A general note: with a company like Tesla, that can take regular price increases to account for inflation and that has few fixed obligations or revenues, it's generally better to model everything in constant dollars (i.e., removing inflation from the model). It's far easier, for example, to think about average sales prices in constant dollars: we can immediately see whether Model S prices are going up or down over time, which gets masked if inflation is included. Of course, the valuation answer will be the same whether modeled in constant or nominal dollars, provided one correctly applies either a real or nominal discount rate.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

The Model S is now officially a tank

On Friday we got some big news.

Not only did NHTSA close their investigation, Tesla announced they were adding more shielding to the bottom of the car (Tesla Adds Titanium Underbody Shield and Aluminum Deflector Plates to Model S).

While many have been waiting for NHTSA to close their investigation, not many were expecting Tesla to announce a voluntary solution/remedy that significantly increases the strength of the underbody.*

This is how I view Tesla’s announcement:

1. TSLA as an investment has been significantly de-risked.

One of the main risk factors for TSLA has been risk of fire due to impact with road debris. If Tesla had not taken action to strengthen the undercarriage, investors would be left with a constant lurking fear that another fire and, even worse, a series of fires could happen at any moment. Now that possibility is significantly reduced (thanks to the extra shielding) and is no longer a major risk factor. Sure, there could be a random fire still but the risks have been mitigated to the point that a series of fires is no longer a significant risk factor. Not only does this put the long-term TSLA investor at ease, it significantly strengthens the stock and company.

2. Tesla showed their engineering chops.

In a matter of a few months Tesla engaged in rigorous testing, troubleshooting, iteration, prototyping, finding a solution, and then rolling it out to production. This is remarkable to see in the auto industry.

In NHTSA’s closing report, they state:

3. Tesla strengthened Model S/X demand.

By strengthening the undercarriage with a comprehensive deflector and shield system that adds minimal weight, Tesla has effectively made the Model S an even better car than before. For many, safety is a paramount issue and for those people Friday’s announcement is welcome news that can/will encourage more people to buy the Model S than if Tesla had chosen not to do anything about the undercarriage.

The Model S is now officially a tank (albeit a very fast and agile one).

Notes:

*At the Detroit Auto Show, when questioned about the possibility of strengthening the undercarriage Jerome Guillen did mention imply that Tesla was looking into it. This was an early clue. Here's a link to the exact spot in the press conference, 2014 Detroit Auto Show - Tesla Press Conference - YouTube

**On 11/19/13 I wrote I post about possible rigorous testing in response to the fires, Articles/megaposts by DaveT - Page 14 .

On Friday we got some big news.

Not only did NHTSA close their investigation, Tesla announced they were adding more shielding to the bottom of the car (Tesla Adds Titanium Underbody Shield and Aluminum Deflector Plates to Model S).

While many have been waiting for NHTSA to close their investigation, not many were expecting Tesla to announce a voluntary solution/remedy that significantly increases the strength of the underbody.*

This is how I view Tesla’s announcement:

1. TSLA as an investment has been significantly de-risked.

One of the main risk factors for TSLA has been risk of fire due to impact with road debris. If Tesla had not taken action to strengthen the undercarriage, investors would be left with a constant lurking fear that another fire and, even worse, a series of fires could happen at any moment. Now that possibility is significantly reduced (thanks to the extra shielding) and is no longer a major risk factor. Sure, there could be a random fire still but the risks have been mitigated to the point that a series of fires is no longer a significant risk factor. Not only does this put the long-term TSLA investor at ease, it significantly strengthens the stock and company.

2. Tesla showed their engineering chops.

In a matter of a few months Tesla engaged in rigorous testing, troubleshooting, iteration, prototyping, finding a solution, and then rolling it out to production. This is remarkable to see in the auto industry.

In NHTSA’s closing report, they state:

“Tesla's testing reproduced damage similar to that seen in the Tennessee incident, and also showed that a change in ride height strategy, which was implemented in Nov. 2013 via a telematic software update to prevent the SVs lowering at legal roadway speeds, mitigates the risk of battery compartment penetration when a three-ball hitch is struck.”

Tesla was able to reproduce the accident damage (ie., fire) from a tow hitch. In other words, they basically ran over a tow hitch (probably many times) until they were able to reproduce the fire/accident. And then they came up with a solution and tested even more. In the blog post, Elon writes:

"During the course of 152 vehicle level tests, the shields prevented any damage that could cause a fire or penetrate the existing quarter inch of ballistic grade aluminum armor plate that already protects the battery pack. We have tried every worst case debris impact we can think of, including hardened steel structures set in the ideal position for a piking event, essentially equivalent to driving a car at highway speed into a steel spear braced on the tarmac."

3. Tesla strengthened Model S/X demand.

By strengthening the undercarriage with a comprehensive deflector and shield system that adds minimal weight, Tesla has effectively made the Model S an even better car than before. For many, safety is a paramount issue and for those people Friday’s announcement is welcome news that can/will encourage more people to buy the Model S than if Tesla had chosen not to do anything about the undercarriage.

The Model S is now officially a tank (albeit a very fast and agile one).

Notes:

*At the Detroit Auto Show, when questioned about the possibility of strengthening the undercarriage Jerome Guillen did mention imply that Tesla was looking into it. This was an early clue. Here's a link to the exact spot in the press conference, 2014 Detroit Auto Show - Tesla Press Conference - YouTube

**On 11/19/13 I wrote I post about possible rigorous testing in response to the fires, Articles/megaposts by DaveT - Page 14 .

FredTMC

Model S VIN #4925

On Friday we got some big news.

Not only did NHTSA close their investigation, Tesla announced they were adding more shielding to the bottom of the car (Tesla Adds Titanium Underbody Shield and Aluminum Deflector Plates to Model S).

While many have been waiting for NHTSA to close their investigation, not many were expecting Tesla to announce a voluntary solution/remedy that significantly increases the strength of the underbody.*

This is how I view Tesla’s announcement:

1. TSLA as an investment has been significantly de-risked.

One of the main risk factors for TSLA has been risk of fire due to impact with road debris. If Tesla had not taken action to strengthen the undercarriage, investors would be left with a constant lurking fear that another fire and, even worse, a series of fires could happen at any moment. Now that possibility is significantly reduced (thanks to the extra shielding) and is no longer a major risk factor. Sure, there could be a random fire still but the risks have been mitigated to the point that a series of fires is no longer a significant risk factor. Not only does this put the long-term TSLA investor at ease, it significantly strengthens the stock and company.

2. Tesla showed their engineering chops.

In a matter of a few months Tesla engaged in rigorous testing, troubleshooting, iteration, prototyping, finding a solution, and then rolling it out to production. This is remarkable to see in the auto industry.

In NHTSA’s closing report, they state:“Tesla's testing reproduced damage similar to that seen in the Tennessee incident, and also showed that a change in ride height strategy, which was implemented in Nov. 2013 via a telematic software update to prevent the SVs lowering at legal roadway speeds, mitigates the risk of battery compartment penetration when a three-ball hitch is struck.”Tesla was able to reproduce the accident damage (ie., fire) from a tow hitch. In other words, they basically ran over a tow hitch (probably many times) until they were able to reproduce the fire/accident. And then they came up with a solution and tested even more. In the blog post, Elon writes:

"During the course of 152 vehicle level tests, the shields prevented any damage that could cause a fire or penetrate the existing quarter inch of ballistic grade aluminum armor plate that already protects the battery pack. We have tried every worst case debris impact we can think of, including hardened steel structures set in the ideal position for a piking event, essentially equivalent to driving a car at highway speed into a steel spear braced on the tarmac."

3. Tesla strengthened Model S/X demand.

By strengthening the undercarriage with a comprehensive deflector and shield system that adds minimal weight, Tesla has effectively made the Model S an even better car than before. For many, safety is a paramount issue and for those people Friday’s announcement is welcome news that can/will encourage more people to buy the Model S than if Tesla had chosen not to do anything about the undercarriage.

The Model S is now officially a tank (albeit a very fast and agile one).

Notes:

*At the Detroit Auto Show, when questioned about the possibility of strengthening the undercarriage Jerome Guillen did mention imply that Tesla was looking into it. This was an early clue. Here's a link to the exact spot in the press conference, 2014 Detroit Auto Show - Tesla Press Conference - YouTube

**On 11/19/13 I wrote I post about possible rigorous testing in response to the fires, Articles/megaposts by DaveT - Page 14 .

Nice assessment DaveT!

And that's why I was suggesting something like that should be done under a sub-brand. Both the truck and the mass market car. Tesla may be revolutionalizing a lot of things, but I think people's perception of exclusive/premium vs standard aint't one of them. Releasing a 20k car under the Tesla banner could damage the brand perception - think Models S positioning. If you look at Mercedes and BMW, even their cheapest, smallest cars start at around $30k in Germany (22-25k EUR).

- - - Updated - - -

You guys may want to check out this 2013 study by KPMG on global car sales. VERY interesting.

Relevant to the conversation above is their segementation and sales projections.

For vehicle classes they have 4 categories:

Super premium: Lambo, Bentley, etc.

Premium: BMW, Mercedes, Lexus (and, I would add Tesla), etc.

Sub-premium: Volkswagen, Skoda, Chevrolet, Ford, etc.

Economy: Dacia, Tata, Suzuki and the like.

For regions, they call North America, Western Europe and "Mature Asia" the Established markets. Ther rest is "Establishing".

So for 2013 they say the Premium catgory is 13% of global sales, with Sub-premium being 86% and Economy 1% for EstablishED markets.

For EstablsihING markets the figures are Premium 4,5%, Sub-premium 75,5% and Economy 20%.

PS: I found the fully study: Part 1 Part 2

Does anyone know of any resources for estimating the bill-of-materials costs of various cars?

HenryF

Member

Hi Dave, I know you have been looking for Deutsche Bank report on SCTY. I got a copy simply by going to dbresearch.com - clicking on Contact at the top and filling out a small form. They sent an email two days later with the attachment. Couldn't send you a private message because your mailbox is full.

Cheers!

Cheers!

Hi Dave, I know you have been looking for Deutsche Bank report on SCTY. I got a copy simply by going to dbresearch.com - clicking on Contact at the top and filling out a small form. They sent an email two days later with the attachment. Couldn't send you a private message because your mailbox is full.

Cheers!

Thanks! This is super helpful. I've been drafting my own SCTY valuation model lately and I think seeing DB's report will help a lot.

What I like about Tesla, SolarCity and SpaceX

I just finishing writing/posting a long post on SolarCity in the new SCTY thread. Check it out here:

SolarCity (SCTY) - Page 23

While writing I was reminded of why I love Elon Musk's companies so much as an investor (currently invested in TSLA and SCTY):

1. Tesla, SolarCity and SpaceX all have long time horizons as companies. Their goals span over the next 20-30 years and this gives a lot of time as an investor to hop on and watch these companies grow. It also gives me peace of mind as these companies are very long-term focused and are solving some really big problems.

2. Tesla, SolarCity, and SpaceX all share many of Elon Musk's values regarding reasoning by First Principle, cost reduction, iteration, business as a product, etc. Once you get to know one of these companies, it helps you understand the other two.

3. Tesla, SolarCity, and SpaceX are working toward noble goals of bettering the world.

4. Tesla, SolarCity and SpaceX are all growing very rapidly. Tesla grew from 3,000 to 6,000 employees in 2013 (figures from annual reports). SolarCity grew from 2,500 to 4,300 employees in 2013 (figures from annual reports). SpaceX grew it's employees from "... 1800 in early 2012, and 3000 by early 2013. By October 2013, the company had grown to 3,800 employees and contractors" according to SpaceX - Wikipedia, the free encyclopedia.

5. Tesla, SolarCity, and SpaceX are all addressing very large markets - autos for Tesla, energy for SolarCity, and space (and maybe air transport) for SpaceX.

On a side note, SpaceX is planning to launch Dragon tomorrow on a space station resupplying mission. They will attempt to recover Falcon 9's first stage. If they can do this, this will be a major step toward a fully reusable rocket, which would be the key to all of what SpaceX aspires for. Here's the summary of what they're trying to do:

I just finishing writing/posting a long post on SolarCity in the new SCTY thread. Check it out here:

SolarCity (SCTY) - Page 23

While writing I was reminded of why I love Elon Musk's companies so much as an investor (currently invested in TSLA and SCTY):

1. Tesla, SolarCity and SpaceX all have long time horizons as companies. Their goals span over the next 20-30 years and this gives a lot of time as an investor to hop on and watch these companies grow. It also gives me peace of mind as these companies are very long-term focused and are solving some really big problems.

2. Tesla, SolarCity, and SpaceX all share many of Elon Musk's values regarding reasoning by First Principle, cost reduction, iteration, business as a product, etc. Once you get to know one of these companies, it helps you understand the other two.

3. Tesla, SolarCity, and SpaceX are working toward noble goals of bettering the world.

4. Tesla, SolarCity and SpaceX are all growing very rapidly. Tesla grew from 3,000 to 6,000 employees in 2013 (figures from annual reports). SolarCity grew from 2,500 to 4,300 employees in 2013 (figures from annual reports). SpaceX grew it's employees from "... 1800 in early 2012, and 3000 by early 2013. By October 2013, the company had grown to 3,800 employees and contractors" according to SpaceX - Wikipedia, the free encyclopedia.

5. Tesla, SolarCity, and SpaceX are all addressing very large markets - autos for Tesla, energy for SolarCity, and space (and maybe air transport) for SpaceX.

On a side note, SpaceX is planning to launch Dragon tomorrow on a space station resupplying mission. They will attempt to recover Falcon 9's first stage. If they can do this, this will be a major step toward a fully reusable rocket, which would be the key to all of what SpaceX aspires for. Here's the summary of what they're trying to do:

"During tomorrow’s CRS-3 launch to station, SpaceX will attempt to recover Falcon 9’s first stage. This test is not a primary mission objective and has a low probability of success (30-40%), but we hope to gather as much data as possible to support future testing. After stage separation, when Dragon is well on its way to the ISS, the first stage will attempt to execute a reentry burn and then a landing burn over the Atlantic Ocean. Falcon 9 is carrying four landing legs, which will deploy partway into the landing burn. Eventually, SpaceX hopes to land the first stage on land. Though success is unlikely with this test, it represents an exciting effort toward someday developing a reusable rocket."

adiggs

Well-Known Member

I love the thought process and confidence that allows SpaceX to try something as visible as landing / recovering the first stage, and being able to say up front "this probably won't work". But they'll learn in the attempt, and the data they gather from the experiment will improve the next attempt, and if it can be done, the fact that they're into this cycle puts them years ahead of the world.

That's exciting stuff

That's exciting stuff

Mario Kadastik

Active Member

I love the thought process and confidence that allows SpaceX to try something as visible as landing / recovering the first stage, and being able to say up front "this probably won't work". But they'll learn in the attempt, and the data they gather from the experiment will improve the next attempt, and if it can be done, the fact that they're into this cycle puts them years ahead of the world.

That's exciting stuff

Well in case you didn't know that, the SpaceX has already done it once, but without the landing legs. They did decelerate the first stage from hypersonic to supersonic to normal speeds, but the aerodynamic drag caused a spin of the stage during the final deceleration that they couldn't compensate with attitude boosters. So the engine flamed out too early and the stage crashed into the sea. But just before it hit it was still 100% intact (a remarkable feat). The landing legs were the missing component as extending them would due to rule of conservation of rotationary momentum balance out the stage and the attitude boosters could take care of the rest. So that's why last time they told for sure it'll fail, this time they assign a 30-40% success rate, which is relatively high. If it works indeed, then I'd guess the next time they probably will bring it close to shore landing and if that works, then the next one may well already be full powered landing on land.

Remarkable indeed. For folks that are not technically inclined, I like to compare these attempts to a baby who is learning to walk without being allowed to fall.Well in case you didn't know that, the SpaceX has already done it once, but without the landing legs. They did decelerate the first stage from hypersonic to supersonic to normal speeds, but the aerodynamic drag caused a spin of the stage during the final deceleration that they couldn't compensate with attitude boosters. So the engine flamed out too early and the stage crashed into the sea. But just before it hit it was still 100% intact (a remarkable feat). The landing legs were the missing component as extending them would due to rule of conservation of rotationary momentum balance out the stage and the attitude boosters could take care of the rest. So that's why last time they told for sure it'll fail, this time they assign a 30-40% success rate, which is relatively high. If it works indeed, then I'd guess the next time they probably will bring it close to shore landing and if that works, then the next one may well already be full powered landing on land.

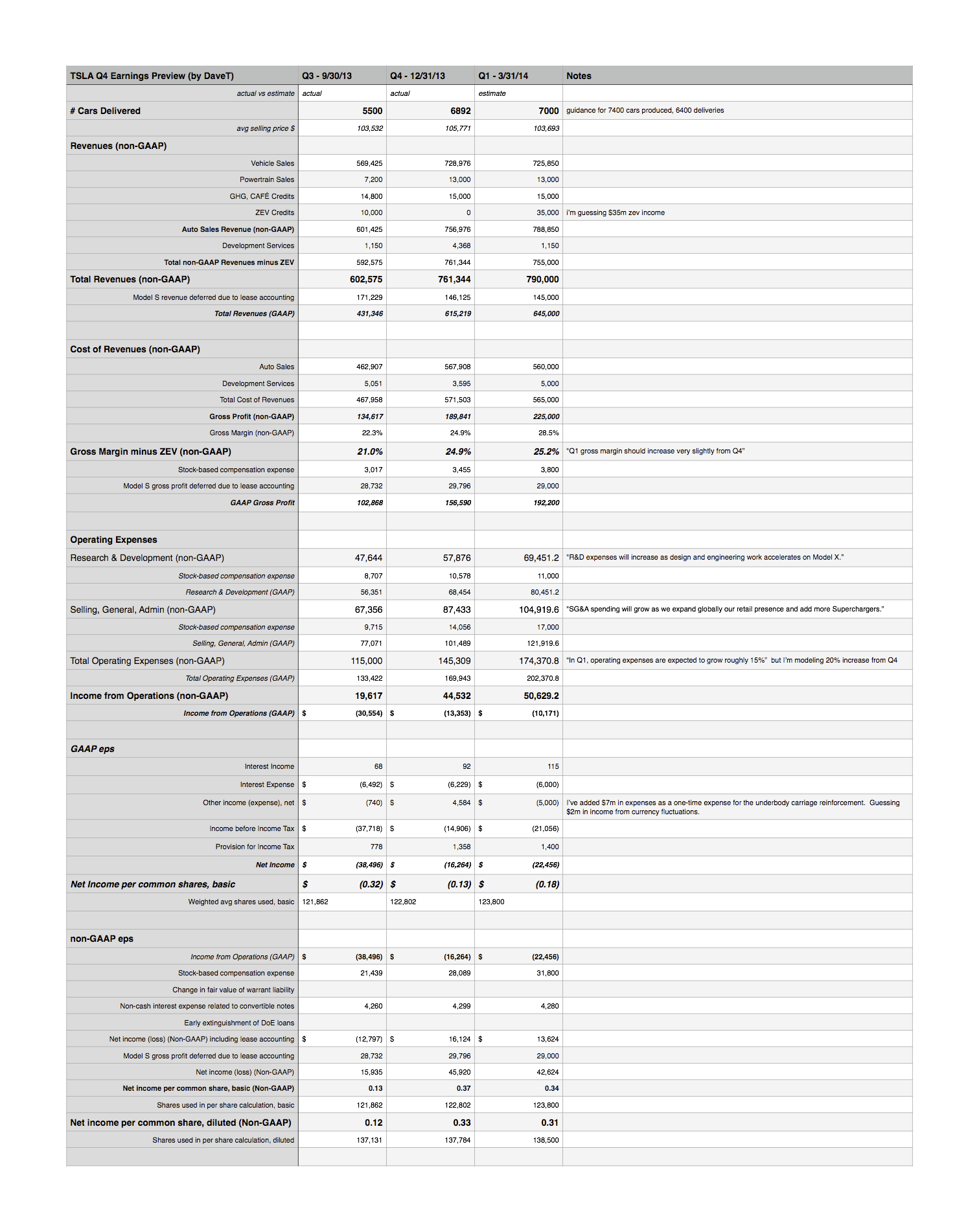

TSLA Q1 2014 Earnings Preview

I’m attaching my Q1 2014 earnings estimates below. Here are some notes:

1. Cars delivered

I’m estimating 7000 cars delivered (and 7800 cars produced). This is based on starting the quarter at 600 cars/week and ending at slightly below 7000 cars/week (650 avg x 12 weeks = 7800 cars). I’m subtracting 800 cars for an increase in cars in transit (+500) and inventory/loaner cars (+300).

2. ZEV credits

I’m estimating $35m for ZEV credits and I have to admit this is a wild guess based on 2013 ZEV quarter-to-quarter trends.

Q1 2013 - $67.9m

Q2 2013 - $51.5m

Q3 2013 - $10m

Q4 2013 - $0

Since I don’t know much about the seasonality of ZEV income, I’m speculating that in Q1 and Q2 there seems to be opportunity to sell ZEV credits more so than in Q3 and Q4. Thus, the ZEV credits gained in Q3 and Q4 will likely (or maybe) be sold in Q1 and Q2 of 2014.

3. Expenses

Tesla guided for an increase of 15% in operating expenses. Since Tesla is growing recklessly/relentlessly I’ve increased this to 20% increase from Q4 expenses.

4. Underbody carriage reinforcement

I’m adding $7m as one-time expense for the underbody carriage reinforcement.

Overall thoughts:

1. Tesla’s actual income/loss will depend a lot on how much ZEV income they’re able to accrue, how many cars they actually sold, and how much their expenses grew.

2. Tesla is still production-constrained and likely was able to increase weekly production from 600 cars/week to almost 700 cars/week. In the Q4 shareholder letter, Tesla states “Battery cell supply will continue to constrain our production in the first half of the year, but will improve significantly in the second half of 2014.”

3. I’m personally not expecting any material news about the gigafactory or Model X.

4. I’m expecting Q2 guidance of somewhere around 8000 cars delivered. And I don’t expect Tesla at this time to raise 2014 guidance of 35,000 cars delivered.

5/6/14 update: someone caught a mistake on the figures for development services, so I made the edit below.

I’m attaching my Q1 2014 earnings estimates below. Here are some notes:

1. Cars delivered

I’m estimating 7000 cars delivered (and 7800 cars produced). This is based on starting the quarter at 600 cars/week and ending at slightly below 7000 cars/week (650 avg x 12 weeks = 7800 cars). I’m subtracting 800 cars for an increase in cars in transit (+500) and inventory/loaner cars (+300).

2. ZEV credits

I’m estimating $35m for ZEV credits and I have to admit this is a wild guess based on 2013 ZEV quarter-to-quarter trends.

Q1 2013 - $67.9m

Q2 2013 - $51.5m

Q3 2013 - $10m

Q4 2013 - $0

Since I don’t know much about the seasonality of ZEV income, I’m speculating that in Q1 and Q2 there seems to be opportunity to sell ZEV credits more so than in Q3 and Q4. Thus, the ZEV credits gained in Q3 and Q4 will likely (or maybe) be sold in Q1 and Q2 of 2014.

3. Expenses

Tesla guided for an increase of 15% in operating expenses. Since Tesla is growing recklessly/relentlessly I’ve increased this to 20% increase from Q4 expenses.

4. Underbody carriage reinforcement

I’m adding $7m as one-time expense for the underbody carriage reinforcement.

Overall thoughts:

1. Tesla’s actual income/loss will depend a lot on how much ZEV income they’re able to accrue, how many cars they actually sold, and how much their expenses grew.

2. Tesla is still production-constrained and likely was able to increase weekly production from 600 cars/week to almost 700 cars/week. In the Q4 shareholder letter, Tesla states “Battery cell supply will continue to constrain our production in the first half of the year, but will improve significantly in the second half of 2014.”

3. I’m personally not expecting any material news about the gigafactory or Model X.

4. I’m expecting Q2 guidance of somewhere around 8000 cars delivered. And I don’t expect Tesla at this time to raise 2014 guidance of 35,000 cars delivered.

5/6/14 update: someone caught a mistake on the figures for development services, so I made the edit below.

Last edited:

Thanks Dave, very realisitc and plausible. The real suprise would be if the ER is much different - save for the ZEV uncertainty.

I know it' hard to predict, but what's your take on market reaction to the above scenario, disregarding any factory/X news? I read somewhere, that consensus is a $700 mil revenue with a 0.10 EPS.

I know it' hard to predict, but what's your take on market reaction to the above scenario, disregarding any factory/X news? I read somewhere, that consensus is a $700 mil revenue with a 0.10 EPS.

Benz

Active Member

Thanks DaveT, very detailed and comprehensive post, great clear presentation. Much appreciated.

+ 1

And I am also expecting total Tesla Model S deliveries to be very close to 7,000 in Q1 2014.

I will also echo.....Thank you!.....The wild card is the ZEV credit.....We just really don't know and it could very well make/break the EPS, and the market reaction to this quarter and the stock price in the short run.

Benz

Active Member

I’m attaching my Q1 2014 earnings estimates below. Here are some notes:

1. Cars delivered

I’m estimating 7000 cars delivered (and 7800 cars produced). This is based on starting the quarter at 600 cars/week and ending at slightly below 7000 cars/week (650 avg x 12 weeks = 7800 cars). I’m subtracting 800 cars for an increase in cars in transit (+500) and inventory/loaner cars (+300).

2. ZEV credits

I’m estimating $35m for ZEV credits and I have to admit this is a wild guess based on 2013 ZEV quarter-to-quarter trends.

Q1 2013 - $67.9m

Q2 2013 - $51.5m

Q3 2013 - $10m

Q4 2013 - $0

Since I don’t know much about the seasonality of ZEV income, I’m speculating that in Q1 and Q2 there seems to be opportunity to sell ZEV credits more so than in Q3 and Q4. Thus, the ZEV credits gained in Q3 and Q4 will likely (or maybe) be sold in Q1 and Q2 of 2014.

3. Expenses

Tesla guided for an increase of 15% in operating expenses. Since Tesla is growing recklessly/relentlessly I’ve increased this to 20% increase from Q4 expenses.

4. Underbody carriage reinforcement

I’m adding $7m as one-time expense for the underbody carriage reinforcement.

Overall thoughts:

1. Tesla’s actual income/loss will depend a lot on how much ZEV income they’re able to accrue, how many cars they actually sold, and how much their expenses grew.

2. Tesla is still production-constrained and likely was able to increase weekly production from 600 cars/week to almost 700 cars/week. In the Q4 shareholder letter, Tesla states “Battery cell supply will continue to constrain our production in the first half of the year, but will improve significantly in the second half of 2014.”

3. I’m personally not expecting any material news about the gigafactory or Model X.

4. I’m expecting Q2 guidance of somewhere around 8000 cars delivered. And I don’t expect Tesla at this time to raise 2014 guidance of 35,000 cars delivered.

View attachment 48726

Any thoughts about the total amount of Customer Deposits on March 31st, 2014?

In the Shareholder Letter of ER Q4 2013 this amount was $163,153,000 (on December 31st, 2013).

Cwin

Member

Its amazing, and scary to see how much ZEV credits will determine the results of this report. If we don't have any, which I doubt, then TM is close to the red.

If TM sells 6600 cars like the street like Barclays estimates, we are further* the red.

If TM sells 6600 cars like the street like Barclays estimates, we are further* the red.

Last edited:

I'm sorry but there is no indication they will be "back" in the red on a non-GAAP basis especially since with 6900 deliveries and $0 ZEV credits the non-GAAP EPS was $0.33 last quarter. Is there some other factor you didn't mention? Of course on a GAAP basis we were already in the red so we couldn't be "back" in the red.Its amazing, and scary to see how much ZEV credits will determine the results of this report. If we don't have any, which I doubt, then TM is back in the red.

If TM sells 6600 cars like the street like Barclays estimates, we are again in the red.

Cwin

Member

I'm sorry but there is no indication they will be "back" in the red on a non-GAAP basis especially since with 6900 deliveries and $0 ZEV credits the non-GAAP EPS was $0.33 last quarter. Is there some other factor you didn't mention? Of course on a GAAP basis we were already in the red so we couldn't be "back" in the red.

Whoops, my bad. I really shouldn't be up this early on these forums. Still, 35m off the top is still a lot to lose. And 400 cars as well.

Both situations which are entirely plausible given the reliability with ZEV credits, and shipments to china, which I haven't seen an estimate for.

I wouldn't say we "lose" $35m off the top since that is DaveT's wild guess. I'm not sure about that number though because I think more manufactures have compliance cars now and may not need ZEV credits. Also, if car makers did need the credits, I would have thought that we would see some ZEV income in Q4 since that was the start of the new model year. OTOH, maybe they decided to sell them in Q1 to make up for the costs of filling the pipeline.Whoops, my bad. I really shouldn't be up this early on these forums. Still, 35m off the top is still a lot to lose. And 400 cars as well.

Both situations which are entirely plausible given the reliability with ZEV credits, and shipments to china, which I haven't seen an estimate for.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Replies

- 1

- Views

- 571

- Replies

- 9

- Views

- 473

- Replies

- 17

- Views

- 973