Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

He is nowhere near as bright as when he made his breakthroughs. I don’t give him any more credence at this point, than anyone else announcing a battery breakthrough.What's your point?

Edit: I would give him more credit for honesty because of his background.

Last edited:

No, I believe the original Securities Exchange Act of 1934 required *annual* reporting. I can't figure out when it was amended to require *quarterly* reporting in the US. It seems rather hard to track down this amendment.

I found that quarterly reporting was mandated in 2007 in the UK, and then dropped in 2014.

Edit: actually, I just checked the statute book, and the most-commonly-cited sections (section 15 and section 13d) do not require quarterly reports. As far as I can tell, the actual law in the US only requires annual reports and does NOT require quarterly reports.

Quarterly reports must be an SEC regulation, not an actual law. When was the regulation put in place?

Edit: OK, I'm tracking it down. It is a CFR regulation, not a law, and the regulation section is 240.13a-13. It's not clear to me when it was added to the regulations, but LONG after the 1930s. It's under the powers in 15 US Code section 78m, allowing the SEC ("the Commission") to require that issuers file "such quarterly reports (and such copies thereof), as the Commission may prescribe".

This regulation (which covers a lot of different things) was originally adopted in 1977, but amended in 1983, 1985, 1989, 1992, 1996, 2005, and 2008. I am not sure which of these amendments introduced the quarterly reporting requirement for all companies, but I'm pretty sure it wasn't the original 1977 regulation, because I remember 10-Qs were not a thing in the early 1980s. I haven't tracked down which amendment it was yet. The requirement seems to have been present before the 1996 amendment. It's a bit of a pain to dig up the text for the earlier amendments, which is why I haven't yet.

I'm guessing it was a Reagan-era 1980s change, because I'm vaguely remembering some newspaper reporting from the 1980s from companies complaining that mandatory quarterly reports would lead to short-termism and earnings "goosing".

Note that while quarterly reporting may or may not be an SEC requirement, it most definitely is a listed exchange requirement of both the NYSE and the NASDAQ. If you fail to report quarterly earnings, then the exchanges will start the process to delist your stock. Once delisted, you'll still be a public company, but your stock will trade "over the counter" on the "pink sheets" (archaic terms now, but I don't know if there is anything else), which basically means your volume will be minuscule. You are now in the realm of pump and dump operators and won't be able to raise additional equity at any real terms.

BTW, this sub-thread was started as a misunderstanding of what Buffet and Jamie Dimon said recently on CNBC. They are advocating for public companies to not give forward looking guidance to next quarter's estimate earnings. They still want quarterly earnings and information from the CEO/CFO on the health and opportunities of the company.

Normally I'd file this in the "too good to be true" department and ignore it but John Goodenough claims a lithium cell which increases capacity over time Battery Pioneer Claims These Solid-State Cells Gain Capacity Over Time

Guys, TMC has an entire subforum devoted to battery tech. I've created a thread over there on this. Let's take discussion about this over there, you'll get more technically informed people over there anyways. In general, "breakthroughs" in the lab on battery tech. have ZERO effect on Tesla stock price since lab results are many, many years away from commercialization. The only time a battery discussion might be warranted in this thread would be the announcement of a new actual battery cell from a manufacturer...

Goodenough's battery that increases capacity over time

JRP3

Hyperactive Member

AgeismWhat's your point?

JRP3

Hyperactive Member

Generally agree but few people venture into the battery forum and this was interesting enough and credible enough that I felt it warranted more exposure and is something we all should keep an eye on. Also this is the weekend. Agree that further discussion should take place in the battery forum.The only time a battery discussion might be warranted in this thread would be the announcement of a new actual battery cell from a manufacturer...

If he is surrounded by young student's he can take credit for their breakthrough's.What's your point?

Most breakthrough's in science happen when the person responsible is pretty young.

Of course said "breakthougher" is standing on somebody's shoulders to get to that point.

JRP3

Hyperactive Member

Potential grid storage technology 'Liquid Air' Technology Offers Prospect Of Storing Energy For The Long Term

I wonder about efficiency and heat gain of the storage tanks.

I wonder about efficiency and heat gain of the storage tanks.

ValueAnalyst

Closed

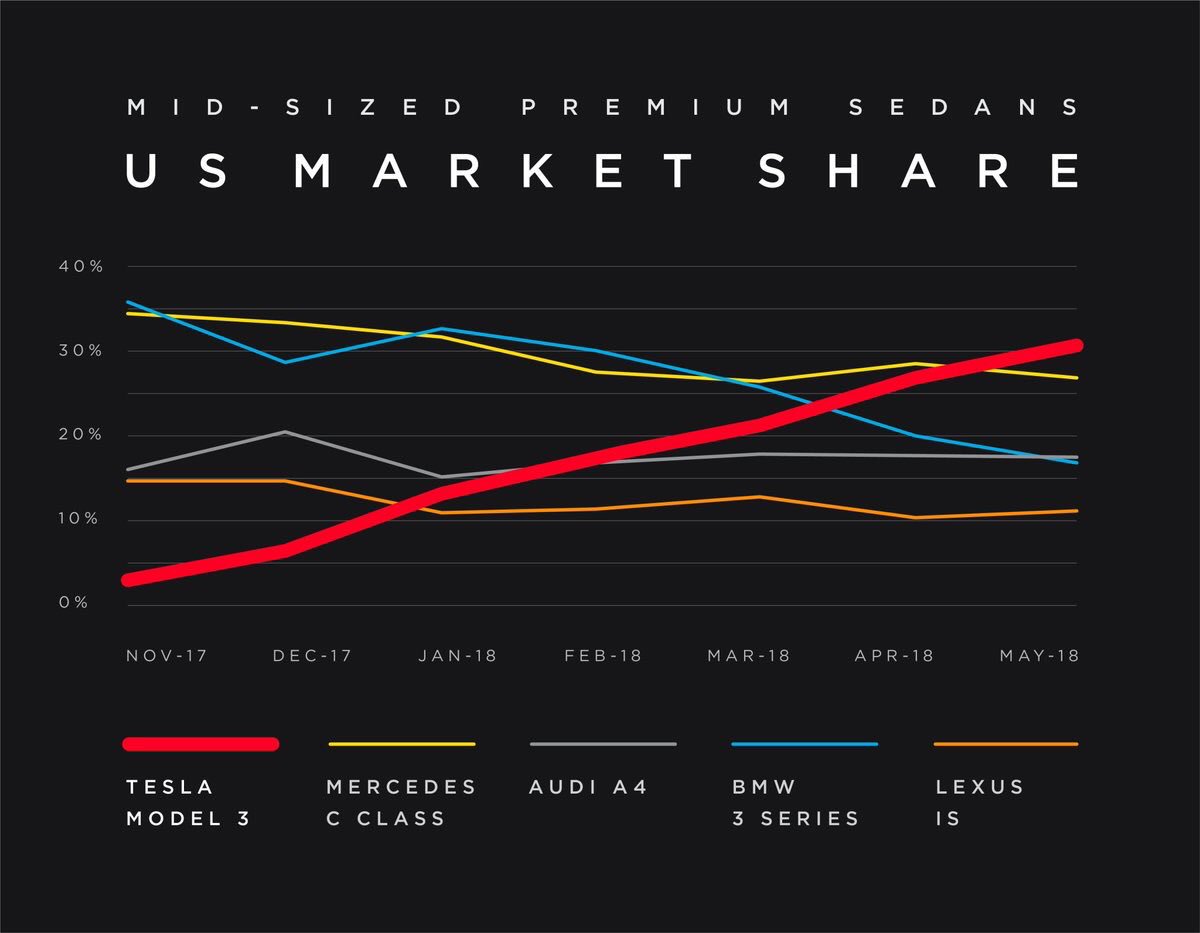

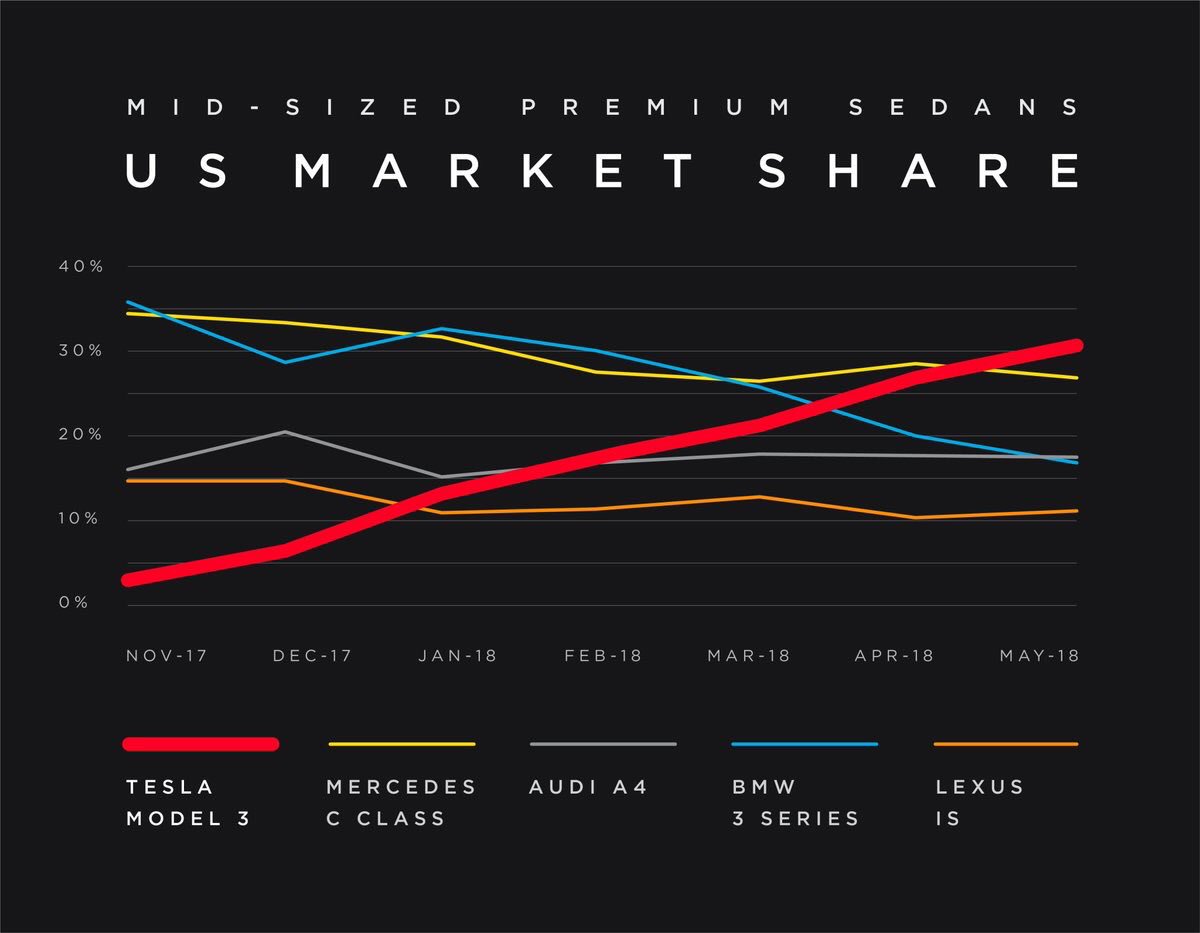

Investors are ignoring this cadence:

ValueAnalyst on Twitter

Model S did it in 4 years.

Model X did it in 2 years.

Model 3 did it in 10 months.

Now imagine Model Y.

ValueAnalyst on Twitter

Model S did it in 4 years.

Model X did it in 2 years.

Model 3 did it in 10 months.

Now imagine Model Y.

Reciprocity

Active Member

Warning: made up hypothetical quote/ announcementInvestors are ignoring this cadence:

ValueAnalyst on Twitter

Model S did it in 4 years.

Model X did it in 2 years.

Model 3 did it in 10 months.

Now imagine Model Y.

Elon does the reveal after the line is installed?

"Oh, one more thing, we are now producing Model Y at GF1, configurator is open, deliveries start next month).

ValueAnalyst

Closed

Tesla has decupled (ten-fold) its weekly production rate every three years, and there is no fundamental reason why this pace of growth cannot continue. If it does, then following 500,000 annualized rate by the end of 2018 or early 2019, we can expect 5 million by the end of 2021, and 50 million by the end of 2024, but let's say 2025 to be conservative. Combined with the fact that full self-driving will allow tomorrow's vehicles to be used up to 20x more than today's cars, which are parked 95% of the time, 50 million annualized production effectively equal one billion annual units by 2025, which is the current population of vehicles in the world today. Note that I did not even mention tomorrow's Boring tunnels, which I expect will comprise majority of "ground" miles traveled by 2025.

Last edited:

Yes, quarterly reports for public companies of a certain size were mandatory since the original SEC act, and the SEC sets financial reporting laws for US corporations and international ones that trade on US exchanges. However I think it was probably in the 80s-ish when all the filings started to become easily accessible with the internet/tv business shows, and public conf calls. I guess prior to that if you wanted to look at a 10-q you'd probably have to call up investor relations and ask them or the SEC to send it to you via snail mail or fax, or maybe get it in the library? I kind of like that idea though of just reading a shareholder letter once a year and otherwise not paying attention to companies, quarterly reports and all that are kind of annoying....

Quarterly reports must be an SEC regulation, not an actual law. When was the regulation put in place?

...

pz1975

Active Member

Nothin' like doin' some flamethrowin' 3 feet from your baby!

ValueAnalyst

Closed

Nothin' like doin' some flamethrowin' 3 feet from your baby!

Train 'em young for global warming.

Tesla is experimenting with taking mobile service to the next level: Wow! New experimental mobile service

This is like back when they had the recall to check the seat belt bolt where they had service people at Superchargers to take care of that so you never had to go in to the service center.

This is like back when they had the recall to check the seat belt bolt where they had service people at Superchargers to take care of that so you never had to go in to the service center.

sundaymorning

Active Member

So, from what I'm hearing (and maybe I've misinterpreted), the existing lines still aren't at 2500/week/line, which is bad. Accounting for Elon optimism, the new "better" line is probably capable of 3000 - 3500/week, so yeah, maybe 3 or 4 lines for 10K+/week. Not as good as I'd hoped. I wonder what parts of general assembly are causing the remaining bottlenecks.

I doubt there's room for that at Fremont. I suppose 1 line in Europe and 1 line in China would help; they can ship the cars as kits, pre-general-assembly, I guess.

Of course if we're lucky they'll get more out of each individual line, but we've known all along that general assembly is the hardest part to automate efficiently. :-(

Regarding General Assembly:

I think a lot of people here has glossed over this bit of a golden nugget that Elon dropped during the shareholder meeting as I haven’t seen it discussed much. If you go back and listen to Elon’s presentation, he says that he is confident Tesla will achieve 5,000 a week even with the current 2 general assembly lines, hence, with the addition of a 3rd line it’s very likely to get Tesla way beyond the 5,000 number. Which is why he’s confident that they’ll get to 5k a week by end of June. My guess is that he’s really aiming for 6k end of 3rd and 7k end of 4th (conservatively).

Wonder what they will be doing by this time next year, or where demand will be. Wouldn't be surprised if reservations continue rising.Regarding General Assembly:

I think a lot of people here has glossed over this bit of a golden nugget that Elon dropped during the shareholder meeting as I haven’t seen it discussed much. If you go back and listen to Elon’s presentation, he says that he is confident Tesla will achieve 5,000 a week even with the current 2 general assembly lines, hence, with the addition of a 3rd line it’s very likely to get Tesla way beyond the 5,000 number. Which is why he’s confident that they’ll get to 5k a week by end of June. My guess is that he’s really aiming for 6k end of 3rd and 7k end of 4th (conservatively).

- Status

- Not open for further replies.

Similar threads

- Replies

- 1

- Views

- 793

- Locked

- Replies

- 0

- Views

- 4K

- Article

- Replies

- 29

- Views

- 6K