Good luck is mainly being prepared.I keep seeing ppl everywhere say that TSLA holders are just lucky. Or replace TSLA with anything that suddenly shot up. Same thing for options.

Ya sure.

But at what point is it no longer luck? Someone should give a definition. I mean if you take the random prophet approach where you get 1million account hand have half say up, the other half say down. Repeat till only one left. How much time is that? And by statistics, the n+1 time he make a prediction that prediction should fail right?

Which means, at one point, someone goes past that prediction point and consistently makes money. It can no longer be attributed to luck.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Johan

Ex got M3 in the divorce, waiting for EU Model Y!

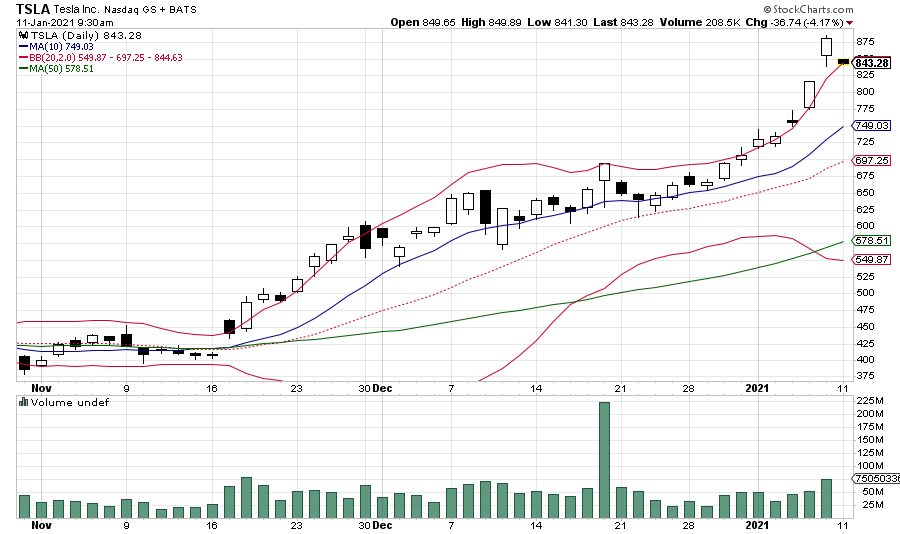

Upper BB starts at 820! How many points did we go up again last week? Sheesh....

Mid BB at 686. Even small corrections will be violent here. What was that about S&P and volatility?

View attachment 626640

This is with a 20-day SMA and 2SD +/- as the upper and lower band, right? Historically we can see that the stock price conforms nicely to those bands. What would it look life if one chose 15 or 10 day moving averages instead? I guess the upper and lower band would diverge even more, signaling high volatility?

jeewee3000

Active Member

Indeed, that's one of my favorite sayings:Good luck is mainly being prepared.

"Luck is what happens when preparation meets opportunity."

I'm becoming uncomfortable with Charles Schwab's politics and looking for another brokerage. I already have accounts at Vanguard and Fidelity, never dipped into options trading (despite reading this thread daily), more HODL. Most of my holdings are TSLA, ARKX with some still in SP500's. Does anyone feel strongly about their brokerage firms?

As far as I can tell, their politics are all about the same. Investment features are what set them apart. And due to the recent consolidations there's even less of a choice.I'm becoming uncomfortable with Charles Schwab's politics and looking for another brokerage. I already have accounts at Vanguard and Fidelity, never dipped into options trading (despite reading this thread daily), more HODL. Most of my holdings are TSLA, ARKX with some still in SP500's. Does anyone feel strongly about their brokerage firms?

UkNorthampton

TSLA - 12+ startups in 1

Hey fellow Brit,

talking of moving into ARK, any thoughts on the most tax efficient way to do so? I have yet to find an ISA or pension manager that can/will include US ETFs for reasons that seem a bit weak.

"Investment products classified as a PRIIP need to provide a KID to our third party data provider in order to be added to our platform. This is the case for all US and Canadian incorporated ETFs and is outside of our control. It is unlikely for US and Canadian ETFs to provide KIDs in the near future which means they cannot be added to our platform."

In the absence of ISA or pension means of doing so I don't see a way to avoid a hefty tax bill on profits. As has been pointed out earlier such a bill is a 'nice problem to have' but I've become used to the tax free status of the ISA and, more to the point, have money locked in a pension that is looking for a more lucrative home.

Ha' ya got a loight 'bor?

Suggested Bailie Gifford, put a provider/fund matrix. Not advice. Hopefully someone more switched on than me can help

UK pre/post retirement strategies

OT: Not sure what you meant by "politics". TDAmeritrade was acquired by Schwab not too long ago, and they list Taiwan as a "Province of China". Not sure if this is recent or all along. My Fidelity account does not say anything like this.I'm becoming uncomfortable with Charles Schwab's politics and looking for another brokerage. I already have accounts at Vanguard and Fidelity, never dipped into options trading (despite reading this thread daily), more HODL. Most of my holdings are TSLA, ARKX with some still in SP500's. Does anyone feel strongly about their brokerage firms?

Last edited:

That oi hev.Ha' ya got a loight 'bor?

Suggested Bailie Gifford, put a provider/fund matrix. Not advice. Hopefully someone more switched on than me can help

UK pre/post retirement strategies

Cheers.

Mike Smith

Active Member

'BofA analyst John Murphy raised the firm's price target on Tesla to $900 from $500 and keeps a Neutral rating on the shares. The stock is "driven by growth afforded by valuation," said Murphy, who has tried to estimate what the current stock price affords to Tesla in terms of incremental plants and units and what those incremental units translate into in incremental revenue and profits. Building automotive industry capacity is expensive and often generates low returns, but "the higher the upward spiral of Tesla's stock goes, the cheaper capital becomes to fund growth, which is then rewarded by investors with a higher stock price," argues Murphy.'

Tesla price target raised to $900 from $500 at BofA TSLA - The Fly

Predicting Tesla's future production and profits based on the current share price is the most ridiculous thing I've ever seen in a research note. Wallstreetbets offers better analysis than this.

Tesla price target raised to $900 from $500 at BofA TSLA - The Fly

Predicting Tesla's future production and profits based on the current share price is the most ridiculous thing I've ever seen in a research note. Wallstreetbets offers better analysis than this.

jhm

Well-Known Member

Chronic disbelief in the non-sustainability of Tesla's growth. When will they ever learn?That doesn’t make sense - an increase of 350K units this year (75% increase) & then only 250K the year after (only 30% increase)

Idiots

Artful Dodger

"Neko no me"

Here is today's TSLA Tech chart as of 09:30 EST:

Note: Upper-BB at Market Opening was $844.63

Cheers!

Note: Upper-BB at Market Opening was $844.63

Cheers!

Looks like MMs pushing down the stock for the opening bell; down 3.45%. Guessing it will rise back when they run out of money

If we keep looking back to where the technology was still under developed, we will be missing out a great deal on a company's future directions.

I can't say for sure if battery swap is a good business model, but they have to differentiate themself from Tesla to attract buyers. I myself wish Tesla allows battery swap. My 2015 MS range drops about 5% every year the last 2 years, but Tesla keeps saying it's normal.

Let's suppose you've owned that car for 5 years and Tesla's been charging you $150/month as NIO does in China. That's $9000. I think you can give Tesla less than that to get your battery situation taken care of? Maybe only part of it is problematic?

TheTalkingMule

Distributed Energy Enthusiast

Stop-loss pushdown of 5% achieved, now they can accumulate. Must be nice!

Phobi

Member

That’s some hard tree shaking...

*loads up the cannon with dry powder*

*loads up the cannon with dry powder*

Why stop at the battery? You can get a brand new car from Tesla every 3 years as long as you pay them 420/month. Oh yeah it's called a lease....Let's suppose you've owned that car for 5 years and Tesla's been charging you $150/month as NIO does in China. That's $9000. I think you can give Tesla less than that to get your battery situation taken care of? Maybe only part of it is problematic?

I find these "revolutionary ideas" to be hilarious

Saw this article this morning which I think sums things up nicely

Why Tesla Stock Keeps Bubbling Higher

Why Tesla Stock Keeps Bubbling Higher...

Tesla may have bubbled EV stocks higher and continues to enjoy daily new highs. Nothing is stopping it from falling by much. If it does, buyers will just buy the dip.

Sure did

jhm

Well-Known Member

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K