Giga Mexico is gonna have to wait I guess. Car sale is down across the board - is this true or am I smoking something good? Factories cost money and Elon thinks the lower overhead software path is a better bet in this environment. Personally I think its a really good idea. Unlike most people, I cringe when I hear new factories while the existing ones are not even at capacity. To be honest, I feel like Berlin is a flop.The SP move up after a pretty bad ER looked to me like shorts covering after assuming Tesla has given up on lower priced models.

The truth as usual is somewhere between Rueter's article and Elon's claim of "they are lying (again)". Tesla hasn't given up on Model 2 but has given up on new manufacturing plants to make them. SO, whatever happens to Giga Mexico, now ?

ps : Looks like my 145 puts and 175 calls are safe (for now)

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

This here is where some insurance can be bought. It's parked right under 163.5. SL the hedge whenever it gaps up in the morning above 163.5.

Thanks for this. Any decent/safe CC targets around here while waiting for the smoke to clear, or too volatile?

Also, if we are going to test $138 again what will be the tell so we can sell longs/aggressive CCs to protect our gains?

According to BBC, META dumped because of their increased CAPRX spending on AI for 2024:

"The firm said it now expected to spend between $35bn and $40bn, (£28bn-32bn) in 2024, up from an earlier prediction of $30-$37bn"

If this is correct then shouldn't NVDA and SMCI be trading up as likely beneficiaries? Also implies to me that other will be spending more on GPU too as it's basically a race right now between M7

"The firm said it now expected to spend between $35bn and $40bn, (£28bn-32bn) in 2024, up from an earlier prediction of $30-$37bn"

If this is correct then shouldn't NVDA and SMCI be trading up as likely beneficiaries? Also implies to me that other will be spending more on GPU too as it's basically a race right now between M7

This is correct in my opinion, The new arms raceAccording to BBC, META dumped because of their increased CAPRX spending on AI for 2024:

"The firm said it now expected to spend between $35bn and $40bn, (£28bn-32bn) in 2024, up from an earlier prediction of $30-$37bn"

If this is correct then shouldn't NVDA and SMCI be trading up as likely beneficiaries? Also implies to me that other will be spending more on GPU too as it's basically a race right now between M7

As for TSLA, I'm also very wary after the +10% yesterday, a lot of which was clearly short covering and closing the losing puts - let's se how that looks when the OI is updated later

I took the risk this week to write 100x -pATM to close out 25% of the DITM -c140's, but if macro crashes I don't expect TSLA to escape unscathed, hence I rolled the 75x remaining -c140's forward one week and now I have more calls freed-up I'll look to be more careful with the puts

Plan B for the -c140's is to roll them out to 15x Dec 2025 -p190/-c190's, this preserves the capital and stabilises the value of the position, directionality is essentially gone and you're just gaining on Theta loss, but not until mid 2025

However, other than a crash, it removes the short term risk and the contracts can be bought-back as leisure form weekly premiums

I do still think big risk of Q2 being worse than Q1, I don't buy at all Musk's remark that there will be growth in 2024, need to start seeing some numbers end of April to get a clearer view on that, but as I said, I'm very cautious still going forwards regardless of the euphoria after ER

I took the risk this week to write 100x -pATM to close out 25% of the DITM -c140's, but if macro crashes I don't expect TSLA to escape unscathed, hence I rolled the 75x remaining -c140's forward one week and now I have more calls freed-up I'll look to be more careful with the puts

Plan B for the -c140's is to roll them out to 15x Dec 2025 -p190/-c190's, this preserves the capital and stabilises the value of the position, directionality is essentially gone and you're just gaining on Theta loss, but not until mid 2025

However, other than a crash, it removes the short term risk and the contracts can be bought-back as leisure form weekly premiums

I do still think big risk of Q2 being worse than Q1, I don't buy at all Musk's remark that there will be growth in 2024, need to start seeing some numbers end of April to get a clearer view on that, but as I said, I'm very cautious still going forwards regardless of the euphoria after ER

Tesla filed this Q&A with the SEC this morning. Note the carrot in the last paragraph “IF there’s lots of positive cash flow, we could obviously buy back shares.”

Question:

“Great, thanks. Yeah, so couldn't agree more. The thesis hinges completely on AI, the future of AI, full self-driving, neural net training, all of these things. In that context, Elon, you've spoken about your desire to obtain 25% voting control of the company, and I understand completely why that would be.

“So I'm not necessarily asking about that. I'm asking if you've come up with any mechanism by which you can ensure that you'll obtain that level of voting control, because if not, then the core part of the thesis could potentially be at risk. So any additional commentary you might have on that topic?”

Answer by Elon Musk:

“Well, I think no matter what Tesla, you know, even if I got kidnapped by aliens tomorrow, Tesla will solve autonomy, maybe a little slower, but it would solve autonomy for vehicles at least. I don't know if it would win on, with respect to Optimus or with respect to future products. But it would, but there's enough momentum for Tesla to solve autonomy even if I disappeared, for vehicles. Now there's a whole range of things we can do in the future beyond that; I'd be more reticent with respect to Optimus. You know, if we have a super sentient humanoid robot that can follow you indoors, and that you can't escape, you know, we're talking terminator level risk, then I'd be uncomfortable with, you know, if there's not some meaningful level of influence over how that is deployed.

“And if there's, you know, shareholders have an opportunity to ratify or re ratify, the compensation. I guess I can't say that, but that is a fact. They have an opportunity. And we'll see, if the company generates a lot of positive cash flow, we could obviously buy back shares.

Question:

“Great, thanks. Yeah, so couldn't agree more. The thesis hinges completely on AI, the future of AI, full self-driving, neural net training, all of these things. In that context, Elon, you've spoken about your desire to obtain 25% voting control of the company, and I understand completely why that would be.

“So I'm not necessarily asking about that. I'm asking if you've come up with any mechanism by which you can ensure that you'll obtain that level of voting control, because if not, then the core part of the thesis could potentially be at risk. So any additional commentary you might have on that topic?”

Answer by Elon Musk:

“Well, I think no matter what Tesla, you know, even if I got kidnapped by aliens tomorrow, Tesla will solve autonomy, maybe a little slower, but it would solve autonomy for vehicles at least. I don't know if it would win on, with respect to Optimus or with respect to future products. But it would, but there's enough momentum for Tesla to solve autonomy even if I disappeared, for vehicles. Now there's a whole range of things we can do in the future beyond that; I'd be more reticent with respect to Optimus. You know, if we have a super sentient humanoid robot that can follow you indoors, and that you can't escape, you know, we're talking terminator level risk, then I'd be uncomfortable with, you know, if there's not some meaningful level of influence over how that is deployed.

“And if there's, you know, shareholders have an opportunity to ratify or re ratify, the compensation. I guess I can't say that, but that is a fact. They have an opportunity. And we'll see, if the company generates a lot of positive cash flow, we could obviously buy back shares.

Yeah, really smart when they just burned $2.5B in Q1Tesla filed this Q&A with the SEC this morning. Note the carrot in the last paragraph “IF there’s lots of positive cash flow, we could obviously buy back shares.”

Question:

“Great, thanks. Yeah, so couldn't agree more. The thesis hinges completely on AI, the future of AI, full self-driving, neural net training, all of these things. In that context, Elon, you've spoken about your desire to obtain 25% voting control of the company, and I understand completely why that would be.

“So I'm not necessarily asking about that. I'm asking if you've come up with any mechanism by which you can ensure that you'll obtain that level of voting control, because if not, then the core part of the thesis could potentially be at risk. So any additional commentary you might have on that topic?”

Answer by Elon Musk:

“Well, I think no matter what Tesla, you know, even if I got kidnapped by aliens tomorrow, Tesla will solve autonomy, maybe a little slower, but it would solve autonomy for vehicles at least. I don't know if it would win on, with respect to Optimus or with respect to future products. But it would, but there's enough momentum for Tesla to solve autonomy even if I disappeared, for vehicles. Now there's a whole range of things we can do in the future beyond that; I'd be more reticent with respect to Optimus. You know, if we have a super sentient humanoid robot that can follow you indoors, and that you can't escape, you know, we're talking terminator level risk, then I'd be uncomfortable with, you know, if there's not some meaningful level of influence over how that is deployed.

“And if there's, you know, shareholders have an opportunity to ratify or re ratify, the compensation. I guess I can't say that, but that is a fact. They have an opportunity. And we'll see, if the company generates a lot of positive cash flow, we could obviously buy back shares.

Pure stock pumping from Musk & Co IMO, as was much of the earnings call and slide deck IMO

I might be wrong, my LEAPS hope I'm wrong, we will see...

Sorry to appear so cynical, but I'm really not feeling drawn into the hype right now, not at all

OptionsGrinder

Member

Does anyone know why Tesla would have to make this filing, focusing only on this one exchange with an analyst question? I am assuming it might have something to do with Elon’s comment on the pending shareholder vote?Tesla filed this Q&A with the SEC this morning. Note the carrot in the last paragraph “IF there’s lots of positive cash flow, we could obviously buy back shares.”

Question:

“Great, thanks. Yeah, so couldn't agree more. The thesis hinges completely on AI, the future of AI, full self-driving, neural net training, all of these things. In that context, Elon, you've spoken about your desire to obtain 25% voting control of the company, and I understand completely why that would be.

“So I'm not necessarily asking about that. I'm asking if you've come up with any mechanism by which you can ensure that you'll obtain that level of voting control, because if not, then the core part of the thesis could potentially be at risk. So any additional commentary you might have on that topic?”

Answer by Elon Musk:

“Well, I think no matter what Tesla, you know, even if I got kidnapped by aliens tomorrow, Tesla will solve autonomy, maybe a little slower, but it would solve autonomy for vehicles at least. I don't know if it would win on, with respect to Optimus or with respect to future products. But it would, but there's enough momentum for Tesla to solve autonomy even if I disappeared, for vehicles. Now there's a whole range of things we can do in the future beyond that; I'd be more reticent with respect to Optimus. You know, if we have a super sentient humanoid robot that can follow you indoors, and that you can't escape, you know, we're talking terminator level risk, then I'd be uncomfortable with, you know, if there's not some meaningful level of influence over how that is deployed.

“And if there's, you know, shareholders have an opportunity to ratify or re ratify, the compensation. I guess I can't say that, but that is a fact. They have an opportunity. And we'll see, if the company generates a lot of positive cash flow, we could obviously buy back shares.

OMG dude! Burned? Seriously?Yeah, really smart when they just burned $2.5B in Q1

It's $2.7B of finished inventory that didn't get delivered yet and $1B of AI compute. That's Q2 FCF/Revenue/Profit on infrastructure, not smoke.

Quarter-end cash, cash equivalents and investments in Q1 was $26.9B. The sequential decrease of $2.2B was a result of negative free cash flow of $2.5B, driven by an inventory increase of $2.7B and AI infrastructure capex of $1.0B in Q1.

Me: $155 and $162.50, looking like 1-2 week rolls for small credits; may have to let the $145 buy-write go.Watching my 167.5CCs....

Berlin seems to be quite stable. The battery line delays due to prioritizing Austin had a negative effect, but it hasn't t profitability before Austin. Flop seems too harsh, although its vision seems cloudy in retrospect.Giga Mexico is gonna have to wait I guess. Car sale is down across the board - is this true or am I smoking something good? Factories cost money and Elon thinks the lower overhead software path is a better bet in this environment. Personally I think it's a really good idea. Unlike most people, I cringe when I hear new factories while the existing ones are not even at capacity. To be honest, I feel like Berlin is a flop.

I am all for fiscal discipline and making decisions based on efficiency, but factories take time to build and ramp so you need to invest ahead of demand. Not sure if there really is a way around that.

Of that spend, likely only 10-15% gets to NVDA/SMCI.According to BBC, META dumped because of their increased CAPRX spending on AI for 2024:

...If this is correct then shouldn't NVDA and SMCI be trading up as likely beneficiaries?

M7 plus a whole lot of other players. That is why I like NVDA long term.Also implies to me that other will be spending more on GPU too as it's basically a race right now between M7

I think there is a bit too much optimism in TSLA SP upside post ER. The floor has been lifted but that is about it. Getting back to $200 seems like a long slog to me. The fundamental lack of long-term buyers is still there. Seeing $200 is going to require execution and not just rehearsal.

You have changed, buddy. Options trading has scarred you.Yeah, really smart when they just burned $2.5B in Q1

Pure stock pumping from Musk & Co IMO, as was much of the earnings call and slide deck IMO

I might be wrong, my LEAPS hope I'm wrong, we will see...

Sorry to appear so cynical, but I'm really not feeling drawn into the hype right now, not at all

Long term buyers? Time for Diogenes to break out his lamp and look for them.I think there is a bit too much optimism in TSLA SP upside post ER. The floor has been lifted but that is about it. Getting back to $200 seems like a long slog to me. The fundamental lack of long-term buyers is still there. Seeing $200 is going to require execution and not just rehearsal.

If the hot money decides to visit for a couple of weeks…. Well, look around see what is happening to the handful of stocks, regardless of MC, that it decides to have fun with.

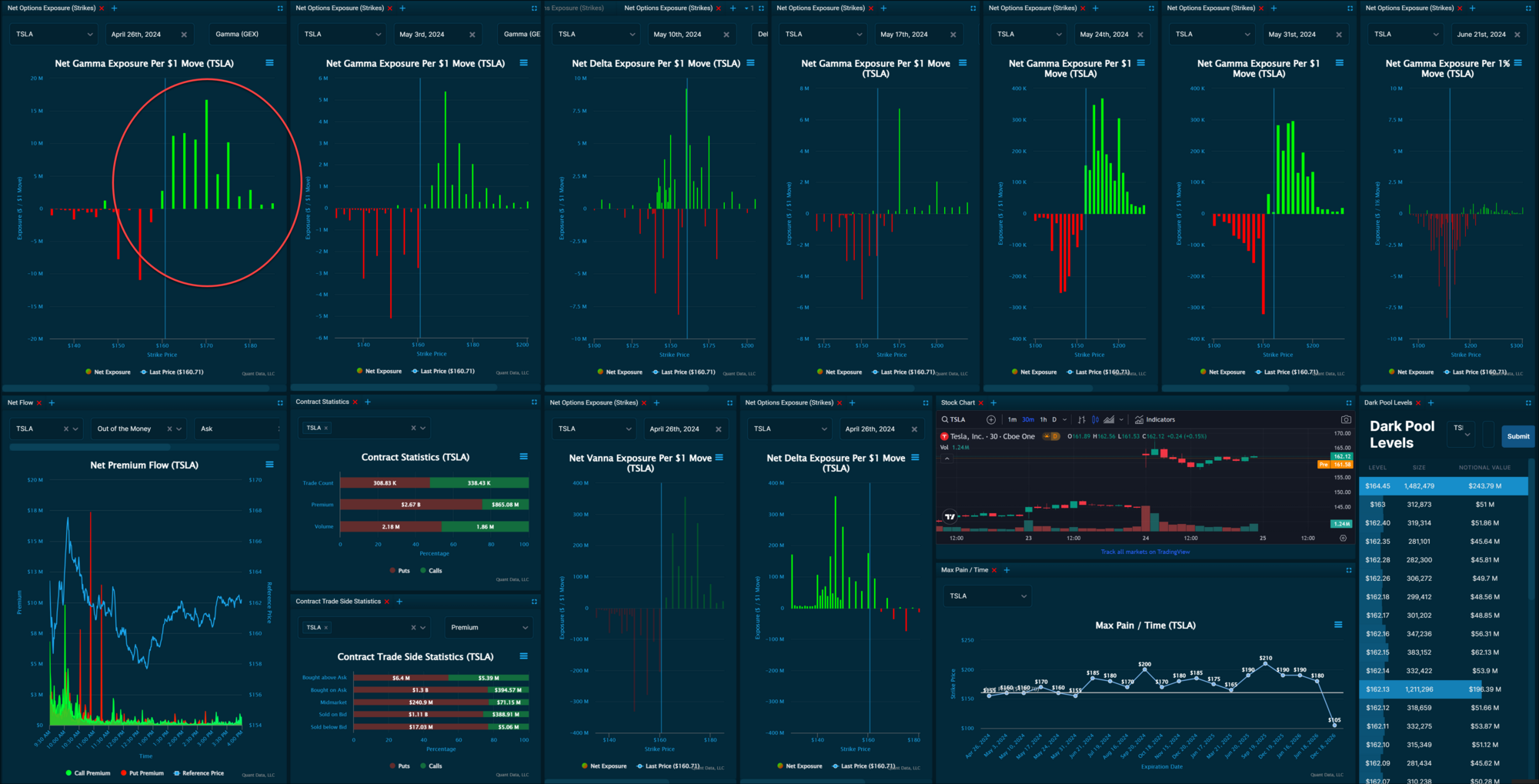

Currently options look like it wants higher for this week, though still a bunch of puts on for next week and end of May:

OptionsGrinder

Member

Thanks for posting these Jim (and Yoona)… two observations: (1) note Vanna for this week sub 160 as a counterweight? (2) net premiums yesterday were fairly redCurrently options look like it wants higher for this week, though still a bunch of puts on for next week and end of May:

View attachment 1041514

yeap, gamma can't point direction but will assist the lift when sp decides to go up (MM has a lot of buying to do, if they haven't already done so). Sometimes MM doesn't hedge yet if it appears sp won't go there anyway.Currently options look like it wants higher for this week, though still a bunch of puts on for next week and end of May:

View attachment 1041514

I think I was previously drinking too much koolaid, I’m applying more critical thought nowYou have changed, buddy. Options trading has scarred you.

Similar threads

- Replies

- 50

- Views

- 7K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K