Featsbeyond50

Active Member

Or Semi

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Or Semi

There was lots of ‘lead’ flying around in several places I have been. Never have I led any ot those nor even ever handled a firearm. Somehow I never had problems in war zones.Not impressed unless you've lead a revolution in Burkina Faso.

It's worth rolling out again - especially for those who've joined in the last couple of years - we surveyed forum members back in 2021 and asked this exact question. While some argued the poll lacked scientific rigour, it garnered 349 anonymous submissions and, I'd argue, was the best source of data available certainly at the time.If you count the value of my house 75%, give or take. But over 95% if you look at my bank account ;-)

I suspect there are a lot of small fish like me for whom TSLA is the single-point-of-failure/success: if it goes well, I can actually buy a better house (family just increased in size...), if not it's a bit of a problem.

I'll still work all my life anyway.

Yes, please. Some of us are older, some of us have changed circumstances.Would you like me to re-issue the poll so we can get 2024 results?

It's worth rolling out again - especially for those who've joined in the last couple of years - we surveyed forum members back in 2021 and asked this exact question. While some argued the poll lacked scientific rigour, it garnered 349 anonymous submissions and, I'd argue, was the best source of data available certainly at the time.

With regards to % invested in Tesla, here are the results by age (to maintain anonymity, we used age ranges):

View attachment 1010663 View attachment 1010664

nb. To read these charts, for example, in the first column of the left chart, 55% of members between 20 - 30 years had more than 95% of their investments in TSLA, 27% of that age range had invested between 75%-95% in TSLA, and the remaining 18% of 20 - 30 year-olds had invested between 50% and 75% in TSLA. Eleven members polled (3.2%) were between 20 and 30 years (see below).

View attachment 1010662

nb. The label is hidden, but 3 members (0.9%) were between 80 and 90 years.

Would you like me to re-issue the poll so we can get 2024 results?

I’m envisioning the officers who came to fill out the theft report of two mirrors and one palm…..There was lots of ‘lead’ flying around in several places I have been. Never have I led any ot those nor even ever handled a firearm. Somehow I never had problems in war zones.

I guess it’s sometimes better to be lucky than smart. In fact the only theft I ever experienced was in Palos Verdes, California USA. While moving in a palm tree, just planted, was stolen at night as well as two mirrors from my new Porsche.

Nobody ever bothered my Teslas.

I share the sentiment of @gtrplyr1. I've been holding since 2013 and all in since 2020 and while the long term prospects with Tesla are better than any other company, from what I can see happening with the world, the near term is bleak for Tesla share holders. The only thing that can move the stock price right now is FSD and the company (Elon) has clearly shifted focus to Bot. This means the next share price run isn't going to start for at least a year, probably more like 2+ years. Sitting on TSLA shares while MSFT, GOOG and NVDA are likely to continue running, seems foolish.

The market now demands results that hit the bottom line. This means Tesla needs to launch Robotaxi or, FSD has to become so appealing that most owners purchase it. I'm sure a lot of you are thinking Tesla Energy, CT ramping, Model Y refresh, etc. I'm sorry but no. Those things are simply not going to be enough to drive to new highs. Sorry, I just made it too easy for myself; those things aren't enough to drive the SP past 300.

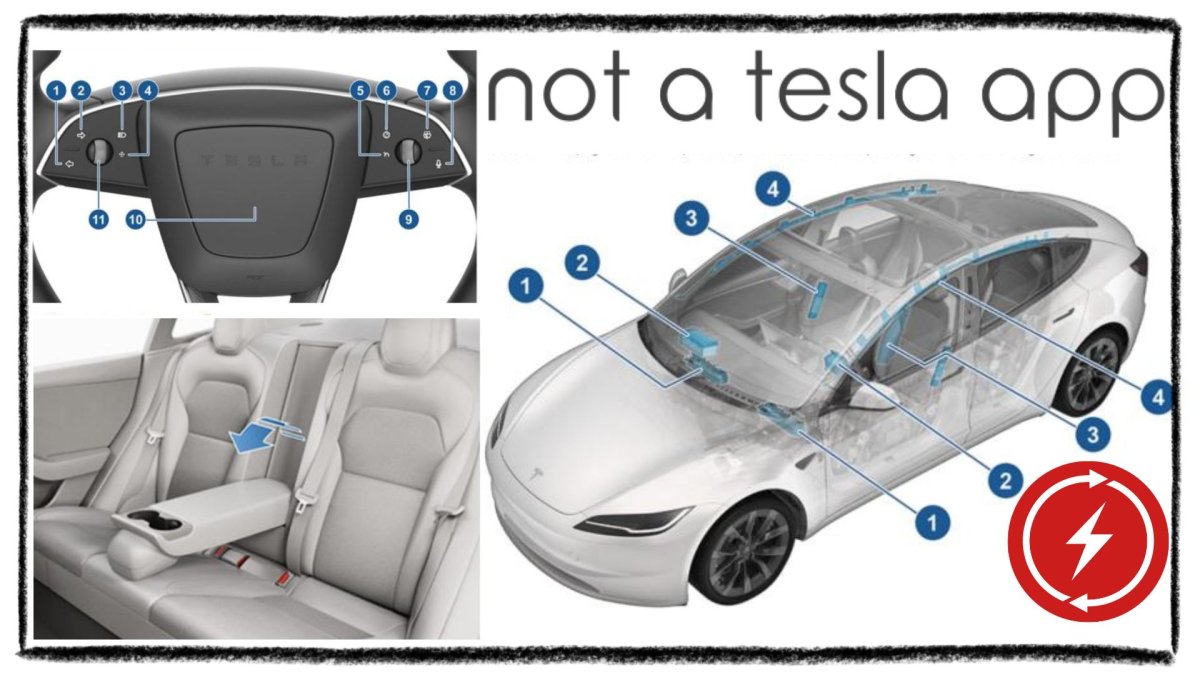

Tesla has released the U.S. owner's manual for the 2024 Model 3, revealing some intriguing differences from its European counterpart (Thanks to Ninerbynature). Additionally, it appears that Tesla has added a couple some changes since the new Model 3 was initially revealed.

Additional Airbags and Updated Steering Wheel

One of the most notable additions to the US version of the refreshed Model 3 is the inclusion of knee airbags. These airbags protect the driver and front passenger's legs in a collision. Oddly, the European models do not currently feature these knee airbags as stated in the manual.

The owner’s manual states that the new knee airbags are for the US only and goes on to state the advantages of the additional airbags:

“Knee airbags and the front airbags work together. The knee airbags limit the forward motion of the front seat occupants by restricting leg movement, thereby positioning the occupants so that the front airbags work more effectively.”

Another addition to the US 2024 Model 3 (don’t call it the Highland) is introducing a multi-function light on the steering wheel. The manual states that similar to the cruise control light on the right, the new multi-function light on the left side is non-functional. It’s not clear what this light will be used for or when it will turn on, but it could possibly indicate when the multi-function ability of the scroll wheel is active.

Something like that. They said that the Palos Verdes Peninsula had the lowest crime rate in Southern California so they really should not make a report for this, especially since we had just arrived so the 'theft' most likely did to take place there at all.I’m envisioning the officers who came to fill out the theft report of two mirrors and one palm…..

…doing a doubled face palm

I agree a good Gen3 launch could drive us to new highs but that's over a year away. I don't agree an unveiling could do itGen 3/Unboxed wasn't mentioned above, though it might play a more significant role than those things that were. How much more significant? This is the question that remains. Once the Gen3 car(s) are seen, prices are known, and the production/cost benefits are quantified, Gen3 could be a catalyst for the SP driven by both demand, and boost the related fundamental markers analysts are used to. Even if GigaTexas comes online with Gen3 this year we'll still be needing Mexico, China, and Germany to be churning them out to alter market sentiment in a big way.

Unfortunately, the current state of affairs is influenced heavily by the FUD and its cloud that obscures those things Retail and Institutional Investors might otherwise be influenced more positively by. Plus, the FUD drives the Options market, though TSLA has now fallen behind MSFT and GOOG in regard to short-selling, hasn't it?

I suppose the same factors that led to TSLA SP growth being damped for the easy-money players to cash in over short term strategies could migrate from TSLA to these seemingly good alternatives. This may lead to a similar situation as they are already in for anyone moving to those stocks. One question to ponder, if they think they have milked this cow dry (TSLA) and are shifting, as evidenced in @Papafox reports, what will that do to TSLA over the following year?

As always, there are too many variables to easily account for enough to determine with any certainty. Making a decision to move out of one company and into another might still be a crap-shoot.

We all know how, historically, being influenced by gut-feeling and emotion to any degree is statistically less successful than holding. In addition, an investor's goals and time horizon add levels of complexity to an already challenging choice.

From a contrarian point of view, having reached a point where HODLers are voicing their concern here to the point of leaning toward getting out of TSLA could be a sign of bullishness, in the sense of the right answer will often be the most ironic.

Thus ensuring they continue to have the lowest reported crime rate...They said that the Palos Verdes Peninsula had the lowest crime rate in Southern California so they really should not make a report for this...

Imo don't sleep on Chinese car exports. They are rapidly going up.What companies have demonstrated they can do any of the above with regards to electric vehicles?

- BYD - only in China

Me too.I'm old & retired.

narendragoidani.medium.com

narendragoidani.medium.com

I agree. There are more companies out there which have a good chance of 2X or 3X your money in the next year or two. Better than TSLA imho. I think TSLA is a great investment for the 5 - 10 years but shorter term not so much.Really considering liquidating most of my position, I’ve lost well into 7 figures from the highs and I see lower margins and more Elon issues on the horizon.

It’s been an amazing run but this company is run by a mental patient and I don’t have any faith in him short term. Teslas long term is bright but I fear a lot of pain in the next 2 years.

I'm not sure I agree that focus has shifted from FSD to bot. I think bot is ONLY a thing because they realized that solving FSD gets you way closer to making a bot than they had assumed beforehand, so they might as well do it.

Bot currently has

ZERO

end users.

This is really important, because as a software dev, I know that nothing gives you greater freedom than having zero end users you have to answer to! You can re-factor, redesign, even re-name the product, even change the business model, and absolutely nobody cares.

With FSD, changing anything is a pain because there are now 5 million Teslas (IIRC) and a LOT of them have been sold as FSD-capable. There have already been multiple hardware revisions, and changes of hardware layout, and a whole host of total software re-writes. But working on a software project as big as FSD with maybe 50,000? FSD beta testers who run that software in a car that could kill them (or others) if there is a bug...

This is not an environment to 'move fast and break things'.

I would be amazed if the FSD development effort does not absolutely dwarf the teslabot team. The R&D cost for FSD is going to be way higher than the bot. Just because Elon tweets about the bot more than FSD right now doesn't mean a thing. They have to be super cautious about FSD. They can tweet a new video of the bot when they feel like it.

Summary: I don't think focus HAS moved from FSD. V12 is likely coming soon, and apparently a big step forward. I expect V13 to come sooner, and with a significant impact on take-rate,

My top ones are 62% TSLA, 35% AAPL, and 2% BTC. I'll probably sell the AAPL before selling any TSLA.Wonder what percentage you fine folks have your net worth tied up in TSLA?

Me I'm well over 90%.