Where are they (the Verge) getting 375k from?

It was a typo in the link. The actual article title said 325,000.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

Where are they (the Verge) getting 375k from?

Indeed. The average selling price (ASP) would only rise well above $35,000, if many Model 3 customers voluntarily choose pricey options and willingly pay for them. That would imply strong demand and high profit margins. People more price conscious can still go with a basic $35,000 model.

One must wonder about either the motives or competence of some analysts.

It was a typo in the link. The actual article title said 325,000.

I clicked on the link when it was posted here, and at the time it said 375,000 both in the title and in the text.It was a typo in the link. The actual article title said 325,000.

It was a typo in the link. The actual article title said 325,000.

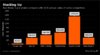

Wow, this is very good. Much higher reservation and much lower double reservations than I thought.Only 5% ordered 2, meaning 95% ordered one. Low speculation says Elon.

We know it's per credit card, not necessarily per person.

View attachment 171163

A true speculator would put 2 on each credit card to max out.Only 5% ordered 2, meaning 95% ordered one. Low speculation says Elon.

We know it's per credit card, not necessarily per person.

View attachment 171163

A true speculator would put 2 on each credit card to max out.

They must have corrected it...

Analysts may be aware of a car model's average selling price (ASP), but a typical car buyer is not. The analyst in question apparently does not realize that. A customer sees the base price and the price of the options in which he might be interested. In the case of a Model 3, even a basic $35,000 model may be a more desirable product that a comparably priced ICE car.

Like Elon tweeted/said, he would rather have happy customers than meet quarterly number. In the end its in your favor if your car is immaculate. I understand your sentiment regarding the stock.. but hey.. its the overall macro dragging it down IMHO.Don't know but, I received a call yesterday from Tesla and was told our X delivery would be delayed approximately 2 weeks as there is a reported concern with the 3 row seats. We were originally scheduled to take delivery 4/8.

I have been cringing on the sidelines and missing all the action since I unloaded my entire TSLA position. This slight consolidation is actually great. I am hoping I am able to get back in ~245.I sold my short term lots and this week's covered call after the numbers broke out. Tempted to do this yesterday but was deterred by the number.

My thoughts on the short term:

While there are still chances for good news breaking out, I doubt anything substantial (solid progress on expanding production) would be released before Q1 ER. The stock has run a great course so far. I would rather see it take a breather for a month. Technically, if we are super strong, we may assume the uptrend after hitting 255. But I think it is more likely to have a 10% off from recent high which points to ~245. Let the shorts regroup, wire money to their account, and refuel the short interest. We need them when we break 300.