Great story, what are your other holdings or what you have your eyes on recently?I was a commercial fisherman. At the time there was no Internet access on boats (especially in Alaska). Since I had millions in one stock and it was over 90% of my net worth it would make little sense to get on a boat for 3-4 months on which my earnings for the entire period would amount to less than the average daily volatility of my brokerage account. At the time, it was not uncommon for my account to shoot up or down by $30-$100,000 each day. Fortunately, mostly up! I needed Internet access to decide when to sell. I loved fishing but there came a time when it would have been financially irresponsible to get on a boat.

This "problem" was brought about by a refusal to take profits simply because one of my stocks had doubled or tripled. And yet this is common financial "wisdom". Never sell or profit take simply because a stock has done well! Sell when the stock's growth has completely played out. By that time you will probably be so far ahead of the game that even if you miss the top by 50% it won't even matter - you will be so far ahead of where you would have been had you "protected" your early profits with profit-taking.

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

tinm

2020 Model S LR+ Owner

Pilot: Tower this is Tesla Air requesting climb to five-zero-zero.

Tower: Cleared for Five-zero-zero.

Pilot: Roger cleared for five-zero-zero. By the way what's the weather look like up ahead, we had some chop getting this far.

Tower: Smooth sailing from here on out, Tesla Air.

Pilot: Roger that.

Tower: Cleared for Five-zero-zero.

Pilot: Roger cleared for five-zero-zero. By the way what's the weather look like up ahead, we had some chop getting this far.

Tower: Smooth sailing from here on out, Tesla Air.

Pilot: Roger that.

Navin

Active Member

Adam Jonas is a straight up chimp. I attended an exclusive Morgan Stanley conference call for clients where he talked at length about Tesla. This was approx 2.5 years ago. I asked him straight up what his thoughts were on Tesla being the dominate force in the auto industry. He flat out said no and went on this long narrative and even laughing at his own thoughts. Today - he is stuck behind that mindset and just acting like an idiot because of his own hubris and inability to reverse himself out of a hole.

“We still see Tesla as fundamentally overvalued, but strategically undervalued”

Well.

I see Adam Jonas as as fundamentally overvalued analyst, but strategically a clown.

“We still see Tesla as fundamentally overvalued, but strategically undervalued”

Well.

I see Adam Jonas as as fundamentally overvalued analyst, but strategically a clown.

Mad@gascar

Teslanaire Extraordinaire

If any of the legacy auto manufacturers are going to go out of business, I really want it to be BMW. Let me explain:

BMW is 50% owned by two members of the Quandt family, Germany's richest family (Stefan Quandt and his sister Susanne Klatten, Germany's richest woman). Together with their siblings and cousins, the Quandts own a vast industrial empire, of which BMW is just a portion. They are the children of two half brothers, Herbert and Harald Quandt, who amassed their fortunes during the Third Reich on the backs of slave laborers. The Quandt brothers (and their father Guenther) profiteered mightily from their cozy connections with the top Nazi leadership: Harald Quandt was Joseph Goebbel's adopted son, and grew up in the Goebbels family. Adolf Hitler himself was the best man at his mother's wedding to Goebbels.

The Quandts owe their wealth directly to their support of the Nazi regime and the bloody exploitation in the concentration camps - something the family is unwilling to discuss. In 1943, and with direct support from the SS, the Quandts established a company-owned concentration camp adjacent to one of their factories in Hanover. There, they exploited the labor of Jews and resistance fighters from Denmark, France, and Czechoslovakia. The slave laborers were callously exposed to lethal levels of toxic chemicals, and no protective clothing or equipment was provided. Internal communications referred to a monthly "turnover" of 80 people, i.e., 80 workers would die each month. Immediately upon arrival the prisoners were told that they would not survive longer than six months. Those who survived against all odds recounted having to drink from toilets and being subjected to whippings. Despite these crimes, the Quandts managed to elude all punishment after the war.

The Quandts' sordid history is chronicled, with heart-wrenching testimony of survivors, in the award-winning documentary "The Silence of the Quandts".

While it is true that people should not be held responsible for their parents' crimes, the problem with the Quandts is that they have refused to apologize or offer any compensation to the survivors of the atrocities, or to their victims' families. Anybody who buys BMW stock today, or purchases their vehicles, directly supports and enriches this kind of people.

Sorry for the downer. Merry Christmas / happy holidays everyone!

Last edited:

I'm thinking we might see a bit of delay. Was expecting a feature complete, but we got visualizations.Unsupervised and robotaxi are synonymous afaic, so if Elon said end of 2020 for unsupervised then that is technically good enough for a robotaxi and just needs regulatory approval.

Not positive how much one is different from another in terms of progress, maybe they disabled actual driving to collect more data first before turning on the FSD, so could be the functionality is already there, just turned off temporary for better safety.

But still, it seems like we were given less than intended, so maybe extra steps will take extra time.

Anyways, if we get major progress by 1/22 call expiration and before I have to take CT delivery, I'll be happy

Could be something like a bunch of youtube videos of supervised FSD that a lot of people get to see and make up their mind about how close that is to being ready or to Waymo...may start affecting the mood of new investors if not Wall Street.

TradingInvest

Active Member

Ihor suggest borrow fees for shorting still at 0,30%.

Can someone elaborate on this? It should'nt start to rise?

As shorts start to cover, more shares become available for borrowing, the borrowing interest rate should go down, not up.

When shorts can't find shares to borrow, that's when fee goes up. Shareholder voting, too many shorts borrowing, large lenders decide to stop lending... those events lead to higher fees.

tinm

2020 Model S LR+ Owner

Adam Jonas is a straight up chimp. I attended an exclusive Morgan Stanley conference call for clients where he talked at length about Tesla. This was approx 2.5 years ago. I asked him straight up what his thoughts were on Tesla being the dominate force in the auto industry. He flat out said no and went on this long narrative and even laughing at his own thoughts. Today - he is stuck behind that mindset and just acting like an idiot because of his own hubris and inability to reverse himself out of a hole.

“We still see Tesla as fundamentally overvalued, but strategically undervalued”

Well.

I see Adam Jonas as as fundamentally overvalued analyst, but strategically a clown.

Kind of depends on meaning of "dominant force." If you mean force for change, a forcing function that's pushing the rest of the industry, then yes, I think Tesla has been the leader for years and will remain a major force for years to come.

If you mean dominant manufacturer, as in largest market share worldwide, no, I don't see Tesla getting there, maybe ever. But that isn't bad news. Remember, the very largest automaker has only roughly ten percent of the world market. Measured as slices of a single pizza, all slices are thin. Question is, how does Tesla get from less than a 1% slice to say a 3-5% slice. At that size, it is a major player, selling multiple millions of cars worldwide per year. At say 5% world market share -- of all light passenger vehicles -- the market cap (assuming company keeps debt under control) would be what, 10X what it is today, with a share price of $4250.

I can dig that.

Just @ me next timeAlso, watch out for the effects of testosterone on yourselves gents and, yes, ladies too. Success boosts testosterone which can increase risk taking behavior. This book looks at trading specifically: The Hour between Dog and Wolf: How Risk Taking Transforms Us, Body and Mind|NOOK Book

Buckminster

Well-Known Member

Will is suggesting that Elon goes further than I suggested above and actually employs him. I think this is even less likely. Will is suggesting Boring Co rather than Tesla as if Boring Co will be managing the ride share business rather than Tesla. I see Tesla/consumer paying Boring Co for tunnel access only.I did wonder if Kalanick was buying:

Uber Co-Founder Travis Kalanick Cuts Stake in Company by More Than 90%

It is unlikely but certainly logical. No one understands better the importance of FSD and Tesla's advantage.

Fantastic idea for his new business also - building the kitchens that will feed Uber Eats etc. Good opportunity for integrating new tech like robot chefs - this needs a Silicon Valley startup to take advantage of the opportunity. The second phase could be putting the kitchen on 4 wheels....

Ron Baron has been quiet for a while - another possible indicator of accumulation?

Mike Smith

Active Member

dha

Member

Latest short figures just released; 27,496,754 shares were held short as of 12/13 settlement: Tesla, Inc. Common Stock (TSLA) Short Interest

Once again, Ihor's numbers were significantly off the mark. On 12/11, he said short interested stood at 26.46 million shares: Ihor Dusaniwsky on Twitter

In terms of delta, Ihor's estimate was off by a whopping 90%. In other words, if you took his numbers at face value, you would believe short interest had decreased by 2.19 million shares since the last reporting period rather than the actual change of only 1.15 million shares.

Once again, Ihor's numbers were significantly off the mark. On 12/11, he said short interested stood at 26.46 million shares: Ihor Dusaniwsky on Twitter

In terms of delta, Ihor's estimate was off by a whopping 90%. In other words, if you took his numbers at face value, you would believe short interest had decreased by 2.19 million shares since the last reporting period rather than the actual change of only 1.15 million shares.

Last edited:

UnknownSoldier

Unknown Member

Shorts are hanging tough. So the buying pressure is all real buyers, not covering shorts? Who has been buying all these shares the past month?Latest short figures just released; 27,496,754 shares were held short as of 12/13 settlement.

Once again, Ihor's numbers were significantly off the mark. On 12/11, he said short interested stood at 26.46 million shares: Ihor Dusaniwsky on Twitter

In terms of delta, Ihor's estimate was off by a whopping 90%. In other words, if you took his numbers at face value, you would believe short interest had decreased by 2.19 million shares since the last reporting period rather than the actual change of only 1.15 million shares.

woodisgood

Optimustic Pessimist

Shorts are hanging tough. So the buying pressure is all real buyers, not covering shorts? Who has been buying all these shares the past month?

Ok, I admit it, it was me.

dc_h

Active Member

Does anyone know the FactSet delivery estimates?

if Tesla tops out before 5 million cars or as a leader in self driving taxis, they will not be ableKind of depends on meaning of "dominant force." If you mean force for change, a forcing function that's pushing the rest of the industry, then yes, I think Tesla has been the leader for years and will remain a major force for years to come.

If you mean dominant manufacturer, as in largest market share worldwide, no, I don't see Tesla getting there, maybe ever. But that isn't bad news. Remember, the very largest automaker has only roughly ten percent of the world market. Measured as slices of a single pizza, all slices are thin. Question is, how does Tesla get from less than a 1% slice to say a 3-5% slice. At that size, it is a major player, selling multiple millions of cars worldwide per year. At say 5% world market share -- of all light passenger vehicles -- the market cap (assuming company keeps debt under control) would be what, 10X what it is today, with a share price of $4250.

I can dig that.

to maintain margin advantages. They have a huge cost advantage today due to their EV scale superiority. Except for a Cyber mini, there’s no additional proposed cars to hit 3 million cars and trucks a year. A redesigned SX platform should bring sales back above 100,000 assuming battery supply is available. Model 3 capacity will be about 750,000 and Y at least 1 million by end of 2022 or 2023. A cyber truck and cyber mini could be 2 million on top of that. By then a Model 2 should be ready as a global 2 million a year car to replace the Corolla and Golf as the worlds top seller.

I got the same thing. I don't think there's another update coming. It's just a reminder to click the Upgrades tab. More Q4 revenue and profitView attachment 492543 is I just upgraded to 50.40.1 and noticed this in my inbox. Does this mean another big update is coming next week? I'm super

confused.

ZeApelido

Active Member

Some additional thoughts on effect of FSD perception on valuation:

If Tesla ever gets to true FSD it will be able to sell a million cars per year with an additional $100,000 of profit. Thats an additional 100 billion dollars of profit per year. At a P/E ratio of 20, that would add... $11,000 to the share price. Lol.

Of course that assumes 100% chance of success. Right now it's probably more like 5%. Probabilistically, the expected value of the future contribution of FSD to share price would then be an additional $550.

Now the market is valuing Tesla FSD close to zilch. If feature complete FSD is deployed next year and shows improvement, I expect investors to begin modeling FSD contribution with higher probabilities.

Even if investors think there is a 5 or 10% chance, the share price could rocket to $1500 on FSD hype alone. Of course once at this level, any autonomous accident could sink the price 20%.

Thr volatility could be huge, but the potential returns in the next 2 years may be astronomical.

If Tesla ever gets to true FSD it will be able to sell a million cars per year with an additional $100,000 of profit. Thats an additional 100 billion dollars of profit per year. At a P/E ratio of 20, that would add... $11,000 to the share price. Lol.

Of course that assumes 100% chance of success. Right now it's probably more like 5%. Probabilistically, the expected value of the future contribution of FSD to share price would then be an additional $550.

Now the market is valuing Tesla FSD close to zilch. If feature complete FSD is deployed next year and shows improvement, I expect investors to begin modeling FSD contribution with higher probabilities.

Even if investors think there is a 5 or 10% chance, the share price could rocket to $1500 on FSD hype alone. Of course once at this level, any autonomous accident could sink the price 20%.

Thr volatility could be huge, but the potential returns in the next 2 years may be astronomical.

theschnell

Member

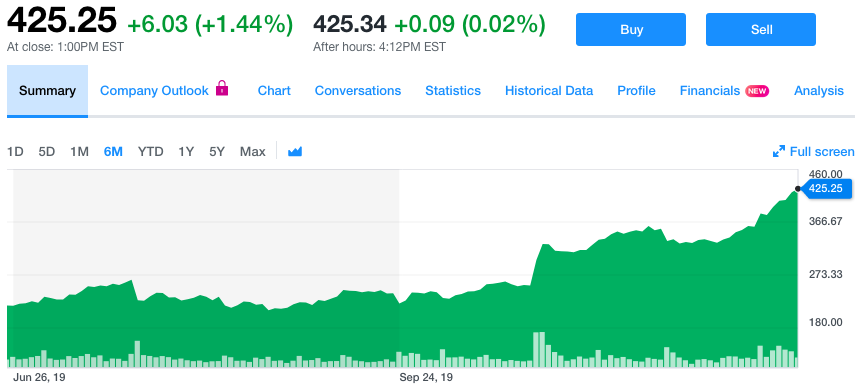

Only had brief opportunities to check the stock today. A little after 9:30 saw we were down $6. Thought “not surprised by a little pullback, but still slightly disappointing, hope we don’t take an elevator down but probably won’t”.

Looked around 10:30 or 11 and was surprised to see $419.

Looked after close and was shocked to $425. Even Jonas and the shorts combined can no longer take us down.

Eventually we’ll stop winning. No clue when.

Looked around 10:30 or 11 and was surprised to see $419.

Looked after close and was shocked to $425. Even Jonas and the shorts combined can no longer take us down.

Eventually we’ll stop winning. No clue when.

Fact Checking

Well-Known Member

Shorts are hanging tough. So the buying pressure is all real buyers, not covering shorts? Who has been buying all these shares the past month?

Today's 27m short interest report was the short interest from 11 days ago, on December 13, when TSLA closed at $358.

This was one trading day before the big breakout to $380 levels. We don't know to what extent shorts were covering since then, but I believe it's by significant levels. There's around ~500k shares worth of pre-market and after hours trading every day - which look like margin calls.

So I think a Tesla short squeeze might be in full swing, magnified by end of year loss taking tax advantages: long-short funds have a lot of S&P 500 gains this year and might have decided to take their TSLA losses, offsetting their other gains. Some of these funds might re-enter either early January, or at around January 30.

Last edited:

ZeApelido

Active Member

And some oddly say Tesla isn't collecting fleet data for FSD training

Autopilot Infrastructure - Backend Engineer - Palo Alto, CA - Indeed.com

Autopilot Infrastructure - Backend Engineer - Palo Alto, CA - Indeed.com

Fact Checking

Well-Known Member

Saw this morning, couldn't respond until now. This is depressing. Stop buying calls people! It puts market makers on the same side as the shorts, and they have a lot of money. If you believe in the company, buy shares. If you're here to gamble, you'll lose. The market makers always win over the long term. Yes they lost with the surprise ER, but they're making it all back by selling everyone a bunch of calls and holding the stock back.

This is an oversimplified view, in that market makers can also buy shares to hedge their sold call positions, but I'm convinced that most of the time they push the stock down (or up) as necessary to hit that max pain number, or move the max pain number by selling more options higher on the curve.

My point is, if you want to gamble with a few options that's fine, but if that's a primary way of "investing" in TSLA, you're going to lose and the money you lost is an actual loss, not a paper loss like many of us experienced who held stock through the lows but never sold

You wrote this on October 28, 1.5 months ago, when TSLA closed at $327.

While options writers probably tried to control the stock price on certain days, I think @ReflexFunds's recent analysis that most market makers are delta hedging their options exposure is probably closer to reality.

If they didn't, if they expected to hold back this rally, then they'd have lost billions of dollars in this +$170 rally since the Q3 earnings - and much of that sum they'd have lost permanently, as hundreds of thousands of call option contracts expired during this rally already.

Last edited:

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K