This is for Colorado resident. I just heard from one of my friends that his Tax rebate in Colorado is denied because the MSRP on the bill of sale shows more than 80000, he bought the base version of MX which shows the MSRP of 79990 online. I was checking my Bill of Sale and what do yo know, mine says 80,630 and it is over 80000. I picked my MX on March 24 so I won't know until next year when I file taxes but I want to make sure what your Bill of Sale shows for the base MX with no upgrades. Will this be an issue for us? I reached out to Tesla regarding this but haven't heard from them yet. I will post the update for you all.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

-

On today's TMC Podcast, we ask the question "What is the Tesla Cybercab?". Join us on YouTube live at 1PM and participate in the chat.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Model X Tax rebate CO denied

- Thread starter pkat76

- Start date

ZuleMYP

Member

This sounds like something you should have noticed before you bought it, they provide the order agreement electronically before purchase. Now if the agreed price and the bill of sale disagree certainly take it to Tesla. I wonder if they somehow bundled something to the MSRP that shouldn't be part of the vehicle?

ewoodrick

Well-Known Member

Many tax credits are based upon the MSRP, not buying price. If you want the credit, you have to make sure that it fits.

So, I checked the order agreement and it shows the amount 79990 but then they added destination charge and the order charge of 250 which took it above 80000. Tesla got back to me and told me that they have always included those numbers in the Bill of sale.This sounds like something you should have noticed before you bought it, they provide the order agreement electronically before purchase. Now if the agreed price and the bill of sale disagree certainly take it to Tesla. I wonder if they somehow bundled something to the MSRP that shouldn't be part of the vehicle?

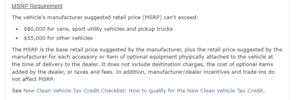

Thanks for replying, The MSRP actually shows 79990 and it shows the right tax credit for Fed and State. The issue is that you have to turn in your Bill of sale (The pink paper) when you file the tax and they might look at it differently. I will make sure to take the screen shot of the price online to be sure.Many tax credits are based upon the MSRP, not buying price. If you want the credit, you have to make sure that it fits.

Ostrichsak

Well-Known Member

This is fine. The cap for tax credit is the MSRP number, as equipped. It doesn't factor in delivery or order fees.So, I checked the order agreement and it shows the amount 79990 but then they added destination charge and the order charge of 250 which took it above 80000. Tesla got back to me and told me that they have always included those numbers in the Bill of sale.

NJturtlePower

Living the Dream, Driving the Future!

This is for Colorado resident. I just heard from one of my friends that his Tax rebate in Colorado is denied because the MSRP on the bill of sale shows more than 80000, he bought the base version of MX which shows the MSRP of 79990 online. I was checking my Bill of Sale and what do yo know, mine says 80,630 and it is over 80000. I picked my MX on March 24 so I won't know until next year when I file taxes but I want to make sure what your Bill of Sale shows for the base MX with no upgrades. Will this be an issue for us? I reached out to Tesla regarding this but haven't heard from them yet. I will post the update for you all.

Have your friend log in to their Tesla account (web based not mobile/app) and you should find a document (forgot what its called) under that vehicle what shows its qualification for the Federal credit signed by Tesla. This document does not need to be submitted, but its your proof if you're ever audited as to the vehicle eligibility.

As others mentioned, hopefully this was not a previously discounted inventory vehicle dropped down to $79990, because in the case it would not qualify if the sticker MSRP was higher originally. If this is not the case the only other reason the credit could be denied is due to income restrictions.

As for your Model X in 2024 its a point of sale so there is nothing to file next year. It won't qualify being over $80k.

Federal Tax Credits for Plug-in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After

Save up to $7,500 on qualifying vehicles!

Attachments

badcommand44

Member

Just my 0.02 but I would recommend spinning up an LLC prior to purchase. You can write off a 6,000 pound+ vehicle as a business expense which is a much bigger tax break than the $7,500 rebate. This is how all those useless politicians and "influencers" pay for their airplanes.

badcommand44

Member

Just my 0.02 but I would recommend spinning up an LLC prior to purchase. You can write off a 6,000 pound+ vehicle as a business expense which is a much bigger tax break than the $7,500 rebate. This is how all those useless politicians and "influencers" pay for their airplanes.

The vehicle does not have to WEIGH over 6,000 lbs. Its GVWR must be over 6,000, which the five passenger X is, just barely.Oops, please ignore the above post. The X is 5,200lbs.

The biggest problem with "spinning up an LLC" to get the big write-off is, it requires a legitimate business purpose for the use of the vehicle. Yes, it is possible. But you may have to prove it, come tax time. There are also some claw back provisions if you sell it in less than five years. I had a legitimate LLC at the time. But decided I couldn't stretch the rules that far.

Ostrichsak

Well-Known Member

It's crazy how those who understand tax law the least are always quickest to offers opinions on the best way to waste time commiting tax fraud for what ends up being next to no financial gain anyway.Just my 0.02 but I would recommend spinning up an LLC prior to purchase. You can write off a 6,000 pound+ vehicle as a business expense which is a much bigger tax break than the $7,500 rebate. This is how all those useless politicians and "influencers" pay for their airplanes.

badcommand44

Member

I own 16 rental homes in 2 states, each home has it's own LLC and I will absolutely be using one of the LLCs to purchase the truck. I'm doing this at the recommendation of both my real estate attorney and tax attorney. Setting up an LLC requires a business purpose and proper registration, once you have that writing off a vehicle is 100% legal.It's crazy how those who understand tax law the least are always quickest to offers opinions on the best way to waste time commiting tax fraud for what ends up being next to no financial gain anyway.

Ostrichsak

Well-Known Member

How many audits have you had?I own 16 rental homes in 2 states, each home has it's own LLC and I will absolutely be using one of the LLCs to purchase the truck. I'm doing this at the recommendation of both my real estate attorney and tax attorney. Setting up an LLC requires a business purpose and proper registration, once you have that writing off a vehicle is 100% legal.

ewoodrick

Well-Known Member

Have you checked the insurance rates? Or have done other vehicles that way?I own 16 rental homes in 2 states, each home has it's own LLC and I will absolutely be using one of the LLCs to purchase the truck. I'm doing this at the recommendation of both my real estate attorney and tax attorney. Setting up an LLC requires a business purpose and proper registration, once you have that writing off a vehicle is 100% legal.

It's astronomical commercial insurance rates that have deferred people from doing it.

Thank you. Definitely helpful.Have your friend log in to their Tesla account (web based not mobile/app) and you should find a document (forgot what its called) under that vehicle what shows its qualification for the Federal credit signed by Tesla. This document does not need to be submitted, but its your proof if you're ever audited as to the vehicle eligibility.

As others mentioned, hopefully this was not a previously discounted inventory vehicle dropped down to $79990, because in the case it would not qualify if the sticker MSRP was higher originally. If this is not the case the only other reason the credit could be denied is due to income restrictions.

As for your Model X in 2024 its a point of sale so there is nothing to file next year. It won't qualify being over $80k.

View attachment 1037652

View attachment 1037658

Federal Tax Credits for Plug-in Electric and Fuel Cell Electric Vehicles Purchased in 2023 or After

Save up to $7,500 on qualifying vehicles!www.fueleconomy.gov

badcommand44

Member

In 20 years of having rentals, 0. You just need good attorneys to guide you through the processHow many audits have you had?

badcommand44

Member

We've done a few other vehicles that way, insurance isn't crazy because I'm not doing cross country driving or anything dangerous. I'm not sure what insurance on the CT will be but I've reached out to both Allstate and State Farm and so far they are saying around $900 every 6-months. I'm sure that will change as more trucks get delivered.Have you checked the insurance rates? Or have done other vehicles that way?

It's astronomical commercial insurance rates that have deferred people from doing it.

I'll drop out of this chat because I didn't mean to derail it. I would just highly recommend looking into an LLC as an option for purchase, there's a lot more leeway than most people think provided an attorney is guiding you.

Ostrichsak

Well-Known Member

That's not the point. You're rolling the dice that you won't get one. When it happens (and it will) the first thing the IRS agent will tell you is that nothing your attorneys or CPA did or told you matters. They'll ask you questions directly and, based on your limited posts here, you're not going to have the answers they're looking for. The results won't be fun and you'll find yourself asking why you ever believed those people in the first place. All for a perceived couple grand "tax avoidance" or whatever the tik tik experts are calling it these days. It's always cooked in a vibe of getting one over on "the man" and you're smarter than everyone else. Until you're not.In 20 years of having rentals, 0. You just need good attorneys to guide you through the process

It depends. I leased a Tesla in 2015 (won’t do that again). It was jointly titled/registered to my LLC, and myself. Actually I was listed first and my company second. I got the standard non-commercial rates. The question never came up.Have you checked the insurance rates? Or have done other vehicles that way?

It's astronomical commercial insurance rates that have deferred people from doing it.

WyoDude

Member

I like how it started as “just spin up an LLC”Just my 0.02 but I would recommend spinning up an LLC prior to purchase.

And then when pressed ended with “Oh yeah, you’ll need an actual business need and probably some attorneys”…Setting up an LLC requires a business purpose and proper registration, once you have that writing off a vehicle is 100% legal.

Great advice

Similar threads

- Replies

- 1

- Views

- 446

- Replies

- 1

- Views

- 524

- Replies

- 4

- Views

- 1K

- Replies

- 4

- Views

- 1K

- Replies

- 23

- Views

- 746