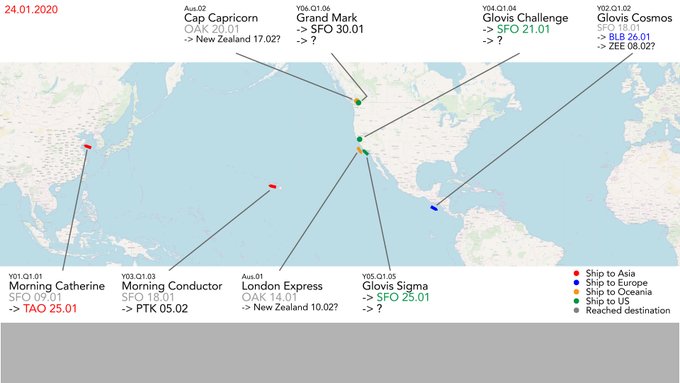

Shipping update:

* As we know, shipping got off to a somewhat late start this quarter (I believe due to refilling drawn-down store / service fleets and meeting the previously-scheduled deliveries that they failed to deliver in Q4), but it's now going at a much faster clip. Departures thusfar were the 9th, 18th, 18th, and 25th. Glovis Sigma arrives tomorrow, the 26th (leaves 28-29th?), Grand Mark arrives on the 30th, possibly followed immediately by Brooklands, as early as the 1st. Depending on when Grand Mark leaves, there will either be 5 or 6 ships having set sail in January.

* For comparison, the first month of Q4 saw "8" ships, although that's a bit misleading. One actually left on 9/30, so it was fully filled with cars made during the previous quarter, and even the one that left on 10/05 may partly have been filled with cars made in the previous quarter. All other "first months of quarters" had only 4 ships.

* First ship of the year, Morning Catherine, has arrived in Qingdao (did not stop in South Korea like expected)

* First ship to Europe, Glovis Cosmos, is expected to get to Zeebrugge around 2 Feb.

* Two additional ships are at sea. Morning Conductor is near Hawaii, heading to South Korea (expected around 5 Feb). This ship had an unusually-short loading time of 14h. Glovis Challenge just left Pier 80 and is en route to Europe. Glovis Sigma arrives tomorrow to replace it as the 5th ship of Q1.

* Glovis Cosmos or Glovis Challenge could possibly contain my car

Latest ship position maps from Julien K:

Julien K on Twitter