Given the electric cars they've produced so far, how is that going to matter?I say this as an investor and not a person that cares about the planet and "The Mission", but it will be a great day for Tesla when GM, Ford, and VW announce that their plans for electric vehicles have been pushed back 5 years due to debt issues.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Krugerrand

Meow

No. Wrong bill denomination for stupid rich.

adiggs

Well-Known Member

That is a pretty extensive list of changes at the Nevada Gigafactory to deal with COVID19. The whole article is basically a list of changes.

Seems like Tesla is much more prepared this time around. A good sign that they can have a constructive discussions with state governments. I imagine all of this will happen at Fremont too.

This stuff sounds pretty much like what my employer has done (also a manufacturer operating factories with 1000's of employees). Presumably they've also taken the step of keeping everybody that works out of that factory that can work from home, to continue working from home. Even if it's not strictly necessary, it keeps that many people out of the building, and makes it that much easier to follow the social distancing protocols for the people that must be in the factory to do their work.

I think this will be approximately the standard we'll see as manufacturing facilities reopen. We'll see how that evolves - there are plenty of production lines where a min 6' apart will mean that the line has to be run slower. And that assumes that the line CAN be run slower.

MTL_HABS1909

Active Member

What I understood from a pretty convincing interview I saw with a professional trader was that in his experience that was not market manipulation, but a case of a bunch of limit sell orders being triggered at a popular target price (950-ish), which then caused a serious drop in SP, which then triggered cascading stop-loss sell orders.. The speed of the initial drop was according to him not something any MM could achieve all by themselves..

Such collective automated triggering can happen again of course.. so my remark was not in any way meant to be reassuring..

I don’t buy it

MC3OZ

Active Member

Good video from Gali:-

Lots of interesting charts, and a good introduction for someone who is new to TSLA.

Lots of interesting charts, and a good introduction for someone who is new to TSLA.

The "Plus in a box" on the top bar allows a couple of extra options, includingApropos, how does one strike-through text or obtain other effects than the one offered in toolbar on top of the editor window? Is there a how-to article somewhere on the TMC site? thanks!

Benzinga - this afternoon: Ross Gerber Says Tesla Is Pushing Ahead Of Competitors During COVID-19 Pandemic

RobStark

Well-Known Member

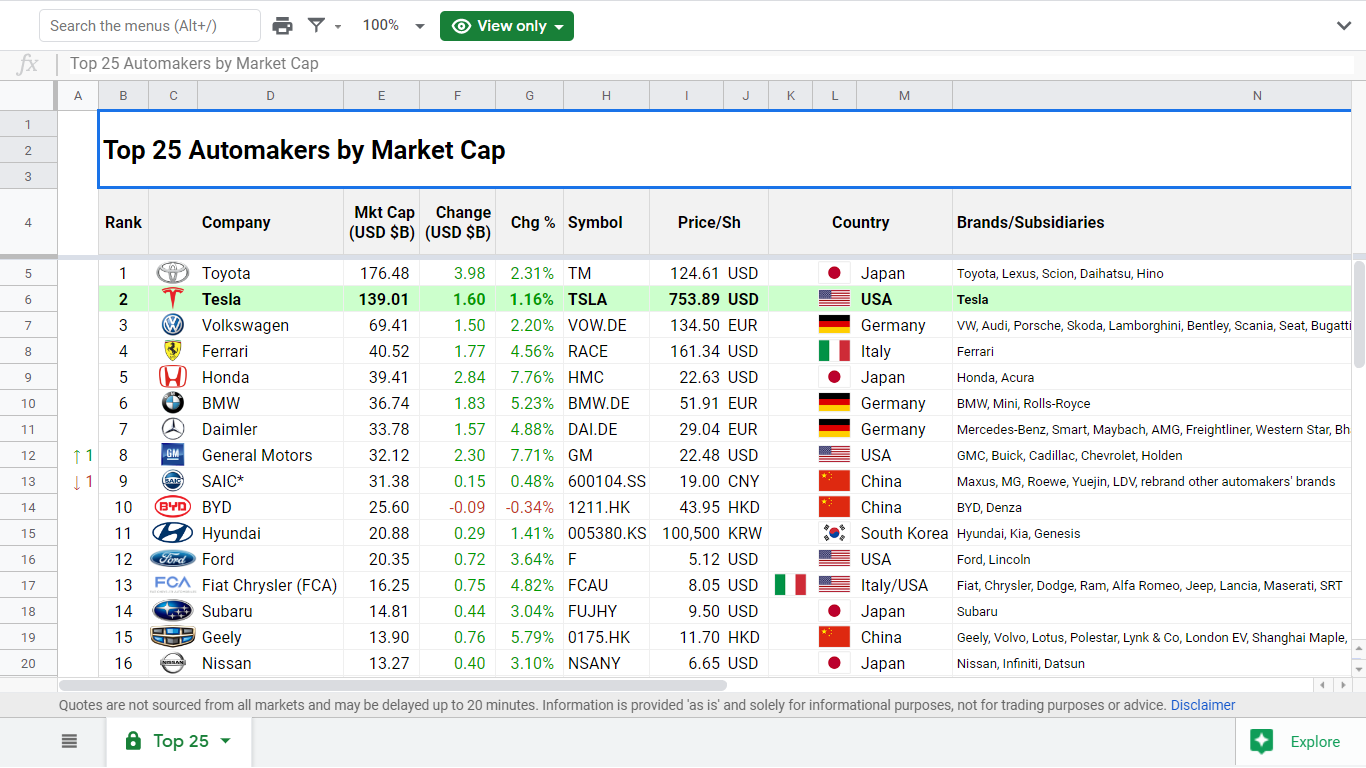

TSLA + RACE> TM

In 2019

Tesla delivered 367,500 cars.

Ferrari sold 10,131 cars

Toyota sold 10,700,000 cars.

In 2019

Tesla delivered 367,500 cars.

Ferrari sold 10,131 cars

Toyota sold 10,700,000 cars.

Dan Detweiler

Active Member

Sorry, not following your point.TSLA + RACE> TM

View attachment 533439

In 2019

Tesla delivered 367,500 cars.

Ferrari sold 10,131 cars

Toyota sold 10,700,000 cars.

Dan

RobStark

Well-Known Member

Sorry, not following your point.

Dan

There isn't a point.

Just an interesting juxtaposition of facts.

Artful Dodger

"Neko no me"

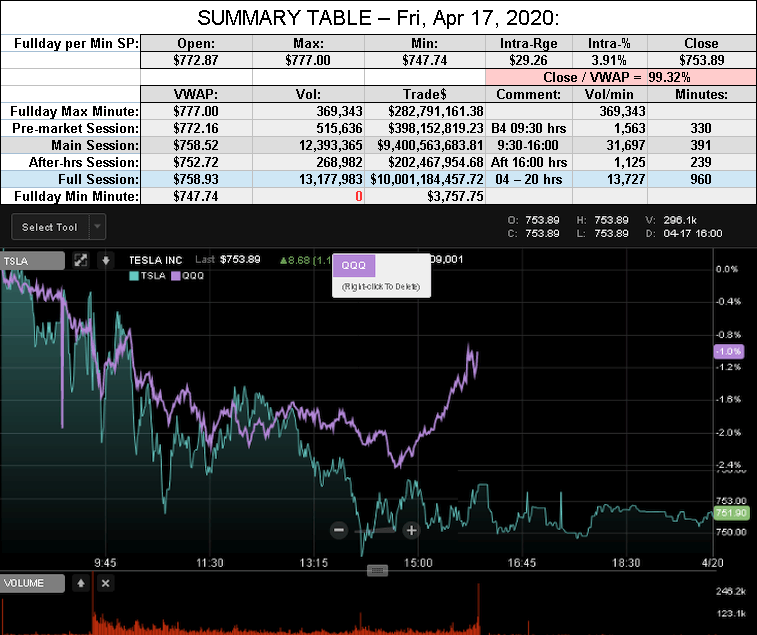

After-action Report: Fri, Apr 17, 2020: (Full-Day's Trading)

FINRA Short/Total Volume = 58.2% (51st Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 49.2% (53rd Percentile rank FINRA Reporting)

Comment: "TSLA Pinned by Market Makers"

VWAP: $758.93

Volume: 13,177,983

Traded: $10,001,184,457.72 ($10.00 B)

Closing SP / VWAP: 99.32%

(TSLA closed BELOW today's Avg SP)

Volume: 13,177,983

Traded: $10,001,184,457.72 ($10.00 B)

Closing SP / VWAP: 99.32%

(TSLA closed BELOW today's Avg SP)

FINRA Short/Total Volume = 58.2% (51st Percentile rank Shorting)

FINRA Volume / Total NASDAQ Vol = 49.2% (53rd Percentile rank FINRA Reporting)

Comment: "TSLA Pinned by Market Makers"

Last edited:

TSLA + RACE> TM

View attachment 533439

In 2019

Tesla delivered 367,500 cars.

Ferrari sold 10,131 cars

Toyota sold 10,700,000 cars.

I have stock in both.

Cathie Wood's weekly review.

Brandlive

Main points:

1) Traditional auto industry is in a world of hurt. Expects mergers and bankruptcies.

2) Expects Hertz (and perhaps Avis) to go bankrupt. Used car prices tanking, so they can’t sell their old fleets.

3) Tesla is taking away market share. They have a "fortress balance sheet".

4) Genomics companies are severely underpriced.

Several of ARKG's stocks popped 15-20% during a day this week. One was involved in successful COVID-19 treatments in Israel.

Brandlive

Main points:

1) Traditional auto industry is in a world of hurt. Expects mergers and bankruptcies.

2) Expects Hertz (and perhaps Avis) to go bankrupt. Used car prices tanking, so they can’t sell their old fleets.

3) Tesla is taking away market share. They have a "fortress balance sheet".

4) Genomics companies are severely underpriced.

Several of ARKG's stocks popped 15-20% during a day this week. One was involved in successful COVID-19 treatments in Israel.

Mo City

Active Member

I have ~5% left in cash. Maybe it's time to buy ARKG even though I'm clueless about the industry itself and the companies involved.Cathie Wood's weekly review.

Brandlive

Main points:

1) Traditional auto industry is in a world of hurt. Expects mergers and bankruptcies.

2) Expects Hertz (and perhaps Avis) to go bankrupt. Used car prices tanking, so they can’t sell their old fleets.

3) Tesla is taking away market share. They have a "fortress balance sheet".

4) Genomics companies are severely underpriced.

Several of ARKG's stocks popped 15-20% this week. One was involved in successful COVID-19 treatments in Israel.

Dan Detweiler

Active Member

Hmmm...ok.There isn't a point.

Just an interesting juxtaposition of facts.

Benzinga - this afternoon: Ross Gerber Says Tesla Is Pushing Ahead Of Competitors During COVID-19 Pandemic

“China wants people in these cars because it tracks everything you do. It’s like a dream car for the Chinese government.”

what a crock. That’s not why China wants Tesla.

Hey Monday is 4/20. If Tesla investors don’t show out on our holy day then I will be a disappointed investor!

I don't know about all of you but I plan to buy one share on Monday in celebration.

ByeByeJohnny

Active Member

On the other hand, as soon as the offices reopen Tesla will move all those cars and then some. It’s simply a delay of revenue not revenue disappearing forever or never there in the first place.

People are fantastic at thinking of the very worse case scenario. I need only remind you of Brexit and how the sky was falling until the next day when it didn’t.

Yes, some businesses are going bankrupt. I contend they probably should have before the virus.

I was raised in an era where you were specifically told you needed to have savings for the ‘unexpected’. That it was your responsibility. Minimum 3 months of wages/living expenses, 6 preferred.

My parents opened a savings account for me by the time I was 8. I had to put some of my allowance in there, indeed the minimum they made me do was 10%. I had my first job at 11 and at least 10% of that money went in there. Had my first credit card at 18 and was responsible for using it and paying it. That’s when I learned about interest charges and decided my hard earned money was better spent in other places than interest charges. My parents made me open an RRSP at 18 and make minimum monthly deposits to start saving for retirement. No, my parents did not come from money nor I, but we all worked hard to get where we are today.

Point being, people and businesses that didn’t position themselves for an ‘emergency’ will pay the price and from that lesson they will either learn and make changes in their life/business practices or they won’t. I am not entirely without sympathy to their plights.

Tesla prepared and positioned itself for an ‘emergency’ like ALL businesses should. That’s just common sense and good business. Measures, that at first glance seemed only about not going bankrupt, soon morphed into recession-proofing. This will be recognized by at least some of the serious money people.

I have no idea when TSLA goes up or goes down or goes sideways or by how much at each phase. What I do know is if you buy all you can afford and hold onto it for dear

life, you will make money while you eat, sleep, fart, and try to land on my island.

Gee, hope you never happen to be in a business that goes to 0% income over a two week period.

Tesla would have been dead if their sales had been zero for six months anytime until late 2019. The never had "savings" to handle zero sales.

They might have survived by owners putting in more money but never by themselves.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K