Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

samppa

Active Member

I'll take Tesla's AI team over Waymo's any day of the week. Karpathy is a rock star.

Also, you forgot what is in my opinion Waymo's (and all of Tesla's competition's) biggest issue. Nobody except for Tesla has a viable plan to convince regulators to actually allow their cars to drive around as robotaxis en-masse. Nobody but Tesla has any way to gather enough data to without a doubt prove that their system is safer than a human. Considering there is a fatality every ~110-115M miles in the US (less frequently in a lot of other countries), going to regulators with anything less than a billion miles is never going to work. Ideally you show them billions or tens of billions of miles with significantly less accidents than the norm, and then it's a no-brainer for regulators to approve your system, because it has statistically proven that it will safe lives.

You're also forgetting about Tesla's AI chip, which is at least 1-2 years ahead of any competition.

There's also scalability. Waymo's strategy, which is reliant on HD maps, is not scalable, whereas all Tesla has to do is upload the software, perhaps make some adjustments for certain jurisdictions (elephants in India/Africa?), and their system works globally.

Vertical integration is like 5 pluspoints all in one. Waymo won't just have to partner with OEMs, but also with dealership networks if it wants to service its cars. Same story for insurance. Same story for charging infrastructure. And who's going to design a snake-charger for Waymo?

I could go on and on, but there's truly no comparison between Waymo and Tesla. It's like comparing Mike Tyson with a teenager who's been boxing for a couple of months.

Lastly, I'm not aware of Amazon's nor Baidu's FSD development efforts, but Intel Mobileye is #2 in the race as far as I'm aware. Far behind Tesla, but definitely a much better strategy than Waymo. In the Mike Tyson and teenager analogy, I'd call Mobileye a strong amateur boxer, or perhaps somebody who's about to go pro.

Where would you put comma.ai:s openpilot in this race?

I have it in my pre-ap model S, and it's surprisingly good. Beats ap1 hands down.

And this is what I’m thinking, so Elon isn’t likely to give in to S&P wishes unless it suits/is beneficial to Tesla.

Which brings me back to Elon’s very specific comment about it being more important to use money efficiently than to have more of it than they can actually use. He’s also commented on Tesla being close to a situation where they’re making enough to fund their expansion as fast as is efficiently and feasibly possible. I think that happens fully in Q3 & Q4.

How much more than the 8B do they need to have on hand? If they come out of Q2 with the same 8B in the bank after riding out the COVID shutdown, yet continuing their expansion, then - we don’t need no stinking capital raise, people! Am I right?

You are. I'm guessing Elon learned it's more important to use money efficiently than to have more of it, observing SpaceX competitor ULA.

Agreed. Also, I am not sure if Waymo's goal is to solve worldwide true-FSD. Not any time soon anyway. I interpret their strategy as going for some very specific and very lucrative geographical areas, do high precision mappings and train their AI for the well defined specifics of these select locations. So this system will be available in downtown LA, Paris, Berlin or Beijing, but good luck dropping it in the Hungarian countryside between 2 villages and expecting it to work. Not happening.I'll take Tesla's AI team over Waymo's any day of the week. Karpathy is a rock star.

Also, you forgot what is in my opinion Waymo's (and all of Tesla's competition's) biggest issue. Nobody except for Tesla has a viable plan to convince regulators to actually allow their cars to drive around as robotaxis en-masse. Nobody but Tesla has any way to gather enough data to without a doubt prove that their system is safer than a human. Considering there is a fatality every ~110-115M miles in the US (less frequently in a lot of other countries), going to regulators with anything less than a billion miles is never going to work. Ideally you show them billions or tens of billions of miles with significantly less accidents than the norm, and then it's a no-brainer for regulators to approve your system, because it has statistically proven that it will safe lives.

You're also forgetting about Tesla's AI chip, which is at least 1-2 years ahead of any competition.

There's also scalability. Waymo's strategy, which is reliant on HD maps, is not scalable, whereas all Tesla has to do is upload the software, perhaps make some adjustments for certain jurisdictions (elephants in India/Africa?), and their system works globally.

Vertical integration is like 5 pluspoints all in one. Waymo won't just have to partner with OEMs, but also with dealership networks if it wants to service its cars. Same story for insurance. Same story for charging infrastructure. And who's going to design a snake-charger for Waymo?

I could go on and on, but there's truly no comparison between Waymo and Tesla. It's like comparing Mike Tyson with a teenager who's been boxing for a couple of months.

Lastly, I'm not aware of Amazon's nor Baidu's FSD development efforts, but Intel Mobileye is #2 in the race as far as I'm aware. Far behind Tesla, but definitely a much better strategy than Waymo. In the Mike Tyson and teenager analogy, I'd call Mobileye a strong amateur boxer, or perhaps somebody who's about to go pro.

On the other hand, Tesla has chosen the harder road as they have bigger goals: they want to crack true-FSD and move the world towards an automated solution to eliminate 99% of the accidents. Sure, the system needs the parameters of local traffic rules and some million miles of relevant data from the country/region, but other than that, is should just work "anywhere".

Runarbt

Active Member

Skoda Enyaq postponed until 2021.

Norwegian customers won't get their VW ID.4 based EV Skoda Enyaq in Q4 2020 but some time in 20201. Orders for the Enyaq started in june 2019 with a $500 deposit.

Source in Norwegian: Nok en elbil utsatt: Skoda Enyaq kommer først i 2021

The Enyaq were supposed to be shown to prepaying customers in January this year but that was cancelled. Now Skoda hope to have something to show the prepaying customers in the fall.

Norwegian customers won't get their VW ID.4 based EV Skoda Enyaq in Q4 2020 but some time in 20201. Orders for the Enyaq started in june 2019 with a $500 deposit.

Source in Norwegian: Nok en elbil utsatt: Skoda Enyaq kommer først i 2021

The Enyaq were supposed to be shown to prepaying customers in January this year but that was cancelled. Now Skoda hope to have something to show the prepaying customers in the fall.

I think he is simply referring to his newborn son. I saw a picture on-line of Elon holding his new baby this week.I am still kinda worried about that "baby-not ready spoon" tweet.

Damn, Twitter/Elon, for messing with my mind.

Where would you put comma.ai:s openpilot in this race?

I have it in my pre-ap model S, and it's surprisingly good. Beats ap1 hands down.

Small excerpt from my Investment Thesis 2.0 blog:

Comma.ai

What would you get if somebody was trying to solve autonomy by copying Tesla, but started from scratch as a startup? The answer is Comma.ai. They do not use LIDAR and rely exclusively on vision, and in some cases some radar data. However, they are not able to install their system into the vehicles they sell to their customers like Tesla, because they are not a car company, so they've come up with a system that can be retrofitted to many (but not all) existing cars. Customers buy this system, which consists of a simple computer and a camera, from Comma.ai and install it into their own vehicle. They then use Comma.ai's Openpilot software which is similar to Autopilot and provides cruise control and lane keeping assist features.

Comma.ai wanted to sell both the retrofit hardware package and the software, but the company had to abandon this plan because the NHTSA demanded they comply with too many safety regulations, so they decided it would be easier to sell the hardware only and open source the software. George Hotz, the founder of Comma.ai, has said that they aim to be the Android of autonomy.

So for Perception they're using a vision based system. For Iteration they're using real world testing and data from 4,500 customer vehicles, which have so far traveled over 10 million miles. These are very good numbers compared to most of the industry, but multiple orders of magnitude away from Tesla's, and Tesla is selling way more vehicles than Comma.ai is selling retrofit hardware. To ever gain regulatory approval, assuming they can get to human safety levels, would require them to convince many more customers to buy their retrofit hardware for cruise control and lane keeping assist features.

But the biggest issues I see with Comma.ai are as follows:

- Their hardware chip is insufficient to reach full autonomy. I can't imagine their $600 hardware retrofit package's hardware chip is anywhere close to being powerful enough to support full autonomy.

- Their sensor suite is great for driver assistance features, but seems insufficient for full autonomy. It contains two windshield mounted GoPros, and I believe also leverages dashcams and radar data of cars that are equipped with them, but all of this seems insufficient. An indication to this fact is that their lane changing feature can change lanes, but cannot determine when it is safe to change lanes and requires the driver to determine this.

- As ADAS from companies like Mobileye become better and are included in more vehicles, the market for Comma.ai's hardware retrofit will shrink. If the open source software that runs on their hardware is not better than other ADAS, nobody will buy their hardware anymore, and they can not expand their real world testing and data gathering, that they need to improve the open source software and reach full autonomy.

- The company itself seems to be a little shaky. George was forced to step down as CEO, although he is still the president and lead enginner. The company also recently moved all the way from Silicon Valley to San Diego, which I don't think is a great sign either.

Artful Dodger

"Neko no me"

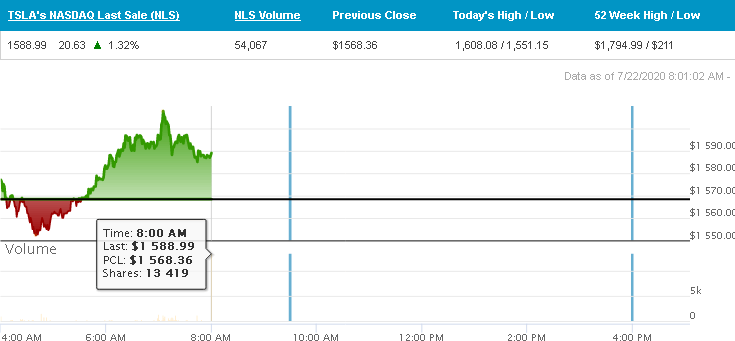

08:00 a.m. Whistle: Wed, 22 Jul 2020

Pre-Market High: $1,607.96 (08:00:01 AM)

Pre-Market Low : $1,553.90 (04:45:43 AM)

Comment: "Last Wednesday-Funday before da Big Badda-Boom"

Cheers!

- NASDAQ-100 Futures: +9.25 +0.09% 07:59:59

- TSLA share price: $1590.90 +22.54 +1.44%

- NASDAQ Pre-market Volume: 127,469 @ 08:00 ET (moderate volume)

Pre-Market High: $1,607.96 (08:00:01 AM)

Pre-Market Low : $1,553.90 (04:45:43 AM)

Comment: "Last Wednesday-Funday before da Big Badda-Boom"

Cheers!

Another great video from Rob.Rob with another well researched S&P video.

Towards the end of this video Rob mentions that the S&P can determine the size of the available share float, and that it is possible for them to only weight Tesla to a lower % of the index than pure market cap would suggest. This would have the effect of reducing the number of shares the index funds need to purchase around the time of inclusion (+- 1 month or so). They could then lift the weighting in subsequent quarters.

One benefit of this approach (from the index's perspective) is that both the numerator and denominator move at this weighting so index funds won't have the mismatch compared to the index that would otherwise occur if the full weighting was included and a long squeeze occurred.

It seems like an easy solution for an organisation that wouldn't want to turn the Tesla inclusion into a dog and pony show by skewing the share price over the short term. The only downside (for the S&P committee) would be that the index itself does not track the actual performance of the top 500 companies in the US as closely as it otherwise could - but who cares, i don't know many people that would bother comparing their returns to anything but the index.

J

jbcarioca

Guest

Actually it is cows in India....

perhaps make some adjustments for certain jurisdictions (elephants in India/Africa?), and their system works globally.

...

Otherwise I agree with your post..

ZachF

Active Member

My hypothesis...TSLA posts a resounding profit but does not want to price a secondary for S&P inclusion hence his “baby isn’t ready for the SPoon” yet. Perhaps Elon sees this share dilution as an easy out for the naysayers and doubters of the last few years and keeping share count where it is is a great way to make them (i.e., shorts) truly S his C....if you will...

...I wonder how bad Chanos is twitching these days?

Hilarious scenario that probably won't happen:

Tesla issues new shares to facilitate S&P 500 addition. Some of these proceeds are used for a special dividend payment to shareholders. Shorty would then be forced to come up with the $$$ for the dividend payment.

Huh, the rules document says the IWF only gets updated annually. Did Rob mention where that scenario was sourced from?Another great video from Rob.

Towards the end of this video Rob mentions that the S&P can determine the size of the available share float, and that it is possible for them to only weight Tesla to a lower % of the index than pure market cap would suggest. This would have the effect of reducing the number of shares the index funds need to purchase around the time of inclusion (+- 1 month or so). They could then lift the weighting in subsequent quarters.

One benefit of this approach (from the index's perspective) is that both the numerator and denominator move at this weighting so index funds won't have the mismatch compared to the index that would otherwise occur if the full weighting was included and a long squeeze occurred.

It seems like an easy solution for an organisation that wouldn't want to turn the Tesla inclusion into a dog and pony show by skewing the share price over the short term. The only downside (for the S&P committee) would be that the index itself does not track the actual performance of the top 500 companies in the US as closely as it otherwise could - but who cares, i don't know many people that would bother comparing their returns to anything but the index.

Investable Weight Factor Maintenance:

Rebalancing Frequency Investable Weight Factors (IWFs) are reviewed annually based on the most recently available data filed with various regulators and exchanges. For the S&P Dow Jones indices, updated IWFs resulting from the annual review are applied either prior to the open of the Monday after the third Friday of September or a date that is more appropriate for a particular index family. For example, the S&P Global BMI constituents’ new IWFs are applied at the annual reconstitution at the open of the Monday after the third Friday of September; for the S&P Frontier BMI index constituents, revised IWFs are applied at the annual reconstitution at the open of the Monday after the third Friday of March.

Please refer to individual index methodologies for specifics on IWF rebalancing schedules.

Updates.

Changes in IWFs resulting from certain corporate actions which exceed five percentage points are implemented as soon as possible or weekly depending on index methodology; changes of less than five percentage points are implemented at the next annual review. In order to minimize index turnover, IWF changes resulting from M&A activity are not subject to the five percentage point threshold. Any merger related IWF change that results in an IWF of 0.96 or greater is rounded up to 1.00 at the next annual IWF review.

Tslynk67

Well-Known Member

Nope, I've no idea what that's about...

Highway2Heel

Member

Why do I feel like there’s some video gamer speak at play here? Which would leave me completely in the dark since I haven’t touched a controller since Sega came out with the Genesis.

ByeByeJohnny

Active Member

Another great video from Rob.

Towards the end of this video Rob mentions that the S&P can determine the size of the available share float, and that it is possible for them to only weight Tesla to a lower % of the index than pure market cap would suggest. This would have the effect of reducing the number of shares the index funds need to purchase around the time of inclusion (+- 1 month or so). They could then lift the weighting in subsequent quarters.

I must be smarter than I think because I made a post about this possibility probably a month ago. Got no discussion except for one comment agreeing they could do whatever they wanted.

Nice to see some great minds catching up

Another price target increase, this time it's from BoA. Slowly but surely these analysts seem to be getting there /s

BofA, despite target boost, says Tesla rally not supported by fundamentals TSLA - The Fly

BofA, despite target boost, says Tesla rally not supported by fundamentals TSLA - The Fly

BofA analyst John Murphy raised the firm's price target on Tesla to $800 from $500 and keeps an Underperform rating on the shares. The shares closed Tuesday down $74.64 to $1,568.36. Tesla's $1,500-plus stock price is "not supported by fundamentals, with valuation driven largely by momentum and low rates," Murphy tells investors in a research note. The analyst attributes the stock's run to the ongoing rotation into and momentum of growth stocks as well as technical buying ahead of Tesla's potential addition to the S&P 500 Index. While data points and news flow "could support the rally for now," Tesla's valuation "appears overheated," contends Murphy. Nonetheless, ahead of the company's Q2 results, the analyst boosted the price target to reflect higher estimates and higher multiples. It is important to recognize that the higher Tesla's stock goes, the cheaper the company's funding gets to support its outsized growth, which is then rewarded by investors in the form of a higher stock price, Murphy says.

@Curt Renz

Reddit user __TSLA__, whom I believe is @Fact Checking , would like more context about your recent quote from Todd Rosenbluth.

It's not entirely clear from the quote whether Todd is suggesting that index funds usually get a ~7 days notice ahead of inclusion separate from the official public announcement, or whether he is referring to the public announcement itself.

Reddit user __TSLA__, whom I believe is @Fact Checking , would like more context about your recent quote from Todd Rosenbluth.

It's not entirely clear from the quote whether Todd is suggesting that index funds usually get a ~7 days notice ahead of inclusion separate from the official public announcement, or whether he is referring to the public announcement itself.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K