Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Cwin

Member

mershaw2001

I'm short the short sellers

Do you think they might be selling them in Q4? It looks like they are looking for massive EPS gains in the back half of q4, perhaps that's driven by the sale of the credits.

Cwin

Member

Do you think they might be selling them in Q4? It looks like they are looking for massive EPS gains in the back half of q4, perhaps that's driven by the sale of the credits.

My bet. They are probably going to trickle them out over 2H 2014 and 2015. Their value should be increasing as the new regulations kick in later this year.

That was great estimate, DaveT, very close.I've added in Q4 2014 earnings results into my spreadsheet and have compared them to my estimates, along with some comments.

Wrong estimate of ZEV credits is very understandable as the timings of credits sales is discretionary.

hummingbird

Member

@DaveT

It's been almost a week since the ER. Were you able to get your hands on any sell side analysts write-ups for Q1? If so I think everyone here would appreciate a summary.

(Recall management guided for very slightly positive non-GAAP EPS for Q2 this time (this was a surprise I believe). I don't recall hearing about 2H's net guidance on the CC. As a result, I am wondering how the street is modeling the rest of 2014 and 2015. Analysts usually call the CFO after the ER to update their spreadsheets and write their notes within 24 hours after ER.)

see 90-day EPS estimate history here (from 0.27 to 0.06 for Q2 after ER):

TSLA Analyst Estimates | Tesla Motors, Inc. Stock - Yahoo! Finance

It's been almost a week since the ER. Were you able to get your hands on any sell side analysts write-ups for Q1? If so I think everyone here would appreciate a summary.

(Recall management guided for very slightly positive non-GAAP EPS for Q2 this time (this was a surprise I believe). I don't recall hearing about 2H's net guidance on the CC. As a result, I am wondering how the street is modeling the rest of 2014 and 2015. Analysts usually call the CFO after the ER to update their spreadsheets and write their notes within 24 hours after ER.)

see 90-day EPS estimate history here (from 0.27 to 0.06 for Q2 after ER):

TSLA Analyst Estimates | Tesla Motors, Inc. Stock - Yahoo! Finance

Last edited:

@DaveT

It's been almost a week since the ER. Were you able to get your hands on any sell side analysts write-ups for Q1? If so I think everyone here would appreciate a summary.

(Recall management guided for very slightly positive non-GAAP EPS for Q2 this time (this was a surprise I believe). I don't recall hearing about 2H's net guidance on the CC. As a result, I am wondering how the street is modeling the rest of 2014 and 2015. Analysts usually call the CFO after the ER to update their spreadsheets and write their notes within 24 hours after ER.)

see 90-day EPS estimate history here (from 0.27 to 0.06 for Q2 after ER):

TSLA Analyst Estimates | Tesla Motors, Inc. Stock - Yahoo! Finance

Just wanted to echo Hummingbird on this...

I think that we might see some updates later this week. According to the Google there will be two conferences at which the analysts will presumably able to get their questions answered and will be well equipped to update their guidance:

- May 12 - Tesla Motors Inc at Deutsche Bank Clean Tech, Utilities and Power Conference

- May 13 - Tesla Motors Inc atWedbush Transformational Technologies Management Access Conference

Last edited:

I've mostly read summaries of analysts notes post-Q1 but there doesn't seem to be much substantial change in outlook or price targets from any of the analysts.@DaveT

It's been almost a week since the ER. Were you able to get your hands on any sell side analysts write-ups for Q1? If so I think everyone here would appreciate a summary.

(Recall management guided for very slightly positive non-GAAP EPS for Q2 this time (this was a surprise I believe). I don't recall hearing about 2H's net guidance on the CC. As a result, I am wondering how the street is modeling the rest of 2014 and 2015. Analysts usually call the CFO after the ER to update their spreadsheets and write their notes within 24 hours after ER.)

see 90-day EPS estimate history here (from 0.27 to 0.06 for Q2 after ER):

TSLA Analyst Estimates | Tesla Motors, Inc. Stock - Yahoo! Finance

Here's the highlights from Morgan Stanley's May 8th (post-ER note):

1Q results were in line on gross margin, while weaker at OP due to ramping R&D and SG&A, taking full year estimates down considerably. Giga factory partnerships have yet to come together, leaving TSLA in a sensitive position of breaking ground without having the team formally in place.

Model S demand looks strong – which is critical. 1Q deliveries were in line with our 6,450 estimate and 2Q production of 8,500 to 9,000 is supportive of the FY target of 35k units, which is unchanged. ATP’s came in 15% higher than we expected, suggesting strong mix. 22% seq growth in net reservations is also well above our forecast. Gross margin performance and guide was unchanged. From here, things get a little complicated...

R&D and SG&A costs ramp up big-time. The 2 charges are targeted to rise 42% by 2Q vs. 4Q. The SG&A ramp is understandable given the aggressive roll-out of distribution and superchargers which is exceeding our fcst and helps de-risk the market. And the ramp in R&D pulls forward what we expected to occur after 2015. Adjusting the cadence of both items reduces our FY14 OP fcst by $248m. The removal of our FY14 ZEV credit assumption is offset by other improvements in gross margin (mix, manufacturing efficiencies) but nearly wipes out our FY14 OP fcst to $19m from $259m previously while our 2015 OP margin falls sharply from 13% to 8%. Our out-year forecasts are unchanged, but resemble more of a hockey-stock telemetry, which investors would rather not rely on.

Our biggest worry is the continued lack of formal commitment from Tesla’s Giga partners. While we understand the planning of this ambitious project requires Tesla taking the lead, we see elevated risk until letters of intent become indelible stamps of commitment. Balancing the needs of state governments, foreign partners and laboratory science may be Tesla’s biggest challenge to date. As holes in various deserts are dug, does Tesla suffer a loss in negotiating power? We think a resolution will be a very important relief to the story.

In terms of their modeling for 2014-2015 here are some more highlights:

2Q 2014 - 7,725 cars delivered (ASP $105k), $0.11 eps non-gaap (exc stock comp)

3Q 2014 - 9,450 cars delivered (ASP $105k), $0.35 eps non-gaap (exc stock comp)

4Q 2014 - 11,027 cars delivered (ASP $105k), $0.72 eps non-gaap (exc stock comp)

FY 2015 - 46,655 cars delivered (ASP $97.2k), $4.61 eps non-gapp (exc stock comp)

I've mostly read summaries of analysts notes post-Q1 but there doesn't seem to be much substantial change in outlook or price targets from any of the analysts.

Here's the highlights from Morgan Stanley's May 8th (post-ER note):1Q results were in line on gross margin, while weaker at OP due to ramping R&D and SG&A, taking full year estimates down considerably. Giga factory partnerships have yet to come together, leaving TSLA in a sensitive position of breaking ground without having the team formally in place.

Model S demand looks strong – which is critical. 1Q deliveries were in line with our 6,450 estimate and 2Q production of 8,500 to 9,000 is supportive of the FY target of 35k units, which is unchanged. ATP’s came in 15% higher than we expected, suggesting strong mix. 22% seq growth in net reservations is also well above our forecast. Gross margin performance and guide was unchanged. From here, things get a little complicated...

R&D and SG&A costs ramp up big-time. The 2 charges are targeted to rise 42% by 2Q vs. 4Q. The SG&A ramp is understandable given the aggressive roll-out of distribution and superchargers which is exceeding our fcst and helps de-risk the market. And the ramp in R&D pulls forward what we expected to occur after 2015. Adjusting the cadence of both items reduces our FY14 OP fcst by $248m. The removal of our FY14 ZEV credit assumption is offset by other improvements in gross margin (mix, manufacturing efficiencies) but nearly wipes out our FY14 OP fcst to $19m from $259m previously while our 2015 OP margin falls sharply from 13% to 8%. Our out-year forecasts are unchanged, but resemble more of a hockey-stock telemetry, which investors would rather not rely on.

Our biggest worry is the continued lack of formal commitment from Tesla’s Giga partners. While we understand the planning of this ambitious project requires Tesla taking the lead, we see elevated risk until letters of intent become indelible stamps of commitment. Balancing the needs of state governments, foreign partners and laboratory science may be Tesla’s biggest challenge to date. As holes in various deserts are dug, does Tesla suffer a loss in negotiating power? We think a resolution will be a very important relief to the story.

In terms of their modeling for 2014-2015 here are some more highlights:

2Q 2014 - 7,725 cars delivered (ASP $105k), $0.11 eps non-gaap (exc stock comp)

3Q 2014 - 9,450 cars delivered (ASP $105k), $0.35 eps non-gaap (exc stock comp)

4Q 2014 - 11,027 cars delivered (ASP $105k), $0.72 eps non-gaap (exc stock comp)

FY 2015 - 46,655 cars delivered (ASP $97.2k), $4.61 eps non-gapp (exc stock comp)

Overall, MS seems pretty realistic, though I think they are a bit too pessimistic or cautious on the GF. Starting to build the facility, TS will signal to everyone they will build it no matter what and the ship is leaving port... That's not a boat you want to miss.

Also, I think the 46k estimate for 2015 is way too conservative. That would mean a stagnating S and about 10k X. Elon already hinted they will roughly double production next year - I think 55-60k is a worst case projection. They should be able to do 46k of S alone and they did say X will ramp aggresivley.

hummingbird

Member

I've mostly read summaries of analysts notes post-Q1 but there doesn't seem to be much substantial change in outlook or price targets from any of the analysts.

Here's the highlights from Morgan Stanley's May 8th (post-ER note):[...]

nearly wipes out our FY14 OP fcst to $19m from $259m previously while our 2015 OP margin falls sharply from 13% to 8%. Our out-year forecasts are unchanged, but resemble more of a hockey-stock telemetry, which investors would rather not rely on.In terms of their modeling for 2014-2015 here are some more highlights:

2Q 2014 - 7,725 cars delivered (ASP $105k), $0.11 eps non-gaap (exc stock comp)

3Q 2014 - 9,450 cars delivered (ASP $105k), $0.35 eps non-gaap (exc stock comp)

4Q 2014 - 11,027 cars delivered (ASP $105k), $0.72 eps non-gaap (exc stock comp)

FY 2015 - 46,655 cars delivered (ASP $97.2k), $4.61 eps non-gapp (exc stock comp)

Thanks Dave. The ER printed "we expect to be marginally profitable in Q2". 0.11 above may still be too high. Others may have moved to 0.00 given wording of ER.

Also, if he cut 2015 OP to 8%, there is no way EPS can be 4.61. Were you looking at an old report or he had an error? Here is the math, with his numbers (assuming zero tax rate due to NOL):

46,655 x 97.2k x 8% / 150m shares = 4,535m x 8% / 150m = 363m / 150m = 2.42

I liked the questions you asked at the Annual Meeting.

It was good to hear Elon's vision for after Gen 3. I believe he said it would be Gen 3, then a Truck, and then a lower cost economy car. Possibly a new Roadster before the Economy Car.

With this new info, it appears Gen III base model will be the closest we get to an economy car for a long time, possibly 10+ years. However, enter a new twist, opening up the Tesla patents may leave room for other manufacturers to enter the economy segment before Tesla gets around to it.

It was good to hear Elon's vision for after Gen 3. I believe he said it would be Gen 3, then a Truck, and then a lower cost economy car. Possibly a new Roadster before the Economy Car.

With this new info, it appears Gen III base model will be the closest we get to an economy car for a long time, possibly 10+ years. However, enter a new twist, opening up the Tesla patents may leave room for other manufacturers to enter the economy segment before Tesla gets around to it.

JRP3

Hyperactive Member

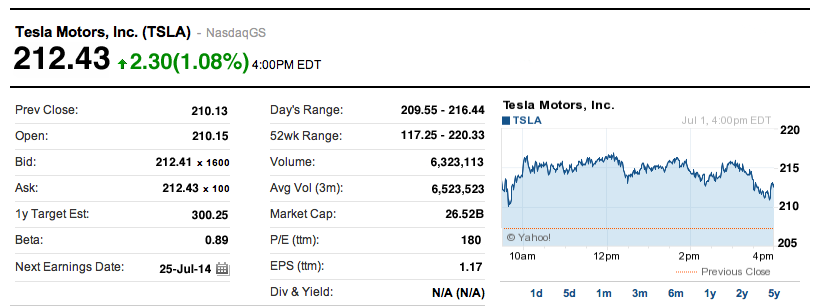

Flashback to July 1, 2013

Over a year ago we witnessed an epic surge in TSLA from $34 on 3/1/13 to $117 on 7/1/13:

Basically, TSLA shares jumped over 3x in just 3 months. The shares I bought at around $30 had almost quadrupled. But I still thought TSLA was undervalued and wrote a few posts encouraging folks to not sell their long-term TSLA holdings. Here are the posts I wrote on July 1, 2013:

Short-Term TSLA Price Movements - 2013 - Page 365

Somebody asked for clarification, so I posted some more.

Short-Term TSLA Price Movements - 2013 - Page 366

And then I posted a guess for what the stock price would be in a year. I screen captured the stock price from that day (7/1/13) and photoshopped what I thought the stock would be worth in a year. I even changed the 52wk range and market cap numbers. My wife thought I was too bold in my forecast and questioned, "are you sure you want to post that?" But I posted it because I thought it would people look forward to what the stock price could/would be in a year.

Short-Term TSLA Price Movements - 2013 - Page 367

Anyway, we're a few days away from July 1, 2014 and it looks like I might have been off. Actually, I was too conservative.

Here are my current forecast/estimates for TSLA stock price and the reason why I'm keeping all my shares:

$500-1000/share within 5 years from now

$2000-3000/share within 15 years from now

Footnote: The reason why I posted this was because the past several days I've been remembering the TSLA price chart I photoshopped and posted last year, but I didn't remember the exact price I predicted or the date. I've been telling myself I'll go back and search for the chart. So, today I finally found time to search for it and found it on the old 2013 short-term thread. It was interesting reading the posts around that time and the differing opinions, and even more interesting to find that I had guessed too low, but not too far off.

Over a year ago we witnessed an epic surge in TSLA from $34 on 3/1/13 to $117 on 7/1/13:

Basically, TSLA shares jumped over 3x in just 3 months. The shares I bought at around $30 had almost quadrupled. But I still thought TSLA was undervalued and wrote a few posts encouraging folks to not sell their long-term TSLA holdings. Here are the posts I wrote on July 1, 2013:

Short-Term TSLA Price Movements - 2013 - Page 365

I'm thinking it's unlikely that we will see a sub-$100 price for TSLA ever again. Recent digestive period is over and Q2 earnings is soon, thus giving stock momentum. As long as Tesla doesn't disappoint with Q2 earnings it's hard to see the stock dipping under $100.

However, the main reason from a bigger picture perspective is that the stock is gaining more long-term holders/believers every week, especially with new cars being shipped to delighted customers. Those customers become huge fans, tell all their friends, and end up buying stock to hold long-term because they believe the long-term story (Gen III and beyond). This ends up shrinking the available number of shares available for short-term traders and gradually inflates the stock price. Basically the "cult of Tesla" is gaining believers everyday and they are buying up stock to keep long-term (more folks like Clprenz who are saying "I am never selling any shares anymore" or AustinEV who says "I will sell some in 2018").

Available shares that are out of the hands of long-term believers start to shrink, thus driving up stock price. It won't happen all at once but I think we'll see this trend gradually continue until at least Gen III release. From now until at least 5 years out the main complaint from people will be "TSLA is priced too high. It's trading at a ridiculous 2xx+ P/E. etc." And it's true to a certain extent. People won't be buying TSLA stock based on current earnings but on very forward earnings which will feel more and more certain to believers as Gen III approaches. In other words, to buy TSLA at any point you'll need to be a believer the mass market story of Tesla. And the main reason why people won't be buying TSLA is because they think the stock price is too pricey and they're not convinced Tesla will sell millions of cars.

We'll have a lot of ups and downs along the way but as long as demand is strong for Tesla's cars we'll likely see a strong uptrend.

ps., as I write this I'm reminded when back in November I posted a comment saying that I didn't think we'd see sub-30s ever again (which turned out to be true), TSLA Investor Discussions - Page 368

Somebody asked for clarification, so I posted some more.

Short-Term TSLA Price Movements - 2013 - Page 366

I could definitely be wrong, but I'm just calling it like I see it.

If you read the replies to my comment back in November about stock not going under 30 ever again (TSLA Investor Discussions - Page 368), most people disagreed with me at the time saying that it will dip. But we had already cross a turning point (MT COY) and Tesla was gaining momentum. It never dipped under 30 since.

The way I see the stock is I consider the secondary offering at $92 as what should have been the Tesla IPO. In other words, if Elon had his way that's when he might have IPO'ed. But Tesla was struggling and needed capital and thus IPO'ed in 2010 which wasn't ideal. They didn't have predictable growing revenue and everything was based mostly on promises of a supposedly coming Model S in 2012. And in 2012 they had setbacks like not being able to deliver 5000 cars like they promised. They had to drastically reduce guidance for cars shipped, revenue, etc.

All this led to a drastic undervaluing of TSLA. TSLA at $30 was really just way too low for what TSLA was really worth IMO (esp. after receiving MT COY). People were clouded with disappointing earnings results quarter after quarter and doubting the future of the company. When I bought in in 2012, I remember telling my wife that TSLA is worth $10-15b at that point and we're getting a huge bargain.

So now that TSLA is worth $10-15b, I'm not very surprised at the valuation. I thought it was worth that back in late 2012. Now I think TSLA is currently worth $15-25b, so I still think it's undervalued from my perspective. I just think people are catching on and you have more and more long-term believers of the ridiculously large market cap potential of Tesla over the next several years.

For Tesla to have a Netflix-like dive, there really has to be some very, very significant news that decreases Model S demand in a meaningful way. That could happen, sure. But right now I don't think it's a realistic possibility. It's more of a theoretically possibility.

As long as Tesla can maintain it's greatest strength which is it's phenomenal demand resulting from a phenomenal product, then there's no reason to think we won't see it keep uptrending.

And then I posted a guess for what the stock price would be in a year. I screen captured the stock price from that day (7/1/13) and photoshopped what I thought the stock would be worth in a year. I even changed the 52wk range and market cap numbers. My wife thought I was too bold in my forecast and questioned, "are you sure you want to post that?" But I posted it because I thought it would people look forward to what the stock price could/would be in a year.

Short-Term TSLA Price Movements - 2013 - Page 367

Alright guys, the next time you're tempted to dump your long-term investment in TSLA cause you think the price has gotten out of hand, please come back to this chart. Here's a glimpse into the future. One year from now.

I think we get used to past stock prices and that's why sometimes current stock prices can seem high. But get used to this stock price from the future, and current stock prices will seem low.

And if you still get antsy, buy some puts as a hedge (as shared before here by others) rather than selling stock or take some cash to play the ups and downs with options.

disclaimer: this is just a guess.

Anyway, we're a few days away from July 1, 2014 and it looks like I might have been off. Actually, I was too conservative.

Here are my current forecast/estimates for TSLA stock price and the reason why I'm keeping all my shares:

$500-1000/share within 5 years from now

$2000-3000/share within 15 years from now

Footnote: The reason why I posted this was because the past several days I've been remembering the TSLA price chart I photoshopped and posted last year, but I didn't remember the exact price I predicted or the date. I've been telling myself I'll go back and search for the chart. So, today I finally found time to search for it and found it on the old 2013 short-term thread. It was interesting reading the posts around that time and the differing opinions, and even more interesting to find that I had guessed too low, but not too far off.

mmmh, impressive, you are :wink:

I guess $400 in 1 year. probably low since the X will be out and at least one or 2 G factories will be well underway

maybe $420, since I am in norhum

I guess $400 in 1 year. probably low since the X will be out and at least one or 2 G factories will be well underway

maybe $420, since I am in norhum

Last edited:

Anyway, we're a few days away from July 1, 2014 and it looks like I might have been off. Actually, I was too conservative.

Here are my current forecast/estimates for TSLA stock price and the reason why I'm keeping all my shares:

$500-1000/share within 5 years from now

$2000-3000/share within 15 years from now

It's so convenient that you share my share price projections! May we toast the arrival of the Tesla juggernaut when the whole world wants a GenIII car and the death of combustion is in clearer sight.

While you're at it, Dave, what's your estimate for one year from now?

In a year I'm estimating TSLA to be between $250-380/share.

If I had to pick a number though, I'd say $330/share.

In a year I'm estimating TSLA to be between $250-380/share.

If I had to pick a number though, I'd say $330/share.

sure my wife would like $333 ( or 369 my S racing # :tongue

between now and then do you think we will see a higher ATH?

May through now(end of Jun) seems stronger than the run from January to the ATH (beginning of Mar) where it then trickled back to under $200.

I could see the same thing happening this year. maybe a run of $400+ then back to ~$300.

Second production line will be running pretty soon. + the factory looked like it was filling up pretty quick back in Jan and that wasn't even for the X line (maybe RHD cars -not sure what it all was)...

and I still get the 'what type of car is that?" question almost daily. + the "where is it made?'

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 1

- Views

- 490

- Replies

- 17

- Views

- 954