navguy12

Active Member

An excellent example of regulatory capture. From the article:

The government spoke with about 200 people before deciding to pause applications, Mr. Neudorf said, including landowners, stakeholder groups, consumer advocates and power providers that rely heavily on natural gas.

But the Canadian Renewable Energy Association – the main group that advocates for wind, solar and energy storage solutions around the country – only found out after the government made its decision public.

The O&G apologists comments in the comments section are breathtaking, especially when there are 100s of “orphaned (oil) wells“ quietly polluting the Alberta countryside.

/cloudfront-us-east-1.images.arcpublishing.com/tgam/TWZNZJIL6NAHVOTHHKQTDXJNBA)

www.theglobeandmail.com

www.theglobeandmail.com

The government spoke with about 200 people before deciding to pause applications, Mr. Neudorf said, including landowners, stakeholder groups, consumer advocates and power providers that rely heavily on natural gas.

But the Canadian Renewable Energy Association – the main group that advocates for wind, solar and energy storage solutions around the country – only found out after the government made its decision public.

The O&G apologists comments in the comments section are breathtaking, especially when there are 100s of “orphaned (oil) wells“ quietly polluting the Alberta countryside.

/cloudfront-us-east-1.images.arcpublishing.com/tgam/TWZNZJIL6NAHVOTHHKQTDXJNBA)

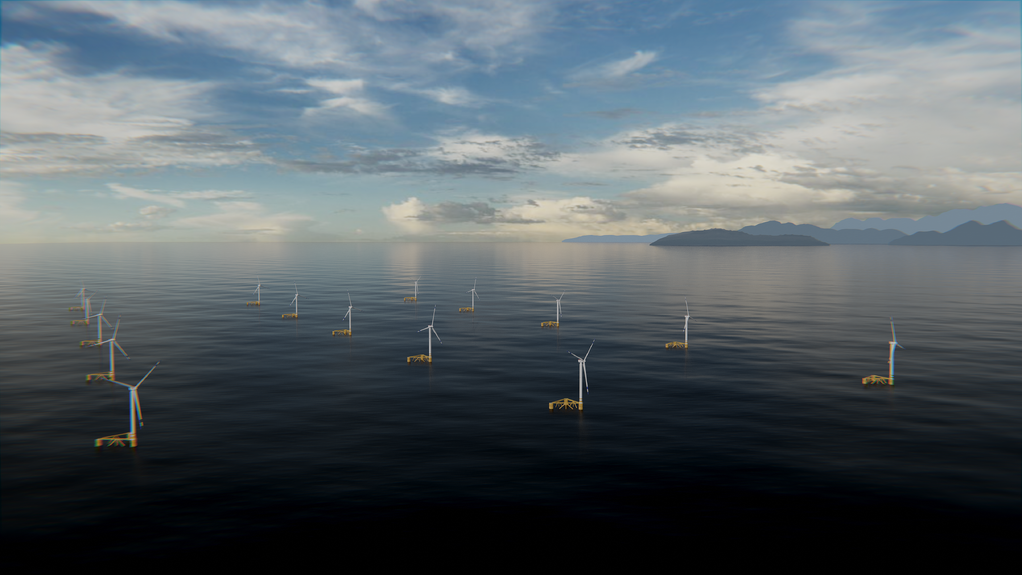

Alberta to pause new solar and wind power projects for six months amid review of end-of-life rules

The move will affect projects bigger than one megawatt as the province looks at issues including where they can be built and the impact on the power grid

/cloudfront-us-east-2.images.arcpublishing.com/reuters/EC5ARLSZ7RO27KWNQOGUPLALUA.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/RHUAV4QPBVMV7JMSQRT7MWEAWI.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/FXJR544VAJKDZB6NGHCOJMEXEU.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/TOHXWGLCZNKCTHCVV6C4MC6VI4.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/5UPUVFTWC5PCTDBHOYBW3OGP5M.jpg)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GHOKYVOZQJPZBCOQ4EO4JYBIGM.jpg)