Johan

Ex got M3 in the divorce, waiting for EU Model Y!

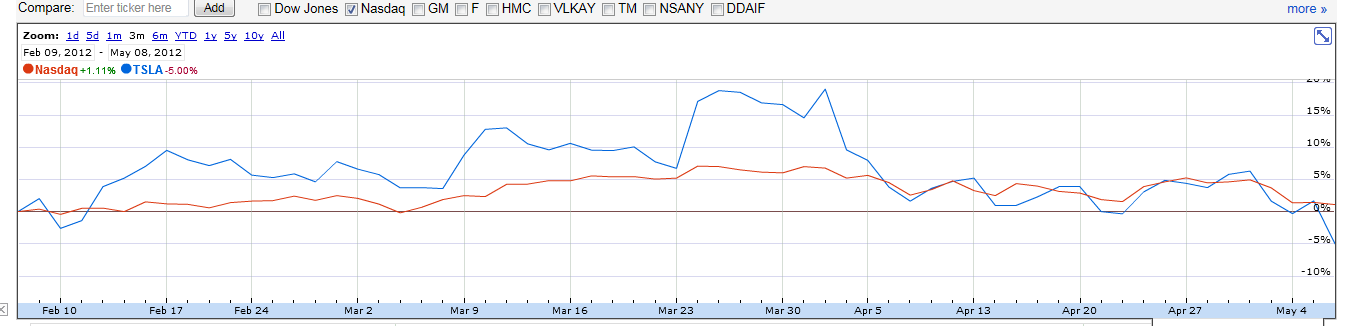

I know this has been pointed out before, but just look at this chart with TSLA and the NASDAQ index overlaid the last 3 months. More or less TSLA is following the general market just with more volatility, and whenever it has differed a lot from the general market movement, it has always corrected again. So until some real heavy news (such as larger demand and production capacity than expected, raving reviews etc. etc.) I think this will continue.