But Musk, at this point, appears more like the folks running Texas. So he has a new line to walk now.I would have thought that Tesla would have done some significant arm-twisting before moving the HQ to Texas

Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Looks like it's headed to being official - $400 registration fee and $200 annual fee in Texas for EVs

- Thread starter brkaus

- Start date

ATX Senior

Member

first year is for two years, so no difference.Very excessive. Especially having first year at 2x.

ATX Senior

Member

The way it was calculated was using BOTH the state and federal gas tax. Texas gets back almost 100% of the federal gas tax, which is just under 20c/gallon. So do the calculations with 37c/gallon and the $200 is more reasonable. Sure, it would be better to be mileage based, and even better, both mileage and weight based, but that is too complicated. Mileage could have been collected using te annual inspection, but that's being eliminated, so there goes that option.The issue here is the eff'd us. State gas tax is $.20/gallon. So that would cover 1,000 gallons of gas. If my car got 30 mpg, then I could go 30k miles. How many people drive 30k miles in an EV? Not a lot, though there are some. Average person drives about 12k miles a year. Factor in the serious, Ben Dover effing for the initial registration and you can see how bad it really is.

I'd need to be driving a pickup with 10 mpg, to even make this remotely fair, let alone the initial Ben Dover registration fee. That is the problem I have it it. It isn't even remotely fair and limited thought was put into this. FYI - my last diesel pickup got 30 mph on the highway and if I drove a Prius and used it for comparison, we got eff'd even more.

Make it $100 a year and no complaints from me.

So, how do they justify the initial $400 registration rip-off? My one car likely won't ever travel enough miles to have used the equivalent miles to justify $200. If I drove a Prius, even factoring in both, it would still be cheaper from a tax perspective. I could drive a PHEV and almost totally escape the taxes.The way it was calculated was using BOTH the state and federal gas tax. Texas gets back almost 100% of the federal gas tax, which is just under 20c/gallon. So do the calculations with 37c/gallon and the $200 is more reasonable. Sure, it would be better to be mileage based, and even better, both mileage and weight based, but that is too complicated. Mileage could have been collected using te annual inspection, but that's being eliminated, so there goes that option.

First I’d want a guarantee Texas was actually using the money to build and maintain roads. Instead of removing pavement and making dirt roads because it doesn’t want to ask taxpayers to pay for maintenance.There's an easy solution to the "but we funded our highways with a gas tax that EV's don't pay" problem:

Enact a new tax on ALL vehicles to pay for your road maintenance. Size it so you can rescind the gas tax. Everyone pays the same. The end.

Initial registration for a car purchased in are as from a licensed dealer in the state is for 2 years.So, how do they justify the initial $400 registration rip-off? My one car likely won't ever travel enough miles to have used the equivalent miles to justify $200. If I drove a Prius, even factoring in both, it would still be cheaper from a tax perspective. I could drive a PHEV and almost totally escape the taxes.

Hopefully they didn’t mess up

legendsk

Member

I'll offer a guess of 2%. 98% => lobbyists, et. al. who can make generous contributions and clean up the money before it goes to the elected officials who created and voted in the bill.I don't mind paying my fair share but I really feel like the Texas version is sort of like she got the coal mine and I got the shaft scenarios. Since moving Texas from Florida, I am missing it more and more. I like that there are no state income taxes in either place but I get ponded on property tax here, sales tax, insurance, etc. and soon it will be this future EV tax.

So when are they going to start taxing the heavy trailers that everyone tows around here? I am sure they are doing a lot more wear and tear on the roads than my model 3 or S do. On my motorcycles they are making out like a bandit on the gas tax received vs damage done.

I am curious how much of the TX gas tax is diverted toward public transit.

ZenRockGarden

Active Member

First I’d want a guarantee Texas was actually using the money to build and maintain roads. Instead of removing pavement and making dirt roads because it doesn’t want to ask taxpayers to pay for maintenance.

Again - it can be done perfectly legit and open.

You make a bill. It rescinds the state gas tax and enacts a uniform vehicle tax in it's place - the proceeds of which go to the same place the gas tax went in similar amounts. Mostly to maintain roads, do maintenance, etc.

There's no way to game the thing. ALL vehicles are paying in. If the tax is being directed somewhere wrong, everyone cares.

Again - it can be done perfectly legit and open.

You make a bill. It rescinds the state gas tax and enacts a uniform vehicle tax in it's place - the proceeds of which go to the same place the gas tax went in similar amounts. Mostly to maintain roads, do maintenance, etc.

There's no way to game the thing. ALL vehicles are paying in. If the tax is being directed somewhere wrong, everyone cares.

basically I was just saying there is no possible way Texas state government will do the right thing in any legislation and action involving TVs, and to hope or expect them to will end in disappointment.Again - it can be done perfectly legit and open.

You make a bill. It rescinds the state gas tax and enacts a uniform vehicle tax in it's place - the proceeds of which go to the same place the gas tax went in similar amounts. Mostly to maintain roads, do maintenance, etc.

There's no way to game the thing. ALL vehicles are paying in. If the tax is being directed somewhere wrong, everyone cares.

EVer Hopeful

Active Member

there is no possible way Texas state government will do the right thing in any legislation and action involving TVs

Yes the Texas legislature does seem to be particularly mean spirited when it comes to TVs

EV’s too! They are amphibious, mean to both.Yes the Texas legislature does seem to be particularly mean spirited when it comes to TVs

ZenRockGarden

Active Member

I agree Texas is highly unlikely to implement a simple, uniform, fair system. But it could be done - taxing fuel was an ok way to fund road maintenance back when most vehicles used said fuel. With electric and hydrogen and various other fuels coming into play, the rational move is a uniform vehicle based tax which replaces the gas tax.

This is right, but in truth the general funds in every state also pay for roads and road maintenance, most, more than half of it. It’s also true there’s an argument that taxes generally should rise on gas and oil use to speed the transition to Ev’s and compensate for the greater costs to the taxpayers ICE vehicles general via pollution and climate change.I agree Texas is highly unlikely to implement a simple, uniform, fair system. But it could be done - taxing fuel was an ok way to fund road maintenance back when most vehicles used said fuel. With electric and hydrogen and various other fuels coming into play, the rational move is a uniform vehicle based tax which replaces the gas tax.

plsiskin@gmail

Member

YUP, just renewed and $200 electric vehicle fee was added. Can you say BS! But they are pushing for us to go green...

Texans could pay $200 annual fee to drive electric vehicles

By a vote of 145-0 Thursday, the Texas House gave approval to legislation that would impose an annual $200 fee on drivers of electric vehicles.www.kxan.com

Approved in both house and senate.

Attachments

CrazyRabbit

Active Member

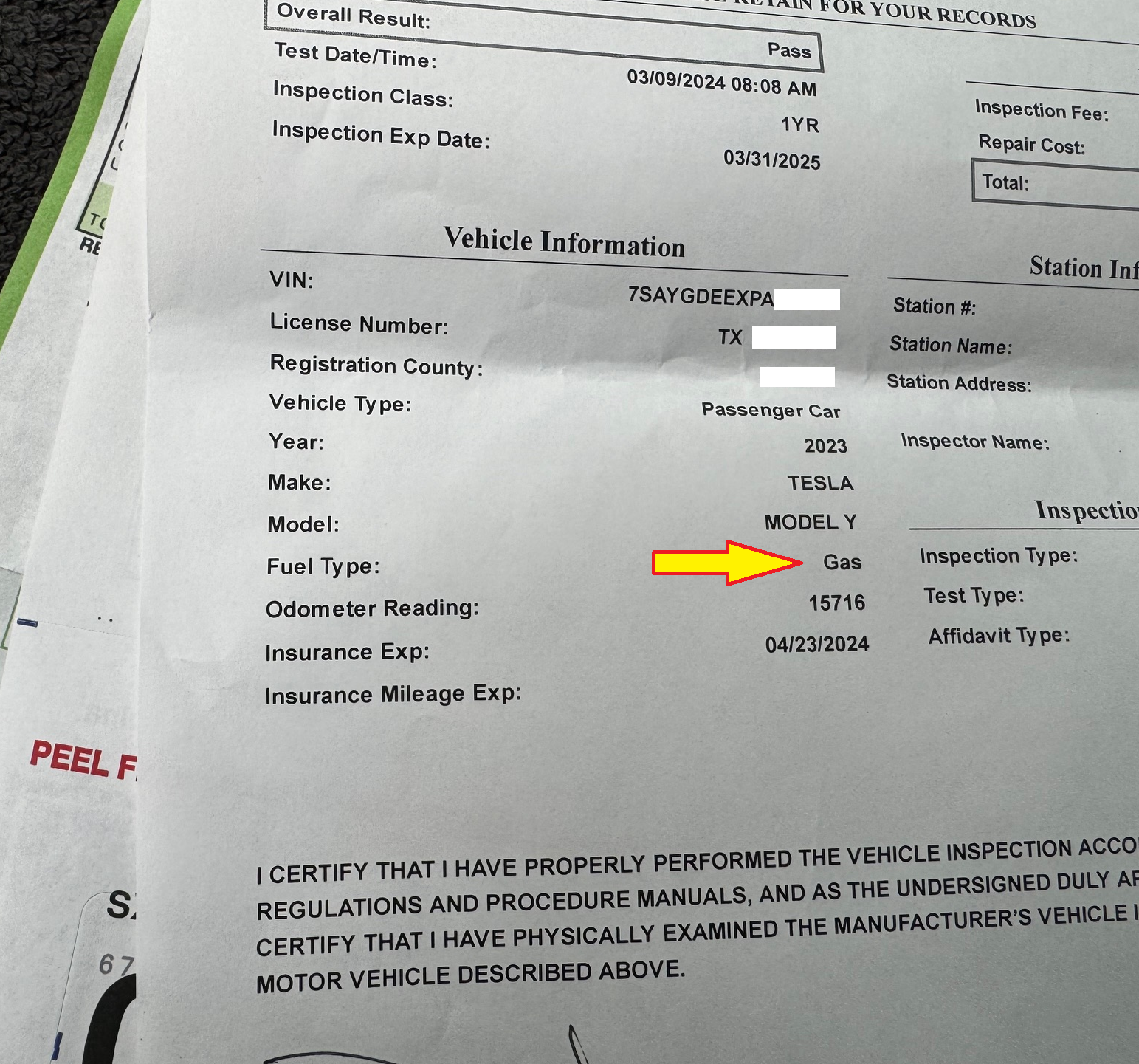

I got my first inspection for an EV last weekend at the local, small-town oil change place who had never inspected a Tesla before. I had to show them how to "start" the vehicle, display the odometer, and turn on the headlights.

Yesterday, I renewed my registration. My Model Y identifies as gas, but that didn't fool the state - I still had to pay the $200 EV tax.

Yesterday, I renewed my registration. My Model Y identifies as gas, but that didn't fool the state - I still had to pay the $200 EV tax.

Oregon has an optional program where you pay as you go. I did not know about it until after I bought my M3. Too late for me, Telsa signed me up for 4 years on the regular program..kinda pissed me off. The pay as you go>Oregon Department of Transportation : OReGO: Oregon's Road Usage Charge Program : Programs : State of Oregon

How much is Oregon EV tax per mile?

How does OReGO work? OReGO participants pay 2 cents for each mile they drive on Oregon roads. That money goes into the State Highway Fund for construction, maintenance, and preservation of roads and bridges.

How much is Oregon EV tax per mile?

How does OReGO work? OReGO participants pay 2 cents for each mile they drive on Oregon roads. That money goes into the State Highway Fund for construction, maintenance, and preservation of roads and bridges.

Last edited:

Similar threads

- Replies

- 4

- Views

- 768

- Replies

- 7

- Views

- 316

- Replies

- 6

- Views

- 1K