I'd only short the bounces. Unless it penetrates the lower trendline support here and stay down for a couple of days.Thank you. I missed my chance selling my longs and cutting a handful of +C150 12/2025 LEAPS at the break of $241 to rebuy lower (was in a meeting), I'm thinking it's too late and not safe to do so now since we may bounce off $234 for a bit and perhaps not violate it until next week if at all. Are you seeing similar or time to go short even here (NFA)?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

ThanksI'd only short the bounces. Unless it penetrates the lower trendline support here and stay down for a couple of days.

SpeedyEddy

Active Member

Just checked and I made a mistake by skewing graphs. There are only a few days Russel (going up) outpaced S&P, too little to call it a trend, so have to admit I was wrong on the Russel call.I do not see what you see (and I hold and trade several small cap indices) but that’s what makes a market. GL

BTW I went all in on shares again, expecting to (if it would be a DCB) to have a bit of time to catch a profit on closing out. (In Holland collecting Gains on options and shares privately are free of taxes, only the value EOY counts for capital tax.)

That's so civilised compared to Belgium, we get taxed on every transaction and losses on shares are not deductible, plus hefty broker fees on share transactions and a government tax on shares buy/sells - so it's actually much better to trade options, which is crazyJust checked and I made a mistake by skewing graphs. There are only a few days Russel (going up) outpaced S&P, too little to call it a trend, so have to admit I was wrong on the Russel call.

BTW I went all in on shares again, expecting to (if it would be a DCB) to have a bit of time to catch a profit on closing out. (In Holland collecting Gains on options and shares privately are free of taxes, only the value EOY counts for capital tax.)

Anyway, that's a bit of a shitshow out there today... I rolled down 20x 9/29 -c250 to 40x -c240, annoyingly my sell order for $6.2 was missed by 20c during the last visit to the high 242's at 11:35EST, in the end I settled for a measly $2.7 when the stock scraped its way back above 236, still, likely all profit, so better than a poke in the eye

-p240's looking a bit sorry for themselves, but have a free roll down to -p230 for next week at this moment, but will wait until Friday at there's loads of extrinsic ($2.5) with the IV being fairly high

Expecting 4x -p270 to be assigned tonight, I hope so as 4x of the -c240's are naked right now

tivoboy

Active Member

+1 Being highly self actualized doth a great trader make! ;-)Just checked and I made a mistake by skewing graphs. There are only a few days Russel (going up) outpaced S&P, too little to call it a trend, so have to admit I was wrong on the Russel call.

BTW I went all in on shares again, expecting to (if it would be a DCB) to have a bit of time to catch a profit on closing out. (In Holland collecting Gains on options and shares privately are free of taxes, only the value EOY counts for capital tax.)

Bounced off the trendline. (?)

SpeedyEddy

Active Member

Now, adding up all knowledge over here , I come to the following thesis. 234 and a bit was (again) an intermediate bottom just above the projected level. Now we will rise into Friday’s close possibly around 250 or 255, (PCE coming in hot). Then weekend comes without any news from Tesla except for disappointing P&D. Starting Monday we really start to crash down to 212 in a few days, back up to 225-230, then 180-185 to complete the move…. (Gut feeling, nothing EW or TA). Who can enlighten us more precise. (This is me thinking aloud and not any kind of investment advise)

All's well that ends well (for today at least):

QTA ranges today vs actual market

QTA ranges today vs actual market

ZenMan

Member

Now, adding up all knowledge over here , I come to the following thesis. 234 and a bit was (again) an intermediate bottom just above the projected level. Now we will rise into Friday’s close possibly around 250 or 255, (PCE coming in hot). Then weekend comes without any news from Tesla except for disappointing P&D. Starting Monday we really start to crash down to 212 in a few days, back up to 225-230, then 180-185 to complete the move…. (Gut feeling, nothing EW or TA). Who can enlighten us more precise. (This is me thinking aloud and not any kind of investment advise)

I think Tesla will announce CyberTruck delivery event this weekend to try and blunt the effects of P&D miss.

SpeedyEddy

Active Member

Tesla the company nor Elon never do anything intentionally to let the stockprice move at a certain moment. Their moves on the other hand will move the stock without intent. Stockprice is never a motivation to execute or not execute things on the business-side (which in many cases would be illegal also)I think Tesla will announce CyberTruck delivery event this weekend to try and blunt the effects of P&D miss.

juanmedina

Active Member

Im going to wait for a bounce to 250 before selling calls. Although I was waiting for a break of 238 to make the call, I've been steadily adding to my leap naked short calls on this entire week. Adding more here would be too greedy so I've stopped.

What strikes are you thinking about selling? what expiration?

In the new Musk biography, which I just finished reading, there was mention of a scramble to announce something before end of quarter to boost the company’s valuation, which became “AI day” if I’m recalling correctly. This is neither illegal nor uncommon.Tesla the company nor Elon never do anything intentionally to let the stockprice move at a certain moment. Their moves on the other hand will move the stock without intent. Stockprice is never a motivation to execute or not execute things on the business-side (which in many cases would be illegal also)

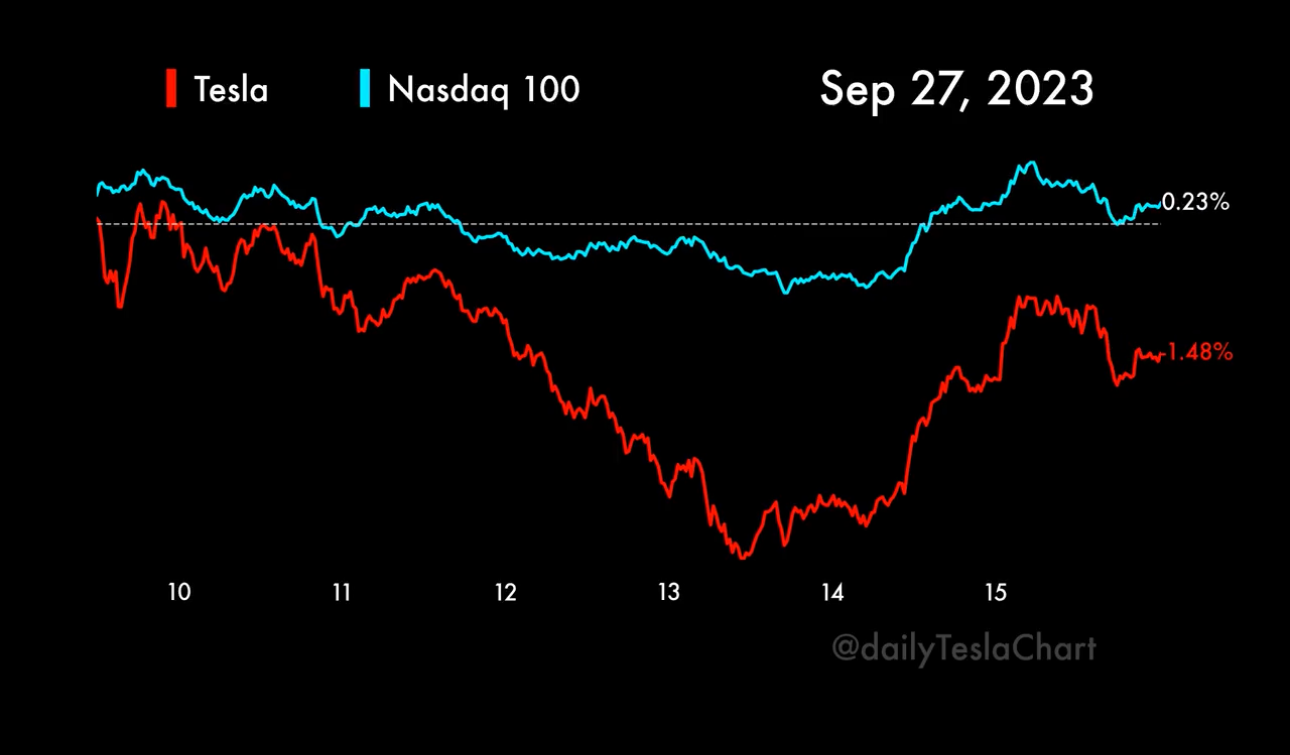

Video of Tesla TSLA vs Nasdaq 100 $QQQ today:

SpeedyEddy

Active Member

Ai day was rescheduled from beginning of August to sept 30th 2022. So same quarter. Curious about the passages in the book!

Ai day was rescheduled from beginning of August to sept 30th 2022. So same quarter. Curious about the passages in the book!

I’ll see if I can find it. Curious how September 30 is end of Q3 too

We did break 238 today. Do you mean a close below 238 or does an intra day break count?A triple top breakout is off the table. The moment of truth is only $1 away. If TSLA breaks 238 then 185 will be confirmed.

Y'all still tracking events hoping for miracles?

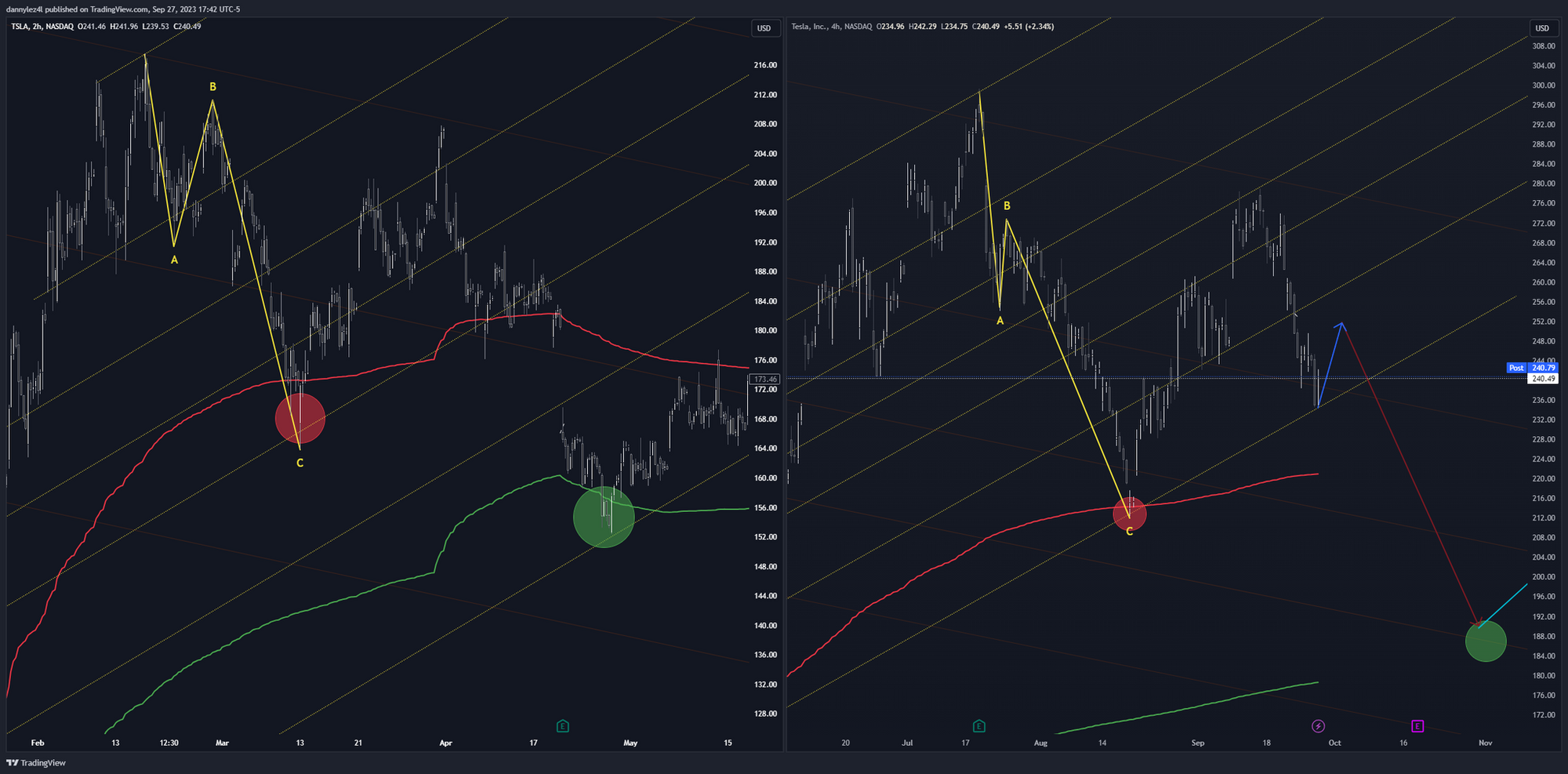

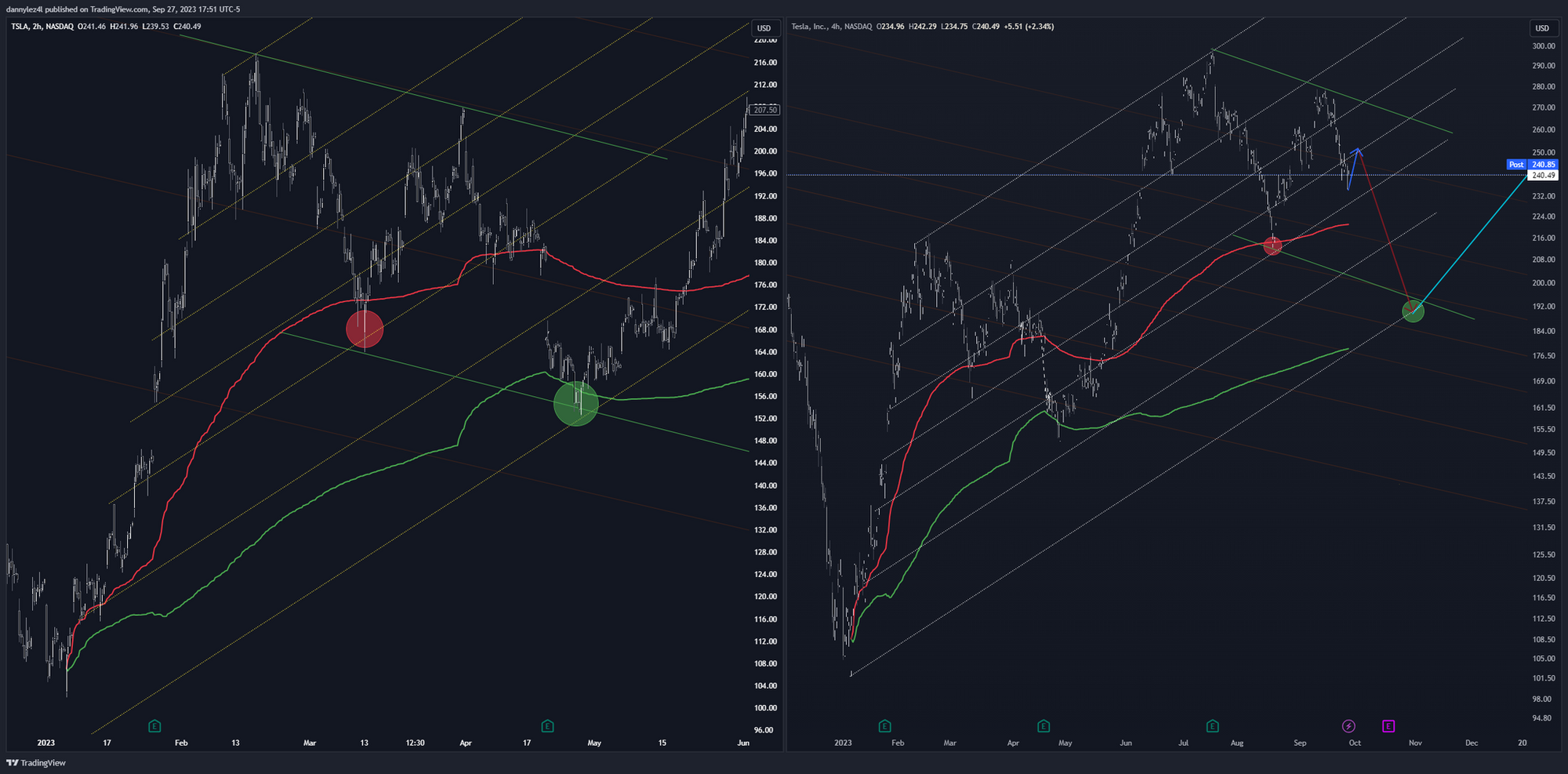

One of my favourite tools to predict the future is fractals. Fractals are intricate (complex) setups on the chart that repeat themselves. This can happen on the same timeframe / wave degree or it can happen on different time frames / wave degrees. At first it gives you a vague deja vu feeling, but then the pieces keep falling into place and so for the next days or weeks you seem to be able to see the future, until the current setup starts deviating from the old one.

Right now, the current correction in TSLA is tracking the 217-152 correction earlier this year super closely. Eerie. So that's going to be my basis for levels and forecasts until it turns out to be grade A voodoo.

217-152 corrected the first leg up from 102 to 217. This time 298 - 185 is going to correct the entire 102-298 rally. Look at the 2 side by side, starting with the first leg down in yellow and how they both ended at anchored vwap running from 102

Then look at the big dead cat that came after. 1st spike. small consolidation. Break out. Big consolidation. Break out. Blow off top. Flush.

The 217-152 correction ended at the lower band of AVWAP. This time I'm betting it's going to do the same thing at 185-190.

251 is where short positions can be considered. 256 if mr. market is generous.

One of my favourite tools to predict the future is fractals. Fractals are intricate (complex) setups on the chart that repeat themselves. This can happen on the same timeframe / wave degree or it can happen on different time frames / wave degrees. At first it gives you a vague deja vu feeling, but then the pieces keep falling into place and so for the next days or weeks you seem to be able to see the future, until the current setup starts deviating from the old one.

Right now, the current correction in TSLA is tracking the 217-152 correction earlier this year super closely. Eerie. So that's going to be my basis for levels and forecasts until it turns out to be grade A voodoo.

217-152 corrected the first leg up from 102 to 217. This time 298 - 185 is going to correct the entire 102-298 rally. Look at the 2 side by side, starting with the first leg down in yellow and how they both ended at anchored vwap running from 102

Then look at the big dead cat that came after. 1st spike. small consolidation. Break out. Big consolidation. Break out. Blow off top. Flush.

The 217-152 correction ended at the lower band of AVWAP. This time I'm betting it's going to do the same thing at 185-190.

251 is where short positions can be considered. 256 if mr. market is generous.

Last edited:

tivoboy

Active Member

You had me at fractalY'all still tracking events hoping for miracles?

One of my favourite tools to predict the future is fractals. Fractals are intricate (complex) setups on the chart that repeat themselves. This can happen on the same timeframe / wave degree or it can happen on different time frames / wave degrees. At first it gives you a vague deja vu feeling, but then the pieces keep falling into place and so for the next days or weeks you seem to be able to see the future, until the current setup starts deviating from the old one.

Right now, the current correction in TSLA is tracking the 217-152 correction earlier this year super closely. Eerie. So that's going to be my basis for levels and forecasts until it turns out to be grade A voodoo.

217-152 corrected the first leg up from 102 to 217. This time 298 - 185 is going to correct the entire 102-298 rally. Look at the 2 side by side, starting with the first leg down in yellow and how they both ended at anchored vwap running from 102

The 217-152 correction ended at the lower band of AVWAP. This time I'm betting it's going to do the same thing at 185-190.

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K