betting on price action for the next 7 days being somewhat contained so lowering my put strike is enough risk management for me today. I don't want to roll my down my Cs as, strictly delta speaking, I'm still having a lot of - delta from my naked 2024 short calls (about 12% of my account atm). Once this ER is out of the way I'll start selling calls more aggressively.Agree on DCB, Macro not looking good either as pressure on FED to not go weak coming week. China and Russia opened proxy attacks on the dollar via OPEC+

Closed my -P 192,50 for friday and "rolled" into -C 207.50 for next week.

Still think my SPY -C 394 and QQQ --C 316 for may 5th will be safe.

I only don't get the -P roll on a DCB-call, why not roll down -C instead and only close -P @dl003 ?

On a more personal note, I'm draining cash from my account for a big purchase so right now I can't take too many directional bets.

Last edited:

SpeedyEddy

Active Member

SpeedyEddy

Active Member

0DTE update

[SPY D putwall 409/410 growing big time, but will it be enough to hold, given W 405 MAXpain?]

[TSLA W putwall 195 growing (will it hold?)]

Things starting to look ugly if again Put-walls will not hold.

[SPY D putwall 409/410 growing big time, but will it be enough to hold, given W 405 MAXpain?]

[TSLA W putwall 195 growing (will it hold?)]

Things starting to look ugly if again Put-walls will not hold.

I get that there are reasons that the 10 year is down so much over the last month. But if interest rates were the biggest factor in this drop over the last year, I fail to see how TSLA won’t run up as it’s getting less attractive to take money out of the stock market and put it in treasuries or savings accounts.

It can’t be both:

Interest rates up = bad for stocks

Interest rates down = stagflation = bad for stocks

I think in the next week or two, the market starts to respond to reflect the lower interest rates and hopefully it coincides with a run up into ER. Closed a few CC at small profit and buying some 4/14 200c and 4/28 220c. Holding a couple -p195 for this week.

It can’t be both:

Interest rates up = bad for stocks

Interest rates down = stagflation = bad for stocks

I think in the next week or two, the market starts to respond to reflect the lower interest rates and hopefully it coincides with a run up into ER. Closed a few CC at small profit and buying some 4/14 200c and 4/28 220c. Holding a couple -p195 for this week.

SpeedyEddy

Active Member

Which would be easier on lower-volume days. RSI hourly is not yet indicating oversold position, so we still can go lower. I am looking at gap-fills 189 and 183 coming into the picture if my "purple zone" as drown above does not hold and is tested as a resistance the coming hours and days. But until now it holds as a bottom! So we seem to be on the verge of the next move, that should be strong and then should be followed through.Wow, that looks like concerted attack on the stock today, every time it’s climbs, being beaten down fast…

In close-up:

- Rolled a buy-write cc 6Apr$185 to 21Apr$195 for $1.33 credit and $10 strike improvement (quite good net)

- Closed 6Apr$210 for 93% profit (cc on core shares), waiting on a bump to resell

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K