Welcome to Tesla Motors Club

Discuss Tesla's Model S, Model 3, Model X, Model Y, Cybertruck, Roadster and More.

Register

Install the app

How to install the app on iOS

You can install our site as a web app on your iOS device by utilizing the Add to Home Screen feature in Safari. Please see this thread for more details on this.

Note: This feature may not be available in some browsers.

-

Want to remove ads? Register an account and login to see fewer ads, and become a Supporting Member to remove almost all ads.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

View attachment 222034 $TSLA hourly chart tremendous underlying strength higher prices coming this week maybe as early as tomorrow bollinger breakout coming

Well there you go again, TrendTrader007, coaxing TSLA's SP to break out above the upper bollinger band again, just as I suggested the stock was set up for a nice, sensible rise within the bb. Clearly, I'm not going to get any beauty sleep tomorrow morning, as these tired eyes scan the computer monitor to see what this next Tesla Monday will bring.

Interesting that they denied it...

Tesla denies report it is planning to open a factory in Guangdong, China

Combo of macros positive, upwards pressure from Fri, new (blue) M3 sighting should make for a nice Monday. But I don't know what to make of the China factory rumor now that Tesla denied it.

Tesla denies report it is planning to open a factory in Guangdong, China

Combo of macros positive, upwards pressure from Fri, new (blue) M3 sighting should make for a nice Monday. But I don't know what to make of the China factory rumor now that Tesla denied it.

Gerardf

Active Member

I see Nasdaq showing TSLA at 306 now.

Also up to approx same level in Frankfurt.

Also up to approx same level in Frankfurt.

Mike Smith

Active Member

$308.40 Tesla is now the most valuable car company in America.

T3slaTulips

Member

Adam Jonas and the Price Targets in the rear view mirror.

Piper Jaffray upgraded Tesla to overweight with PT $368 ($223 previously). Some details from the note: After driving Tesla for 7 months, Piper upgrades shares to Overweight

Notable quotes:

Notable quotes:

After driving a Tesla for seven months, and conducting investor meetings with the company last week, Piper Jaffray analyst Alexander Potter upgraded Tesla to Overweight from Neutral and raised his price target for the shares to $368 from $223.

Potter is more convinced following meetings with management that Model 3 deliveries will begin in 2017.

TrendTrader007

Active Member

$TSLA so basically $300 did turn out to be the new floor for this stock now all the $400 $500 2019 and 2018 calls don't look so far fetched

above average returns r based on reasonable positions

Out of world stellar returns only come with crazy super leveraged ones

Period.

$TSLA again just my personal philosophy

clearly NOT an advice to anyone

Do NOT do this at home

Time 4 me 2 take a break enjoy my profits

above average returns r based on reasonable positions

Out of world stellar returns only come with crazy super leveraged ones

Period.

$TSLA again just my personal philosophy

clearly NOT an advice to anyone

Do NOT do this at home

Time 4 me 2 take a break enjoy my profits

Last edited:

TrendTrader007

Active Member

$TSLA bulls make money bears make money pigs get slaughtered

It takes courage to be a pig

My last words on social media

It takes courage to be a pig

My last words on social media

Gerardf

Active Member

SP keeps drifting up pre-market. Even saw 310 for a moment.

Are we finally seeing shorts covering ? .. and a slow-but-steady short-squeeze ?

Pressure on them must be high..

Are we finally seeing shorts covering ? .. and a slow-but-steady short-squeeze ?

Pressure on them must be high..

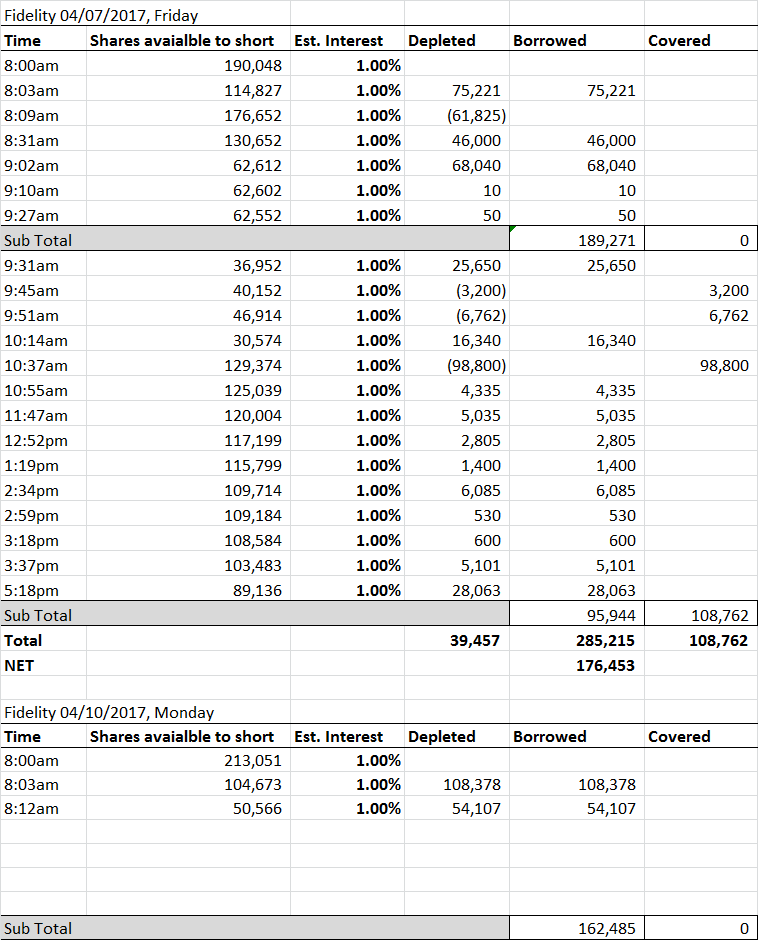

In the meantime, there is business as usual in Shortsville: on Friday there were 285k shares borrowed for shorting (as caught by the trading screen snap shots), and 109k covered for a net shorted 176K shares.

Today, between 8:00am and 8:12am there were additional 163k shares borrowed for shorting, still 51k shares available for shorting.

Today, between 8:00am and 8:12am there were additional 163k shares borrowed for shorting, still 51k shares available for shorting.

myusername

Banned

because they don't want a Trump tweet... otherwise they tend to allow positive fake rumors to fly.Interesting that they denied it...

Tesla denies report it is planning to open a factory in Guangdong, China

Combo of macros positive, upwards pressure from Fri, new (blue) M3 sighting should make for a nice Monday. But I don't know what to make of the China factory rumor now that Tesla denied it.

geneclean55

Active Member

Jonathan Hewitt

Active Member

Totally depends on your time frame. Long term you should already be loaded up. Medium term things are looking great with the breakout and then retest of $300 but anything can happen. Short term we may get a gap and fade this morning to retest $305 area or Friday's close, giving a better short term buying opportunity, but we may get a gap and go and break $310 and not look back.Buy more at open or should I wait

Last edited:

I'm very proud of my Tweet storm this morning. @farzyness in case any of you wonderful people want to cringe at the horrible jokes.

geneclean55

Active Member

This is my conundrum also.Totally depends on your time frame. Long term you should already be loaded up. Medium term things are looking great with the breakout and then retest of $300 but anything can happen. Short term we may get a gap and fade this morning to retest $305 area or Friday's close, giving a better short term buying opportunity, but we may get a gap and go and break $210 and not look back.

Pre-market volume is heavy. Probably end up being 2/3 premarket volume that we saw last Monday morning after delivery info was released! Stock went up another 12 bucks during regular trading hours that day.

corrected for the good JH: 'but we may get a gap and go and break $310 and not look back'but we may get a gap and go and break $210 and not look back

Jonathan Hewitt

Active Member

For the record I increased my exposure Friday in anticipation of a strong day today so I will be hedging some of my positions this morning most likely. Not because I think we won't gap and go (I have no idea) but because I am very heavily exposed with short term options right now and I generally only like to do stock and LEAPS. When my plan works for short term options (gap up today) it means I should reduce some of my risk. If we do fill the gap I can then unhedge my longs and be ready for another move up. If we keep going I at least locked in some good profits.Totally depends on your time frame. Long term you should already be loaded up. Medium term things are looking great with the breakout and then retest of $300 but anything can happen. Short term we may get a gap and fade this morning to retest $305 area or Friday's close, giving a better short term buying opportunity, but we may get a gap and go and break $210 and not look back.

As far as long term stuff I already made that position all less than $200/share and won't be adding to it.

Jonathan Hewitt

Active Member

Thank you! Correctedcorrected for the good JH: 'but we may get a gap and go and break $310 and not look back'

- Status

- Not open for further replies.

Similar threads

- Locked

- Replies

- 0

- Views

- 4K

- Locked

- Replies

- 0

- Views

- 6K

- Replies

- 6

- Views

- 5K

- Article

- Replies

- 29

- Views

- 6K

- Replies

- 1

- Views

- 891