humbaba

sleeping until $7000

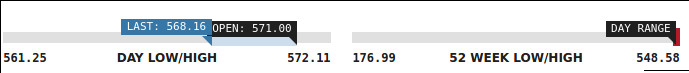

despite refreshing the page, Market Watch can't seem to grok the new high: they are still showing the 52 week high as 548.58

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Please take a moment to educate this newb,

Why is the 8k@$600 worse ?

Thanks,I'm guessing it's because if you're worried about 8k@$600, you have to worry about both the 8k@$600 AND the 11.7k@$550

It would remove all that competition from the taycan.

Why does Toyota still have a higher market cap than Tesla?

I'm serious, I know they currently do huge volume and are quite profitable but it makes no sense - they are about to fall on harder times. They may be able to extend their ICE business two or three years longer than most big OEM's due to their initial volume, diverse offerings and perhaps their ability to meet emissions by juggling product mix, but they are still dying in terms of growing cash flows and profits. Are their properties around the world highly valuable for other purposes perhaps? Will they become a real estate company?

Just wondering why anyone would think their money was safe there

That's what's so great about this new reality where raising funds costs nothing and the brand is standing alone at the top. They can produce and sell literally ANYTHING they want, even a ridiculous looking truck.Predicting the Cybertruck sales rate precisely is easy:

Essentially unlimited. Tesla will sell them as fast as they can make them for years to come at any conceivable ramp rate. Unless it can't get a 5-star safety rating (which is a distinct possibility) or they need to raise the announced pricing (or there are other "catches"), people will be falling all over themselves to get this thing.

I will concede, it won't sell all that well in Europe. But the other markets dwarf Europe for truck sales anyway.

Daniel Ives of Wedbush raises price target from 370 to 550.

TESLA: Wedbush sube precio objetivo de 370 a 550$

Sandy Munro disagrees with you. He says they wouldn't do it that way for 600k/year. Did you watch the video?

Even in my son's portfolio, his 211 shares are now 55.42% of his account! He may never have to work unless he is bored and wants to. The first purchase I made for him was 100 shares @ $30.09 on 06/13/2012. The highest price paid was $298 on 11/02/2017.

I toured the Fremont factory on 12/31/2019. All I can say under signed NDA is I would not hold your breath for 2/2020. Then again, I'm not a production line installation consultant so wtf do I know? If they can build an entire GF3 in China in record time, maybe they can bring up and test a Model Y robotic final assembly line in record time also?? Time (or another factory tour under NDA!) will tell...

This is not under NDA but educated guesses. Since the Model Y shares ~70% parts with the 3, then it seems they could have hand-assembled many test Model Y's and that is what we are seeing on the roads. My tour was abbreviated for New Year's Eve so the tram did not take us to see the huge stamping presses. My guess is they already have final or near-final molds for Model Y body panels and have stamped out enough of them to hand assemble the Model Y's they needed for testing.

Elon only responded "I like turtles" a couple of times.

Ah, this explains why yesterday's pre-market looked like a step function! Thanks for knowing this!While Nasdaq early trading opens at 4am, few investors have access to the platform so early and liquidity is usually poor.

7am and 8am ET are when early trading facilities of big U.S. brokerages open, the margin call and other early trades usually accelerate at those timestamps. (13:00 and 14:00 central European time.)

So the early trading volume distribution is usually:

FWIIW, yesterday 7am-8am there was a weak bear attempt trying to push from $510 and getting to $507, only to be blown away by the 8am bullish price action.

- 4am-7am: low volume

- 7am-8am: moderate volume

- 8am-9:30am: moderate to high volume

(Or it might have been a clever and cheap head fake by a bullish fund, or a pessimistic investor. We'll never know.)

Tell that to DetroitIt's not super-difficult to master something when you do it the same way for decades.