Still, it costs them more each time, and every Tesla sold, every solar panel installed, every Powerwall installed reduces their revenue, making each downward push relatively more expensive. Also to keep the politicians in line, more money has to be spent because even the most anti-environmental politicians know that public sentiment is switching towards a sustainable future. Water wears stone.Unfortunately, once again, the shorts and various media have managed to mitigate damage and drive the stock down to mitigate much of the immediate gains after the ER. Seems their pockets are unlimitedly deep. *sigh*

Dan

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Tesla, TSLA & the Investment World: the Perpetual Investors' Roundtable

- Thread starter AudubonB

- Start date

Fact Checking

Well-Known Member

Now what we will likely see is another period pass in Q4 where the realised deferred revenue severely lags the forecast from a year ago. But at some point we will see convergence of these two numbers, with the benefit going straight to the bottom line.

BTW., if by "bottom line" you mean GAAP profits, then I agree that nearly 100% Autopilot and FSD deferred revenue will be profits - but the other parts will have significant cost of goods aspects.

Singer3000

Member

Yup. Though presumably upgrading the legacy fleet to HW3 will have a hit to COGS too. Did we settle at a marginal cost number for the fancy new computers?BTW., if by "bottom line" you mean GAAP profits, then I agree that nearly 100% Autopilot and FSD deferred revenue will be profits - but the other parts will have significant cost of goods aspects.

Unfortunately, once again, the shorts and various media have managed to mitigate damage and drive the stock down to mitigate much of the immediate gains after the ER. Seems their pockets are unlimitedly deep. *sigh*

Dan

While I can’t guarantee that the bulk of the short position and media attempts at reputational sabotage are really just chess pieces/strategic tools in a much larger game of extending the life of the fossil fuel economy,

I can say,

having thought this quite probable for several years now,,

the media miscoverage, the general dearth of movement to EVs by the global incumbents, the persistence of shorting, and the price action of the stock... none of these catches me with surprise and head scratching with much of any frequency.

those of us who think the media, shorts, and ICE incumbents are just ‘insulated,’ ‘stupid,’ ‘incompetent,’ ‘fools,’ incapable of seeing what we’re all seeing... well, with this set of interpretations, there seems to be surprise and head scratching and disbelief on a regular basis.

I am skeptical that we see a fundamental shift in media coverage and the outlier short position in Tesla before about 2022 at the earliest. I see TSLA moving up nicely during that time, but continuing to bounce between about 20-50% undervalued.

Who knows, maybe at some point in the 2020s there will be a backlash to such a huge game having been played for so long (if, this is indeed the case), much more of the public will not assume for profit programming is aimed foremost at “journalism” and TSLA will swing to being overvalued.

Fact Checking

Well-Known Member

Together with Tesla rapidly filling up its Q4 backlog, I'm tentatively preparing for Q1 to be Tesla's best profit quarter yet, despite Model Y and GF3 ramp related costs.

BTW., what's your take on the China credit line disclosures of Tesla from the Q3 10-Q:

- China Loan Agreements:

- Q2: unpaid Principal Balance: $27m

- Q2: unused Committed Amount: $482m

- Q3: unpaid Principal Balance: $219m

- Q3: unused Committed Amount: $924m

But $219m seems shockingly low total GF3 capex to me. Is Tesla paying some of their GF3 capex from other accounts, or are the payments still outstanding, contingent on successful ramp-up of the production lines?

Fact Checking

Well-Known Member

Yup. Though presumably upgrading the legacy fleet to HW3 will have a hit to COGS too. Did we settle at a marginal cost number for the fancy new computers?

Good point. I made some crude estimates that places the HW3 board cost somewhere between $100 and $500 - but they only would have to replace the board, none of the other HW components such as the cooling loop (where applicable).

So it's the board cost plus labor cost. I suspect the primary constraint on Tesla is service technician labor availability and throughput, which should put the seasonally best opportunity in Q1. Upgrading even just 100,000 cars will be a major workload to service centers.

Pras

Member

So November 2019 is almost here. The time depicted in the original blade runner movie. No doubt Elon chose this time to reveal his cybertruck.

But expanding the theme beyond, we are nowhere near having flying cars (aka spinners), the world is still not very split, and feels more normal than the film depicted.

Good or bad, it tells us that Hollywood’s imagination of a future is more extreme / dramatic than how it plays out. Elon is trying to close that gap.

But expanding the theme beyond, we are nowhere near having flying cars (aka spinners), the world is still not very split, and feels more normal than the film depicted.

Good or bad, it tells us that Hollywood’s imagination of a future is more extreme / dramatic than how it plays out. Elon is trying to close that gap.

ReflexFunds

Active Member

BTW., what's your take on the China credit line disclosures of Tesla from the Q3 10-Q:

Since some of these were USD credit lines and some of them RMB credit lines, I always assumed that these were basically for GF3 capex and ramp-up opex (the credit agreement does allow ramp-up financing as well), and that Tesla would perform all GF3 related payments from these credit lines - even if they are say equipment ordered from a German firm.

- China Loan Agreements:

- Q2: unpaid Principal Balance: $27m

- Q2: unused Committed Amount: $482m

- Q3: unpaid Principal Balance: $219m

- Q3: unused Committed Amount: $924m

But $219m seems shockingly low total GF3 capex to me. Is Tesla paying some of their GF3 capex from other accounts, or are the payments still outstanding, contingent on successful ramp-up of the production lines?

I think they have likely only spent close to the $219m GF3 capex so far (excluding the 50 year lease payment they made last year). Tesla had $375m of capex payables at Q3, I think much of this is likely GF3 on delayed payment terms.

Fact Checking

Well-Known Member

I think they have likely only spent close to the $219m GF3 capex so far (excluding the 50 year lease payment they made last year). Tesla had $375m of capex payables at Q3, I think much of this is likely GF3 on delayed payment terms.

I'm wondering how you arrived at the $375m capex payables:

- if I take the "Purchases of property and equipment excluding finance leases, net of sales" field, it grew from $529m in Q2 to $915m in Q3, and increase of +$386m.

- there's a "Acquisitions of property and equipment included in liabilities" item, which increased from $287m in Q2 to $375m in Q3 - an increase of +$88m.

dgodfrey

Member

Fact Checking

Well-Known Member

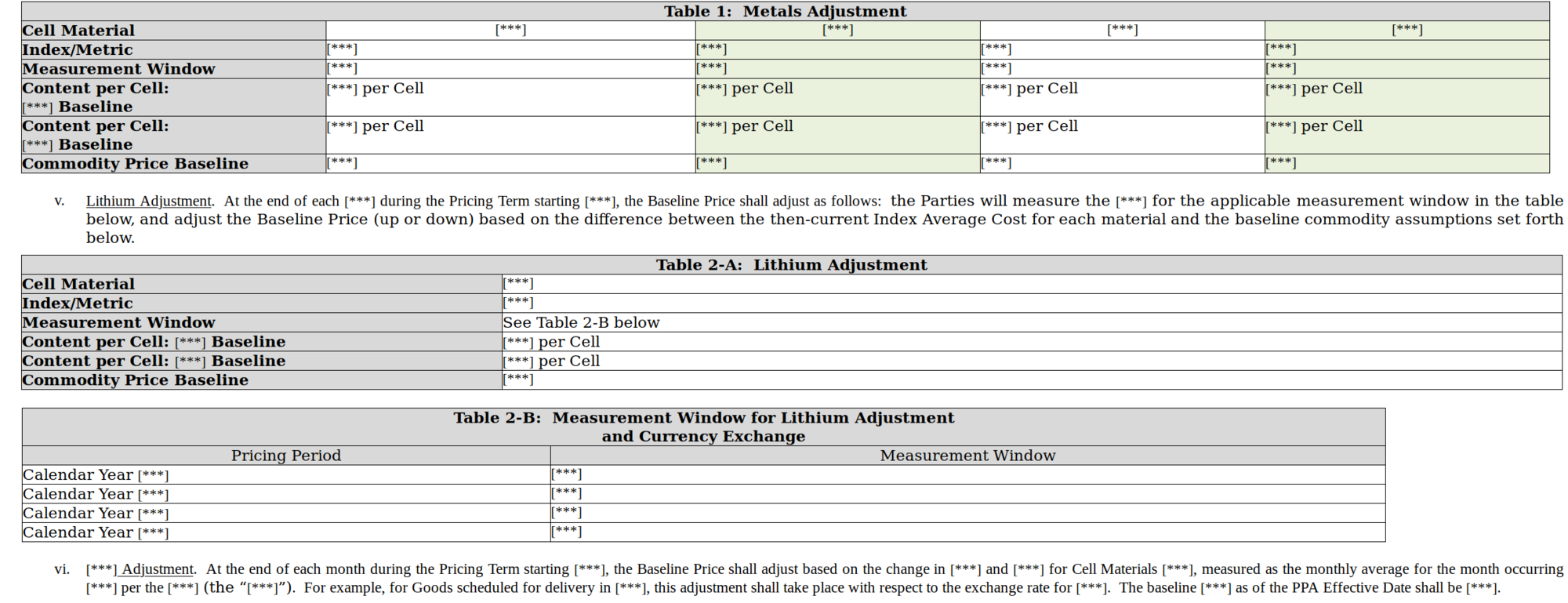

Another interesting disclosure in the 10-Q is the cell pricing agreement with Panasonic - I haven't seen this disclosed before:

I think the dates are interesting as well: Tesla signed the agreement on 2019/09/20, 3 days after Panasonic (2019/09/17) - which suggests that Tesla was in the stronger negotiation position.

The actual prices and materials are redacted, but the overall formula is:

This suggests that their cell pricing contract tracks world metal spot prices, with a 12-month-trailing averaging method? Maybe longer averaging for certain metals?

Anyway, it appears that Tesla might have come to a new supplier agreement with Panasonic in September, which might be some of the CoGs reduction - and those CoGs benefits would continue into Q4 as well.

Tesla, for the first time, mentioned supplier agreements as a driving force in their Q3 10-Q:

I.e. Tesla is chalking up the margin improvements primarily to manufacturing improvements and better supplier agreements.

Falsifies the "Q3 was only a one time margin improvement" TSLAQ thesis ...

I think the dates are interesting as well: Tesla signed the agreement on 2019/09/20, 3 days after Panasonic (2019/09/17) - which suggests that Tesla was in the stronger negotiation position.

The actual prices and materials are redacted, but the overall formula is:

This suggests that their cell pricing contract tracks world metal spot prices, with a 12-month-trailing averaging method? Maybe longer averaging for certain metals?

Anyway, it appears that Tesla might have come to a new supplier agreement with Panasonic in September, which might be some of the CoGs reduction - and those CoGs benefits would continue into Q4 as well.

Tesla, for the first time, mentioned supplier agreements as a driving force in their Q3 10-Q:

"Cost of automotive sales revenue decreased $392 million, or 9%, in the three months ended September 30, 2019 as compared to the three months ended September 30, 2018, primarily due to a decrease of 10,255 Model S and Model X cash deliveries, lower average Model 3 costs per unit compared to the prior period primarily due to improvement of manufacturing efficiencies, and reductions of materials costs, including commercial negotiations with suppliers in the three months ended September 30, 2019. The decrease was partially offset by an increase of 17,140 Model 3 cash deliveries and higher average Model S and Model X costs per unit compared to the prior period from discontinuation of lower end trims in 2019."

I.e. Tesla is chalking up the margin improvements primarily to manufacturing improvements and better supplier agreements.

Falsifies the "Q3 was only a one time margin improvement" TSLAQ thesis ...

Last edited:

Treelon. hahahaha. nice.He seems to have enjoyed it as well …

View attachment 471277

Is there any consensus as to how this would be operationally implemented? Would service centers send out invitations as their schedules permitted? Does other service get put on hold while the upgrades are performed? Will there be dedicated teams at the SCs that specialize in performing the upgrade?Good point. I made some crude estimates that places the HW3 board cost somewhere between $100 and $500 - but they only would have to replace the board, none of the other HW components such as the cooling loop (where applicable).

So it's the board cost plus labor cost. I suspect the primary constraint on Tesla is service technician labor availability and throughput, which should put the seasonally best opportunity in Q1. Upgrading even just 100,000 cars will be a major workload to service centers.

In any case, we would want to avoid the appearance of a "recall".

I think any recall FUD would be shut down pretty hard by cars driving themselvesIs there any consensus as to how this would be operationally implemented? Would service centers send out invitations as their schedules permitted? Does other service get put on hold while the upgrades are performed? Will there be dedicated teams at the SCs that specialize in performing the upgrade?

In any case, we would want to avoid the appearance of a "recall".

TheTalkingMule

Distributed Energy Enthusiast

I somehow missed the Solar Roof V3 announcement portion of the call last week. Holy crap that is huge news, far more impactful than even the profit surprise IMO. 40% cheaper than the V2 offering? Almost on par with a high end roof+solar? This thing will sell like mad.

Energy Forum Thread

Combine this with Tesla actively killing off the ridiculous and expensive sales process in the US and focusing on set online pricing.....you've got the top installer in the US by far. If they're logically focusing on the service issues over the next 12 months, we should see Tesla absolutely dominate the high end install market, solar roof and traditional panels.

Energy Forum Thread

Combine this with Tesla actively killing off the ridiculous and expensive sales process in the US and focusing on set online pricing.....you've got the top installer in the US by far. If they're logically focusing on the service issues over the next 12 months, we should see Tesla absolutely dominate the high end install market, solar roof and traditional panels.

Hock1

Member

The naked short-selling issue is complex. For obvious reasons, the heavies of Wall Street aren't exactly eager to enlighten everyone as to how they control/manipulate stocks for their own outsized aggrandizement. So, necessarily one has to piece together how they operate. As I have mentioned here many times, the two cornerstones of manipulative short selling are 1) The Madoff Exemption and 2) The removal of the uptick rule, allowing short sales on downticks. Frustratingly, both are "legal". However, stock manipulation is illegal. I think that if one spends the time to fully understand the ramifications of these two "tools" of manipulation, it will be easy to see to envision how it is done.May I ask for the source of that information, and can you or anyone else (shout-out to @Hock1, @Doggydogworld, @brian45011, @luvb2b) link to some sort of public document or article that shows or strongly implies that "Nasdaq Market Makers" (Nasdaq member firms - of which there are hundreds I believe), are allowed unlimited short positions within the ~5 business days stock borrowing window?

I haven't found the U.S. rules (which is weird ...), but here are the European commodities market "Nasdaq Clearing" rules for margin requirements and collateral management:

Nasdaq Clearing - Collateral Management

"Intraday Risk Monitoring

Intraday risk reports are generated every hour (starting at CET 10:00 and ending at CET 18:00) or more often if deemed necessary. Each intraday margin calculation reflects any clearing participant’s change in exposure, with updated positions and real time prices, during the clearing day. In case of a breach by a participant of the intraday risk limit, the Clearing Risk Management will issue a margin call."

"Intraday Margin Calls

Nasdaq Clearing has both the authority and the capacity to calculate and require intraday margin as a means of maintaining a desired level of margin coverage. The Rules and Regulations of Nasdaq stipulate that the new margin requirement shall enter into force immediately and be met by the member no later than 90 minutes after the clearing house notified the clearing member that a new margin requirement has been calculated."

Pretty clear position size dependent Value-at-Risk rules for long and short sales, and margin is maintained electronically and goes up and down based on positions.

Are you suggesting that no such rules exist on the U.S. Nasdaq exchange, that any market maker or hedge fund that is member of the exchange (there's hundreds of them) is allowed a full business week of unlimited short positions, with no margin rules and no risk management whatsoever?

If true then that's incredible - and might be worth for journalists (shout-out to @ZachShahan) to follow up on.

A good article to give some clarity to this issue:

Madoff’s Crime of Staying Naked Short

This is not an article to be skimmed.

I think even the shorts would have a hard time spinning a planned upgrade that was announced about a year in advance as a recall.Is there any consensus as to how this would be operationally implemented? Would service centers send out invitations as their schedules permitted? Does other service get put on hold while the upgrades are performed? Will there be dedicated teams at the SCs that specialize in performing the upgrade?

In any case, we would want to avoid the appearance of a "recall".

The sequel steered the narrative to an alternate timeline where technologies of replicants, interstellar spaceflight and flying cars (and the long-term survival of Atari and PanAmSo November 2019 is almost here. The time depicted in the original blade runner movie. No doubt Elon chose this time to reveal his cybertruck.

But expanding the theme beyond, we are nowhere near having flying cars (aka spinners), the world is still not very split, and feels more normal than the film depicted.

Good or bad, it tells us that Hollywood’s imagination of a future is more extreme / dramatic than how it plays out. Elon is trying to close that gap.

ReflexFunds

Active Member

I'm wondering how you arrived at the $375m capex payables:

- if I take the "Purchases of property and equipment excluding finance leases, net of sales" field, it grew from $529m in Q2 to $915m in Q3, and increase of +$386m.

- there's a "Acquisitions of property and equipment included in liabilities" item, which increased from $287m in Q2 to $375m in Q3 - an increase of +$88m.

Capex payables appear on balance sheet (to cancel out the PP&E asset on balance sheet) but do not flow through the cash flow statement. The balance sheet number of capex payables is disclosed as a note at the end of the cash flow statement under the line "Acquisitions of property and equipment included in liabilities". This is a balance sheet number so $375m is the total as at Q3 end. Much of GF3 was already installed at Q2, so likely much of this was already in capex payables at Q2, but some of the Q2 payables would have also been settled during Q3 so the $88m net QoQ increase in capex payables doesn't give the full picture.

Pffft. You just have to turn your brain inside out: “Tesla recalls over 100,000 cars due to under-powered electronics”.I think even the shorts would have a hard time spinning a planned upgrade that was announced about a year in advance as a recall.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Locked

- Replies

- 11

- Views

- 10K

- Replies

- 6

- Views

- 5K

- Locked

- Poll

- Replies

- 1

- Views

- 12K