Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

InsideEVs reports 2,485 Model 3s for the month of February. Bloomberg says 8,771 Model 3s total.

Richgoogol

Member

So I guess it is due to this and the market is not taking it well?InsideEVs reports 2,485 Model 3s for the month of February. Bloomberg says 8,771 Model 3s total.

JoaoD

Tech Enthusiast

Not news, but if you google Tsla you can find the usual Seeking Alpha Fud, and today is: "Increasing costs will make model 3 unprofitable tesla"News?

Svetlin

Member

More "color" from InsideEVs:

For February, we must assume that most of the remainder of the Model 3s manufactured in January made their way into owners’ driveways. Added to this, we gather that some early February production was delivered prior to the 28th of the month. We should also point out that an anonymous source with close ties to Model 3 production made us aware that the line has been down for as much as a week at a time over the course of the last month or so due to timing issues with the robots.

This puts our February Model 3 delivery estimate at 2,485.

Waiting4M3

Active Member

Yes, But the article is a bit confusing in one part. It says that Bosch are basically divesting completely from battery cells but the article states that they believe they need to understand the cell technology but not to manufacture the cells. So I would imagine they would still have some battery cell testing and labs and the like. What is clear to me is that Bosch understood clearly the requirement was to invest $20B over 10 years or so to manufacture cells and they decided that was to risky. But they understood that it was required. Everyone assumes that someone else is going to do it. I think they all assume China will do and dump cells on the market at a loss just like they did with solar. I think that is miss guided. For one, batteries are really really heavy and very expensive to ship half way around the world. This is why Tesla is the only smart company out there. As prices drop, the logistics around raw materials and shipping finished cells around the world is going to become a larger and larger percent of the cost of the cells. Just using dummy numbers, lets say its $200/KWh for Daimler to buy cells from S. Korea. The cost to ship that might only be $10/KWh and the price for S. Korea to get the raw materials from around the world might be $20/KWh including the trip from the mines to where its refined and then a final trip to Korea. If nothing else changes except the cost to manufacture the cells and the price drops to $150/KWh, then that $30/KWh is a much larger percent. As the price drops to $100/KWh it could be as much as 30% of the total cost of the cells. If Tesla has a $0 cost to ship cells because they do not leave the Gigafactory. Tesla is also working on sourcing materials from near where the plant is manufacturing cells. The logistical overhead for Tesla could be as much as 10-15% cheaper then Daimler who might source cells from China or S. Korea. This is not good when you are trying to be competitive. Also, Tesla has a partnership with Panasonic where Tesla is committed to purchase large numbers of cells at a fixed rate that is lower because of the commitment. Is Daimler, an ICEv company going to committed to buy Billions of dollars in cells to get a good price? My best guess is that the competition will be in a constant situation where they are paying more for cells that are of lower quality and thus require better packs to make them both safe and competitive with Tesla in charging and density. You can see this today where you have a car like the Ipace that has a 90KWh pack, is smaller then a model 3 and has a range of about 250miles, which is 60+ less then the Model 3 with a 75KWh pack. That is an impossible hill to climb when it comes to competition. You must really love Jag to buy that vehicle. Why would Daimler have any better pricing? They are no more committed to going Electric and they have not done things required to get prices down. There is only one way, massive scale and highly compressed logistics and supply chain. Scale allows you to buy a company like Ghromann to fully automate the manufacturing process.

Just a nitpick but I think the shipping cost estimate you have in your example may be 3-5x too high. But another factor is the time it takes to package the cells for shipment and unpacking them to use in production. Tesla uses 4416 2170 cells per M3 LR, that's 3 million cells per day at 5k/wk car production rate. As Tesla has experienced, moving parts into and around the factory is not just a cost issue, but a physical flow rate issue. At some point traditional logistic handling can not keep up even if you're willing to pay the cost. GGF greatly reduces the packaging/transportation bottleneck. Sure some of the competitions could use prismatic cells which could be larger unit than 2170, and deal with fewer cells, but then it would be more difficult/expensive to use a single cell design to fit into multiple car designs, especially if those cars are all selling at very low volume. So in the end Tesla's volume and vertical integration still win out.

Reciprocity

Active Member

InsideEVs reports 2,485 Model 3s for the month of February. Bloomberg says 8,771 Model 3s total.

Those numbers are not even remotely comparable.. Bloomberg is highest Vin Report in total. So you would have to add up Jan + Feb + 2017 Deliveries to have a more comparable value, but still not even close as one is deliveries the other is manufactured. Some vehicles would still be in transit, but that number shouldnt be that high.

Those numbers are not even remotely comparable.. Bloomberg is highest Vin Report in total. So you would have to add up Jan + Feb + 2017 Deliveries to have a more comparable value, but still not even close as one is deliveries the other is manufactured. Some vehicles would still be in transit, but that number shouldnt be that high.

I wasn’t comparing the two. I’m aware that InsideEVs is February deliveries and Bloomberg is total vehicles manufactured since the start of production. Sorry if my post was unclear.

jeewee3000

Active Member

oof, bought at the wrong time. 200 shares then a 3$ drop....

I know the feeling.

But don't worry, I don't expect we'll go below 320 before heading back up.

More "color" from InsideEVs:

The information about the production line is very helpful. March delivery numbers will likely suffer as a result.

Waiting4M3

Active Member

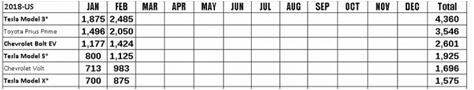

The M3 will be at the top of that chart for a long time to come:

schonelucht

Well-Known Member

GGF greatly reduces the packaging/transportation bottleneck. Sure some of the competitions could use prismatic cells which could be larger unit than 2170, and deal with fewer cells, but then it would be more difficult/expensive to use a single cell design to fit into multiple car designs, especially if those cars are all selling at very low volume. So in the end Tesla's volume and vertical integration still win out.

South Koreans are already moving up the value chain by selling modules and even complete packs instead of single cells. Chinese will follow and there is no reason to believe why Panasonic won't do the same.

Esme Es Mejor

Member

InsideEVs reports 2,485 Model 3s for the month of February. Bloomberg says 8,771 Model 3s total.

That squeaks into my expectations of 2400-3200 delivered. I assume the market was expecting more though.

Waiting4M3

Active Member

Will the battery makers be willing to make different size/shape modules at 100k/yr run rate for individual car makers? What will they charge for that?South Koreans are already moving up the value chain by selling modules and even complete packs instead of single cells. Chinese will follow and there is no reason to believe why Panasonic won't do the same.

Edit: the point is never about what can or can't be done, the point is always about the cost and speed. I just don't see others beating Tesla in cost and speed by outsourcing their cell supply.

Reciprocity

Active Member

South Koreans are already moving up the value chain by selling modules and even complete packs instead of single cells. Chinese will follow and there is no reason to believe why Panasonic won't do the same.

That will increase the cost as well. Its not like package cells into modules is going to be free. As a matter of fact, its going to increase the cost more then not using modules when compared to Tesla's solution. You literally need to make these modules interface with each other and the pack including cooling. This extra packaging is going to make them more expensive to source even if its its cheaper to prep them for shipping and un-package them when they get to their destination. The only real benefit is scale, but gigafactories already allow for that benefit.

Esme Es Mejor

Member

I used my first sell limit order today— previously, I’d done everything with market orders. Bought at 338 (market order) and set a limit order in the 341s, which triggered.

Then I set a buy limit order for 337, which looked unlikely to trigger. Then the InsideEVs numbers came out.

So, now I’ve used limit orders on the sell side and buy side. I’m not a complete Neanderthal, but not far removed.

Then I set a buy limit order for 337, which looked unlikely to trigger. Then the InsideEVs numbers came out.

So, now I’ve used limit orders on the sell side and buy side. I’m not a complete Neanderthal, but not far removed.

JRP3

Hyperactive Member

Major FUD pile on SA today, 5 negative articles so far.Not news, but if you google Tsla you can find the usual Seeking Alpha Fud, and today is: "Increasing costs will make model 3 unprofitable tesla"

- Status

- Not open for further replies.

Similar threads

- Replies

- 0

- Views

- 93

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Poll

- Replies

- 1

- Views

- 12K