The Accountant

Active Member

What will be Tesla Guidance for 2022?

My gut tells me that Tesla will guide to 50% growth in deliveries for 2022. However that would only be about 1,380,000 deliveries.

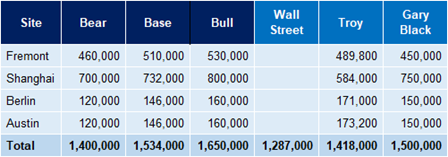

Below I have listed my Bear, Base and Bull numbers for 2022 along with what Wall Street, Troy and G. Black estimate.

Gary recently tweeted that when meeting with Tesla mgmt, they indicated 1.5m for 2022.

Tesla will provide 2022 guidance during the Q4 Earnings Call in late January. If they guide to 1.5m, the stock will pop in my opinion. If they guide to 50% growth (1.38m), then I think the stock does nothing even with Wall Street currently at 1.287m

Troy has an unusually low number for Shanghai. It's a bit stale and I assume he will take that number up in his next 2022 estimate.

My gut tells me that Tesla will guide to 50% growth in deliveries for 2022. However that would only be about 1,380,000 deliveries.

Below I have listed my Bear, Base and Bull numbers for 2022 along with what Wall Street, Troy and G. Black estimate.

Gary recently tweeted that when meeting with Tesla mgmt, they indicated 1.5m for 2022.

Tesla will provide 2022 guidance during the Q4 Earnings Call in late January. If they guide to 1.5m, the stock will pop in my opinion. If they guide to 50% growth (1.38m), then I think the stock does nothing even with Wall Street currently at 1.287m

Troy has an unusually low number for Shanghai. It's a bit stale and I assume he will take that number up in his next 2022 estimate.

:max_bytes(150000):strip_icc()/shutterstock_253136563-5bfc2b98c9e77c00519aa7a8.jpg)