Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

Re if it’ll boost SP at all, as mentioned earlier I believe the big boys here said that any revenue recognition in a given quarter for FSD will be viewed as a one-off by WS and not boost SP meaningfully if at all.Tesla has removed the "Beta" name from the latest FSD software. This leads to questions about FSD revenue release.

However, if FSD revenue continues to show revenue growth quarter-after-quarter, then and only then will it possibly lead to affecting the share price positively.

If so, other than FOMO for a ChatGPT moment (whatever that means…), likely nothing tangible until several more quarters pass. Hopefully we can be surprised but I’m not counting on it.

(Maybe one benefit is it may help keep TSLA from falling too low ($120-$100) over the next few days or after upcoming earnings call.)

Last edited:

I agree with you. The challenge with options right now is that we know a major change in the fundamentals is coming from FSD. We just don't know when. I have CCs for Friday sitting at 180 and 185, and a 2 year old BPS for the following week at +170/-195P (hence the aggressive CCs). I can't tell if the SP is dropping this week or shooting up to 200. I can justify and see a path to either outcome. Based on that, you could make the argument to stay out of the market, but the breakout to ATH could start this month, or in two years. That is a long time to stay out for fear of being run over on CCs.Re if it’ll boost SP at all, as mentioned earlier I believe the big boys here said that any revenue recognition in a given quarter for FSD will be viewed as a one-off by WS and not boost SP meaningfully if at all.

However, if FSD revenue continues to show revenue growth quarter-after-quarter, then and only then will it possibly lead to affecting the share price positively.

If so, other than FOMO for a ChatGPT moment (whatever that means…), likely nothing tangible until several more quarters pass. Hopefully we can be surprised but I’m not counting on it.

(Maybe one benefit is it may help keep TSLA from falling too low ($120-$100) over the next few days or after upcoming earnings call.)

Thinking like this is what makes people buy services from guys posting pics with their Ferrari and their million $ homes.Look the guys obviously crazy. His also an uber driver and has no blue tick so he doesn't exactly have a huge amount of disposable income.

He may have been right on the 185 and 175 call but you know he would be a billionaire if he was right on the 300 top, sold everything and leveraged his entire networth on NVDA 800 yearly contracts around July 2023. A few correct calls doesn't make you a savant. Money talks and we all know if you have enough money you stop posting tips on how to make money.

Me? I'm not trading based on his prediction, but also not judging his technicals based on whatever he may say about P&D and fundamentals. It is a waste of time. I just need to wait and see if his predictions come true or not.

"Money talks and we all know if you have enough money you stop posting tips on how to make money." This probably goes for me and Yoona and tivoboy and a lot of other people on this thread.

Last edited:

StarFoxisDown!

Well-Known Member

The real data that’s going to determine how Wall St chooses to value FSD for the near term is how many people opt for the monthly subscription after this one month of free FSD.Re if it’ll boost SP at all, as mentioned earlier I believe the big boys here said that any revenue recognition in a given quarter for FSD will be viewed as a one-off by WS and not boost SP meaningfully if at all.

However, if FSD revenue continues to show revenue growth quarter-after-quarter, then and only then will it possibly lead to affecting the share price positively.

If so, other than FOMO for a ChatGPT moment (whatever that means…), likely nothing tangible until several more quarters pass. Hopefully we can be surprised but I’m not counting on it.

(Maybe one benefit is it may help keep TSLA from falling too low ($120-$100) over the next few days or after upcoming earnings call.)

If the take rate is even somewhat good, I expect Tesla (and Elon) to make it very public known.

Starting with Q2 earnings, I'm really hoping Tesla switches to reporting FSD subscriber numbers.

All Tesla needs to do is give wall st some key data points to track and if the curve is at least decent, wall st will hype it.

I agree with you. The challenge with options right now is that we know a major change in the fundamentals is coming from FSD. We just don't know when. I have CCs for Friday sitting at 180 and 185, and a 2 year old BPS for the following week at +170/-195P (hence the aggressive CCs). I can't tell if the SP is dropping this week or shooting up to 200. I can justify and see a path to either outcome. Based on that, you could make the argument to stay out of the market, but the breakout to ATH could start this month, or in two years. That is a long time to stay out for fear of being run over on CCs.

Sounds like a scenario that calls for shorter DTE plays, gradually entering into positions, and not being greedy. Hmmm, where have I heard that before...?

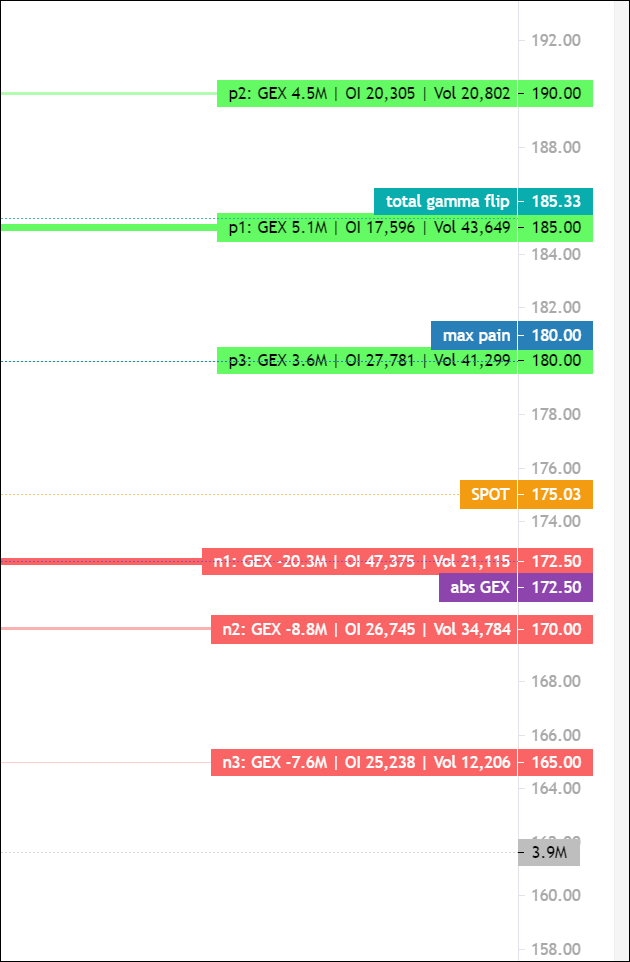

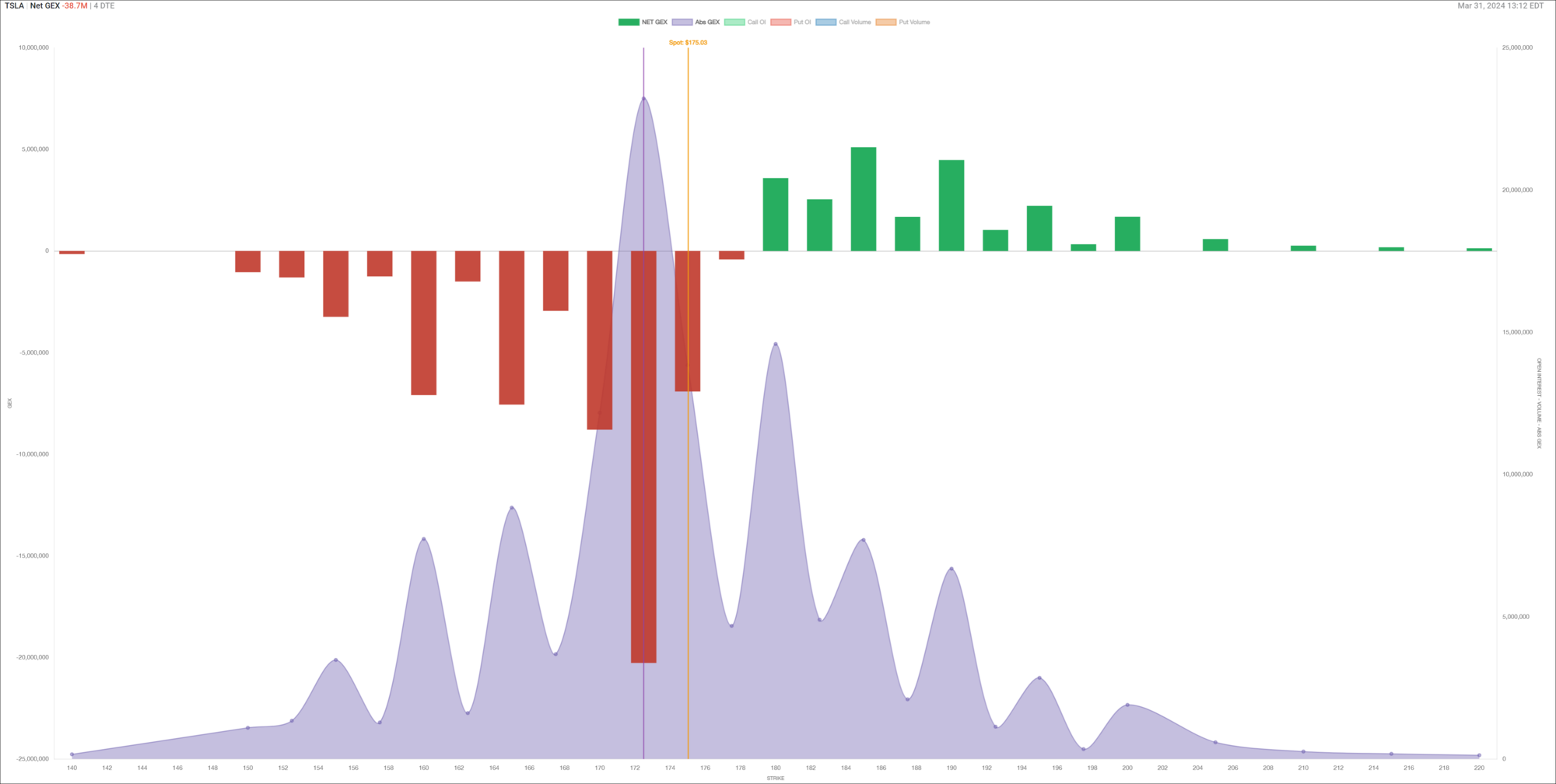

Interesting GEX profile this week:

Highest Call OI (potential stall area up): $180.00

Highest Put OI (potential stall area down): $172.50

Gamma flip: $185.33

Max Pain: $180.00

Moving Averages:

5-Day: $175.35

20-Day: $176.16

50-Day: $187.29

Highest Call OI (potential stall area up): $180.00

Highest Put OI (potential stall area down): $172.50

Gamma flip: $185.33

Max Pain: $180.00

Moving Averages:

5-Day: $175.35

20-Day: $176.16

50-Day: $187.29

Regarding FSD, the only thing that matters for the stock is increase of the uptake rate. I can't see value at $12,000 for a supervised system. $12,000 requires the perceived path to autonomous driving. On the plus side, it might help add monthly subscriptions for now.

I think we are starting to see a shift in perception for Tesla, now they just need to do a good earnings call.

I think we are starting to see a shift in perception for Tesla, now they just need to do a good earnings call.

TSLA the day after the earnings call for the past four (!) quarters:

23.4Q (1/25): -12.13%

23.3Q (10/19) : -9 .30%

23.2Q (7/20) : -9 .74%

23.1Q (4/20) : -9 .75%

(Credit: Bb1btc)

23.4Q (1/25): -12.13%

23.3Q (10/19) : -9 .30%

23.2Q (7/20) : -9 .74%

23.1Q (4/20) : -9 .75%

(Credit: Bb1btc)

"but this time it's different"TSLA the day after the earnings call for the past four (!) quarters:

23.4Q (1/25): -12.13%

23.3Q (10/19) : -9 .30%

23.2Q (7/20) : -9 .74%

23.1Q (4/20) : -9 .75%

(Credit: Bb1btc)

A few more of those drops and there’s nowhere left to go down but up"but this time it's different"

But maybe, as many on these forums think, the most probable bad P&D and lower earnings are already baked in based on the 30% stock price decline since the beginning of 2024. I don’t think so, but we will find out in less than 1 month. I have made my options placements, both short and longer term.TSLA the day after the earnings call for the past four (!) quarters:

23.4Q (1/25): -12.13%

23.3Q (10/19) : -9 .30%

23.2Q (7/20) : -9 .74%

23.1Q (4/20) : -9 .75%

(Credit: Bb1btc)

Curious how you positioned for it.I have made my options placements, both short and longer term.

Just need “60 Minutes”Just send @Yoona the spreadsheet.. we’ll figure it all out, backrest it and build a PA model around it and buy an island.

Like Australia. ;-)

tivoboy

Active Member

As I’m oft to say, like a broken clock, I’m at least right twice a day.Who know. A lot of Savant are also Wacko. Maybe he fit in between somewhere

Let give the guy a few more days and let see.

but TWELVE broken clocks, each at a different time well one of them is ALWAYS right.

So my objective has always been, to surround myself by at least ELEVEN OTHER CLOCKS.

Welcome to the clock store. ;-)

tivoboy

Active Member

This, more than mostly anything else.yes, his Market On Close (screenshot 3:55pm) is the Closing Cross (starts at 3:55pm and executes at 4pm)

his view on MOC is one-sided: it is a bet for the next day but i don't think he realizes it is also a short covering of the whole day; tweets are misleading since short covering is always neutral but seen as bullish (ie, he sees a massive 4M order at 3:55 which in reality could be just be a buyback/closing of the day's MMD)

Hmmm…word is Tesla IR compiled consensus for Q1 2024 is 443k deliveries, with avg/median @ 431k.

Estimates provided by Baird, Barclays, Bernstein, Bank of America, Canaccord, Citibank, Cowen, Daiwa, Deutsche Bank, Evercore ISI, Exane BNP, Goldman Sachs, Guggenheim, HSBC, Jefferies, JP Morgan, Mizuho, Morgan Stanley, Needham & Co, New Street Research, Oppenheimer, Piper Sandler, Redburn, RBC, Truist, Tudor, UBS, Wedbush, Wells Fargo, and Wolfe.

Which will it be:

Beat

Meet

Big miss

Small miss

Estimates provided by Baird, Barclays, Bernstein, Bank of America, Canaccord, Citibank, Cowen, Daiwa, Deutsche Bank, Evercore ISI, Exane BNP, Goldman Sachs, Guggenheim, HSBC, Jefferies, JP Morgan, Mizuho, Morgan Stanley, Needham & Co, New Street Research, Oppenheimer, Piper Sandler, Redburn, RBC, Truist, Tudor, UBS, Wedbush, Wells Fargo, and Wolfe.

Which will it be:

Beat

Meet

Big miss

Small miss

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K