Failure to deliver

(the below paragraph is quite opaque to me)

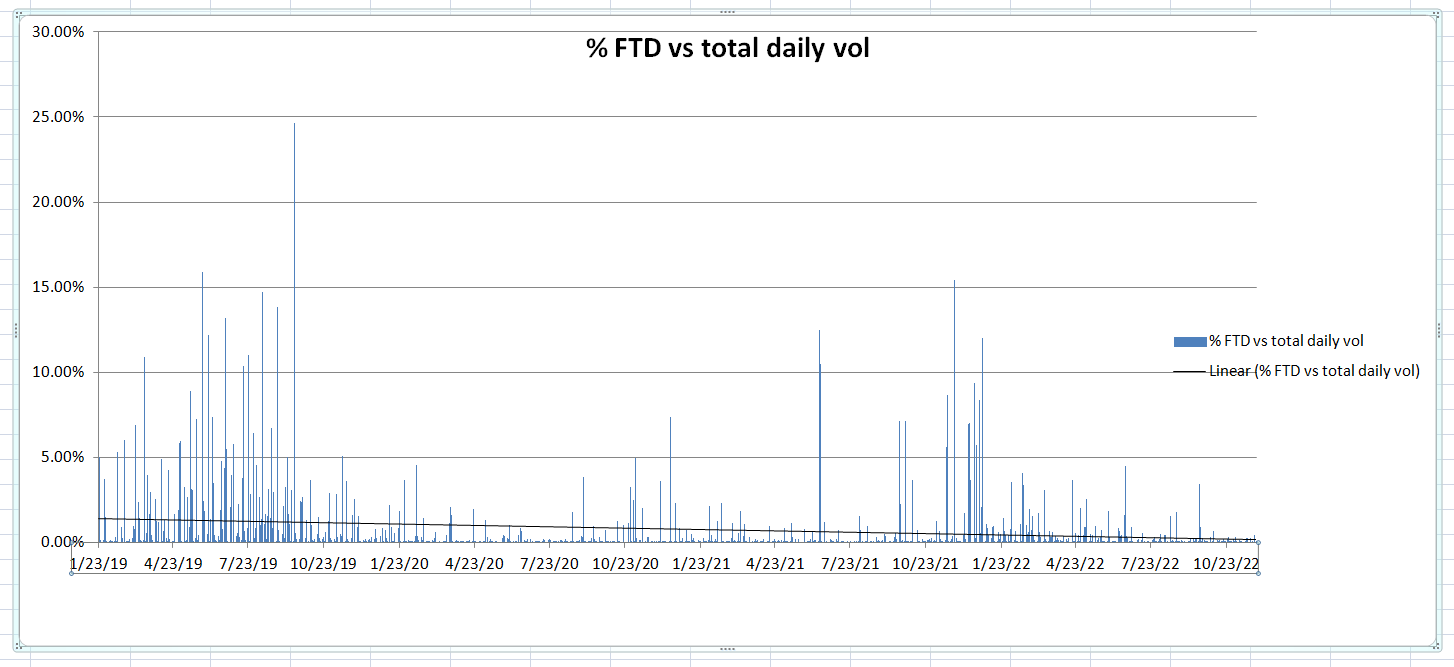

(I have (tediously) aligned the data in the FTD file to the date, close and vol so it is hopefully more or less correct)

(November, 2018, December 2018 and 1st 1/2 of January 2019 are "missing/no data" and the SEC has the BOLDED disclaimer, so this dataset starts on january 23rd, 2019.

Sure looks like lots of shenennigans on the left side

-----------------snip--------------------------

The values of total fails-to-deliver shares represent the aggregate net balance of shares that failed to be delivered as of a particular settlement date.

If the aggregate net balance of shares that failed to be delivered is less than 10,000 as of a particular settlement date prior to September 16, 2008, then no record will be present in the file for that date even if there are fails in that security. If the aggregate net balance of shares that failed to be delivered is zero as of a particular settlement date on or after September 16, 2008, then no record will be present in the file for that date.

Fails to deliver on a given day are a cumulative number of all fails outstanding until that day, plus new fails that occur that day, less fails that settle that day.

The figure is not a daily amount of fails, but a combined figure that includes both new fails on the reporting day as well as existing fails.

In other words, these numbers reflect aggregate fails as of a specific point in time, and may have little or no relationship to yesterday's aggregate fails.

Thus, it is important to note that the age of fails cannot be determined by looking at these numbers.

In addition, the underlying source(s) of the fails-to-deliver shares is not necessarily the same as the underlying source(s) of the fails-to-deliver shares reported the day prior or the day after.

(WTH does this sentence mean please)

Please note that fails-to-deliver can occur for a number of reasons on both long and short sales.

Therefore, fails-to-deliver are not necessarily the result of short selling, and are not evidence of abusive short selling or “naked” short selling.

For more information on short selling and fails-to-deliver,

see http://www.sec.gov/investor/pubs/regsho.htm

http://www.sec.gov/divisions/marketreg/mrfaqregsho1204.htm

http://www.sec.gov/rules/final/34-50103.htm.

(the below paragraph is quite opaque to me)

(I have (tediously) aligned the data in the FTD file to the date, close and vol so it is hopefully more or less correct)

(November, 2018, December 2018 and 1st 1/2 of January 2019 are "missing/no data" and the SEC has the BOLDED disclaimer, so this dataset starts on january 23rd, 2019.

Sure looks like lots of shenennigans on the left side

-----------------snip--------------------------

The values of total fails-to-deliver shares represent the aggregate net balance of shares that failed to be delivered as of a particular settlement date.

If the aggregate net balance of shares that failed to be delivered is less than 10,000 as of a particular settlement date prior to September 16, 2008, then no record will be present in the file for that date even if there are fails in that security. If the aggregate net balance of shares that failed to be delivered is zero as of a particular settlement date on or after September 16, 2008, then no record will be present in the file for that date.

Fails to deliver on a given day are a cumulative number of all fails outstanding until that day, plus new fails that occur that day, less fails that settle that day.

The figure is not a daily amount of fails, but a combined figure that includes both new fails on the reporting day as well as existing fails.

In other words, these numbers reflect aggregate fails as of a specific point in time, and may have little or no relationship to yesterday's aggregate fails.

Thus, it is important to note that the age of fails cannot be determined by looking at these numbers.

In addition, the underlying source(s) of the fails-to-deliver shares is not necessarily the same as the underlying source(s) of the fails-to-deliver shares reported the day prior or the day after.

(WTH does this sentence mean please)

==>> We cannot guarantee the accuracy of the data. <<===sec words

(editorial: but we can make it as confusing and as opaque as possible)Please note that fails-to-deliver can occur for a number of reasons on both long and short sales.

Therefore, fails-to-deliver are not necessarily the result of short selling, and are not evidence of abusive short selling or “naked” short selling.

For more information on short selling and fails-to-deliver,

see http://www.sec.gov/investor/pubs/regsho.htm

http://www.sec.gov/divisions/marketreg/mrfaqregsho1204.htm

http://www.sec.gov/rules/final/34-50103.htm.