But what kind of cells are they? I think Ford and GM exclusively use pouch cells, which Tesla will not use.I thought CATL was manufacturing cells in the USA, with Ford and GM almost stopping EV production you would think there'd be some surplus

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Wiki Selling TSLA Options - Be the House

- Thread starter adiggs

- Start date

@tivoboy Looks like 12/15 turning out as you predicted

I'm thinking of selling some -C310 3/15/24, anticipating Jan/Feb weakness. It's offering around $4.00 today. Are you thinking we dump more from here or there's a chance we can get better prices if we wait a bit (and if that strike/DTE is a decent r:r)?

Ty

I feel like the JPow presser offers the best chance at one more pump.

tivoboy

Active Member

No rate hike today, Powell will TRY to present Hawkisk Fed, leave even a possible hike in Jan on the table as crazy as that might sound. No cuts till late Q2’24 earliest. Unless all goes to hell in a hand basket In Q1‘24 which is possible, but not probable.Interest decision: last chance to hike for obvious reasons (elections) I guess they won't. Stocks up a bit

Powell will again likely ruin the party by hinting for a year longer no cuts. Stocks fall. Next meeting they will cut to window dress Bidenomics.

halfway to the SP top today I sold C232.5, that now are more than 1 dollar up. Will close before 14:00 most likely.

Starting to feel more bearish than yesterday. Especially because the direction is not turning up after MA4x.

Maybe a meltdown is coming (which is good for taxes in Holland), but we will know soon enough, maybe even before today's close.

Last edited:

tivoboy

Active Member

In the near term, I don’t think prices for SELLING CC are going to go higher, if that is what you were asking. We just had a further dump, puts are jumping nicely. If we see a $22X, if will get pretty testy.@tivoboy Looks like 12/15 turning out as you predicted

I'm thinking of selling some -C310 3/15/24, anticipating Jan/Feb weakness. It's offering around $4.00 today. Are you thinking we dump more from here or there's a chance we can get better prices if we wait a bit (and if that strike/DTE is a decent r:r)?

Ty

tivoboy

Active Member

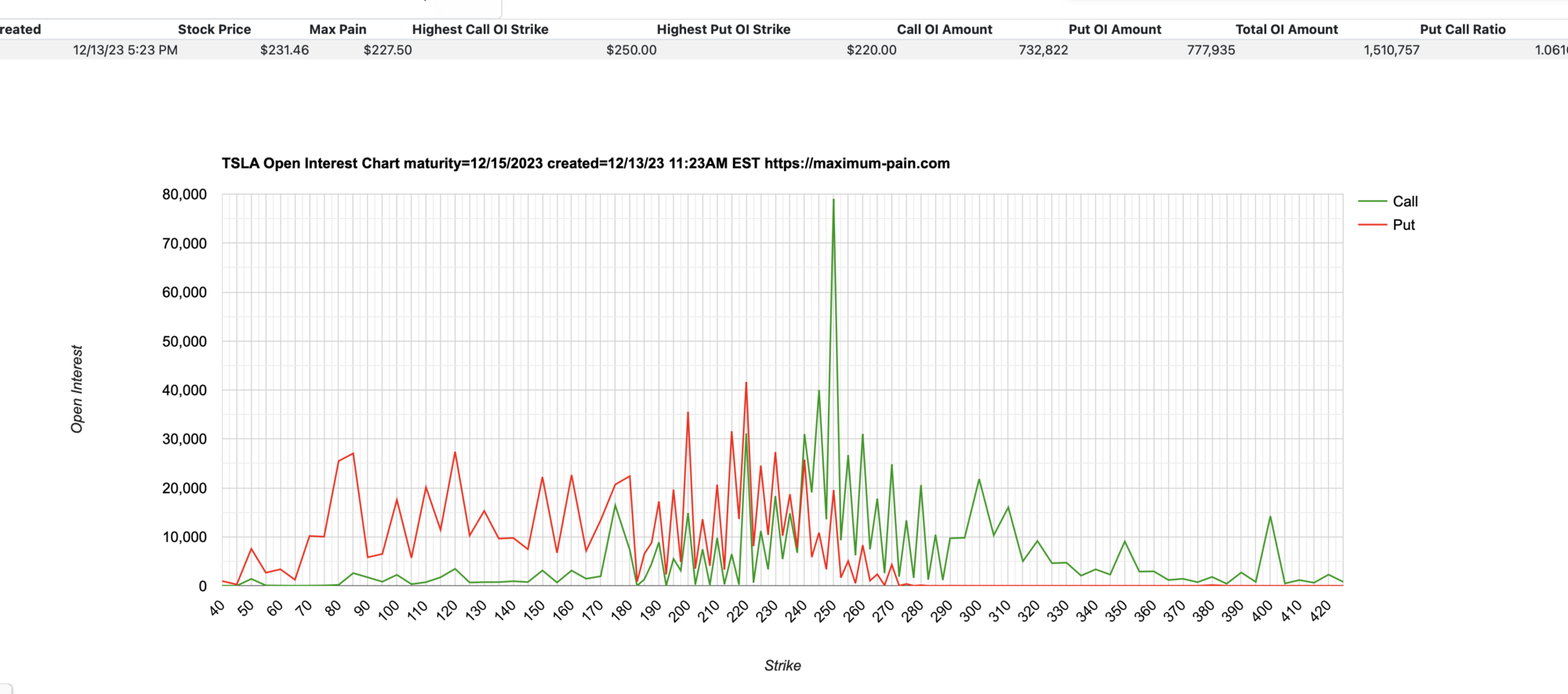

Worth remembering that it's a triple-witching OPEX this week, with MP @$227.50

TexasGator

Member

was thinking the same thing - funny how that always happens. Plus the momo folks pile on in both directions once the stock starts to moveWorth remembering that it's a triple-witching OPEX this week, with MP @$227.50

SpeedyEddy

Active Member

only two little mine lamps shining @ $226.76 and $224.75 before the gap to $220 is filled completely (first real support that I can see for at least a moment.)

In the near term, I don’t think prices for SELLING CC are going to go higher, if that is what you were asking. We just had a further dump, puts are jumping nicely. If we see a $22X, if will get pretty testy.

Thanks. What are you thinking re rest of 2023 playing out, hanging around $220's, going further down, going back up?

tivoboy

Active Member

I’ll sell the 45 12/15 +P accumulated over the past three weeks if we tap $3 per option (Avg. .70). Traveling again today, can’t be greedy.

EVNow

Well-Known Member

He should really do private placements. Selling throughout the year is possible if he keeps publishing those forms weekly ... might still put pressure on the stock knowing he will sell (unless there is some randomness to it).And we mustn't forget that Musk has a ton of options to exercise by 2028, way more than he did in previous years, of which he'll need to pay huge taxes, will mean selling TSLA regardless of the situation with X

Of course it's Elon's right to sell some stock, but his method on selling is the issue, even selling on the open market it could be done a lot better - spread the selling over the year, plan well ahead, trickle-sell rather than opening the tap full

SpeedyEddy

Active Member

retail buying in at lunchtime... time to do the things you regretted not doing while going down

thenewguy1979

"The" Dog

So while we are accumulating +C you're stockpiling +P? Great move..........I’ll sell the 45 12/15 +P accumulated over the past three weeks if we tap $3 per option (Avg. .70). Traveling again today, can’t be greedy.

At least now we have a more clear directional bias. Let go folk..... no more posturing

Lol. But maybe that was it for downsideretail buying in at lunchtime... time to do the things you regretted not doing while going down

I’d be careful calling anything clear at the moment, esp. with FOMOC coming up and OPEX happening this week. Like they say don’t short in the hole. $228 might be it for downside at the moment unless we close below $231. Let’s see what we get.So while we are accumulating +C you're stockpiling +P? Great move..........

At least now we have a more clear directional bias. Let go folk..... no more posturing

If one of us felt compelled to buy a few 20 June 2025, $300 strike calls on this dip... should their friends feel compelled to try to stop them??

@UncaNed - Still disinclined to consider these a long-term-hold, but just FYI if one were to feel compelled to look at the shorter term and try to buy-the-dip, at least the $39/ea right now is a better entry than the $44-$45/ea these were at Monday AM.Yes. Unless the person buying those *promised* to sell them before early next year.

thenewguy1979

"The" Dog

Overall Macro become flat after the PPI pumps this morning. Waiting for Powell to give his monthly speech.

Maybe he play nice and pump the market in the last hrs. like last month....

After all said and done - no more singular directional play for me. Got no furs left to burn

edit - I have personally seen / experience the leverages of selling vs buying. However - the greed of that 1 big upside or downside has always temped me like a fine medium done piece of filet mignon.....mmmm..... mignon.

Maybe he play nice and pump the market in the last hrs. like last month....

After all said and done - no more singular directional play for me. Got no furs left to burn

edit - I have personally seen / experience the leverages of selling vs buying. However - the greed of that 1 big upside or downside has always temped me like a fine medium done piece of filet mignon.....mmmm..... mignon.

Last edited:

Bought 100x C200 for Jan 5, 2024 and 1k shares on the dip this AM. Let's see how well this ages.

Sold the options for +$3 and change each. Probably leaving $ on the table, but no need to be greedy on the day. Guess I'll keep the shares though.

Sold these at $45...I guess I can rebuy them at $33.50. Hopefully this also ages well...

P.S. As much focus as there is on "what trade to do *right now*", I find sometimes the most important thing is when to simply do nothing, sometimes for days on end. Like poker...the question should not be "What do I do right now to win with the cards as they're dealt out right now?" but rather more of "Is this my hand? If so, great, if not, toss the cards back and wait for opportunities with the next hand dealt."

Similar threads

- Replies

- 50

- Views

- 8K

- Replies

- 10

- Views

- 4K

- Replies

- 106

- Views

- 10K

- Replies

- 5

- Views

- 5K