They work 24/7

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

The Accountant

Active Member

Two TSLAQ members walk into a bar.......

Have you heard the joke told by TSLAQ?

Goes something like this...."Tesla loses money on every car they sell". I'm still waiting for the punchline.

The US Auto companies have reported their Q4 results. Let's see what we have:

Gross Margins

Tesla 19%

Ford 12%

GM 16%

Operating Income

Tesla 5%

Ford -1%

GM - 2%

Ford at -1% and GM at -2%. They're telling the joke all wrong....It's Ford and GM losing money on every car they sell.

Tesla numbers will only improve as they grow the topline.

I will post VW's numbers once they report Q4.

Have you heard the joke told by TSLAQ?

Goes something like this...."Tesla loses money on every car they sell". I'm still waiting for the punchline.

The US Auto companies have reported their Q4 results. Let's see what we have:

Gross Margins

Tesla 19%

Ford 12%

GM 16%

Operating Income

Tesla 5%

Ford -1%

GM - 2%

Ford at -1% and GM at -2%. They're telling the joke all wrong....It's Ford and GM losing money on every car they sell.

Tesla numbers will only improve as they grow the topline.

I will post VW's numbers once they report Q4.

TheTalkingMule

Distributed Energy Enthusiast

Bloomberg headline......Tesla Sold Shares at Steepest Discount It’s Ever Given Investors

Lol!!

Lol!!

Tslynk67

Well-Known Member

From CNBC:

Loup Ventures' Gene Munster and Roth Capital's Craig Irwin debate Tesla's bear and bull cases

Really like the young CNBC guy, he asks good questions and listens, kind of spoilt it when the old guy with the wig showed up at the end...

And Pennywise - love that he said Tesla raising capital now is a sign that it's all over, the growth is finished, the demand is gone, R&D going up, then thirty seconds later he praises Zack for doing the raise and said "the best time to raise capital is when you can".

So, yeah, well...

Loving the battle today, especially as I have some skin in the game with that $805 call - adds a bit of spice to it all

Freder Reeve

Member

I checked my local inventory at 6am this morning and 45 was down to 41; the SR+ that was added a little while ago is already gone. I think a lot of lucky people are getting Model 3s for valentines day.Inventory's been weird today. Around 20 3s got added locally here, including a bunch of stealth Ps, and then around an hour later it all disappeared at once and we're back to zero.

kind of spoilt it when the old guy with the wig showed up at the end...

You own me a new laptop...or at least a cleaning for all the coffee I spit out when I read that!

1101011

Proud TSLA/SCTY shareholder since 2013.

Having a conversation with an employee of Jervis B. Webb Company. They are a leading provider of material handling systems. Been to Fremont? You've seen their smart carts, and also moving product on the assembly line.

They been asked to quote on work "within battery plants" in California, Nevada, China and Germany.

Sounds like Tesla is really preparing to gear up.

Battery Day cannot come soon enough!

They been asked to quote on work "within battery plants" in California, Nevada, China and Germany.

Sounds like Tesla is really preparing to gear up.

Battery Day cannot come soon enough!

TheTalkingMule

Distributed Energy Enthusiast

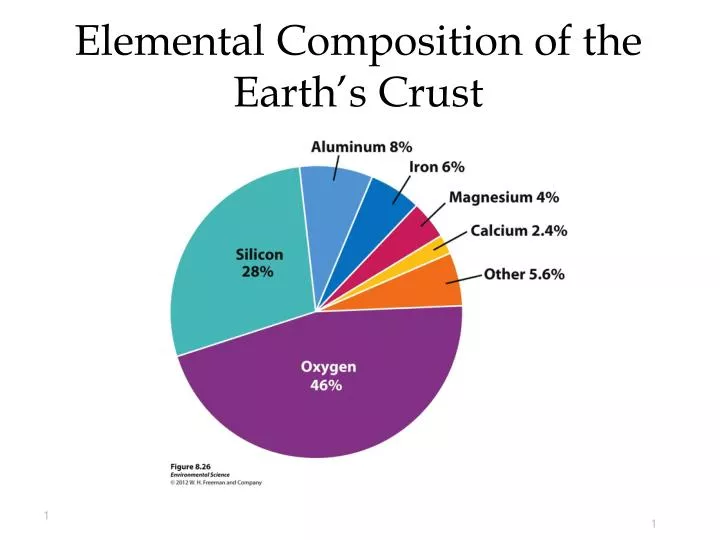

Around 2012 the popular sentiment was we'd soon run out of silicon for solar panels. A few hundred GW of production later.....I agree. The current glut won't last. Tesla's growth alone is going to skyrocket global consumption this year.

45 minutes ago Bayern 5[1] reported on Tesla's GF4 in Grünheide, including the fact that the logging will continue and that "Verein für Landschaftspflege und Artenschutz in Bayern e.V."[2] had filed a protest in vain.

[1] B5 aktuell - Wikipedia

[2] Verein für Landschaftspflege und Artenschutz in Bayern – Wikipedia

PS. While these good news have already been reported here it is noteworthy that B5 reports on it, they very rarely report on Tesla.

[1] B5 aktuell - Wikipedia

[2] Verein für Landschaftspflege und Artenschutz in Bayern – Wikipedia

PS. While these good news have already been reported here it is noteworthy that B5 reports on it, they very rarely report on Tesla.

Last edited:

Mike Smith

Active Member

As a retail favorite this would be a huge benefit to TSLA.

White House considering tax incentive for more Americans to buy stocks, sources say

White House considering tax incentive for more Americans to buy stocks, sources say

woodisgood

Optimustic Pessimist

Craig, who's quickly becoming my favorite bumbling bear, sounded really unsure of himself. Stressful time to be a TSLA bear...

The 'don't get it' look has switched from smug to confused...

ThisStockGood

Still cruising my Model S 70 2015

Around 2012 the popular sentiment was we'd soon run out of silicon for solar panels. A few hundred GW of production later.....

The sentiment was "we'd run out of silicon"?

Solar silicon was refining constrained during the peak (which was in 2008, not 2012). It was not at a local low, like lithium is currently; it was at a local high.

If you want to use 2012 as a baseline for some reason, prices rose from there.

They later fell again, but again, this was about refining. For comparison: lithium carbonate prices (99,5% battery grade, China spot prices, yuan)

Also.. could you clarify your position? Are you saying that because there have been various trends in polysilicon refining capacity relative to solar PV consumption, that means lithium prices will trend... downwards from a low as Tesla ramps dramatically?

In general when it comes to mineral resources, prices are a balance between how much the world expects to need - far enough in advance to actually build said capacity - and how much the world actually needs. A misbalance between capacity and demand - which is easy to occur in a rapidly evolving marketplace - leads to spikes or crashes. When it comes to lithium, the world overbuilt capacity several years ago, and market prices reflect this.

I'm very much not of the view that the world is currently overestimating Tesla's needs. Nor do I think that Tesla is of that view, either. They've said that they may need to go into mining in order to get their needs met; the two top targets for this would be nickel and lithium (rare earths for motors would be in third place... I'm not so sure they're going to be sticking with natural graphite for the long term, and we know they're working to get rid of cobalt).

The longer-term picture however is more of an interesting question. With demand and production estimates properly balanced... what's a fair market price for lithium carbonate / equivalent, based on available resources and technology? And it's a balance that will shift over time as production needs grow but new technologies advance. But regardless of the answer to that question... that's not the situation we're in today. We're in an overproduction scenario at present.

Last edited:

Take yesterday for example. The stock was down as much as 7% in pre-market. Many of us knew the stock would recover and would have jumped at the opportunity to buy at those levels. Yet only a certain few got to capitalize because by the time the market opened for us, the stock had almost fully recovered. This makes no sense!

Yesterday was a very unusual day with a huge announcement before earnings resulting in it taking a while for the bulk of investors to react.

Instead of complaining about it why don’t you open an account that allows you to trade after hours and then let us know how it went?

No Cars without Batteries. So smells like "Battery Production" is what is next

It looks like GF3+4 solves that by adding on-site battery production, and I can see that happening for subsequent Gigafactories.

Pretty obvious that they're trying to pin it at $800 today.

Indeed, my cursory survey of trading in TSLA options expiring today suggests that $800 currently appears to be the most profitable target for many of the large option writers who might try to manipulate the share price. That could change during the final hour of the session.

Published MaxPain figures have been way off base during the TSLA run-up in recent months, and can be disregarded.

JohnnyEnglish

Member

Has there been any speculation regarding how the deliveries of the first Ys will be done? Based on the first M3s from Fremont and the first MIC M3 I am guessing that there will be some sort of delivery event, presumably with 1-2 weeks notice. If they are aiming for early March I would hope that we hear something soon.

Anybody knows how to buy the new shares..? If info has been published...

They were all allocated yesterday. Read some of my posts up thread.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K