Ah, so towering Starlink to cellular link tower thing.It's "a new type of cellular tower that allows up to three cellular carriers to locate in the same tower."

Like this one in Lancaster:

View attachment 541771

Source: City boosts cell service

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Krugerrand

Meow

Basically agree, but if they have the same no-nothing analysts that were at the previous Investor Day, they won't understand it any more than they understood self driving technology.

This is my thoughts as well. I’m prepared to have my brain blown out of my butt, but I’m expecting nobody else at the party from Wallstreet to understand beyond, ‘Hi, everyone. Welcome to Battery Day.’

Krugerrand

Meow

I'm thinking we are looking at June for battery day.

What’s your level of conviction compared to yesterday’s, we’ll finish in the green?

MC3OZ

Active Member

The reinvesting of dividends is a significant part of the ultra-conservative investment strategy.

Tesla will be much more attractive to conservative investors when it pays dividends.

IMO this is an other disruption people don't see coming...

With working Robo-taxi's and another 5-10 years of exponential growth it will become hard for Tesla to avoid paying dividends... my Elon like time-frame 5 years possibly, 10 years definitely.

IMO the only way to keep exponential growth going and avoid paying dividends is keep expanding into more and more product categories, again that is another disruption many don't see coming. Home HVAC is just the beginning..

Tesla will be much more attractive to conservative investors when it pays dividends.

IMO this is an other disruption people don't see coming...

With working Robo-taxi's and another 5-10 years of exponential growth it will become hard for Tesla to avoid paying dividends... my Elon like time-frame 5 years possibly, 10 years definitely.

IMO the only way to keep exponential growth going and avoid paying dividends is keep expanding into more and more product categories, again that is another disruption many don't see coming. Home HVAC is just the beginning..

It's "a new type of cellular tower that allows up to three cellular carriers to locate in the same tower."

???

Traditional cell towers always supported more than one cell site/carrier. Even pole-mounted DAS supports more than one carrier. This is what CC and AMT do.

MC3OZ

Active Member

This is my thoughts as well. I’m prepared to have my brain blown out of my butt, but I’m expecting nobody else at the party from Wallstreet to understand beyond, ‘Hi, everyone. Welcome to Battery Day.’

I think this Bloomberg article is a canary in the coal mine, they will know it is important, just jumble up all the facts into an incoherent mess and not admit they don't really have a clue what they are talking about.

The public reading mainstream media articles will not have a clue what it is all about, but get a sense it is important, unless there is a bigger news story that day.

Trading activity should be sheep-like, if it seems important and the share price is going up, I think many will jump on board, if it is going down people will assume the market knows something. Fair bet shorts try to set the early market narrative.

I'll admit I always have no clue about short term market movements.

Krugerrand

Meow

Our advisor has urged sale since stock passed $500/share. Lol. I did sell some in a Roth at $906 and then bought back @ $760 or so.

My tax guy last year was, um...I think it might be a good idea for you to diversify, the price is going to go down and you’ve got everything in TSLA. That was in the low to mid $200’s. At tax time this year, you should do whatever you think is right for you.

Yes, thank you I will.

Krugerrand

Meow

Ok, but be careful, and whatever you do, don't say the words "energize" or "mothership".

Artful Dodger

"Neko no me"

Here's a bit of odd/interesting news. A massive tower was built in the span of a few days at the London, Ontario Supercharger: T Ξ S L A London HW3.0 on Twitter

Is it just me, or does it look like the square mount on the tower could be used to hold something like a Starlink receiver box? Elon did say they would shortly begin testing in Northern latitudes.

Are there any glyphs on the side?

"We need to make Starfleet real" -- Elon Musk, tweeted Dec 22, 2019

Jus' say'...

Cheers!

Excerpt: It allows people to buy a Tesla in Michigan, but the sales contract still must say it was bought in another state.

That appears to be due to a mind boggling political compromise. How long will Michigan voters/consumers put up with such nonsense?

Until the legislature decides to stop sending sales tax dollars to Ohio...

Jack6591

Active Member

As cell towers go—that’s a damn fine looking cell tower.

ZeApelido

Active Member

my brain blown out of my butt

I am not prepared for this.

Artful Dodger

"Neko no me"

IMO, its been obvious for over a year that the new battery tech will only be available initially in the flagship Model S 'Plaid (and soon joined by the Model X):More and more rumors are leaking out about next-gen battery tech. Next comes Battery Day. Any hints that Tesla has a strategy to keep this from osborning sales? I'd think at least some people would wait, just as many will wait for a new model laptop or phone.

- this solves the problem of lagging Model S/X demand

- restores price premium for top-of-the-line product

- uses the bty output from the pilot production line at Fremont

- provides product validation and production experience

- next will be Cybertruck, then likely Semi and/or Roadster

No matter. The Model 3/Y have ZERO competitiors now, and there are NONE on the horizon. Tesla will likely adopt the new bty tech at the forthcoming 2nd American Model Y plant, and reduce the pack's physical size and cost while matching performance specs with the Fremont 3/Y.

Cybertruck and Semi will be off the chain, IMO. It's gonna be an exciting 2-3 years, partner!

Cheers!

Dan Detweiler

Active Member

Well, he's entitled to his opinion but I do find it rather interesting that this guy gets a voice with Market Watch. I tend to agree with you. Who is this guy, and why should I care?Green-tech blogger slams Elon Musk as ‘a self-important jerk,’ reconsiders buying a new Tesla

Green-tech blogger slams Elon Musk as ‘a self-important jerk,’ reconsiders buying a new Tesla

Who is Steve Hanley and why should I care?

Dan

Last edited:

willow_hiller

Well-Known Member

As cell towers go—that’s a damn fine looking cell tower.

I think it may actually be a bit more than just a cell tower. On the Twitter thread someone identified that the tower comes from a company called Landmark Dividend, and the mast is part of their "FlexGrid Ecosystem" https://www.landmarkdividend.com/our-services/flexgrid/the-flexgrid-ecosystem-portfolio/

Evidently it's a part of a larger smart-city infrastructure system that includes deliberate connections to the grid and EV chargers:

Last edited:

Thought I would share the new takeaways that I saw from Deutsche Banks's Tesla note from Monday. The whole thing is very bullish in my opinion.

Title: "Positive takeaways from Tesla investor meetings"

Highlights that were new to me in no particular order:

Title: "Positive takeaways from Tesla investor meetings"

Highlights that were new to me in no particular order:

- Tesla confirmed that Model 3 capacity at Shanghai has now reached 200k. The production rate should reach 4,000 per week by mid-year. Having to have battery packs shipped in from Nevada was limiting production. Sounds like localized production of cells by LG are starting to taking over. They continue to expect nearly all components to be localized by the end of the year.

- Tesla highlighted three main forces that can increase China margins up materially further in 2020. a) low utilization of the factory in Q1 due to Chinese New Year and COVID. b) Unfavorable trim mix. Q1 only had SR+ vehicles produced. LR & Performance Model 3's should improve this. c) Costs will reduce as localization of parts improve.

- Gross margins included sequentially due to two main reasons: a) China gross margins went from negative to "nearly 20% in 1Q". b) Leasing mix increased sequentially. Leasing carries gross margins of about 50%.

- Noted from the 10-Q: costs from the Fremont factory shutdown due to COVID were about $24m in Q1.

- The backlog for all models gives a strong pipeline regardless of the COVID environment. They also think the current pace of orders can support a full run rate at Fremont ASAP.

- Tesla's long-term CAGR goal of 50% might be surpassed in the near-term with all the new capacity coming online simultaneously.

- Is not worried about supply chain issues in Fremont given that other OEMs are also beginning to start production back up again as well.

- Tesla's future US factory will likely have additional Model Y production, given Fremont's limited capacity at 500k cars per year.

- Operating leverage: a) Shanghai operating expenses remained mostly constant, despite the increase in Model 3 volumes. Tesla believes there can be large operating leverage here as they continue to ramp. b) R&D spend is mostly fixed. Not tied to production volume.

- For battery day, the company would like to hold it at a date that enables investors to be able to attend it in person. So we might have to wait a little bit.

- Reiterated regulatory credits for 2020 will be considerably higher vs. 2019 due to the contract with FCA.

- Tesla is selling its credits to more than 10 automakers worldwide and it is hard to estimate how much will be booked in a given quarter.

Artful Dodger

"Neko no me"

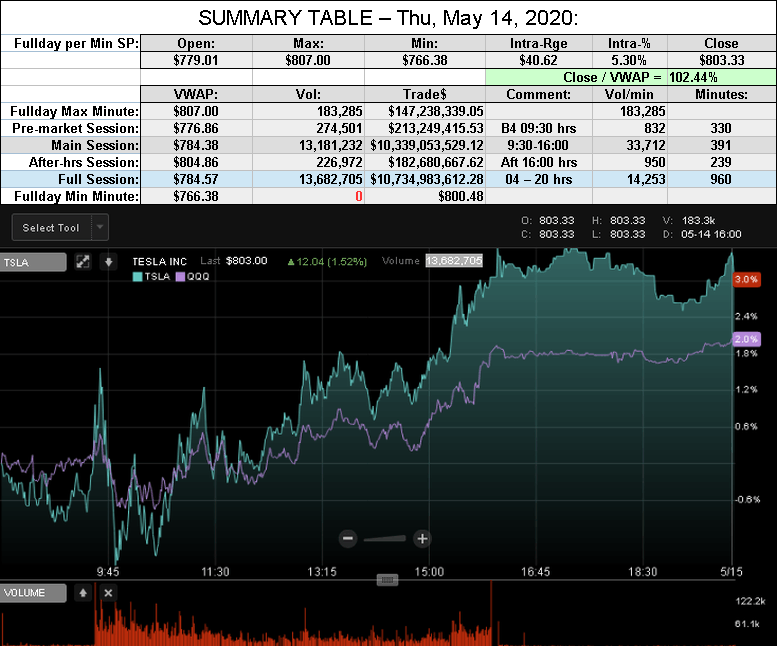

After-action Report: Thu, May 14, 2020: (Full-Day's Trading)

FINRA Short/Total Volume = 40.3% (42nd Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 54.8% (56th Percentile rank FINRA Reporting)

FINRA Short Exempt volume was 1.09% of Short Volume today.

Comment: "Morning bear raid rejected; Closed at intraday high"

VWAP: $784.57

Volume: 13,682,705

Traded: $10,734,983,612.28 ($10.73 B)

Closing SP / VWAP: 102.44%

(TSLA closed ABOVE today's Avg SP)

Volume: 13,682,705

Traded: $10,734,983,612.28 ($10.73 B)

Closing SP / VWAP: 102.44%

(TSLA closed ABOVE today's Avg SP)

FINRA Short/Total Volume = 40.3% (42nd Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 54.8% (56th Percentile rank FINRA Reporting)

FINRA Short Exempt volume was 1.09% of Short Volume today.

Comment: "Morning bear raid rejected; Closed at intraday high"

Last edited:

I'd love to see more data.

I've been day trading the stock with ~20 shares. Some days are better than others. Today for example I bought right in, it shot up ~$5 and I sold. It was $96 in about 7 seconds. In general I wait till the 9:40 dip, which lately has been moving closer to 10am, buy and then ride that up till about noon.

I know some people, ahem, like to come at me bro for this approach but I'm simply looking to grind out more "free" TSLA shares to put into my long term pot. If I wasn't expecting dow 10,000 sooner than later than yeah I'd throw all my cash at TSLA and walk away for a few years. Sadly I'm expecting the worst with the macros and the best with Tesla which makes for some serious mental short circuitry. The best way forward, to me, is to have a set amount of ride or die shares that I'm holding till SP 20,000 and then day trade to add more into the bucket without touching my stack of cash ready to buy buildings in NYC for pennies on the dollar in a couple years. lol

So yeah, you clearly have some serious knowledge on this short term game and I'd love to learn more. I use Think or Swim platform. What kind of bands are you setting up? Are those just basic BBs? What indications should I look out for to predict this kind of thing in the future?

Maybe we should setup a new thread that discusses day trading this stock?

Thank you!

Best,

Gene

Be forewarned that this will be a post about day trading, so if this is a pejorative concept to you please skip this. That being said, I’d like to share how I’ve incrementally been able to add 25 TSLA shares (and counting) using margin to my core position over the past several weeks since C19 arose. I want to lay out the case why I don’t think day trading TSLA on margin is too risky, so long as one doesn’t make a bet they can’t afford to lose.

It’s been posted here from time to time (most recently last night by @phantasms) that people have been having luck day trading within the first half hour or so of market open, where the stock takes a sharp drop shortly after opening, then rises $5-$15 in about 30-50 minutes. I, too, have been playing this angle, and have noticed it applies to other stocks I follow as well, not just TSLA. I don’t know why this pattern occurs, but it does very frequently, so I’ve been capitalizing on this phenomenon and now I’m going to tweak my technique after last night’s discussion of Bollinger bands brought about by @Artful Dodger and others.

First off, let me first say that I believe holding with a long-term perspective is most likely the best way to create wealth. That is what Buffett and so many others say, and has also been my experience; it is why I keep my core shares intact and only add to them.

The problem is, I’m so bullish on that TSLA that I want more shares quickly. This has led me to day trade (only TSLA) with my margin account. Some may object that this is simply too risky, but my position is that if one isn’t too greedy and/or stupid, I honestly don’t think it is. Here’s why.

I think it’s safe to say most of us here feel as if TSLA is a pretty safe bet. Sure, it’s volatile, but otherwise it’s a pretty sure bet, and I do not own a single share of any other company (partly because I don’t feel any company is as quality as TSLA, but also because I haven’t the energy nor time to educate myself on other companies). Last night @phantasms said he was using 20 shares to capitalize on the morning price swing and pocketing the money; I’m doing the same, but with margin because all my money is already tied up in TSLA. Plus, trading 20 shares doesn’t get you too far for the effort, but trading 100-200 can easily net you $500-$1500/day many if not most days of the week. Sure, some days are better than others, and some days one shouldn’t play at all due to bad news/bad macros/whatever, but on average this approach has been working out for me pretty well these past few weeks.

Last night, however, after reading more about Bollinger bands, I’m realizing that I’m not buying as smartly as I could be, because after I make my money for the day I just buy a share. I don’t do it thoughtfully, I just plow the money back into another share at whatever the market price is when I get around to it. This is stupid. What I’m going to do going forward is, assuming the stock will continue its relentless volatility, and assuming MMs will use Fridays to push the share price down to max pain, I’m going to try to snag a lower share price to get more value out of my money. So, for example, tomorrow, since max pain is supposed to be around $765ish, I’m going to place a buy limit at $765, with the assumption the SP will get down to that level at some point during the day. Of course, the day might be very good for the SP and it won’t get that low, so no problem, I'll make my purchase another day. I’m going to try to be more patient in my buying, that’s all I’m saying, and I’m going to rely more on the BBs, the macros, news, etc, before buying.

Today was an unusual day. The stock opened high as usual, then went higher, then started dropping. When it dropped significantly to $781 I bought 100 shares, thinking SP was getting close to bottoming out. Well it kept dropping. A lot. I searched the web for bad news about Tesla, but found none, only bad macro news which is to be expected these days. I could tell after about 30 min the SP wasn’t going to pop up to $790 or anything, so I set a sell limit at $786, thinking that the SP was going to be low for the day and that there was nothing to do about it now. I’ve sort of wanted to see if my sell orders would sell after-hours anyway (I NEVER hold margin shares, I get in get out quick), and I thought, well, tonight was going to be my night to learn if orders go through after hours. I’d lost too much, and I knew TSLA would be up again above $786 in no time, I just didn’t think it would be today when the SP was bouncing around the $760s. But as luck would have it the day turned out just fine.

Anyway, that’s my two cents. Yeah I’m open to a day trading thread, too, if someone wants to start one.

I’d like people here to give day traders a chance. We’re also longs, and we use our earnings to buy more TSLA and Teslas.

In closing, I’d like to reiterate that if one isn’t too stupid or greedy, and doesn’t make bets they can’t afford to lose (remember, flash crashes happen too), margin day trading TSLA (and only TSLA in my opinion) can be safe and profitable.

Artful Dodger

"Neko no me"

Yeah, Reuters also said the MiC Model 3 LR would use LFP batteries from CATL...Well, the Reuters article from today said explicitly that they new batteries would be used in China, that implies they will be going into the 3/Y in that market at least.

This latest 'exclusive' report from Reuters is also full of holes (why LFP or NMC when Tesla has it's own patented bty chemistry), misunderstandings (ie: bty factory size vs. output), and plain errors (ie: MiC 3 LR coming in late 20/21 when we know it's ALREADY in production).

I wouldn't take their word on much. Reporter obviously has no technical background in the subject.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K