Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Reaching quite a tempting new buy point, in my opinion.

Hey Aud, I was hoping you'd chime in. Last we heard you were going to be mighty pissed if "the D" turned out to be a supercar. It has..(well, kinda)..and yet you are considering buying more TSLA? (I don't recall what thread that was in...probably better to answer there).

Hi Woof.

My discussion way back then (3,600 miles and ten days ago ) was in response to my reading what I considered irrational slavering over a vehicle that would de-throne the Veyron. In that the D merely equals the F1 in its neck-snappingness, I claim I can keep the high ground AND my point :tongue:.

) was in response to my reading what I considered irrational slavering over a vehicle that would de-throne the Veyron. In that the D merely equals the F1 in its neck-snappingness, I claim I can keep the high ground AND my point :tongue:.

A bit more seriously: I think we can look at the D as demonstrating what this week's technology can do both for the X (showing the advantages of electric dual motors) AND autonomous driving features can do for the S as well as the X. In that regard, I'm neither going to chastise TMC for taking its eye off the Secret Master Plan ball, nor am I going to eschew price weakness in TSLA to keep from adding to our position*.

That's this week's technology, I wrote. What will next week/month/year bring?

*Except, of course, we lost a bundle - h*ll, a whole d*mn haystack - on GTAT so we've not got gobs of ready cash at the moment:redface:

My discussion way back then (3,600 miles and ten days ago

A bit more seriously: I think we can look at the D as demonstrating what this week's technology can do both for the X (showing the advantages of electric dual motors) AND autonomous driving features can do for the S as well as the X. In that regard, I'm neither going to chastise TMC for taking its eye off the Secret Master Plan ball, nor am I going to eschew price weakness in TSLA to keep from adding to our position*.

That's this week's technology, I wrote. What will next week/month/year bring?

*Except, of course, we lost a bundle - h*ll, a whole d*mn haystack - on GTAT so we've not got gobs of ready cash at the moment:redface:

neroden

Model S Owner and Frustrated Tesla Fan

OP does raise the point re what the true price should be. For a company that has made a small profit in one quarter and a has a fair bit of accumulated losses under their belt, Tesla is arguably over-valued already.

I have a very simple model for "target pricing" for TSLA, but I think it's pretty good.

# cars expected to be sold in target year

times average sales price per car (which we can get information on and guess about)

times gross profit margin (for which Elon has clear targets, which the company deliberately manages for, and which is reported regularly)

minus recurring capex and overhead in steady state, which I believe to be roughly constant regardless of production level

divided by # shares outstanding

times a reasonable long-run PE (I'm going with 10 for this, but there's an argument for 5)

Because I'm looking at the company's state in about 5 years, and interest rates are roughly zero I'm not bothering to discount it back to the present day. But you could.

Here's the interesting thing about the model: which assumptions it's sensitive to. It is most highly sensitive to the number of cars sold per year: it makes a humungous difference in the expected stock price. The second largest sensitivity is the long-run PE factor, which I'm figuring will eventually revert to the "norm" for automotive manufacturers, but that norm varies from 5 to 10, so... anyway. It's not very sensitive to changes in the gross margin, believe it or not, and it's hardly sensitive at all to the size of recurring opex/capex costs.

This means that a "fair value" for TSLA is based largely on how many cars you expect them to sell at their pricing. Small changes in the sales estimates lead to large changes in your estimate for the target price of the stock. Large changes in the sales estimates lead to larger changes in your estimate for the price of the stock.

neroden

Model S Owner and Frustrated Tesla Fan

What numbers are you using for your formula right now?

I'll reserve that as proprietary information.

Talking about shorts, this thread looks like an interesting thread to revamp

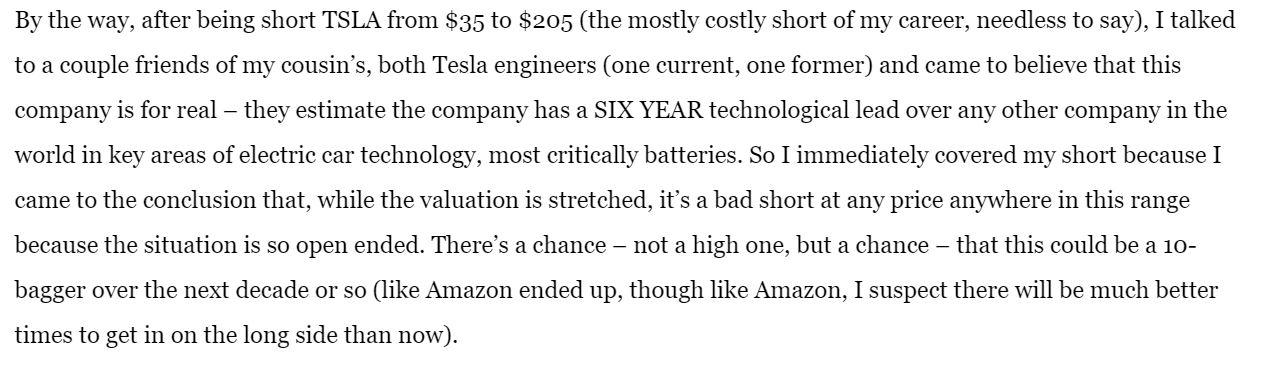

There is one famous TSLA short, Whitney Tilson, that is pondering buying into Tesla.

Tilson got out of his 'worst short ever' at $205 and is now pondering a long position in Tesla Motors.

There is one famous TSLA short, Whitney Tilson, that is pondering buying into Tesla.

Tilson got out of his 'worst short ever' at $205 and is now pondering a long position in Tesla Motors.

Talking about shorts, this thread looks like an interesting thread to revamp

There is one famous TSLA short, Whitney Tilson, that is pondering buying into Tesla.

Tilson got out of his 'worst short ever' at $205 and is now pondering a long position in Tesla Motors.

View attachment 92475

That's not something you read everyday. Kudos to him for actually being man enough to admit he was wrong.

Talking about shorts, this thread looks like an interesting thread to revamp

There is one famous TSLA short, Whitney Tilson, that is pondering buying into Tesla.

Tilson got out of his 'worst short ever' at $205 and is now pondering a long position in Tesla Motors.

View attachment 92475

At $205, anyone who was in the IPO already had a 10-bagger, since the IPO price was $17. Of course most people couldn't get in much below $30.

Much below $30? I bought at $18.30 on IPO day. Then it popped to $22 and I decided a 20% return in one day was good enough for meAt $205, anyone who was in the IPO already had a 10-bagger, since the IPO price was $17. Of course most people couldn't get in much below $30.

What is it with this thread that crawls out of its well-deserved crypt about every twelve months? I may have to use my Powers as a ZombieModerator.......

We are having a victory lap over shorts

Feels good

Soundtrack for victory lap

When I got in this stock in March 2013, I had some discussions with few investors who were Tesla sceptics at the time (more than sceptics). Discussions went nowhere as expected, and my response to them was that they will most likely buy into Tesla once it is over $300. That is how it works with some people

Sorry no pictorial evidence of discussions, no recordings, just fond memories

Much below $30? I bought at $18.30 on IPO day. Then it popped to $22 and I decided a 20% return in one day was good enough for meIt wasn't until 2013 I bought back in though thankfully at $40.

Congratulations on good decisions and execution

20% return in a year is fantastic, 20% in a day screams sell.

Last edited by a moderator:

Similar threads

- Replies

- 23

- Views

- 717

- Locked

- Replies

- 0

- Views

- 3K

- Replies

- 0

- Views

- 210

- Poll

- Replies

- 16

- Views

- 2K

- Replies

- 5

- Views

- 860