I believe they’re already being bailed out; a trillion $ inflation induction act and this $9b. loan to Ford. The prognosis is unchanged; but make no mistake, it’s a bailout.I can already hear legacy auto sharpening their pencils to justify why they should be bailed out.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Knightshade

Well-Known Member

I believe they’re already being bailed out; a trillion $ inflation induction act

Given they appear to be receiving only a tiny fraction of the $ from that compared to Tesla not sure that'd constitute any sort of bailout? They have to be making good EVs, in a way they can afford to make in volume, to get any significant portion of those funds and if they do that they won't need to be bailed out. It's their FAILURE to do what they need to benefit significantly from the IRA that is likely to lead to needing an actual bailout.

and this $9b. loan to Ford.

That sort of loans is kind of the opposite of bailouts- they get significant review anymore before approval, and are then repaid with interest. Both Ford and Tesla got them from the same program many years ago too, and both repaid them with interest (though Tesla did so quite early while Ford was simply on time)- Now Ford is repeating that process (and while the loan is larger this time, it's not CRAZY larger given inflation, 2009 loan was 5.9 billion, this one is 9.2)

dhanson865

Well-Known Member

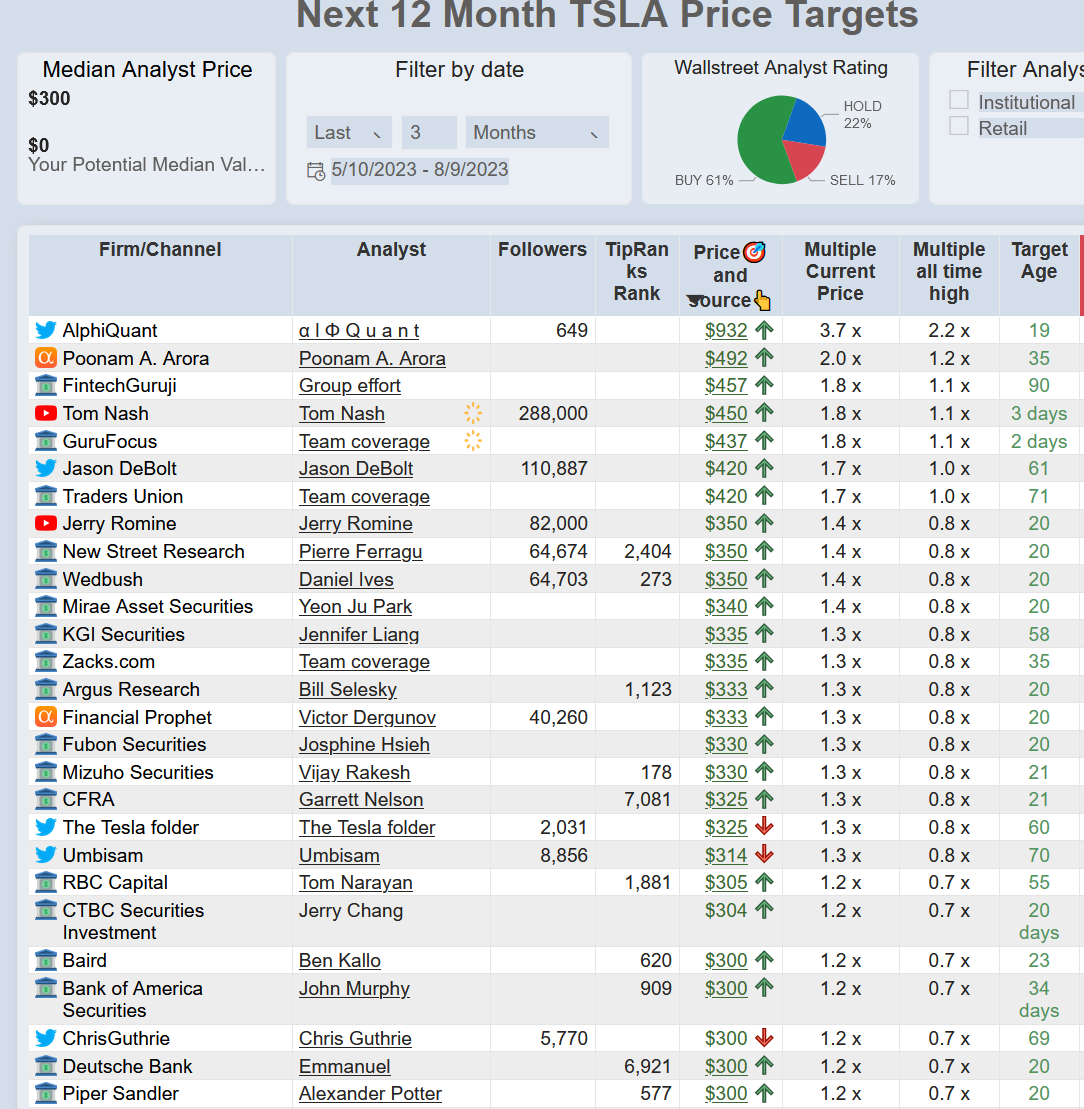

price targets filtered by the people that bother to update the targets publicly on a more frequent basis (this leaves out names like Ark or SMR that put out a public update two or three times a year). Oh and I did only show the top portion, I didn't bother to snip twice to continue the list for the laggards that increase the prediction price but keep it below the current price.

Of the recent forecasts only 1 is hyperbolic.

from Tesla Price Targets for those not familiar with the site.

Of the recent forecasts only 1 is hyperbolic.

from Tesla Price Targets for those not familiar with the site.

Last edited:

There's one potential survival path for legacy auto, if they're smart enough to see it and humble enough to take it, and that's to use Tesla hardware, i.e. the skateboard on licence, which would likely be most of the car other than the cosmetic aspectsSpeaking of the mission... hmph.

Legacy manufacturers are now locked into near-bankruptcy

Legacy auto are now locked into near bankruptcy. ‘Naïve green dreamers’? We were right all along.

It’s all starting to happen exactly as Elon Musk and Tony Seba (and yours truly) have predicted for . . a full decade.medium.com

What would be Tesla's incentive to spend its own resources on running such licencing scheme?There's one potential survival path for legacy auto, if they're smart enough to see it and humble enough to take it, and that's to use Tesla hardware, i.e. the skateboard on licence, which would likely be most of the car other than the cosmetic aspects

Wouldn't this resources be much better spent on bringing up its own production?

They have money, they can hire people, they can build factories.

What good could would others bring to the table to improve the mission?

Nothing.

Licencing is empty hope.

The licence would be for the incumbents to manufacture in their own factories, at their own expenseWhat would be Tesla's incentive to spend its own resources on running such licencing scheme?

Wouldn't this resources be much better spent on bringing up its own production?

They have money, they can hire people, they can build factories.

What good could would others bring to the table to improve the mission?

Nothing.

Licencing is empty hope.

Tesla's design, specs and software = money for Tesla, survival for incumbents and drives the Mission

I went back to the source document and it looks like there is a cap on the benefit the customer can make from this deal of $1,500/yr using a maximum of 60 dispatch sessions a year- so my numbers above are possibly a bit overcooked. This caps Tesla's benefit at $375/yr and presumably is not true energy trading at market rates, but some sort of load balancing service with notional rates used in the calculation. That's only $3.75k over the 10y warranty period - however various internet sites put the useful life at between 15y and 25y - so potentially up to $9.4k over the life of the asset.20% of the profits for a service that is nearly automated sounds amazing. Tesla could well make more from energy trading over the life of the powerwall than they make from the initial sale. Or to put another way, Tesla could probably give the powerwalls away for free and still come out ahead over the life of the asset.

Energy trading desks at banks and other trading shops are extremely lucrative if done correctly (particularly when there are market dislocations) - It's a shame Tesla can only scale as fast as it's battery storage.

If the market treats this as recurring revenue it will also attract juicy valuation multiples.

Still great revenues and potentially more than they make from the sale - but not quite as much as initially thought.

Last edited:

JusRelax

Active Member

Finally, the farce that is ESG is getting starting to get the boo(t) it deserves:

petit_bateau

Active Member

The reference was to TESLA 10Xing to 20 million not the entire EV industry.

Tesla will 10X, EV industry will 5X

Also, I wouldn't consider PHEV an EV so the whole market will need to go from 13% to 90%+

Is Tesla's goal not to produce 20million vehicles per year?

I agree that PHEV are by no means true EVs. It is clear that the vast majority of PHEV never get plugged in for a charge in their lives. Nevertheless PHEV are worth tracking as they increasingly affect the GWh/yr of battery deployed, and that is a good underlying industrial adoption indicator. That is why I have included PHEV in the S-curve analysis, and we now are at the mid-2023 = 19% point on the S-curve, where the red cross is*, which is remarkably close to the predicted end-2023 position of 21%. That is up from 13% for 2022.

Another 5-years of this rate of progress and it is game over apart from sweeping up the fragments.

For simplicity assume the market stabilises at 100 million vehicles/year, so Tesla's target of 20m/yr would represent a 20% market share. (Personally I have modelled with 94m/yr but it really doesn't matter.)

Tesla has not achieved that market share by vehicle-#-sales count in recent years, declining from 17% in 2019 to 12% in 2022. So by vehicle # it will need to grow its vehicle sales faster than industry average to recover the lost ground. More positively Tesla has a 22% market share by battery GWh, but even there Tesla is growing at !! only !! 48% yoy which is slower than the industry average of 80% yoy.

I will be astounded if there are not several high profile company failures during this transition, and it will be interesting to see what happens to any of their EV capacity that can be salvaged when they go pop. It might be that only the cell supply is worth rescuing and diverting into the viable auto businesses. But there must also be concerns as to what extent some less satisfactory cells are being used in automotive - not all of that 80% yoy cell supply growth is built on firm foundations.

Tesla's own market share graphs give much the same story, suggesting a 2030 position of say 12-15%, which would still be a huge outcome. Regrettably it would not justify the current TSLA share price if that were to be the only outcome, so let us hope that the other revenue streams deliver and are profitable (energy, robotics).

The brand positions give one a pretty shrewd insight as to who has a chance of surviving long enough to compete in the post-transition landscape. Leaders by automotive group include Tesla, BYD, SAIC, Geely-Volvo, Stellantis, SAIC, Volksawgen Group, Hyundai/Kia, and GM (via its 50/50 share in the Wuhling HonGuang Mini), and Mercedes. I sense that a pretty steep filter is going to get applied at some point.

World EV Sales Now 19% Of World Auto Sales! - CleanTechnica

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News! Global plugin vehicle registrations were up 38% in June 2023 compared to June 2022, rising to 1,260,00 units. In the end, plugins represented 19% share of the overall auto market (13% BEV share alone). ...

cleantechnica.com

cleantechnica.com

So my own big takeaways are:

- There is not 10x left, really there is not much more than 5x left as it is the GWh cell supply that is the controlling constraint;

- Any company that is not well along the S-curve by now is likely to fail to survive the transition;

- Since several Chinese companies are much further along the S-curve than the industry average, then they will inevitably displace a number of legacy ICE manufacturers, i.e. Western/Japanese;

- Since Tesla is also much further along the S-curve than the industry average, then it too will inevitably displace more legacy ICE manufacturers;

- And Tesla will have to improve its relative performance if it is to reach 20m vehicles and a ~20% market share, though to an extent it can bulk up its vehicle# position as it progressively launches smaller vehicles, i.e. the 2/Z and in time a '1';

- As companies go to the edge there will be a savage price war which will make the last year or so of margin compression look like a kindergarten affair. Margin compression will be a reality for everyone in the industry, and only those with huge access to capital and compelling products with good margins and assured cell supply will survive. It will be an absolute bloodbath, and it will have huge geopolitical implications. The US-IRA is only a foretaste of what is likely coming in protectionist terms. Bailouts and last man standing will be the name of the game.

- Tesla absolutely needs to retain all its capital to sustain itself through this transition, so no share buybacks for the next 5-years unless an outrageous opportunity presents itself. Also Tesla needs to have sales, production and cell supply and critical raw material supply positioned globally so as to withstand a round of global protectionism. All of which is happening.

-----------

*19% would reflect 18m vehicles if the full-year-2023 outcome is 94m vehicles (both tbd of course in the full-year version), and since I have given the 3-S-curve version of this graph that is perhaps the most useful way to plot this for now. However the stats I've seen for all-auto suggest 2023 FY of 86.2m units so that would be 16 million EVs if H2-2023 is just a replay of H1-2023.

Last edited:

UkNorthampton

TSLA - 12+ startups in 1

More about Turkey (new Tesla market, deliveries started in mid-May 2023). These delivery numbers won't be reported as Tesla isn't part of the reporting organisation for Turkey & not tracked anywhere else. Should (but won't) add to Europe figures as Model Ys Made in Germany (MiG).

Reportedly Tesla surprised at number of orders >10,000 in a few weeks (far more by now). Strong car market at present for all models especially imports. Buying a car is a way to turn devaluing/hyperinflationary currency into assets (Model Y).

There's at least one Turkish word on show in the video (çıkış - exit). Seems to be either Turkish Formula 1 location or a fleet hire firm's location - it could be that this company is doing a Hertz which would be a great way to convert Turkish Lira (even if borrowed at 17.5+%) into assets - Intercity Filo - HOMEPAGE

Good:

Reportedly Tesla surprised at number of orders >10,000 in a few weeks (far more by now). Strong car market at present for all models especially imports. Buying a car is a way to turn devaluing/hyperinflationary currency into assets (Model Y).

There's at least one Turkish word on show in the video (çıkış - exit). Seems to be either Turkish Formula 1 location or a fleet hire firm's location - it could be that this company is doing a Hertz which would be a great way to convert Turkish Lira (even if borrowed at 17.5+%) into assets - Intercity Filo - HOMEPAGE

Good:

- "Thousands of Teslas" - feel free to count on the video. I didn't, but believable.

- Any German overproduction has a new location for delivery. Frees up any concerns for Berlin overcapacity.

- Possible mass adoption by 1 or more car hire firms (often low mileage near coastal resorts)

- Early teething problems with deliveries to a new market.

- Quarter/month mismatches between production & customer deliveries

- Mass flashing of indicators/lights (updates?), few open bonnets & boots

- Delivery / German manufacturing numbers won't include these at the moment.

- Turkish Lira prices need constant changing

- Bird poop

Thousands of MY's waiting for delivery in the Tesla Turkiye's parking lot because they messed-up deliveries.

They are now changing the delivery dates for customers every day, pushing it 1 day further at around 5pm......

Last edited:

Bean-counter thinking never works in the long run. To get the best people, you have to pay the top dollar. 13 years is a very long stint at Tesla. They certainly got value for their money.Will this make Elon reconsider such large option packages going forwards?

A bonus (alongside much reduced share options)of a house and increased salary would be better value for the shareholder.

Will this make Elon reconsider such large option packages going forwards?

A bonus (alongside much reduced share options)of a house and increased salary would be better value for the shareholder.

It’s the luck of the draw. His tenure started just before a meteoric rise in the stock price.

JusRelax

Active Member

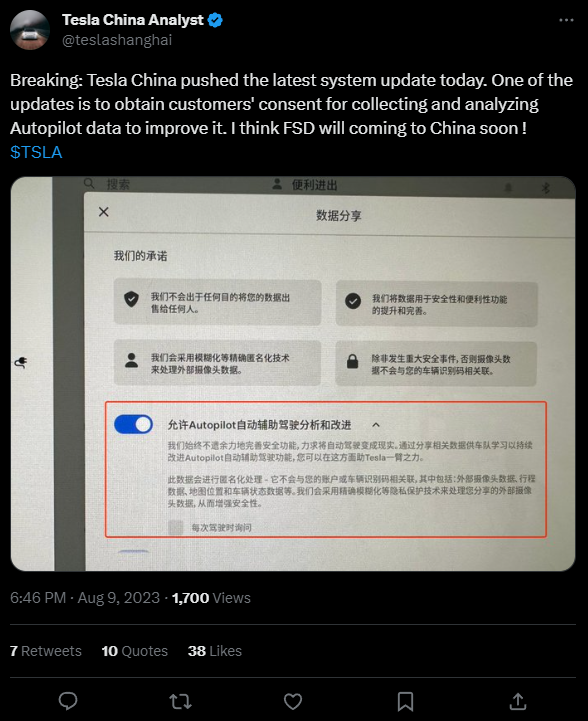

It looks like you can now opt-in for allowing Tesla to collect data specifically for autopilot/FSD purposes on the most recent software update in China:

And he has enormous incentive to nurse his portfolio through the coming tripling+ of TSLA.It’s the luck of the draw. His tenure started just before a meteoric rise in the stock price.

That is true but…the real core value of Autobiddder/Virtual Powerplant is near-instantaneous response, first demonstrated with the South Australia Hornsdalê Power Reserve, later with large deployment of Poerwalls integrated:20% of the profits for a service that is nearly automated sounds amazing. Tesla could well make more from energy trading over the life of the powerwall than they make from the initial sale. Or to put another way, Tesla could probably give the powerwalls away for free and still come out ahead over the life of the asset.

Energy trading desks at banks and other trading shops are extremely lucrative if done correctly (particularly when there are market dislocations) - It's a shame Tesla can only scale as fast as it's battery storage.

If the market treats this as recurring revenue it will also attract juicy valuation multiples.

Hornsdale Power Reserve - South Australia's Big Battery

The Hornsdale Power Reserve is the world’s first big battery. The first 100 MW saved SA consumers $150 million over two years. It was expanded by 50 MW in 2020.

hornsdalepowerreserve.com.au

hornsdalepowerreserve.com.au

Lately many utility-level suppliers have developed similar products that are increasingly common, primarily in Europe and, reportedly, China.

The US, which has no national grid, is more complex and more primitive in many respects. Without discussing that here in detail (there are other threads for that) the major consequence is that Tesla is building on a large base of localized regulatory and technical expertise in power generation, distribution and payment systems ( inter alia insurance, taxation, distribution etc also developed) which makes Tesla perhaps the only company capable of navigating the entire power systems in many places.

The net consequence of all that is the strong probability that Tesla is on the cusp of major high-margin revenues almost everywhere they have the licenses, among others today the EU, UK, part of Texas, plus the newly announced States. Since each one of those has specific power and grid service tarries and conditions it is impractical to judge jurisdiction by jurisdiction revenues and margins.

However, at least one roughly analogous service, much less precise and rapid in response, has had gross margins of >50%. That case was wholesale only, with response interval of five minutes, predicated on industrial equipment powered on or off, the pre-Autobidder norm.

To optimize VPP revenues utility bidding systems also must be renovated, but that is rapidly becoming the norm as both wind and solar resources combine with storage systems.

From Hornsdale to the present day Power utilities are being transformed. Perhaps the single most consequential effect is the nearly limitless demand for utility level storage, as Elon rinds us so often. The recent transformation of Tesla Energy profitability is only the very beginning of what is on the way.

Rememore, a rising sea floats all boats. This is so huge there is great opportunity for many others, too, as we already see in the EU and elsewhere.

I was very concerned for him, the poor man was unhappy.Bean-counter thinking never works in the long run. To get the best people, you have to pay the top dollar. 13 years is a very long stint at Tesla. They certainly got value for their money.

Artful Dodger

"Neko no me"

The licence would be for the incumbents to manufacture in their own factories, at their own expense

Tesla's design, specs and software = money for Tesla, survival for incumbents and drives the Mission

Yeah, I think Tesla licences the factory that builds those cars, based on Elon's long-standing comments:

- eventually, all automakers will have autonomy

- longterm, Tesla's advantage will be manufacturing

- prototypes are easy; production is hard

- the factory is the product

Cheers!

Last edited:

FreqFlyer

Active Member

Instead of worrying how established manufacturers are going to transition to EVs, worry about the EVs companies that were suppose to be disruptors in the markets. Sad, I was impressed with their products. I guess BYD won too many contracts.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/V7AS6C7JZNJJDDXVWL72EYSXKM.jpg)

www.reuters.com

www.reuters.com

/cloudfront-us-east-2.images.arcpublishing.com/reuters/V7AS6C7JZNJJDDXVWL72EYSXKM.jpg)

EV firm Proterra files for Chapter 11 bankruptcy protection

Electric-vehicle parts supplier Proterra filed for Chapter 11 bankruptcy protection on Monday, making it the latest company to go belly up in an industry grappling with supply chain constraints, slowing demand and a funding drought.

jeewee3000

Active Member

Don't read too much into this. IIRC I received an update in the EU that asked certain sharing permissions, some of which regarding to driving behaviour/clips for autopilot/fsd training. This was a repeated ask by the car: when I got my car and I enabled all features (incl. 'FSD' (lol in Europe)) and doing so I gave permission for data collection but this update around May/June I believe asked me again, in a different way.It looks like you can now opt-in for allowing Tesla to collect data specifically for autopilot/FSD purposes on the most recent software update in China:

View attachment 963452

It's safe to say FSDbeta for EU is nowhere close. The soonest could be 2024 given the regulatory hurdles. So for China I don't believe it is any sooner than EU.

That is a very interesting debate though: where will FSDbeta first release next? EU or China? I'm inclined to say Europe but who knows.

Gave you a disagree because you keep pushing BYD as the leading EV manufacturer, they are not, the majority of their sales are PHEVsI agree that PHEV are by no means true EVs. It is clear that the vast majority of PHEV never get plugged in for a charge in their lives. Nevertheless PHEV are worth tracking as they increasingly affect the GWh/yr of battery deployed, and that is a good underlying industrial adoption indicator. That is why I have included PHEV in the S-curve analysis, and we now are at the mid-2023 = 19% point on the S-curve, where the red cross is*, which is remarkably close to the predicted end-2023 position of 21%. That is up from 13% for 2022.

Another 5-years of this rate of progress and it is game over apart from sweeping up the fragments.

View attachment 963439

For simplicity assume the market stabilises at 100 million vehicles/year, so Tesla's target of 20m/yr would represent a 20% market share. (Personally I have modelled with 94m/yr but it really doesn't matter.)

Tesla has not achieved that market share by vehicle-#-sales count in recent years, declining from 17% in 2019 to 12% in 2022. So by vehicle # it will need to grow its vehicle sales faster than industry average to recover the lost ground. More positively Tesla has a 22% market share by battery GWh, but even there Tesla is growing at !! only !! 48% yoy which is slower than the industry average of 80% yoy.

I will be astounded if there are not several high profile company failures during this transition, and it will be interesting to see what happens to any of their EV capacity that can be salvaged when they go pop. It might be that only the cell supply is worth rescuing and diverting into the viable auto businesses. But there must also be concerns as to what extent some less satisfactory cells are being used in automotive - not all of that 80% yoy cell supply growth is built on firm foundations.

View attachment 963437

Tesla's own market share graphs give much the same story, suggesting a 2030 position of say 12-15%, which would still be a huge outcome. Regrettably it would not justify the current TSLA share price if that were to be the only outcome, so let us hope that the other revenue streams deliver and are profitable (energy, robotics).

View attachment 963441

The brand positions give one a pretty shrewd insight as to who has a chance of surviving long enough to compete in the post-transition landscape. Leaders by automotive group include Tesla, BYD, SAIC, Geely-Volvo, Stellantis, SAIC, Volksawgen Group, Hyundai/Kia, and GM (via its 50/50 share in the Wuhling HonGuang Mini), and Mercedes. I sense that a pretty steep filter is going to get applied at some point.

World EV Sales Now 19% Of World Auto Sales! - CleanTechnica

Sign up for daily news updates from CleanTechnica on email. Or follow us on Google News! Global plugin vehicle registrations were up 38% in June 2023 compared to June 2022, rising to 1,260,00 units. In the end, plugins represented 19% share of the overall auto market (13% BEV share alone). ...cleantechnica.com

View attachment 963442

So my own big takeaways are:

- There is not 10x left, really there is not much more than 5x left as it is the GWh cell supply that is the controlling constraint;

- Any company that is not well along the S-curve by now is likely to fail to survive the transition;

- Since several Chinese companies are much further along the S-curve than the industry average, then they will inevitably displace a number of legacy ICE manufacturers, i.e. Western/Japanese;

- Since Tesla is also much further along the S-curve than the industry average, then it too will inevitably displace more legacy ICE manufacturers;

- And Tesla will have to improve its relative performance if it is to reach 20m vehicles and a ~20% market share, though to an extent it can bulk up its vehicle# position as it progressively launches smaller vehicles, i.e. the 2/Z and in time a '1';

- As companies go to the edge there will be a savage price war which will make the last year or so of margin compression look like a kindergarten affair. Margin compression will be a reality for everyone in the industry, and only those with huge access to capital and compelling products with good margins and assured cell supply will survive. It will be an absolute bloodbath, and it will have huge geopolitical implications. The US-IRA is only a foretaste of what is likely coming in protectionist terms. Bailouts and last man standing will be the name of the game.

- Tesla absolutely needs to retain all its capital to sustain itself through this transition, so no share buybacks for the next 5-years unless an outrageous opportunity presents itself. Also Tesla needs to have sales, production and cell supply and critical raw material supply positioned globally so as to withstand a round of global protectionism. All of which is happening.

-----------

*19% would reflect 18m vehicles if the full-year-2023 outcome is 94m vehicles (both tbd of course in the full-year version), and since I have given the 3-S-curve version of this graph that is perhaps the most useful way to plot this for now. However the stats I've seen for all-auto suggest 2023 FY of 86.2m units so that would be 16 million EVs if H2-2023 is just a replay of H1-2023.

I'm pretty astonished that CleanTechnica also pushes this false narrative

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M