Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Here's the tweet:Bleah. It might be interesting if it actually parsed into a sentence.

Here's my rendering of it in English:Tesla is more dangerous than other car cos realize. Their popularity in SV is not because this is a niche market.

The last bit is my riff.Tesla Motors is more dangerous than other car companies realize. The Model Ss popularity in Silicon Valley is not because this is a niche market, but because it's full of smart people who appreciate superbly crafted technology.

Just got an model X update mail...

Ditto that. Short version: new reservations won't arrive until 'well into' 2016, the falcon doors are coming, the X will be tow-rated, and betas will be used for crash testing 'in the near future'.

I'm not surprised by this note, and I hope Wall Street isn't either. According to the most recent tally here on TMC, there are about 22k Model X reservations. If we allow for, say, 20% cancellations, that's 17.5k Model Xs that Tesla needs to deliver before they get to a "new reservation." This new statement by Tesla does help us put some realistic bounds as to the ramp-up production of the Model X. My working assumption is that they'd get about 7.5k out the door in 2015. If they plan to build 30k Model Xs next year, then they're sold out through April 2016, which is 'well into' 2016 in my book. No surprise for me that they're keeping falcon doors and towing (both promised). Good news that they're ready to start crash testing; after they start crash testing, they have limited room left to tinker without invalidating the test results.Ditto that. Short version: new reservations won't arrive until 'well into' 2016, the falcon doors are coming, the X will be tow-rated, and betas will be used for crash testing 'in the near future'.

UPDATE: interesting that there's no AH impact from this letter.

Last edited:

daniel Ox9EFD

Member

Bloomberg on discrepancy between deliveries and registrations for Tesla Jan - Sep 14

Here is a link to the report:

Where Are Tesla’s 12,000 `Missing’ Cars? - YouTube

There are some harsh accusations about Tesla bluffing the numbers to keep the stock up, which seems unreasonable.

But the question is fair - what is the cause for the discrepancy?

US registrations jan - sep 2014:

9331

Deliveries for same period:

21821

discrepancy:

12490

What is the breakdown of deliveries outside US as far as we know?

My take on it -

Quoting the WSJ (which is dangerous) - based on this link - Tesla Seen Boosting North American Deliveries in 3rd Quarter - WSJ - WSJ

"According to JL Warren Capital LLC, which collects registration and import data in China, Tesla has exported 3,406 vehicles to China since April."

So of the 12490, 3406 went to China. Leaving 9084 for Europe.

Of that - according to this post on Tesla's website forum -

Tesla Model S Deliveries Averaging 436 Per Month In Norway In 2014 (UP from 357) | Forums | Tesla Motors

Norway averaged 436 per month in 2014 as of Sep.

“According to OFV, Norway’s automotive industry association, the California electric car manufacturer has sold an average of 436 Tesla Model S sedans a month for the past year"

Which totals 3924 for Jan - Sep. That leaves 5160 for the rest of Europe, Canada and Japan. Seems a little high but believable.

Also interesting - any comment on the discrepancy between deliveries and registrations within China?

Here is a link to the report:

Where Are Tesla’s 12,000 `Missing’ Cars? - YouTube

There are some harsh accusations about Tesla bluffing the numbers to keep the stock up, which seems unreasonable.

But the question is fair - what is the cause for the discrepancy?

US registrations jan - sep 2014:

9331

Deliveries for same period:

21821

discrepancy:

12490

What is the breakdown of deliveries outside US as far as we know?

My take on it -

Quoting the WSJ (which is dangerous) - based on this link - Tesla Seen Boosting North American Deliveries in 3rd Quarter - WSJ - WSJ

"According to JL Warren Capital LLC, which collects registration and import data in China, Tesla has exported 3,406 vehicles to China since April."

So of the 12490, 3406 went to China. Leaving 9084 for Europe.

Of that - according to this post on Tesla's website forum -

Tesla Model S Deliveries Averaging 436 Per Month In Norway In 2014 (UP from 357) | Forums | Tesla Motors

Norway averaged 436 per month in 2014 as of Sep.

“According to OFV, Norway’s automotive industry association, the California electric car manufacturer has sold an average of 436 Tesla Model S sedans a month for the past year"

Which totals 3924 for Jan - Sep. That leaves 5160 for the rest of Europe, Canada and Japan. Seems a little high but believable.

Also interesting - any comment on the discrepancy between deliveries and registrations within China?

There were a lot of Model Ss delivered in September, and because Tesla doesn't handle registration, it wouldn't surprise me at all to learn that registration data lags deliveries by a non-trivial amount.

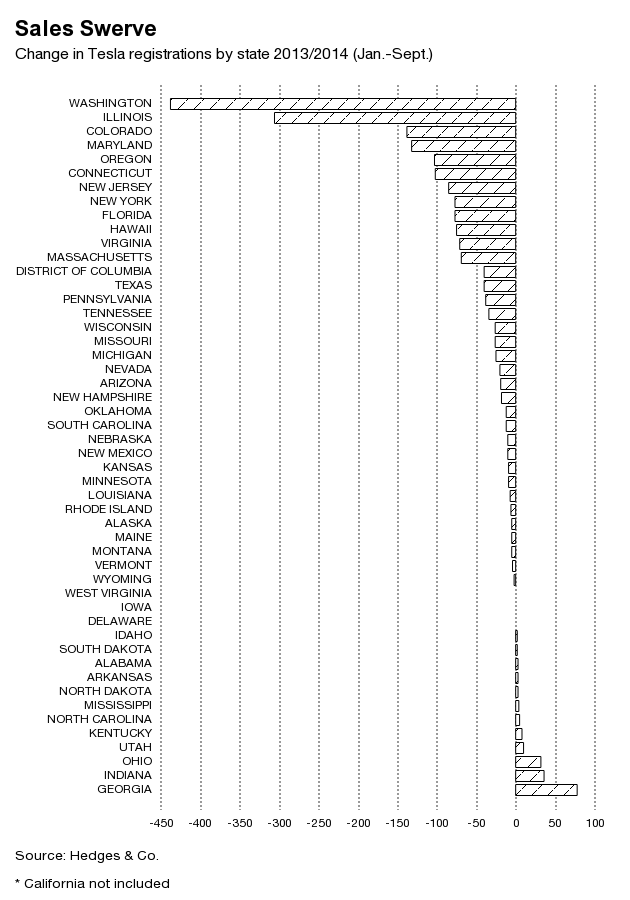

What is more troubling is that deliveries are way down in the US. It is true that more product is allocated to foreign markets but this does not explain why deliveries are down dramatically in the US. Its not like anyone in the US was denied a sale. If you order one, you will receive one within 3 to 4 months. This one chart below is very telling. The few states that have increased sales are no where close to making up for losses in established states. This only means demand has peaked 1-2 years after sales have begun in any given market and this is also true for North America as a whole. Will this be expected in Europe/Asia. Will sales peak by 2017 in China? What will happen once Norway ends all incentives once EVs reach 50,000 sold?

daniel Ox9EFD

Member

Do we have a good estimate of how many deliveries (and better yet, how many registrations) in September?

I found an 'InsideEVs' estimate of 2500

(September 2014 Plug-In Electric Vehicle Sales Report Card)

If half of them didn't register their car in Sep. this would lower the 'other' category to around 4000.

If we take Canada sells estimates as a rough proxy for deliveries -

By one estimate (Plug-in Electric Car Sales In Canada, Oct 2014: Tesla Outsells Leaf: UPDATED)

There were 918 Jan - Sep.

By ibtimes estimate - Tesla Is Experiencing Tepid German, Danish Sales So Far; Netherlands Performance Faring Better

There were 348 registrations in aug - sep. I extrapolated from that around 1500 jan - sep. Probably somewhat lower.

This leaves ~1600 or 177 a month for all other markets. This completely sounds reasonable, even if the numbers are a little off there is not much mystery to the 'missing 12,000 Teslas'.

I found an 'InsideEVs' estimate of 2500

(September 2014 Plug-In Electric Vehicle Sales Report Card)

If half of them didn't register their car in Sep. this would lower the 'other' category to around 4000.

If we take Canada sells estimates as a rough proxy for deliveries -

By one estimate (Plug-in Electric Car Sales In Canada, Oct 2014: Tesla Outsells Leaf: UPDATED)

There were 918 Jan - Sep.

By ibtimes estimate - Tesla Is Experiencing Tepid German, Danish Sales So Far; Netherlands Performance Faring Better

There were 348 registrations in aug - sep. I extrapolated from that around 1500 jan - sep. Probably somewhat lower.

This leaves ~1600 or 177 a month for all other markets. This completely sounds reasonable, even if the numbers are a little off there is not much mystery to the 'missing 12,000 Teslas'.

GasDoc

Member

Where Are Tesla’s 12,000 `Missing’ Cars?: Video - Bloomberg

Apparently every delivery not going to NA is "missing", what the ****? Are they implying Tesla is lying about their sales to other regions? Where is this coming from?

I can't believe how biased some stories are, Cory must be recieving money under the table, it's ridiculous.

Are they baiting Elon to Tweet?

If he does, better buckle up.:scared:

Chickenlittle

Banned

They are not missing. They are all parked on my drivewayFunny thing is a few days go weren't they talking about 2k missing cars and now it's 12k? Must have a really high production rate for cars to go missing that quickly...

(Well that or it's nonsense...hmm...)

InTheShadows

Active Member

There were a lot of Model Ss delivered in September, and because Tesla doesn't handle registration, it wouldn't surprise me at all to learn that registration data lags deliveries by a non-trivial amount.

Up to three months if I remember correctly. When we took delivery of our car we waited a month and a half to register it. We would have waited longer had we not been up against the new year and wanted the tax credit for 2013. The CA temp tag was good for three months IIRC. We didn't have to pay sales tax until we registered the car. 6% on a $100k car is a big chunk of sales tax. So we put that off as long as possible. Which I am sure there are many other people that do the same thing.

With this being the situation and most cars being delivered at the end of the quarter I would guess there is a large majority of them are not registered until well into the next quarter.

chickensevil

Active Member

There were a lot of Model Ss delivered in September, and because Tesla doesn't handle registration, it wouldn't surprise me at all to learn that registration data lags deliveries by a non-trivial amount.

ESPECIALLY in states like Maryland, Virginia, New Jersey, New York, Texas... to name a few which are not insignificant US markets... What do all of these states have in common? Self-Registration. I doubt it has gotten any better from when I got my car. It took them almost up until expiration of my Temporary tags (which was only valid for 30 days) to get the paperwork I needed to even take it to the DMV and register my car. So while I received my car in March, and Tesla certainly would have counted my vehicle as revenue in March, I did not officially "register" my car until almost the end of April, which would have been well into the next quarter.

I also easily could have asked for an extended temporary tags (they were already about ready to help me get another set, since the paperwork was taking so long) and extended that out even longer than April... Easily into May and if I really pushed maybe June (since sales tax had to be paid upfront to the DMV I could easily see people not having the ~4k in cash that you have to pay them for Sales tax and trying to delay while they got the funds together).

So using my singular data point, it is easily not unfeasible for me to see the September delivered cars in just those states alone not hitting their data pull yet. And then their numbers from January-February are also skewed since that would have been carry over from the previous year.

Bottom line, you can't count registrations... And that 9k number is totally wrong.

- - - Updated - - -

Up to three months if I remember correctly. When we took delivery of our car we waited a month and a half to register it. We would have waited longer had we not been up against the new year and wanted the tax credit for 2013. The CA temp tag was good for three months IIRC. We didn't have to pay sales tax until we registered the car. 6% on a $100k car is a big chunk of sales tax. So we put that off as long as possible. Which I am sure there are many other people that do the same thing.

With this being the situation and most cars being delivered at the end of the quarter I would guess there is a large majority of them are not registered until well into the next quarter.

Wow 3 months? Now we have two data points, one more and we can start to form a trend

- - - Updated - - -

Are they baiting Elon to Tweet?

If he does, better buckle up.:scared:

Would be nice if he did

InTheShadows

Active Member

ESPECIALLY in states like Maryland, Virginia, New Jersey, New York, Texas... to name a few which are not insignificant US markets... What do all of these states have in common? Self-Registration. I doubt it has gotten any better from when I got my car. It took them almost up until expiration of my Temporary tags (which was only valid for 30 days) to get the paperwork I needed to even take it to the DMV and register my car. So while I received my car in March, and Tesla certainly would have counted my vehicle as revenue in March, I did not officially "register" my car until almost the end of April, which would have been well into the next quarter.

I also easily could have asked for an extended temporary tags (they were already about ready to help me get another set, since the paperwork was taking so long) and extended that out even longer than April... Easily into May and if I really pushed maybe June (since sales tax had to be paid upfront to the DMV I could easily see people not having the ~4k in cash that you have to pay them for Sales tax and trying to delay while they got the funds together).

So using my singular data point, it is easily not unfeasible for me to see the September delivered cars in just those states alone not hitting their data pull yet. And then their numbers from January-February are also skewed since that would have been carry over from the previous year.

Bottom line, you can't count registrations... And that 9k number is totally wrong.

- - - Updated - - -

Wow 3 months? Now we have two data points, one more and we can start to form a trend

I just looked it up when I read your post, it's 30 or 90 days depending on what the dealer issues.

I just pulled our folder.

Now the article is officially FUD. There are probably still people driving around on temp tags that got their cars let quarter.

rolosrevenge

Dr. EVS

In the Seattle area, when you have the temporary tags the automated tolling systems don't detect your car, I could see that being a reason delay registration and getting a license plate.

InTheShadows

Active Member

In the Seattle area, when you have the temporary tags the automated tolling systems don't detect your car, I could see that being a reason delay registration and getting a license plate.

If your fees are like the NYC area I can see a huge incentive to do that. $15 each way on a bridge, twice a day. In 90 days that's $1800 in bridge tolls avoided if you have to take the VNB to work and back 5 days a week. Plus the highway tolls. And delaying paying sales tax. That's a lot of incentive to delay registering your car. (Though I doubt most tesla owners would be into toll skipping.)

chickensevil

Active Member

I just looked it up when I read your post, it's 30 or 90 days depending on what the dealer issues.

I just pulled our folder.

Now the article is officially FUD. There are probably still people driving around on temp tags that got their cars let quarter.

Yeah, I think cause I had New Jersey temp tags, they were only valid for 30 days. Each state is a little different I think, and now they can't do Jersey tags anymore I don't think so there's that...

What is more troubling is that deliveries are way down in the US. It is true that more product is allocated to foreign markets but this does not explain why deliveries are down dramatically in the US. Its not like anyone in the US was denied a sale. If you order one, you will receive one within 3 to 4 months. This one chart below is very telling. The few states that have increased sales are no where close to making up for losses in established states. This only means demand has peaked 1-2 years after sales have begun in any given market and this is also true for North America as a whole. Will this be expected in Europe/Asia. Will sales peak by 2017 in China? What will happen once Norway ends all incentives once EVs reach 50,000 sold?

Welcome to the Tesla Motors Club, MonroeSS. Thank you for your observations.

Please note the previous posters' comments regarding how registration data can be deceiving, and should not be equated with current sales or deliveries and especially not with orders or demand in general. Since you are new to this forum, it's understandable that you may not be aware of earlier discussions regarding this consideration. Certainly Tesla Motors management is aware of that accounting peculiarity and the matters I discuss below.

Unlike the situation with owners of cars made by the established automakers, virtually all Tesla car owners have been first time Tesla buyers. When a product is new, an initial surge of sales is to be expected and then a simmering down. Meanwhile, customer satisfaction is exceptionally high. Soon there should be an echo effect due to those trading in their 2012 Model S's for the new dual motor/autopilot version. Others, whether they own a Model S or not, are waiting for the Model X. And of course a great many more are waiting for the Model 3.

As long as there is a significant backlog there remains no need to advertise. Here in Illinois most folks are either unaware or vaguely aware of Tesla Motors and the Model S, unless they are financial news junkies. Illinoisans are somewhat uneducated regarding the advantages of electric cars in general and Tesla cars in particular. Compared with California there are relatively few Model S owners here to help promote sales through word of mouth. This is likely true elsewhere outside of California. Once production ramps up to the point that advertising makes sense, look for a huge boost in demand and for all talk of a seeming decline to dissipate.

Last edited:

Citizen-T

Active Member

What is more troubling is that deliveries are way down in the US. It is true that more product is allocated to foreign markets but this does not explain why deliveries are down dramatically in the US. Its not like anyone in the US was denied a sale. If you order one, you will receive one within 3 to 4 months. This one chart below is very telling. The few states that have increased sales are no where close to making up for losses in established states. This only means demand has peaked 1-2 years after sales have begun in any given market and this is also true for North America as a whole. Will this be expected in Europe/Asia. Will sales peak by 2017 in China? What will happen once Norway ends all incentives once EVs reach 50,000 sold?

The thing that I love most about this company is that when I first started investing people were concerned with whether or not the Model S was vaporware. Then they said that they would never be able to produce them at volume. Then that there was no demand beyond the initial backlog of reservation holders. Then that they would never be able to make a profit on the car. Today people are concerned with sales of a car that sells for over 100k on average with impressive margins peaking out at ONLY something like 100,000 units a year!

I think this whole conversation about demand completely misses the point anyway. Demand is not an issue at all. Simple thought experiment: how much demand would there be for Model S if Tesla cut the price in half? Answer: a tremendous amount. Obviously, they can't do that. They would be losing money on each car, but the experiment is informative in that it shows that demand is not a problem at all. The problem is the cost of generating demand. The real question is not "When are we going to hit peak demand?" It is, "As investors, how much of our profit margins are we willing to sacrifice to gain volume?"

Today, Tesla spends chump change generating demand. These scare stories about "peak demand" are missing this truth. It is not as though everyone already has a Tesla and nobody needs another one (i.e. market saturation). Think of all the ways that demand can be boosted: Tesla can advertise, they can increase the breadth and density of the Supercharger network, they could roll out battery swapping (for real), they could lower the price of the Model S, they could add more features that customers desire, they could build more stores to educate potential customers, etc., etc. These things will undoubtedly spur demand, though, at a cost.

As investors, what we really need to weigh is: can Tesla reach the needed volumes and profit margins to justify the appreciation in stock price we are looking for?

Personally, I think that most people are seriously underestimating just how much demand is being naturally generated by word-of-mouth over time. I think people massively underestimate the amount of demand that is being generated by changes in people's perceptions (whether right or wrong) of pollution and global warming. I think people vastly underestimate Tesla's ability to generate demand based on the strategies I outlined above (and others I haven't thought of). Most of all, I think that people forget the impact that falling battery prices (especially in the age of gigafactories) and the effect of increasing economies of scale and rampant innovation in manufacturing Tesla is experiencing. These will continue to have a positive impact on Tesla's margins, and thereby, its ability to divert money to generating demand without cutting into the existing margins.

So, when I look out into the future, I do see a day (maybe you are right, maybe it is in 2017) when we see not "peak demand" but the end of "free demand." When we need to start acting like every other auto-maker out there and paying up for incremental demand if we want it. But I also see the Gigafactory coming online at that same time. I see the ability to pay for that demand with incremental gains in margins, not by cutting into our established ones. I see the ability to divert our attention to other models. The day is coming when it will be cheaper to find a Model X or Model III customer than to find the 100,001th Model S customer, and I expect that is what Tesla's managers will decide to do. So be it.

Most of all, I don't see any reason why reaching some state of equilibrium with the market for Model S should prevent the astronomical rise of TSLA's share price for many years to come given all the options available to us to continue growing the company. In the end, that's the only question I want to answer, "Can TSLA continue to give me returns that justify tieing up my money with it?"

Where demand for the Model S settles out is irrelevant at this point to this question. Tesla can divert resources to other Models or even other markets (like energy storage) when production capability finally exceeds Model S demand. This question of Model S demand might be a problem if we were invested in Model S. We aren't, we are invested in Tesla Motors. Model S demand won't be met for a few years. Tesla demand won't be met for more like a decade, perhaps decades.

Muskol

Member

Looks like another Morgan Stanley note is driving TSLA lower in the premarket.

Unconfirmed from Twitter, revised down 2015 EPS forecast by 44% to $2.45, cutting 2015 Model X deliveries down to 5000 from 15000.

Unconfirmed from Twitter, revised down 2015 EPS forecast by 44% to $2.45, cutting 2015 Model X deliveries down to 5000 from 15000.

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 106

- Replies

- 23

- Views

- 885

- Replies

- 21

- Views

- 6K

- Replies

- 0

- Views

- 226