Almost 1% Green! I was a good surgeon. Maybe I should go back. I REALLY, REALLY suck at this....Well that plan didn't work... I closed all my 2/11 BPS yesterday trying to enter new positions on a dip today. Was licking my chops at the open and then the SP... went up?

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

I had some aggressive day trading 955/1005bcs and 900/885bps set up yesterday (yes small spread, low margin), assuming the market wouldn't enjoy +950 or -900. Turns out my bcs aren't aggressive at all, and my bps are.

bkp_duke

Well-Known Member

i also thought of quick daytrade 2/11 +p800/-p900/-c1000/+c1100 $4.90 credit, but decided not to go ahead

edit: too chicken

Same here. Too chicken.

Glad I didn't, I would be sweating right now more than I like.

The wild 2/11 900/885bps was at +50% so I closed it.

Edit: seems to be right on top. For now.

Edit: seems to be right on top. For now.

chiller

Member

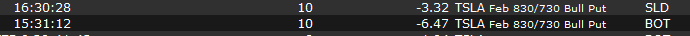

Did a quick 1 hour trade this morning:

EDIT: this is GMT+1 so market open is at 15:30.

EDIT: this is GMT+1 so market open is at 15:30.

Last edited:

Knightshade

Well-Known Member

So I've managed to dodge any loss on BPSes so far, most are managed out for a while- but I've got a few losers that slipped through the cracks at -1025/+915 for tomorrow expiration.

So following this up real quick, I've ended up in -1000/+800 spreads for 2/18 on these

Long as we stay over 900 I can keep rolling these weekly for a small credit (and sweating early assignment if I wait too late in the week I suppose)... but without any major "good" news likely anytime soon I dunno that we close over 1k anytime soon either.... With the current pop looks like I could roll to 4/14 at -950/+750 for either even or a $1ish/sh credit.

Which gets me hoping we can close >950 in between P&D and ER. But also leaves a bunch of time macros could blow stuff up.

Any thoughts on the situation? Stick to week to week or push out and keep a hunk of margin tied up longer?

Same here. Too chicken.

Glad I didn't, I would be sweating right now more than I like.

Looks like you made the right call. When my head and gut don’t agree, I think harder about what I’m considering. just make sure whatever you get into would be rollable if things don’t go as expected

I sure didn’t expect us to end up green this morning

I don’t know anything about spreads(yet?) but I sold and bought my first put this morning. 2/18 850 open at 11.55 (had a limit for 10 even, so scored) sold minutes later for 6. Seems like the right idea. Only really made money on buying calls the weekend of P/D announcement, Friday weekly 1200 for 5 sold Monday for 20. These puts seem way more profitable and selling safe calls…also got an April 14 850 put @ 56 that is probably better to keep a bit? Or could sell at 46 probably today

Last edited:

I did a couple of 870/910 960/1000 IC earlier. They're in and out of green now but I'm not overly concerned about them.

Well, it seems I fat fingered the 955/1005bcs yesterday because I thought they were 2/11 and really sweet, but it turns out they're 2/18.Sorry, 2/11. I don't dare to look that far into the future that close ATM. In this case I looked at the open interest and volume charts to guesstimate the market will end somewhere between 900 and 950 this Friday.

But I will look at 2/18 to see if that's true for day trading.

Yeah once green I'm getting out of this.

In case you are all wondering why we are Red now.... 5 minutes ago I sold a bunch of 850/750s for tomorrow (when it was already worth less than half of what it was earlier this morning). Please excuse me while I go to the garage and sharpen some old scalpels....

Last edited:

In case you are all wondering why we are Red now.... 5 minutes ago I sold a bunch of 850/750s for tomorrow (when it was already worth less than half of what it was earlier this morning). Please excuse me while I go to the garage and sharpen some old scalpels....

Don't be so hard on yourself. One of the FOMC members made some very hawkish comments at about 9:45 AM PT / 12:45 PM ET:

TheTalkingMule

Distributed Energy Enthusiast

Don't be so hard on yourself. One of the FOMC members made some very hawkish comments at about 9:45 AM PT / 12:45 PM ET:

That's barely hawkish IMO, and the path I prefer.

.25/.25/.5

We are running perfectly great all things considered, and if this pandemic is truly over, we should ride the super-tight job market to higher rates.

We need to have room to operate if the bottom falls out and we need to turn around and lower 12-24 months from now.

TSLA is looking super strong considering all the change and uncertainty swirling about. If it's not tanking now, I don't see the logic in tanking 3 Fed meetings from now when insane 1Q earnings are already out.

Exciting times, if a bit flat.

corduroy

Active Member

I just closed out my last BPS position -835/735 position at 92% profit. I now have no open positions (except LEAP stuff). Can't remember the last time that happened. I was purposely de-risking around the CPI numbers and waiting for a sharp enough down move to open something new, but that hasn't come yet this week.

I have been selling quite a few NVDA iron condors though, IV is high right now so pretty good returns.

I have been selling quite a few NVDA iron condors though, IV is high right now so pretty good returns.

Are we really going to test 850 tomorrow?!?In case you are all wondering why we are Red now.... 5 minutes ago I sold a bunch of 850/750s for tomorrow (when it was already worth less than half of what it was earlier this morning). Please excuse me while I go to the garage and sharpen some old scalpels....

samppa

Active Member

Closed all my -c1000 for tomorrows expiry at 90% profit.

Will sell more calls on the next green day.

I've started to sell fairly aggressive weekly covered calls on all my shares. My aim is to roll these if they go close to itm, and eventually let them assign and go to all cash.

Will sell more calls on the next green day.

I've started to sell fairly aggressive weekly covered calls on all my shares. My aim is to roll these if they go close to itm, and eventually let them assign and go to all cash.

Once you decide to sell, then selling really aggressive covered calls gets really easy, eh?Closed all my -c1000 for tomorrows expiry at 90% profit.

Will sell more calls on the next green day.

I've started to sell fairly aggressive weekly covered calls on all my shares. My aim is to roll these if they go close to itm, and eventually let them assign and go to all cash.

I'm taking the move down this morning to open some put spreads for next week. 850/550s at $10 each. I'm using the really wide spreads to keep a wide range of management choices available. All the way down to the 700 strike midpoint if needed, though with IV going down I suspect that effective rolls won't go down that far.

Mostly since I'm going with cash secured puts or close to it, these are fully cash backed and have a nearly naked put profile. The insurance put is around .05, so the overall position will evolve as if it were a naked put over a fairly wide range below the 850 strike.

I've also got 950 and 970 strike covered calls for next week, leaving me in an 850 / 950 effective strangle. It's actually a vertical spread on one side and a diagonal spread on the other side, but my analysis, management, and tracking of the position is more consistent with a strangle.

Mostly since I'm going with cash secured puts or close to it, these are fully cash backed and have a nearly naked put profile. The insurance put is around .05, so the overall position will evolve as if it were a naked put over a fairly wide range below the 850 strike.

I've also got 950 and 970 strike covered calls for next week, leaving me in an 850 / 950 effective strangle. It's actually a vertical spread on one side and a diagonal spread on the other side, but my analysis, management, and tracking of the position is more consistent with a strangle.

Just STO 10x -p750 18/2 for a ridiculous 1.25

I was hesitant to go for 850 and then roll down if the SP goes in the 800s but I feel like playing a little bit safer. I have some 10x -p925 18/2 I rolled beginning of January. I don’t feel like having to roll 2 positions again.

Tuesday, I BTC my -p910 11/2 for 50% profit and STO -p850 25/2. Yesterday, I was telling myself I closed it too early and should have extracted more juice but today happy to have done so with the new SP movement. I was expecting a close near maxpain however the opposite of what I expect happens. Going to stay safe until we resume a clear bull trend after some rangebound sideways trading.

My 20x 18/2 1050 CCs are already +50% after 2 days. Hesitant to close it today and open a new position tomorrow but not sure I will be able to open it into strength as I am working and won’t be available for most of the day. Might keep them like that. They are good looking.

I was hesitant to go for 850 and then roll down if the SP goes in the 800s but I feel like playing a little bit safer. I have some 10x -p925 18/2 I rolled beginning of January. I don’t feel like having to roll 2 positions again.

Tuesday, I BTC my -p910 11/2 for 50% profit and STO -p850 25/2. Yesterday, I was telling myself I closed it too early and should have extracted more juice but today happy to have done so with the new SP movement. I was expecting a close near maxpain however the opposite of what I expect happens. Going to stay safe until we resume a clear bull trend after some rangebound sideways trading.

My 20x 18/2 1050 CCs are already +50% after 2 days. Hesitant to close it today and open a new position tomorrow but not sure I will be able to open it into strength as I am working and won’t be available for most of the day. Might keep them like that. They are good looking.

Last edited:

ChefBoyardee

Member

Closed some more IC call legs just now for decent profit since 905 is resistance. I'm expecting a recovery, but if we decide to test 870 I'll close some more

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K