More like 540,000499,550 is a Pandemic 500,000

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

SageBrush

REJECT Fascism

Indeed. It's pretty easy to read confidence between the lines in the Tesla reporting when they report 60k production a month run rate in Q4 2020 followed by a reminder that Model Y is just now starting in Giga Shanghai. That sounds like 1 Million a year for 2021, with Giga Berlin and Giga Austin coming online in the next year or so.Using Q4 totals as an estimate of their current run-rate, that adds up to a run-rate of 722k/year now. Pretty likely they can hit 750k (50% growth) for 2021.

Tesla really seems to be heading towards 5M a year in 2025. I'll have to sit down and pencil out how much of that 2025 scenario is already priced into the stock price. Let's see ...

5E6 cars per year

1E4 gross profit per car

-> 5E10 gross profit

? 750E6 stocks

At P/E of 20

-> 1.33E3 = 1,333 per stock

So a little over half of a rosy scenario

Electroman

Well-Known Member

Seth is a bigger dick than Fred.

Fred is okay, I can tolerate him except for his entitlement attitude, but Seth I believe is the wind behind many of the clickbait headlines and stories.

Fred is okay, I can tolerate him except for his entitlement attitude, but Seth I believe is the wind behind many of the clickbait headlines and stories.

Electroman

Well-Known Member

So it appears that Troy and others were quite a bit off mark on their delivery numbers compared to their numbers in previous quarters.

X Fan

Active Member

Rebecca Elliot of WSJ with a nice first article (refreshing after the hack we had before):

Elon Musk Steers Tesla to Record Deliveries

Elon Musk Steers Tesla to Record Deliveries

marvinat0rz

Member

Yeah, something's wrong with the IPO system: no retail investor can ever buy shares at that price.

My CAGR is based on TSLA's Closing Price on it's first day of trading, July 2nd 2010.

Retail HODL'rs actually COULD have those gains. Paging @Krugerrand and a few others I think...

Cheers!

I wish there was a thriving secondary marketplace for stock in pre-IPO companies, where a "non-accredited" investors could participate. And without a lot of paperwork and lawyers. I think we're moving further and further away from a world where regular folks can buy stock in a small-ish public company that has the prospect of growing to a global behemoth. I'm sure there have been more companies than Tesla in this league in the last 10 years, but there's certainly not a whole lot of them. Contrast that to the early 00s, where all of today's tech behemoths were publicly listed and trading at sub-billion dollar valuations.

Most tech companies that IPO today go public with valuations in the 100 billion dollar range. The companies are household names long before that point, and the profit potential is much smaller. Around one order of magnitude, rather than 2 or 3. With the continued rise of index funds, the public markets become more and more of a dumping ground for stocks that have most of their growth behind them. I'm sure this suits founders and venture capitalists splendidly.

UnknownSoldier

Unknown Member

I'm more disturbed that he doesn't know that "LL Cool J" stands for "Ladies Love Cool James" and that makes his Twitter handle absolute nonsense.Perhaps it could have something to do with this tweet from one of their founders?

View attachment 623547

https://twitter.com/llsethj/status/1217198837212884993

Wonderful post and I sell puts as the math works in favor either way to accumulate shares or build capital...with TSLAAgreed. Let me take this as an opportunity to update our idea of break-even on call options. This will show how hard it is to beat holding stocks.

Suppose for sake of illustration. The current share price is $705 and a Jan 2023 call with strike $700 is $261 (= 0.37×$705).

The conventional idea of breaking even on the call option is that at expiration the share price is $961 (=$700 + $261). That is, the investor walks away in Jan 2023 with the same cash they had two years ago. From a cash point of view, they have indeed broken even. But from a Tesla shareholder view point they have substantially fallen behind.

You have your choice of holding 1 contract, purchased at $26,100, or 37 shares of TSLA, also worth $26,100 at the time.

At cash break-even price, the option choice leaves you with $26,100 in cash in Jan 2023, but this is just enough to buy 27.16 shares of TSLA. Thus, stead of holding 37 shares, you have effectively lost 9.84 shares, a 26.6% decline in shares. So this is definitely not break-even from a share perspective.

Moreover, those 37 shares would be worth $35,557 (= 37 shares × $961/sh). This is a gain of $9,457 or 36.2%. While many of us may expect that Tesla will do much better this over the next two years, cash break-even on call options represents a substantial opportunity cost compared with simply holding shares.

So would would a share break-even price look like. Basic algebra leads to an expiration price of

ShareBreakevenPrice = strikePrice/(1 - initialCallPrice/initialSharePrice)

= $700/(1 - 0.37) = $1,111.11

At this price 1 contract or 37 shares have the same value, $41,111, which is a gain of 15,011 or 57.6%. Moreover, at this price 37 shares of TSLA could be bought back from the proceeds of the call option.

I suggest that the share break-even price ($1,111/sh) should be more important long-term Tesla investors than the cash break-even price ($961/sh). Before buy the call option and putting shares at risk, one should have strong conviction that the price of TSLA in Jan 2023 will be in excess of $1,111.

I would point out that the valuation of a call option is based on a delta hedge replicating portfolio of stock and cash. Essentially hedging a call option means increasing share holdings as the share price increases. Buy a contract is essentially paying a counterparty to do this accumulation of shares for you. But to a certain extent any investor can do this for themselves. Over the next two years, we will have many opportunities to add to our TSLA holdings. And we can do that as the price becomes more attractive rather than simply as the price goes up as the delta hedge would do. Adding your own cash is best, but even if you must use a margin loan for cash, you'll have more available credit when the share price is depressed holding shares rather than call options.

So think carefully about how many shares you want to accumulate over the coming years as you contemplate whether call options will actually improve your share position.

All the best in the New Year!

woodisgood

Optimustic Pessimist

Rebecca Elliot of WSJ with a nice first article (refreshing after the hack we had before):

Elon Musk Steers Tesla to Record Deliveries

Finally a journalist that sees the real story.

I’ve come up with a new mantra for all, and especially for 2021 onwards:

Tesla: Drive it like you stole it.

TSLA: Trade it like you’re dead.

Tesla: Drive it like you stole it.

TSLA: Trade it like you’re dead.

I guess even WSJ is tired of being wrong all the time.Finally a journalist that sees the real story.

I put the Fear Of The Mod in her now, didn’t I!Finally a journalist that sees the real story.

sdtslafan

Member

Perhaps it could have something to do with this tweet from one of their founders?

View attachment 623547

https://twitter.com/llsethj/status/1217198837212884993

If Seth thinks that was a fun ride, he should have stayed in the rest of 2020!!

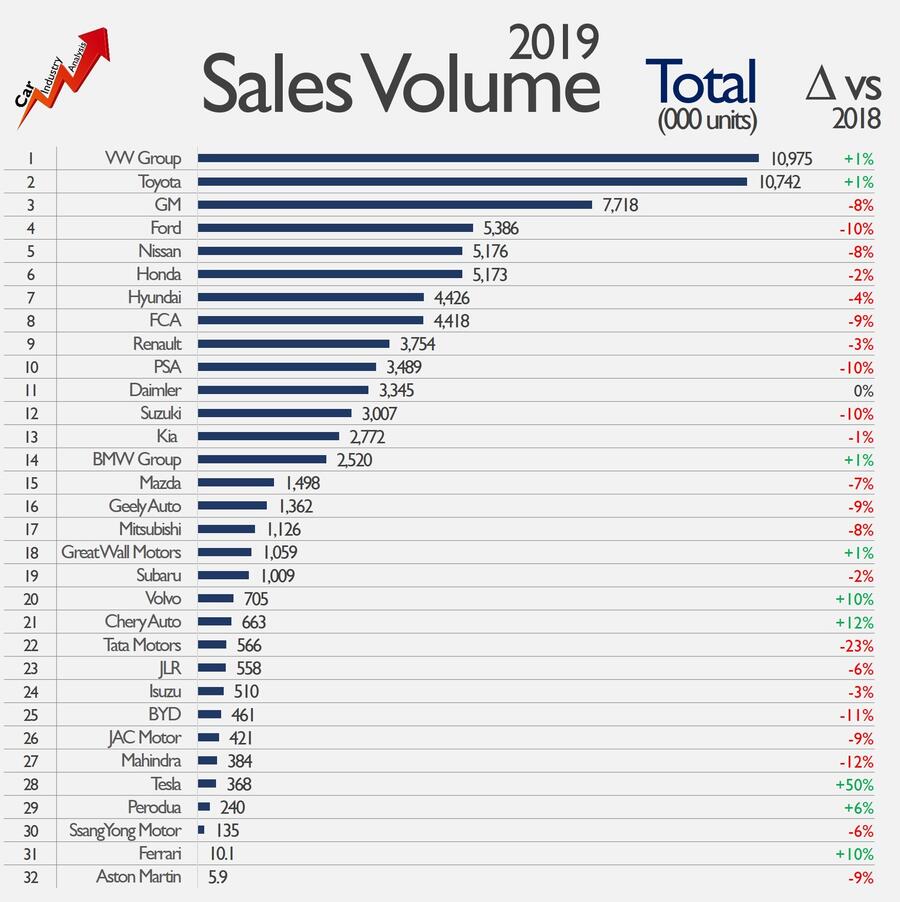

Good chance all the others will have slipped back a fair bit during 2020. Can Tesla beat Volvo in 2020? That would be pretty special.This represents global number of cars sold in 2019. I post it to put into context where Tesla sits and in particular to demonstrate the size of the 'pie' that Tesla can eat. When the 2020 figures are produced Tesla will have overtaken JLR. In 2021 Tesla should have risen to 20th position and will have overtaken Tata Motors and Volvo. Onwards and upwards.

Off Shore

Off Topic Member

Except for The Batteries. She never mentioned The Batteries. She may not know about The Batteries.Finally a journalist that sees the real story.

Troy was 1.7% high and way better than Q3 and one thier best so far so not sure why you think differently.So it appears that Troy and others were quite a bit off mark on their delivery numbers compared to their numbers in previous quarters.

https://twitter.com/TroyTeslike?s=09

2022 should see the start of factory construction for the "model 2" given Elon mentioned deliveries starting in 2023 at battery day.

Between now and 2023 we are likely to see multiple giant facilities spring to life:

All told, there could be up to 10 facilities/expansions required between now and the end of 2023 (excluding current construction) to meet bullish interpretations of guidance. I'm excited to hear what capex guidance we get from the Q4 call around these plans.

- Model 2 facilities - potentially concurrent construction in China, EU, US given likely demand for the vehicle

- Tesla still needs to produce buildings for the 4680 cells in the US and possibly other regions - potential for 2-3 facilities

- The precursor materials may also need refineries (wording?) assuming Tesla takes it in house - numbers could match the number of 4680 facilities.

- Semi production will need a new building in Nevada or eslewhere

Where is the name Model 2 coming from? Surely it’ll be the Model A.

S3XY

CARS

Cybertruck, A, Roadster, Semi

No?

Good chance all the others will have slipped back a fair bit during 2020. Can Tesla beat Volvo in 2020? That would be pretty special.

2021. Easy peasy.

Mo City

Active Member

"A" is already taken by the Tesla ATV.Where is the name Model 2 coming from? Surely it’ll be the Model A.

S3XY

CARS

Cybertruck, A, Roadster, Semi

No?

Similar threads

- Locked

- Replies

- 0

- Views

- 3K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Replies

- 6

- Views

- 11K

- Locked

- Replies

- 27K

- Views

- 3M