Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Powerwall and solar roof postponed until TSLA recovers :-("Tesla Electric”

Reported in Electrek, but this is the source material. More info about the pilot project in Texas (bold mine):

If you’re a Powerwall owner with retail choice in Texas, you can save on your electricity bills. You earn credits toward your bill when you contribute energy stored in your Powerwall to buffer the grid. As a member, you can also monitor the sources of your electricity supply 24/7 in the Tesla app and ensure that any electricity you use from the grid is offset with 100 percent Texas-generated renewable energy. On average, Tesla Electric members have the potential to earn over 50 percent more in credits on their electricity bills compared to similar plans.

Tesla Electric | Tesla

Tesla Electric is a retail electricity provider designed for vehicle and Powerwall owners. Learn more about Tesla Electric, eligibility, benefits and more.www.tesla.com

Todd Burch

14-Year Member

First, this is for two shifts I believe. Which means they're hitting 1500 Model Y per week, per shift. Adding a third shift gets you to 4500/wk.Good, but makes me think the goal of 5000 per week by end of year wont happen. Have we seen Berlin release this information?

Second, I think the 5k goal/wk was for Berlin, not Austin--though I may be wrong about that. Berlin is a bit ahead of Austin.

lafrisbee

Active Member

Gigapress

Trying to be less wrong

“A bit conservative on EPS” is a huge understatement in my opinion. $1.88 for Q4 2024 is a joke. That’s like $6.5B.Someone seems to get it, although I think they are bit conservative with EPS estimates

FSDtester#1

"Circle Jerk Old Guard" per cyborgLIS

Or BPTIX which is the institutional share ... less costs. Either one you can put inside a 401k if you have the pull or if you are the 401k administrator. Which currently the fund holds close to 50% TSLA... how convenient for employees to be able to contribute to this fund and DCA weekly or bi weekly, especially if they get employer matching. Since as we know, 401k's don't allow for individual stocks, so this give you almost a 50% opportunity to invest in the best risk adjusted long term company that I am aware of. YMMVHey mate, what's the stock symbol (to save me some searching)?

Merci beaucoup mon ami!

Not sure, as Tesla didn´t announce. But VIN analysis here has been pretty consistently above 3k/week for a while. Also, news about adding a 3rd shift soon to get to around 5000/week also support this as Tesla wouldn´t add a thrid shift until potential with 2 shifts maxed out.are we sure Berlin is above 3k per week? How come they never tweeted this milestone out yet? Or did i miss it?

And why a 3rd shift if demand is expected to diminish? No one's really explained this to me yet.

petit_bateau

Active Member

Is that off 2-shifts ?

Artful Dodger

"Neko no me"

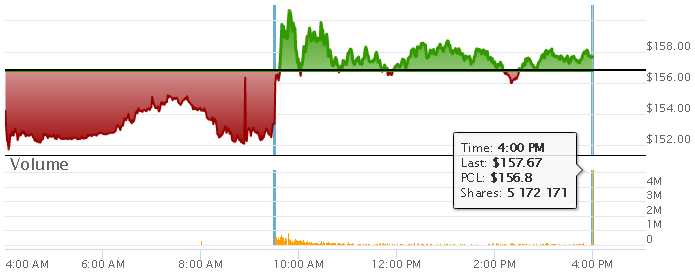

Fun Fact: only 2 components in the S&P 100 finished in positive territory today, Tesla and Verison.

Over 120M shares of TSLA traded by 4 pm and 5.2M shares traded in the 4:00 o'clock minute:

Can you say 'covering'? Lotsa day traders and cappin' goin' on today.

Cheers!

Over 120M shares of TSLA traded by 4 pm and 5.2M shares traded in the 4:00 o'clock minute:

Can you say 'covering'? Lotsa day traders and cappin' goin' on today.

Cheers!

It sounds like they are using something like Autobidder to get you the best rates.This is pretty cool, but it looks (from the Tesla website) that it is only available in Houston and Dallas areas, as they have the appropriate level of choice in their electric providers.

Hoping we manage to allow this in Austin soon - I would love to sell some of my Powerwall solar electrons on a price-demand basis. (I sell my excess energy back now to Austin Energy at a fixed rate, slightly less than retail).

Tesla tracks energy prices in real time and sells your excess electricity to the grid when prices are high, earning you credits on your bill

lafrisbee

Active Member

Hmm? Seem like 121.4M shares traded... typical day"only" 120M shares traded today

Dikkie Dik

If gets hard, use hammer

If 2023 picks up the shortfall this year and the Cybertruck launch is seamless, then we could well get priced to that perfection that we enjoyed for a few short months. I am optimistic that Tesla can do this for 2023 and especially 2024.

I am too. In fact I am hopeful 4th quarter results are going to get us pointed in the right direction.

I keep listening to earnings calls and the big ticket items I'm hoping to keep keep getting put off or just fall short. Really, the 4680 is the biggie, but personally, the Cybertruck as well.

More incentives to take delivery now rather than waiting until subsidies kick in.

I just checked the availability of new inventory cars in Belgium and there’s 1 Model 3 listed and 2 Model Y’s. And 1 demo Model 3 with 5000km. No S or X availability of course. A couple of days ago there were about 20 cars available and I already considered that low.

This is not a sign that Tesla is ending the wave, on the contrary.

Anyway, it’ won’t cost Tesla a lot in incentives to move those 3 cars into hands of potential customers.

TSLA Siempre

Member

Whatever happened to Tesla ending such waves? IIRC several well known predictors of P&D based their #s on such wave endings that this info from China suggest are not actually ending?

Yeah. It’s annoying. Last quarter I think was the third time that they said they were ending the wave.

Optimeer

Member

A new FSD Beta Version 10.69.3.3 was first pushed today to the OG beta testers. I could not detect a change in the release notes compared to 10.69.3 / 10.69.3.1.

Version 10.69.3.2 only went out to Tesla employees.

Version 10.69.3.2 only went out to Tesla employees.

Has Tesla’s 2022 met our expectations?

I get the impression that some people think Tesla’s poor performance in 2022 is somehow the result of Musk’s behaviors or Musk selling. While it might have had some impact, 2022 was not a year full of good news and rose parades. Neither for Tesla, nor for the macro environment. Look back a year ago this time and think about what we expected.

This is on top of fed increasing rates, literal war, huge energy crisis in Europe, Chinese economic and political instability.

- 4680 production in Texas was going to be ramping up fast by now. This has not happened. Lots of equipment, very little if any output.

- Model Y production in Texas and Berlin were going to be complete. We’re getting closer… but shy of the 5k/ week expectations at the moment.

- Deliveries were supposed to be up at least 50%. We’re likely falling a bit short of that too. COVID shutdown in April and slower than expected factory ramps more or less skewed this target.

- The 4680 Model Y from Texas was going to be the wonder car with huge range, huge weight savings, and massive cost reductions. Seems like the promised battery chemistry updates didn’t come through and we’re still looking at energy density comparable to 2170s. Since the 4680 production is still struggling, cost savings are questionable at the moment too.

- Cybertruck was supposed to be launched…. Yes, this was still on the table for 2022 a year ago.

- While FSD Beta “Full Release” is out, Robotaxi and it’s promises are still seemingly at least another couple years out, nor does it appear likely FSD is in a state where it’ll drive revenue in a huge way soon.

While I still think Tesla is an A+ company, 2022 was clearly a C- sort of year And coming into 2022, we were priced for an A+ year and lets be honest, most of us expected it. If 2023 is a C- sort of year, it’s likely we’re not going to see any big positive swings in the SP regardless of Musk’s “antics” or lack of antics.

People need to own the fact that for Tesla, this hasn’t been an outstanding year even if you remove all of the Musk related news from the picture. We were priced for perfection…. We knew Tesla was priced for perfection. Tesla did fine…. But they were not up to the level of performance we or the investing world expected.

When people claim Musk is responsible for the current state of Tesla stock, they are ignoring dozens of other things which contributed to what has been a less than stellar year for Tesla. I have no idea what the impact of Twitter and Musk’s sales have had on the SP over the past year, but the current rut is largely driven by missed expectations. If Musk was selling shares on the back of the 1.6-1.7m deliveries which most here expected, it would be a non-event. Likewise, if we were eyeballing the Cybertruck order forms and Tesla was taking deliveries. Or even if the 4680 was flying out the door at Texas… just that would be huge.

I’m certainly underwater far more than most here and I’ve lost too much to admit to my wife in short term options. But I’m not nearly as worried about Musk‘s stock sales as I am about these other more fundamental things.

And let’s not forget that the SP contained a lot of ‘air’ after the run-ups caused by the first stock split and the S&P inclusion. Those events did not create any structural value and support for the SP. We’re now back at where we were before those two artificial catalysts.

Short OT to relax the mood - static fire, this is only one out of six engines on Starship 24!

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M