QTA Levels for today + Commentary NFA

1/12

1/19

1/12

1/19

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

In this particular setup I don't really care about how ITM they go as they're the short side of a LEAP calendar straddle being written against the June 2026 +p270'sCurios how red to you allow -Ps to get before looking to flip to -C or roll the -P out?

I have a medium-term set of 15x -P290 9/20/24 which is currently about 17% red (STO when SP ~$245). I'm holding out for a pop to $255-$300 between now and expiration to BTC for modest gains or just hold to springtime 2024 (60-90 days out to expiration) to revisit if needs rolling or let expire. My concern is if we dump to $180 in between no reason to hold a red position that will get redder through that.

(The -C300 9/20/24 I has as a combo with that I already BTC for nice profit and will re-STO on next apex.)

In this particular setup I don't really care about how ITM they go as they're the short side of a LEAP calendar straddle being written against the June 2026 +p270's

The only thing I'll be looking out for is that the extrinsic doesn't get too low and risk early assignment

What I'm looking for is to let them be all the way to expiry, then start rolling them, weekly, monthly, quarterly, whatever gives a decent premium improvement

Well it moved the SP, just not in the direction we had hopedHighland available for NA. Wonder if this will move the sp tomorrow.

So much for the Highland catalyst. I suppose it is being outweighed by the fact that RWD and LR no longer qualify for the EV credit and the one which did (P) is no longer available. So no room for a price increase.

Personally I'd ride it out, I wouldn't be selling at a loss, keep an eye on the extrinsic not going to zero, then roll out 3 months and straddle with callsI'm asking specifically in my situation, I'm sitting on the 15x -P290 9/20/24 which is about 17% red now, is the idea to just stick it out even deep red and deal with later in the year or flip at some point for a loss, say if we lose $228 and head down, and re-STO lower for the ride back up?

Like I wrote in my post, I used to have the -C300 9/20/24 as a combo with that, which I already BTC for nice profit and plan to re-STO on next apex.

the biggest catalyst now is that there is no catalystWhat catalyst are left? I cannot think of any. Also, I have to come to realize that FSD is far fetched any time soon. If Tesla drops prices on the Model 3 because of losing the incentive we are due for more pain.

And that for some bizarre reason, Tesla don't adapt their lease terms to allow the rebate to come into playSo much for the Highland catalyst. I suppose it is being outweighed by the fact that RWD and LR no longer qualify for the EV credit and the one which did (P) is no longer available. So no room for a price increase.

they are so sure on FSDAnd that for some bizarre reason, Tesla don't adapt their lease terms to allow the rebate to come into play

Personally I'd ride it out, I wouldn't be selling at a loss, keep an eye on the extrinsic not going to zero, then roll out 3 months and straddle with calls

That's what I would do as of this moment in time, but I'm liable to change opinion very fast too

I think you summed it up nicely. It goes up when it want.You think? I don't. My evidence of this is TSLA constantly not joining the bullish price action compared to the other M7 stocks - seems EV stocks are being beaten-up and TSLA is ftrending with those rather than tech

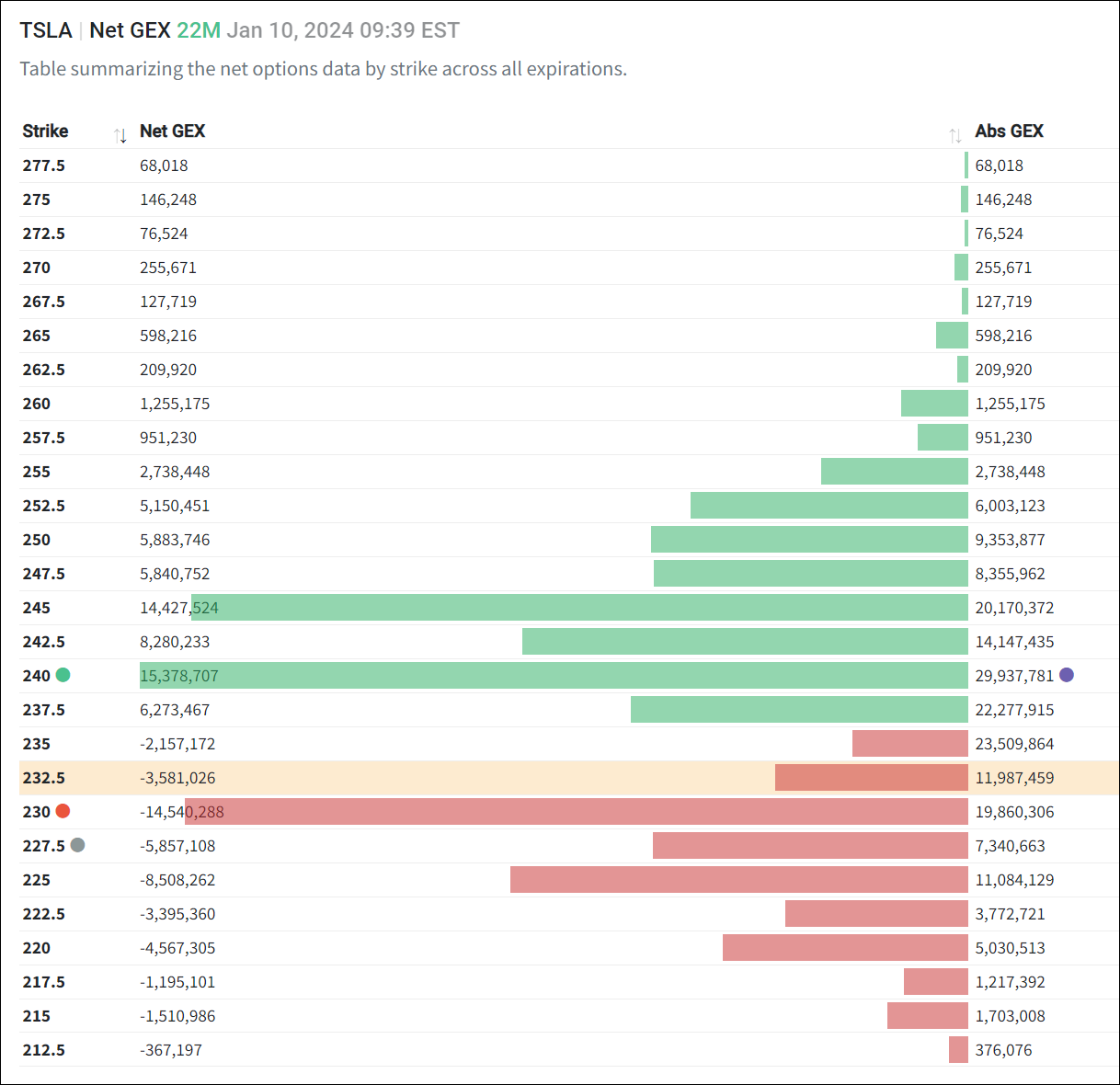

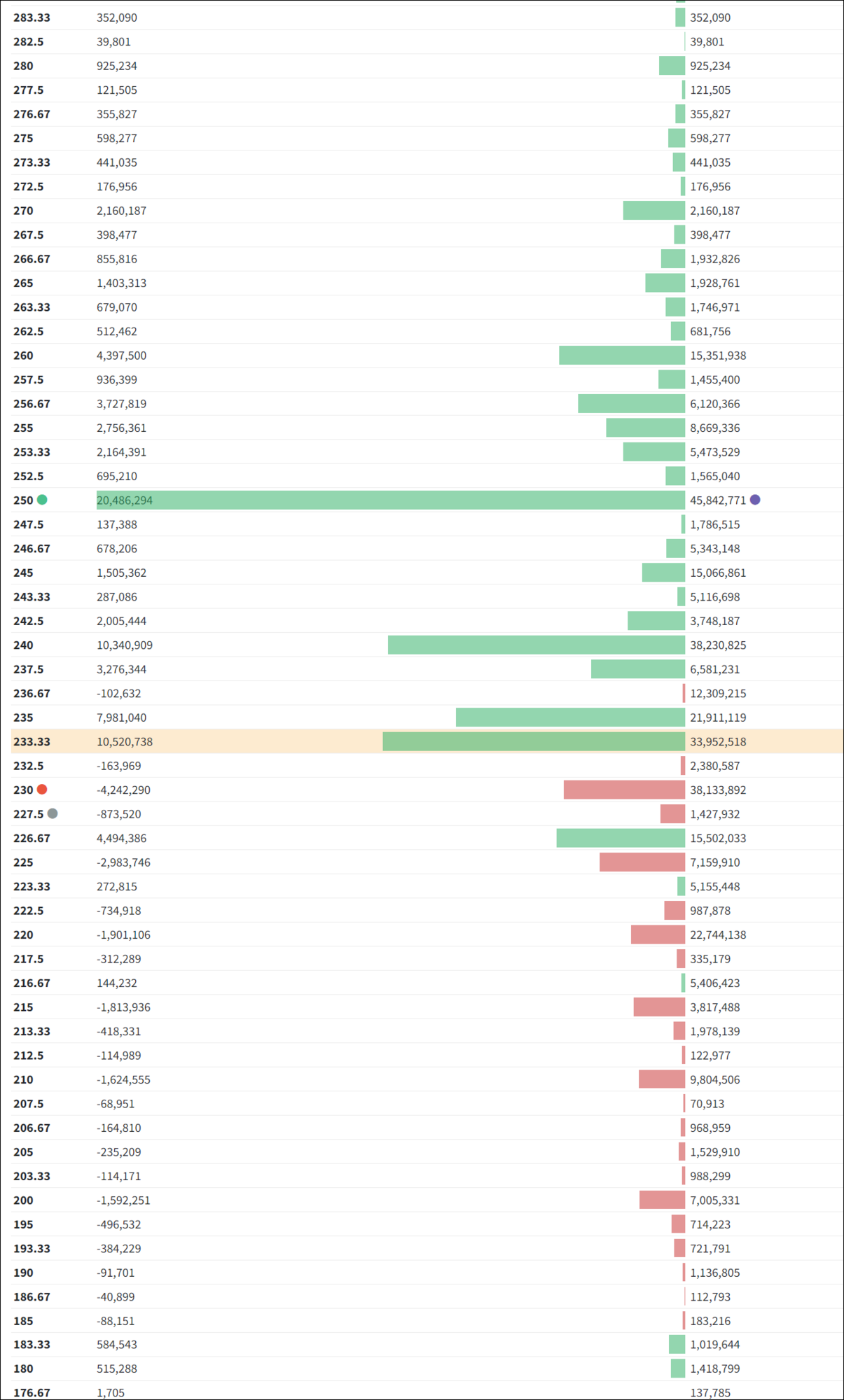

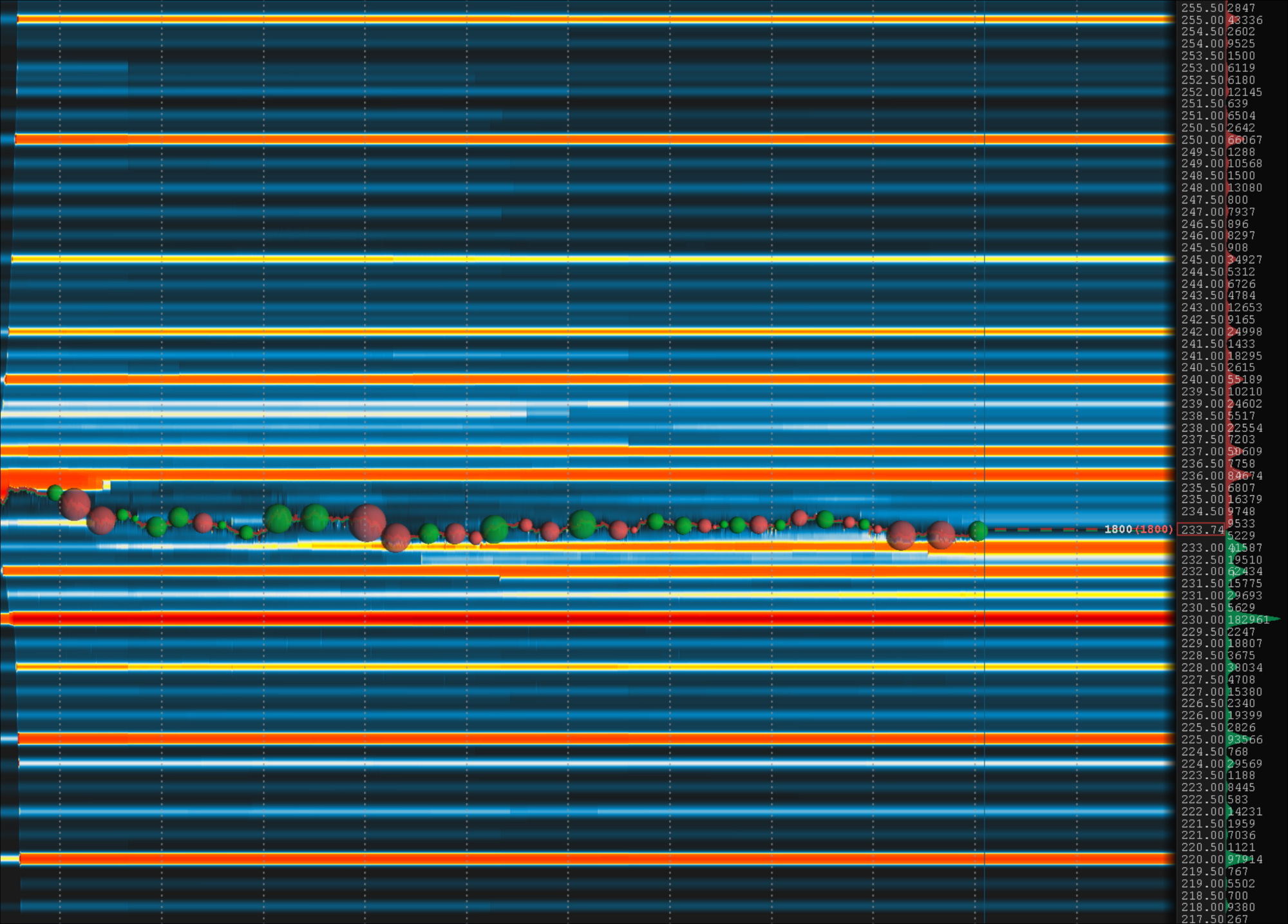

All setting up for the big OPEX on the 19th I think, then earnings, we'll see after that, and this will mostly be dependent on automotive margins and 2024 outlook

TSLA will pop when you don't expect it, most likely out of synch with other stocks and when everyone has gradually moved their short calls closer ATM to make up for the crappy, low premiums, then we'll get steam-rollered

That's the way it goes, always

Monthly lease payments do include the credit.And that for some bizarre reason, Tesla don't adapt their lease terms to allow the rebate to come into play

Yes? I thought Tesla's exact terms didn't allow it??Monthly lease payments do include the credit.

32% may touchUgh, the slight blip up doesn't feel genuine. If the 230 support is eaten away, I am considering flip rolling 1/12 +p205/-p225 to 1/19 -c245/+c285 for a 1.06 credit at 232.75, for instance. The target is a wider spread , more room to roll up and out, if needed. Behind these are 1/12 +p200/-p220 which may be at risk if the downward pressure continues.

Sitting tight for now. At SP 228, I'd be half that credit, credit nonetheless. Aim higher with short call or take and deal with as needed next week?