So what % probability are you putting on TSLA being a $1T+ market company in 10 years?I don't think we disagree we just see the same thing but from a different point of view I guess :

I don't care if TSLA reaches $1200 next month or in 5 years.

I just know that in 10 years it will be $6000+ .

200$ or 2000$ doesn't make any difference to me as long as Tesla as a company keeps its path.

And I forget everything in between.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Don't be so blue Dave. Help work on making it better.I don’t think we’ll come to an agreement here. More power to you if you think TSLA at $1200 next month is a massive buy. This thread is becoming near worthless.

I personally would not exceed 50 to 60 % margin no matter what the size of portfolio is

I am currently 156% long TSLA and I pay 4% interest and will only get a margin call if it falls below 30%

when I had $1 portfolio I only had 20% margin. I was never long more than 120% at any given time, not counting options

multiple names yes you could take more as long as they have a low correlation with each other

yes it is highly dependent on interest charged by broker and margin limit

i'm paying well in excess of $24 K in margin interest per month or like $800/day or $290K per year on my TSLA position currently and it will only go up as the Fed raises interest rates so it is all very relative

you're welcome

Thanks. That's very helpful... Looking for clarity on one more bit. So you seem to suggest lower leverage on smaller portfolios. Like 20% on $1 but maybe up to 50 to 60% on $10. Did I understand that right? If so, curious what your reasoning behind that is.

Last edited:

geneclean55

Active Member

TradingInvest

Active Member

So what % probability are you putting on TSLA being a $1T+ market company in 10 years?

Here are my rough estimates regarding Tesla's market cap in 10 years:

5% chance much lower than today

10% chance similar to today

60% chance much higher than today but less than $1T

25% chance above $1T

My estimates change from time to time based on market development.

Whatever happens, I think the path won't be smooth, that's almost 100%.

Trust me, I’ve tried.Don't be so blue Dave. Help work on making it better.

Well, I enjoy your posts, when they make an appearance.Trust me, I’ve tried.

It's also pretty darn entertaining. I'd hate for you to miss out on that.

Deliveries continue

Instagram post by Quinn Murphy • Oct 14, 2017 at 1:44am UTC

Good to see. Twig mouse didn't get his Model 3 this week, though.

geneclean55

Active Member

I noticed that.Good to see. Twig mouse didn't get his Model 3 this week, though.

Looks like a QC issue, as he says its out of production. Maybe a bunch of cars are going through QC. One can hope.

Ulmo

Active Member

My reflexive reaction is "TSLA isn't Bitcoin; it's not going that high, without huge new developments." Do you think it gets to that without new developments, i.e., just the current product lines announced? Or do you think it requires new developments, i.e., new products put into the pipeline (like maybe a room temperature superconductor, and fun stuff like that)?I don't think we disagree we just see the same thing but from a different point of view I guess :

I don't care if TSLA reaches $1200 next month or in 5 years.

I just know that in 10 years it will be $6000+ .

200$ or 2000$ doesn't make any difference to me as long as Tesla as a company keeps its path.

And I forget everything in between.

VINs or it didn't happen...Deliveries continue

Instagram post by Quinn Murphy • Oct 14, 2017 at 1:44am UTC

Runarbt

Active Member

My reflexive reaction is "TSLA isn't Bitcoin; it's not going that high, without huge new developments." Do you think it gets to that without new developments, i.e., just the current product lines announced? Or do you think it requires new developments, i.e., new products put into the pipeline (like maybe a room temperature superconductor, and fun stuff like that)?

How about:

- Tesla start building 3 more GFs, China Europe and USA. No joint venture needed in China. India allow Tesla to sell cars without factory.

- SA TE project built on time. Puerto Rico next, complete 100% tesla rebuild of entire island. And TE profit increase 10x.

- And tesla announce they swap chemistry to Toshiba niob in GF over night, easy transition

chargetime only 6minutes to 80%, and all superchargers is upgraded to support this charge rate.

- Tesla semi is sold out through 2020. Sweep all competition away.

Only point which might be a bit far fetched is a quick chemistry change. The other points I think have a pretty high possibility of turning to facts real soon. within a year or so.

Last edited:

How about:

Tesla start building 3 more GFs, China Europe and USA. No joint venture needed in China. India allow Tesla to sell cars without factory.

SA TE project built on time. Puerto Rico next, complete 100% tesla rebuild of entire island. And TE profit increase 10x.

And tesla announce they swap chemistry to Toshiba niob in GF over night, easy transitionchargetime only 6minutes to 80%, and all superchargers is upgraded to support this charge rate.

Tesla semi is sold out through 2020. Sweep all competition away.

Only New is quick chemistry change which might be far fetched. Other points i think will happy within a year or so.

The thing more likely to push up prices is a fast ramp of batteries and M3s. There is a huge backlog of orders of both powerwalls and M3s, and if Tesla could produce any more than they are then they would be selling them for hard $.

We all know there will be more announcements for factories etc. but TBH it doesn't mean anything until the current factories are pumping out huge volumes.

viKtor slamet

Member

The problem right now is that manufacturing is not sexy. Tesla needs to change that with “machine that makes the machine”, and really need to show manufacturing cars doesnt mean razor thin margin. Model S/X needs to reach Gross Margin of 35% as promised and Model 3 needs to reach GM% of 25%+. When Tesla is able to show this to the street, the perception will change, then couple that with additional income stream from the software side, and tesla energy, then $1T market cap is possible.

So what % probability are you putting on TSLA being a $1T+ market company in 10 years?

Ok so first let's make things clear :

Any company that today is worth more than 400B, and grow at an average market rate of just 10% a year will be worth more than 1T in 10 years. This concern already about 8 company as of today.

Now, even if 0 company reach the level of those companies, and just half of those companies succeed at achieving a return of 10% a year for 10 years.

It means 4 companies will be worth more than 1T in 10 years.

__________

I don't know what are the chances of Tesla being worth more than 1T in 10 years.

I know that having a net income of 50B with a 20 PE ratio is largely achievable for Tesla.

ValueAnalyst

Closed

Possible ignitions for a short squeeze:

and many more...

- Gigafactory 3/4/5/6 full build-out guidance: timeline (by 2020/21) or cost (less than $5 billion) or capacity (more than 1.5m/yr each)

- Max capacity revisions to Gigafactory 1 or 2 to 1.5m+ cars/yr and 2GW, respectively, by 2020. Why else acquire Grohmann?

- 100k+ Solar Roof reservations "in just two weeks"

- Guidance for Tesla Semi ramp-up by the end of 2018 and gross margin 20%+ soon thereafter

- Model 3 EBIT margin guidance of 5%+ at $42,000-45,000 ASP at 10,000 units/w

- Model 3 "final reveal" event in July pushing Model 3 reservations to 1m+ in 3Q17

- Model 3 ramp-up to 5,000/w in 4Q17

- Combined Model S/X gross margin (incl. autopilot) exceeding 30% by 4Q17

- Brent oil prices surging above $70 by 4Q17

- Chanos throwing in the towel

View attachment 228533

On May 26, I had listed the above 10 "possible ignitions for a short squeeze."

None of these ten conditions have materialized yet, and TSLA has not yet had a short squeeze.

I expect at least one condition to materialize in the next six months.

My reflexive reaction is "TSLA isn't Bitcoin; it's not going that high, without huge new developments." Do you think it gets to that without new developments, i.e., just the current product lines announced? Or do you think it requires new developments, i.e., new products put into the pipeline (like maybe a room temperature superconductor, and fun stuff like that)?

If you consider Tesla Network into the current product line announced, then yes that's pretty much it. The bulk of the growth will come from already announced products. Simply scaled up and improved.

JRP3

Hyperactive Member

- Puerto Rico next, complete 100% tesla rebuild of entire island. And TE profit increase 10x.

- And tesla announce they swap chemistry to Toshiba niob in GF over night, easy transition

chargetime only 6minutes to 80%, and all superchargers is upgraded to support this charge rate.

Neither of these will happen.

On May 26, I had listed the above 10 "possible ignitions for a short squeeze."

None of these ten conditions have materialized yet, and TSLA has not yet had a short squeeze.

I expect at least one condition to materialize in the next six months.

I don't really like how this sub bangs on about a short squeeze. They are incredibly rare and usually happen when there is a significant switch in perception in a very short space of time.

It's highly dubious that any of your 10 examples will both occur and have the impact required to effect a true short squeeze. Any announcement of further production capacity, further demand or margin increases just won't have the firepower for the market position to change dramatically enough to cause a short squeeze. The comments on oil and Chanos will obviously not cause a short squeeze.

The only thing that could potentially cause the squeeze is real production capacity increases and that not being known until its announcement (which won't happen).

At best, we will soon see the S curve for model 3/battery production come to fruition and a gradual reduction in short interest as a result.

Please stop carrying on about a short squeeze and focus on what matters - what Tesla is really producing, and if competitors ever decide to scale up in Batteries/EVs in a manner faster than expected.

Words of HABIT

Active Member

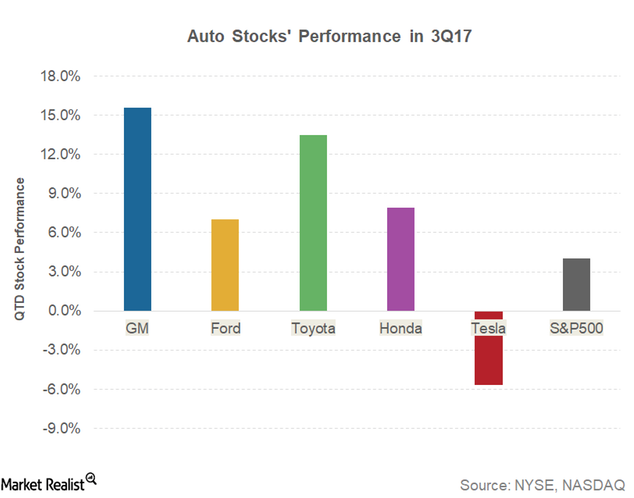

All the talk here of $1T market cap, on the short term thread no doubt. This is no different than those forecasting TSLA to zero. For 3Q17, TSLA was the worst performing auto (I know, Tesla Motors is more than that) stock by a wide margin. Agree with DaveT that this thread is getting too high in the clouds at times. TSLA has gained 97% since Nov.24/16 in anticipation of the M3. Perhaps we stay in the $350/sh range until the M3 clearly shows results of mass production which is unlikely to be confirmed until after 1Q18 quarterly meeting. Semi, TE, MY, Truck are all up and coming but IMHO will not add significantly to the SP until results are proven, as it is still all about the M3. I'm super long Tesla Motors, not only for potential personal gain, but for the benefit of Mother Earth and humanity.

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 891