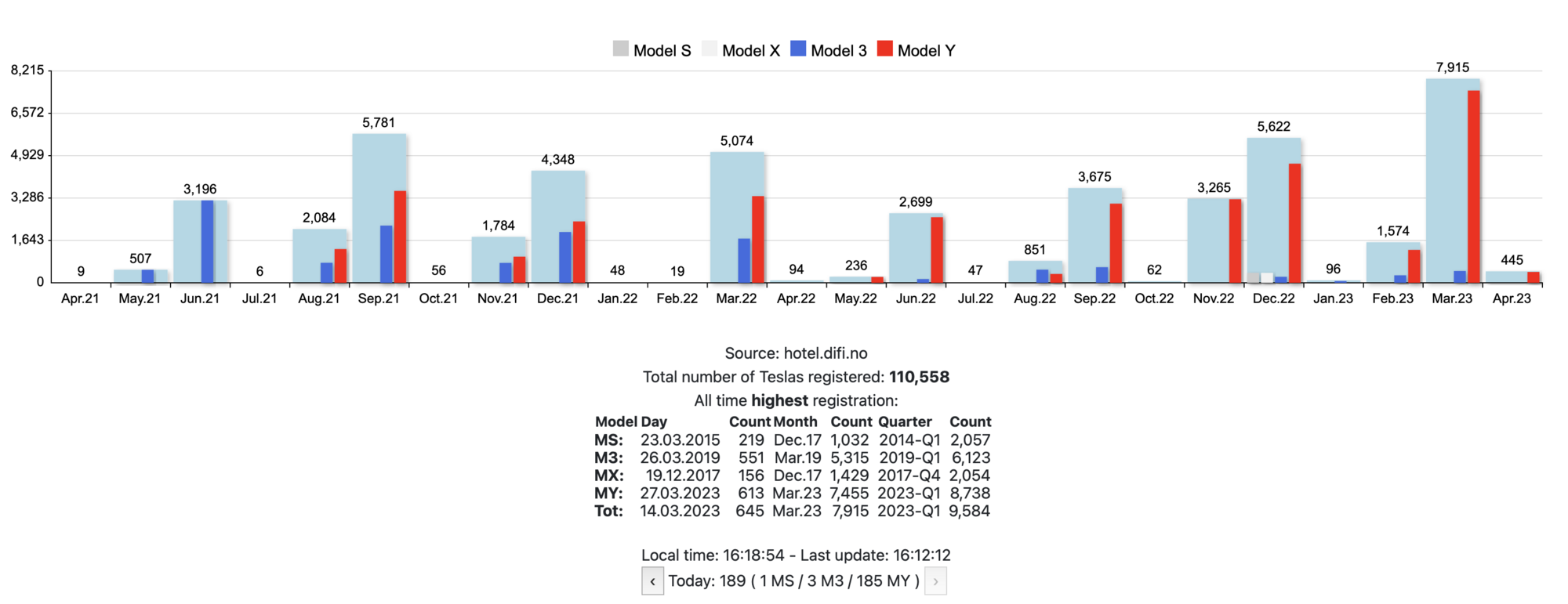

Looks like Tesla have made big steps towards ending the delivery wave in the EU, more cars delivered in Norway this month than all the first month/quarter of the previous two years

Same in Denmark I believe, likely elsewhere too, one would assume

Same in Denmark I believe, likely elsewhere too, one would assume