intelligator

Active Member

1/26 -p205/+p165 look good to you? I left to sit 1/19 -p215/+p175 but could be a decent roll if needed, good lower IC position standalone.

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

1/26 -p205/+p165 look good to you? I left to sit 1/19 -p215/+p175 but could be a decent roll if needed, good lower IC position standalone.

1/26 -p205/+p165 look good to you? I left to sit 1/19 -p215/+p175 but could be a decent roll if needed, good lower IC position standalone.

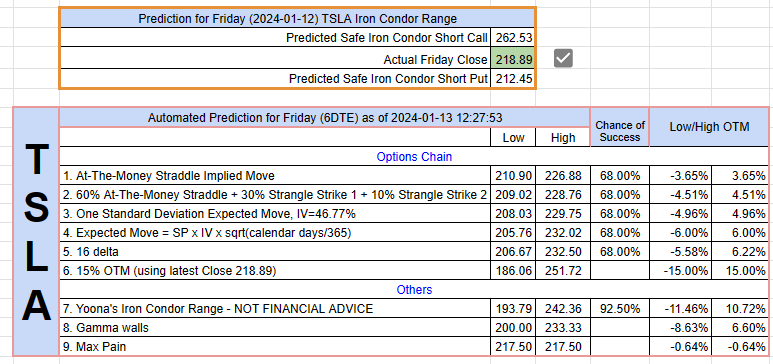

1/19 options market predicting 205-230ish

BTC those for a nice $15k profit this AM, TY for making me think of this strike, @BornToFly - dinner at Dante's on Grant is on me if the timing ever works out, as a minor "TY!"That is a nice premium for $230 for this Friday...I'll join you, STO 200x C230s for this Friday against some of my newly-purchased shares from this AM.

Hmm...question asked of myself, and I answered back with a resounding "Absolutely not!" Then I clicked over to the Fidelity tab...Again, ask yourself if you should be trading this stock. Don't want to be an asshole. Just want to remind how easily manipulated we can be sometimes.

Must have gone all in on PutsAgain, please sell all your stock tomorrow, go full short and never cover if you are apalled by today's breaking news. Talk is cheap peeps.

Im annoyed by all you little people crying over stuff that doesnt matter.

last check DI003 got boatloads of -225P,Must have gone all in on Puts

Is the below something similar to what you have in mind for next week?257 is dead. The 0.381 retracement now lies at 232. TSLA will get there before ER even if it's a dead cat, especially if it's a dead cat. Let's get there first then we'll look at the structure.

Do you think that will be a magnet, or make 230 Calls safe?

Do you think that will be a magnet, or make 230 Calls safe?

OI call walls are not the same as gamma wallsDo you think that will be a magnet, or make 230 Calls safe?

Thanks for clarifying! I should really learn to call them gamma walls.OI call walls are not the same as gamma walls

View attachment 1009514

sp doesn't magnet or gravitate into a call wall, no matter how high it is

if sp is below but near a tall gamma wall, especially those with high OI, it will magnet into it going up (dealers buy shares)

if sp is above but near a tall gamma wall, especially those with high OI, it will magnet into it going down (dealers sell shares)

there are times where a tall gamma wall = tall call wall, this happens as we approach 0DTE (hence, the confusion)

next week max pain = 235 but gammas saying 200-210Thanks for clarifying! I should really learn to call them gamma walls.

next week max pain = 235 but gammas saying 200-210

if dealers succeed in pushing up sp near mp, the red walls shrink and the green walls climb

if they fail and we are near the tallest red walls, they become magnets

View attachment 1009515

Anything can happen, but $230 calls for 1/19 are likely quite safe. Even $225 calls for 1/19 seem quite safe to me. I hope I am very, very wrong, and 100% look forward to this being thrown in my face within the next 72 hours.Do you think that will be a magnet, or make 230 Calls safe?