Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Burgandy line possible rejection area to sell into (look to the left, rejected there before):

OptionsGrinder

Member

@Yoona thank you for this GREAT information. An additional consideration, probably difficult to model, is that in some cases by rolling ITM CC at 5 strike increments, you could gain some additional extrinsic premium value each week. For example you MIGHT be getting $2 or even $3 in premium each of those weeks, depending on how close you are to ITM, rather than $1 or less. The additional handful of premium dollars during the weeks you are rolling to OTM, can help you get to "break even" a little faster. Thanks again!TSLA Rolling - does it work? Part 3

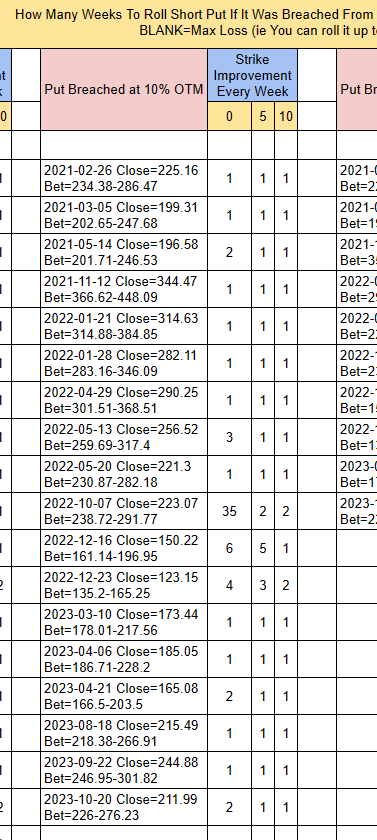

Compared to puts, calls take longer to OTM if rolled

if my 7DTE short call is breached, (for ex 2023-06-09 i have a 10% OTM bet -c235.36 but it closed at 244.39):

if one is selling 10% or 12% OTM calls, any breached call will take at most 6 rolls before it goes OTM (5-strike improvement every week, total $30 improvement) ie move -c200 into -c205 into -c210 into -c215 into -c220 into -c225 into -c230

- if i roll with no strike improvement (assuming no early assignment), i can close it in 10 weeks; this means rolling to the same strike 10 times

- if i roll with 5-strike improvement every week, it will go OTM in 3 weeks (week 1 -c240.36, week 2 -c245.36, week 3 -c250.36); this means rolling 3 times and going up total 15

- if i roll with 10-strike improvement every week, it will go OTM in 1 week (week 1 -p245.36); this means rolling 1 time and going up total 10

if one is selling 15% OTM calls, any breached call will take at most 2 rolls before it goes OTM (10-strike improvement every week, total $20 improvement) ie move -c200 into -c210 into -c220

if one is selling 8% OTM calls, there is a 15.82% chance that it will go ITM.

summary:

- rolled puts go OTM faster than rolled calls, especially if there is a 5- or 10- strike improvement every week

- assuming no early assignment, there is no "max loss" when rolling puts - 100% will eventually go OTM (since 2021)

- assuming no early assignment, "max loss" is possible when rolling calls

- "max loss" means you can roll up to today or for a long time, and it will still be ITM (might as well take the loss)

- translation: i should be more afraid of rolling calls than puts

View attachment 1009633

View attachment 1009660

Aaah, no. If the Call is ITM, you are lucky to roll up $5/week without a debit.@Yoona thank you for this GREAT information. An additional consideration, probably difficult to model, is that in some cases by rolling ITM CC at 5 strike increments, you could gain some additional extrinsic premium value each week. For example you MIGHT be getting $2 or even $3 in premium each of those weeks, depending on how close you are to ITM, rather than $1 or less. The additional handful of premium dollars during the weeks you are rolling to OTM, can help you get to "break even" a little faster. Thanks again!

OptionsGrinder

Member

I didn't say anything about debits (or credits).. only talking about the extrinsic premium value that you can extract while waiting for price to come into your new strike levelsAaah, no. If the Call is ITM, you are lucky to roll up $5/week without a debit.

tivoboy

Active Member

I think it’s more about the fact that the ~ 5K German EV subsidy ended, and Tesla is trying to keep pricing relatively same for Germany and European buyers.Model Y price cuts are probably because the new version is coming and they need to clear inventory without angering current buyers.

Tesla offered to cut price in Germany for half of December, AND give 1% loans to new buyers. Now, they just cut price, and carried much across Europe. They also lost the EV sales lead to VW, so this is trying to keep market share and sales. Germany is also just about AT recession (if not already), so throttling Berlin for a few weeks, and probably not pushing for more shifts will indicate more about overall market demand.

BTC these for a $17k profit…not because I think they might suddenly be ITM, but rather so I can sell the underlying shares on any bounce. See everyone on the other side of earnings. GLHF!Now on to more fun, STO 200x C225s for this Friday instead. If @dl003 gets his run up to $232, I'll still be very happy with seeing this particular block of shares get called away at $225.

juanmedina

Active Member

in freefall times like these, this chart is my comfort level

i know that i can roll down with 10-strike improvement every week and a 30-wide spread will get credit and it will OTM within 2 weeks (based on backtesting to 2021)

not advice. Past performance is no guarantee of future results.

i know that i can roll down with 10-strike improvement every week and a 30-wide spread will get credit and it will OTM within 2 weeks (based on backtesting to 2021)

not advice. Past performance is no guarantee of future results.

Last edited:

Held yesterday's lows so far.

QQQ lost the 50-day, everything is very heavy here, hope TSLA can hold up.

QQQ lost the 50-day, everything is very heavy here, hope TSLA can hold up.

We might be done with wave C. It now rests on ER.I wonder if the dump we had to $212 today so close to ER (5 days…) will suffice.

@dl003 has your recent EW count showing we might be done with down (Wave C) @ $232 and may start a skyrocketing new leg up been invalidated with the added dump from $232 to $212 or only strengthens it?

View attachment 1009612

We might be done with wave C. It now rests on ER.

What's your gut feeling where TSLA's heading after ER?

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 6K