Well, this post isn't a primer on Lithium, or even a Lithium Light (that's Li-Li, for yuk-yuks).

Rather, a few points to use as what to consider when assessing Lithium as a potential investment opportunity.

1. There is very little Li, as a fraction of total mass, in a Li-ion battery

2. There is very little Li, as a fraction of its dollar input, in a Li-ion battery

3. Regardless, as of 2Q 2016, the very best electricity storage technology, by a variety of parameters, necessitates some Li. This is likely to continue for the foreseeable future.

4. Li is concentrated mostly as evaporites or evaporite brines. These locations are present primarily in an area of contiguous Argentina, Chile and Bolivia; distantly in parts of Australia, China and Nevada.

5. There do exist other sources of Li; mostly from spodumene, which is derived with pegmatite pods, and with associated clays.

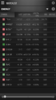

6. A private, though publicly traded - and also with traditionally extremely strong ties to the government, company in Chile is the largest player to date in Li production. This company, Soquimich (traded as SQM on the NYSE), is broadly diversified enough that even though it is the largest producer, Li is not its most important product. Thus, for SQM, Li is to some extent a by-product and at best a co-product. This enables it to have outsized importance in determining the market price for Li2CO3, the substance by which Li normally is traded.

I'll stop there - too much packing to do....